Revenue

Revenue

Revenue is the income a firm retains from selling its products once it has paid indirect tax, such as VAT. Revenue provides the income which a firm needs to enable it to cover its costs of production, and from which it can derive a profit. Profit can be distributed to the owners, or shareholders, or retained in the business to purchase new capital assets or upgrade the firm’s technology.

Revenue is measured in three ways:

Total revenue

Total revenue (TR), is the total flow of income to a firm from selling a given quantity of output at a given price, less tax going to the government. The value of TR is found by multiplying price of the product by the quantity sold.

Average revenue

Average revenue (AR), is revenue per unit, and is found by dividing TR by the quantity sold, Q. AR is equivalent to the price of the product, where P x Q/Q = P, hence AR is also price.

Marginal revenue

Marginal revenue (MR) is the revenue generated from selling one extra unit of a good or service. It can be found by finding the change in TR following an increase in output of one unit. MR can be both positive and negative.

Revenue schedule

A revenue schedule shows the amount of revenue generated by a firm at different prices.

| P(£) (000) | Qd | TR (000) | MR (000) |

| 10 | 1 | 10 | |

| 9 | 2 | 18 | 8 |

| 8 | 3 | 24 | 6 |

| 7 | 4 | 28 | 4 |

| 6 | 5 | 30 | 2 |

| 5 | 6 | 30 | 0 |

| 4 | 7 | 28 | -2 |

| 3 | 8 | 24 | -4 |

| 2 | 9 | 18 | -6 |

| 1 | 10 | 10 | -8 |

Revenue curves

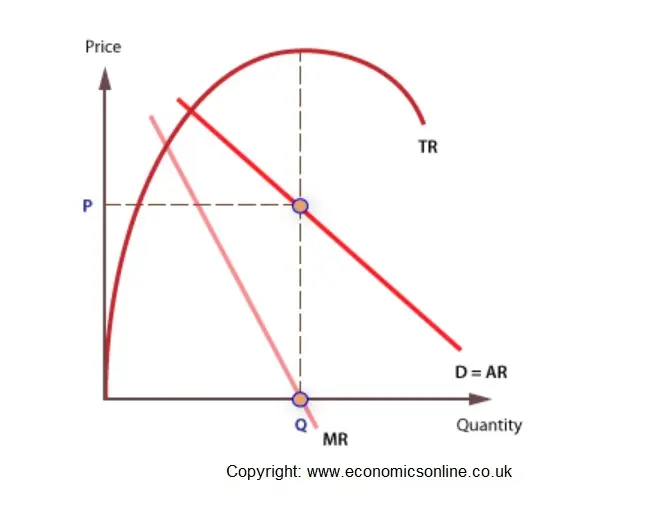

Total revenue

Initially, as output increases total revenue (TR) also increases, but at a decreasing rate. It eventually reaches a maximum and then decreases with further output.

Less competition in a given market is likely to lead to higher prices and the possibility of higher super-normal profits.

Average revenue

However, as output increases the average revenue (AR) curve slopes downwards. The AR curve is also the firm’s demand curve.

Marginal revenue

The marginal revenue (MR) curve also slopes downwards, but at twice the rate of AR. This means that when MR is 0, TR will be at its maximum. Increases in output beyond the point where MR = 0 will lead to a negative MR.