Supply-side shocks

Supply-side shocks

The level of national income can change in the short term if there is a supply-side shock. Many factors can bring about a sudden changes in supply, including changes in the following:

- Wage levels, which affect firms’ unit labour costs.

- Other costs of production, such as commodity prices, or which changes in oil prices are significant.

- Indirect taxes, such as VAT.

- Subsidies.

- Productivity of factors, especially labour.

- Changes in the use of technology and production methods.

- Direct taxes, such as income tax, via an incentive or disincentive effect.

- Length of the working week.

- Labour migration.

The effect of cost shocks

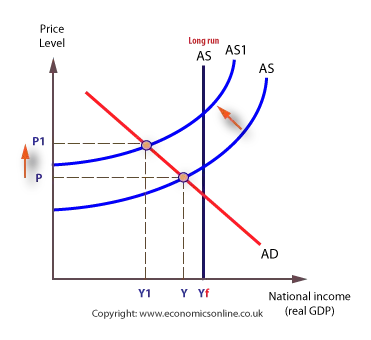

A cost shock will affect the aggregate supply curve in the short run, and the AS curve will shifts upwards and to the left.

Taking the example of a wage shock, the increase in wages will lead to a rise in business costs, which will shift the AS curve shift upwards, causing the price level will rise from P to P1.

This will cause a contraction of AD, and equilibrium will fall to Y1, resulting in a fall in real output and a probable loss of jobs. Therefore, cost shocks can result in serious economic difficulties for the affected country. Increases in oil prices are always a concern because of the general inflationary effects they can create.