Inequality and poverty - policies

Policies to reduce inequality and poverty

Reducing inequality and poverty, and promoting equity, are important macro-economic objectives. The widening income gap between the rich and poor has highlighted the need to understand the causes of relative inequality and poverty, and to construct suitable policies to reduce poverty and narrow the income gap.

The principles of horizontal and vertical equity

Policy towards inequality and poverty is influenced by the desire to achieve both horizontal and vertical equity. Horizontal equity means that, as a guideline for tax and benefits policy, individuals in the same financial circumstances have the same fundamental ability to pay taxes, and, therefore, should be taxed at the same rate.

The principle of vertical equity suggests that, when individuals are in different circumstances and have different abilities to pay, they should not be taxed at the same rate.

The UK tax system, like many, tries to achieve both horizontal and vertical equity. Income tax is calculated as a % of earnings, so as income rises the tax take rises, meaning that Individuals earning the same income will be taxed at the same rate, and those earning more or less will pay more or less tax. The system also has bands of tax, with a tax-free allowance, so that at very low income, no tax is paid, and at very high income the upper tax band will apply. Horizontal equality is achieved because everyone pays in the same tax band pays the same tax. This means that a high earning individual will get the same tax-free allowance as the low paid, and will pay tax at the same rate as others over the different bands of income.

OECD Report

According to a report by the OECD in December 2014, the gap between rich and poor is now at its highest level in 30 years in most OECD countries. The overall increase in income inequality is driven by the top rich 1% who have seen their incomes accelerate away from the average.

The OECD also suggests that reducing inequality through tax and transfer policies does not harm growth, so long as the chosen policies are well designed and implemented. They argue that redistribution efforts should focus on families with children and youth, and improvements in human capital investment by the promotion of skills development and learning.

The tax and benefits system

Governments can intervene to promote equity, and reduce inequality and poverty, through the tax and benefits system. This means employing a progressive tax and benefits system which takes proportionately more tax from those on higher levels of income, and redistributes welfare benefits to those on lower incomes.

Stages of redistribution

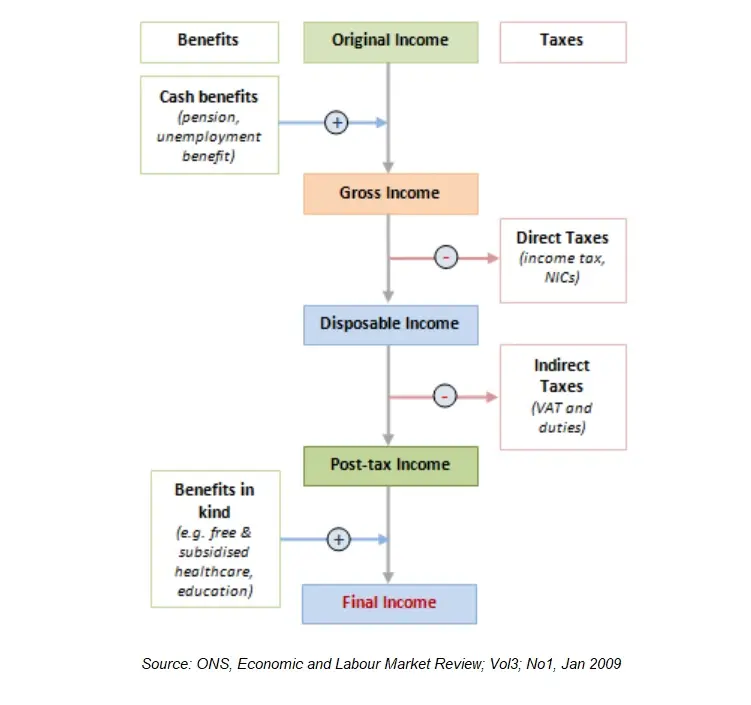

Original income can be adjusted in a number of ways to either increase or decrease post-tax income.

Cash benefits

Cash benefits are designed to help those on low or zero original income, and include contributory and non-contributory benefits.

Contributory benefits, such as pensions and job-seekers’ allowance, are those where individuals or employers make a contribution into the National Insurance Fund.

Non-contributory benefits, such as housing benefit, income support, carer’s benefit and child support, do not require a previous contribution to have been made. Generally, there are tests to see if individuals actually need these benefits, called means tests, though child benefit is not means tested and is a universal benefit available to all families with children.

Direct taxes

Income tax in the UK is mildly progressive and helps to redistribute income. This is because:

- Individuals on low incomes pay no income tax. In 2014 the tax-free ‘personal’ allowance was £10,000.

- Beyond this, income earners pay tax at the ‘basic rate’, which is currently 20%.

- Those on ‘higher incomes’ pay tax on some of their income at a higher tax rate, which is 40%.

- A higher rate of 45% for those earning over £150,000 of taxable income.

These tax bands help narrow the income gap and so help reduce inequality.

Indirect taxes

In contrast, indirect taxes are regressive meaning that, as a percentage of income, the proportion of tax paid declines at higher income levels, and, as such, the burden of the tax is largely on the poor. This means that, as a rule, indirect taxes widen the income gap.

The progressive effects of direct tax, and regressive effects of indirect tax generally cancel each other out.

Benefits in kind

Benefits in-kind are those services, such as healthcare and education, that are provided free or heavily discounted at the point of consumption. These benefits can make a considerable impact on final income, increasing it considerably for the poorest, and narrowing the gap between rich and poor.

Criticisms of progressive taxes and benefits

Taxes and benefits clearly compensate for the failure of labour markets to provide sufficient original income for all citizens. However, such intervention can be criticised because:

- It may create a disincentive effect, which occurs when individuals are discouraged from working hard because they pay more of their income in taxes.

- It may create moral hazard, where some individuals may not look for ways to improve their own position because the state provides insurance against poverty, unemployment, and disability.

For information on Welfare Reform

The National Minimum Wage

The long-term aim of a minimum wage is to remove the problem of poverty pay, which exists when the earnings from paid work do not result in a living wage and fail to push people out of poverty.

See also: National Minimum Wage

Policies to reduce unemployment

Unemployment is a major cause of poverty and inequality. Unemployment can be reduced by:

- Government sponsored job creation schemes.

- A monetary or fiscal stimulus to aggregate demand.

- Active labour market policies to increase employability, such as re-training schemes.

- Welfare-to-work schemes which encourage labour market participation.

See also: poverty