Monetary policy

Monetary policy – definition

Monetary policy refers to changes made by a central bank to interest rates and/or the quantity of money in order to achieve changes in aggregate demand that keep inflation within its target range. Monetary policy can also be used to help achieve other macro-economic objectives, such as economic growth and reducing unemployment.

Interest rates and monetary transmission mechanisms

Policy-makers in different countries may have different mandates for the implementation of monetary policy. For example, in the UK the Bank of England has a single mandate – to stabilise the price level at an inflation rate of 2%.

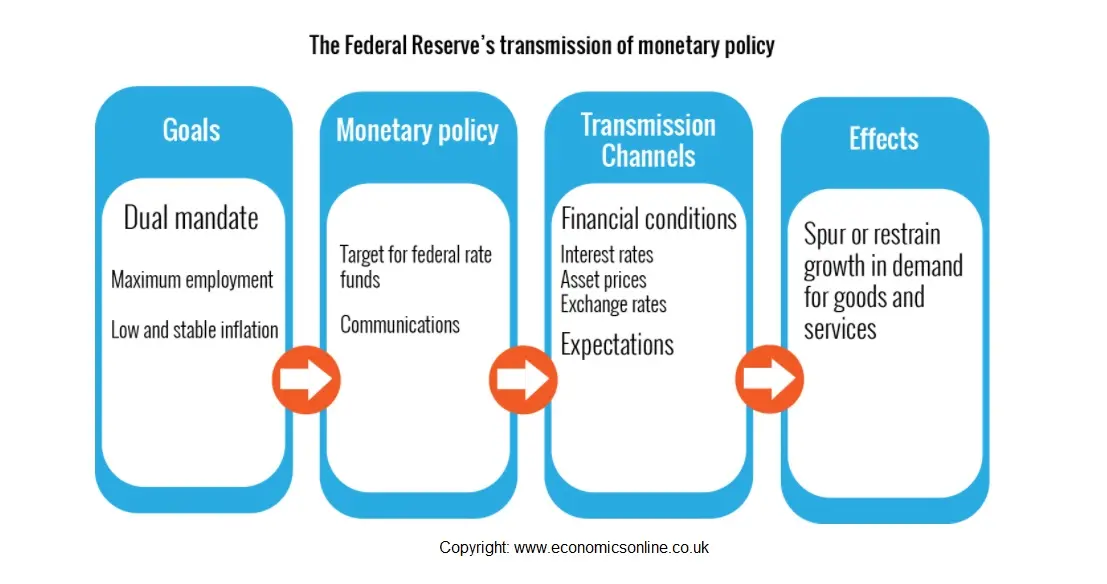

However, the US’s Federal Reserve (‘Fed’) has a dual mandate – namely stable prices and maximum employment.

Some central banks set a more flexible target for inflation. For example, in India, the Reserve Bank of India (RBI) sets price stability as the primary objective of monetary policy while also focussing on growth, It sets an inflation target every five years, with the current target covering the period 2016 to 2021. The lower inflation limit is 2% inflation, with an upper limit of 6%.

While different central banks may use slightly different methods to influence monetary conditions, the common aim of monetary policy is to stabilise the price level.

The MPC of the Bank of England

The Monetary Policy Committee (MPC) of the Bank of England sets the short-term interest rate at which the Bank supplies ‘base money’ into the banking system. In simple terms the Bank of England, as monopoly supplier of base money chooses the price it is prepared to lend to the private financial sector. Lending is done through gilt sale and repurchase agreements (‘repo’), and the repo rate is, effectively, the UK’s official interest rate. Other domestic interest rates then realign in the direction the repo rate has moved.

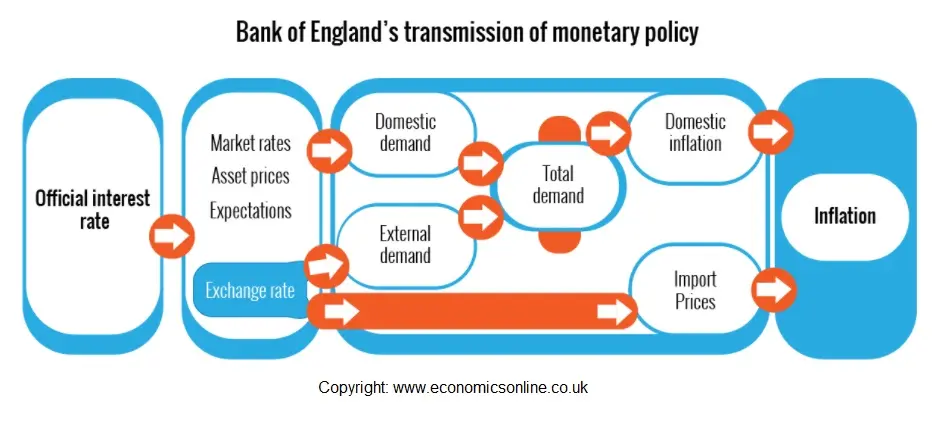

Changes in the official interest rate affect economic activity through the ‘transmission mechanism’.

Changes in the official rate affect other rates, asset prices and confidence, which in term affects total demand in the domestic economy. Interest rates also affect the exchange rate so that, for example, higher rates make sterling assets more attractive to international investors, which increases demand for sterling and pushes sterling upwards. This has the affect of making imports cheaper, and reduces ‘imported inflation’.

The Federal Open Market Committee

Monetary policy decisions in the US are made at meetings of the Federal Open Market Committee (FOMC) – using interest rates to achieve stable inflation of 2%, while attempting to achieve maximum employment. Private sector banks hold reserve balances at the Fed, and they may borrow and lend reserves to each other depending on their requirements. The key instrument used by the Fed is the ‘federal funds rate’ which is the interest rate that banks pay to borrow reserve balances overnight. The Fed can change this rate to either stimulate demand or to restrain it. Once the federal funds rate is changed, rates on a whole range of lending will move in the same direction.

As with the Bank of England, the Fed, and other central banks, the role of monetary policy is to influence aggregate demand for goods and services in the economy.

When demand slows, unemployment will tend to rise and inflation will tend to decline. In this case, monetary policy is ‘eased’ through lower interest rates.

-

Read more on monetary policy

-

Read more on quantitative easing