Fiscal policy

Fiscal policy

Fiscal policy is the deliberate alteration of government spending or taxation to help achieve desirable macro-economic objectives by changing the level and composition of aggregate demand (AD).

Types of fiscal policy

There are two types of fiscal policy, discretionary and automatic.

Discretionary

Discretionary policy refers to policies which are decided, and implemented, by one-off policy changes.

Automatic

Automatic stabilisation, where the economy can be stabilised by processes called fiscal drag and fiscal boost. If direct tax rates are progressive, which means that the % of income, then a rapid increase in national income will be slowed down automatically. Fiscal drag means that, as incomes rise, the impact of rising incomes for the better off is reduced as they pay proportionately higher taxes, and the impact of rising incomes on the poor and unemployed is reduced as they come off benefits, and start to pay tax. The effect is that the increase in disposable income is moderated.

Fiscal boost

Similarly, a potentially rapid and deep decrease in national income would be prevented by fiscal boost. Fiscal boost means as incomes fall in a recession the impact of falling incomes is softened as income earners pay proportionately lower taxes, and retain more post-tax income.

The impact of falling income is to increase unemployment, but rather than experience a complete collapse in personal income, the unemployed, and the poor, receive benefits, and spend more than they would have without such benefits. Hence, a downturn in the economy is also ‘moderated’.

Government expenditure

Central and local government – the public sector – spends money for a variety of reasons, including:

- To supply goods and services that the private sector would fail to do, such as public goods, including defence, roads and bridges; merit goods, such as hospitals and schools; and welfare payments and benefits, including unemployment and disability benefit.

- To achieve supply-side improvements in the macro-economy, such as spending on education and training to improve labour productivity.

- To inject extra spending into the macro-economy, so as to achieve increases in aggregate demand and economic activity.

- To reduce the negative effects of externalities, such as setting pollution limits.

- To subsidise industries that may need, for one reason or another financial support which would not be available from the private sector.

- To help redistribute income and achieve more equity.

Local government is very important in terms of the administration of spending. For example, spending on the NHS and education are administered locally, though local authorities.

Spending

The main areas of UK government spending in 2016-17, which totalled £772.5bn, were pensions, health and education. Debt interest has increased over the medium-term as a result of higher public sector debt.

Central government borrowing

If revenue is insufficient to pay for expenditure, there will be a fiscal deficit. In this situation, government must borrow by selling long term bonds or short term bills. Bonds are long-term securities that pay a fixed rate of return over a long period until maturity, such as 10 years after they are originally issued, and are bought by financial institutions looking for a safe return. Government can also sell Treasury Bills, which are issued into the money markets to help raise short-term cash. Bills have a life of 90 days only, whereupon they are repaid.

In 2015, UK government borrowing totalled £75.3bn, which was approximately 5% of GDP, with accumulated debt standing at 83.3% of GDP. (Source OBR). By 2017, borrowing as a % of GDP had fallen to just 2.4%.

Local government borrowing

Local authorities can also borrow if their combined revenue from the Council Tax and central government support is insufficient to meet local spending.

If the borrowing requirements of both central and local government are combined, the amount of borrowing is called the public sector net cash requirement (PSNCR). Fiscal deficits vary with the business cycle.

During periods of economic growth, tax yields rise, and spending on welfare payments fall, pushing the public finances towards a surplus. During periods of economic slowdown, tax yields fall and welfare payments rise, pushing the economy towards a fiscal deficit.

Fiscal rules

The first fiscal rule, the golden rule for borrowing- established in 1997 by the then Chancellor Gordon Brown – was that the government should balance its books over a trade cycle, and only to borrow to fund capital projects, such as road building. The second rule was the sustainable investment rule which stated that the ratio of net investment to GDP should not exceed 40%. These rules were relaxed in 2008 by Chancellor Alistair Darling, to enable planned spending brought forward in an attempt to inject spending into the ailing UK economy.

The coalition government, which came to power in 2010, abandoned these fiscal rules as it became clear that they possessed little credibility at a time of accelerating public debt. In an attempt to return some order to public finances, the coalition government launched the Office of Budget Responsibility (OBR).

Public sector spending

Using public spending to stimulate economic activity has been a key option for successive governments since Keynes. Keynes argued that public spending should be increased at times of recession to compensate for falling private spending. There are two types of spending:

- Current spending, which is expenditure on wages and raw materials. Current spending is short term, and has to be renewed each year.

- Capital spending, which is spending on physical assets like roads, bridges, hospital buildings, and equipment. Capital spending is long term as it does not have to be renewed each year – it is also called spending on ‘social capital’.

Evaluation of public spending

The advantages

- Public spending can have a considerable impact on the level of AD, and compensate for failings in other components of AD, such as a fall in household spending on consumer goods and firms spending on capital goods.

- If the spending is on capital items, then infrastructure can be improved, and this can help improve economic growth.

- Spending on infrastructure also provides an external benefit to the rest of the economy.

- Public spending can be targeted to achieve a wide range of economic objectives, such as job creation and reducing unemployment, achieving more equity, road building, action against poverty, and re-building city centres.

The effect of a fiscal stimulus on output and jobs

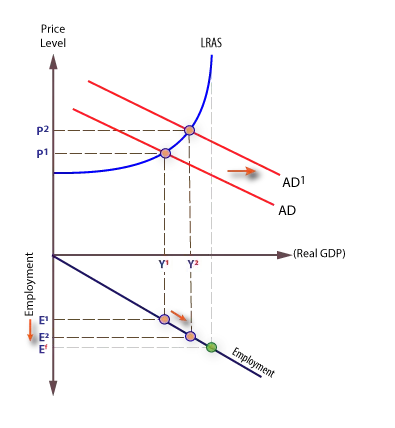

We can use the AD-AS framework to show how a fiscal stimulus can shift AD to the right, and increase real output which in turn can create jobs.

The disadvantages

- There may be a considerable time-lag between spending and the benefits of spending. For example, a decision to increase spending on education will take months to implement, and years and decades to see the full benefits. Indeed, the full benefits may never be ‘seen’ because of information failure.

- In trying to promote growth or create new jobs a fiscal stimulus through increased government spending can be inflationary, especially if the government has to borrow from the financial markets or if the spending is too fast, such as with an increase in current spending on wages. This can be seen in the diagram above, with the shift in AD pulling up the price level, from P1 to P2.

- There is a potential ‘trade off’ between unemployment and inflation, first analysed by A.W. Phillips. If the aim of an increase in public spending is to create jobs there is the strong possibility that inflation will be created, and growth in jobs may only be temporary as the economy readjusts to the previous level of unemployment.

- A major constraint to government spending across the EU is a country’s membership of the Stability and Growth Pact. This pact limits government borrowing to no more than 3% of national income in any one year, and to no more than an accumulated public debt of 60% of the value of national income. The purpose of the Stability Pact is to stop Euro area countries weakening the value of the Euro by ‘printing money’, which occurs when governments borrow from the money markets. The UK Chancellor has imposed a different constraint – that borrowing is acceptable if it funds capital, rather than current, public sector spending.

However, the financial crisis of 2008 – 2010 and the subsequent global recession, forced many countries to break this pact, as they borrowed substantial amounts to help stimulate their domestic economies. Perhaps the worst case to emerge was that of Greece, whose annual deficit exceeded 12% of GDP in 2009 (four times the pact limit), and whose accumulated deficit is predicted to reach 135% of GDP by 2011 (twice the agreed limit). The situation for Greece is made especially worse given the size of its hidden economy, estimated at over 30% of GDP.

(Sources: The Guardian and The Telegraph).

Revenue and tax policy

Central and local government must raise revenue in order to meet its spending commitments. Revenue is raised from a number of sources including:

Taxation

Direct taxes, such as income tax and corporation tax, and indirect taxes such as Value Added Tax (VAT), are the main sources of revenue to the UK Treasury.

National insurance

National insurance is a compulsory contribution from both employer and employee to provide workers with a minimum welfare payment during periods of unemployment.

Charges

Both central and local government can charge for using resources under their control, such as parking charges, prescription charges, and TV licences.

Privatisation

The sale of state-owned assets, such as public utilities like gas, water, and electricity, has in the past provided ‘windfall’ revenue to the UK government. The sale of property rights provides a similar source of revenue, such as selling licences to broadcasters and to mobile phone companies for the right to use the public ‘airwaves’.

Borrowing

Borrowing has become an increasingly significant source of funding for many governments. If a government does not have enough revenue to fund its spending plans, it may borrow from the commercial banks or the public by selling short term securities, called bills, and long term securities, called bonds. Both central and local government may need to borrow heavily from time to time to fund spending commitments.

Revenue sources

Local government revenue

Local authorities in the UK have the power to raise revenue via a local tax called the Council Tax. However, council taxes do not cover all local spending, and local authorities are usually subsidised by central government through a grant. Reform of local authority finances has been proposed, with the following options being considered:

- A local income tax

- A local sales tax, or specific local charges, such as the London Congestion Charge

Changing tax rates

Taxes can be raised or lowered to control or expand household spending, and AD. Income tax can be adjusted in a number of ways, such as by changing:

- The tax free allowance (the standard personal allowance) – all income earners are allowed to earn an amount of income before they start to pay tax. For example, the personal tax free allowance in the UK for 2015/16 was £10,600. Therefore, to stimulate demand, this allowance could be increased to give households more disposable income.

- The basic tax rate – which is 20%. Basic rate means the rate that affects most income earners.

- The number of tax bands – for example, before 2009 there were three bands of: 0 – £2320 of taxable income from savings is taxed at 10%; £0 – £34,800, taxed at 20% tax, and over £34,800 is taxed at 40%, which is the higher tax rate. By adding new lower or higher bands the level of consumption and the distribution of income can be altered. In 2014 a new higher tax band of 45% was added for people earning a taxable income over £150,000.

- The range of income in each band – each band could be widened or narrowed by increasing or reducing the range of income in each band.

Evaluation of tax policy

The advantages

- Indirect taxes can be targeted very specifically at altering behaviour, such as polluter pays taxes, and taxes on demerit goods.

- Taxation can stabilise the macro-economy automatically, through fiscal drag and boost.

- Discretionary changes in direct taxes can help regulate aggregate demand.

- Taxes and welfare spending can also be used to help reduce the income gap between rich and poor, reduce poverty, and to help to promote equity.

The disadvantages

- Changing tax rates, allowances and bands, is a highly complex business, especially in comparison with changing interest rates. Because of this changes are relatively infrequent, with only small adjustments being made each year in the annual budget.

- Households may increase or reduce their savings following tax changes, so the effect on household spending of an increase or decrease in taxes may be weak.

- There may be considerable time-lags between changing taxes and changes in household spending.

- Higher taxes may have a disincentive effect on work and enterprise, as some individuals alter their perception of the relative costs and benefits of work, in comparison with leisure.