Definition of ad valorem tax

Ad valorem tax

Ad valorem taxes are those which are levied on spending and which are set as a percentage of the value added by a firm – Value Added Tax (VAT) is an example of an ad valorem tax.

Read more on taxes and subsidies

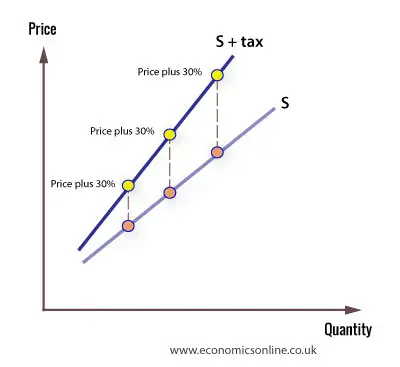

Here we can see that if we consider the supply curve as a cost curve then a 30% ad valorem tax will increase the costs of production by 30% at each level of output. This means the supply curve including the tax (S + tax) will be above the original curve and at a steeper gradient.