Unstable markets

Unstable markets

Some primary markets can become unstable and require intervention to help them stabilise. In particular, many food producers suffer three main economic problems:

- Falling long term income.

- Unstable prices.

- Loss of bargaining power to big supermarket chains.

Falling incomes

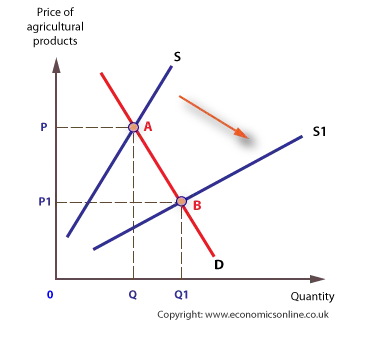

Farm incomes have fallen in the long term because the supply of food has increased. Supply has increased for a number of reasons, including:

- The greater use of new technology, and better crop yields.

- New entrants into the market, such as Vietnam, which entered the coffee market in the 1980s, have also helped shift the market supply curve to the right.

- Loss of power to the big supermarket chains

- Loss of power to the big supermarket chains, which means that supermarkets can dictate terms and prices to farmers. The buying power of supermarkets is referred to as monopsony power. Farmers are price takers which means they have to accept the price that the supermarkets dictate, supermarkets are the price makers.

Supply has increased due to the application of more efficient production methods and, in some cases, new entrants into the market. Demand is relatively price inelastic, hence revenue falls following the price reduction.

However, demand has not increased in the long run, so revenue (P x Q) falls. In fact, the demand for some food has fallen over time.

Revenue 0PAQ is clearly larger than revenue 0P1BQ1.

Unstable prices

Many commodity markets exhibit short term instability.

Movements in cocoa prices are typical of many commodity markets, which tend to exhibit considerable volatility. These price movements usually reflect changes in conditions of supply – with changes in weather patterns (such as el Nino conditions) and short-term growing conditions playing a large part.

Movements in cocoa prices are typical of many commodity markets, which tend to exhibit considerable volatility. These price movements usually reflect changes in conditions of supply – with changes in weather patterns (such as el Nino conditions) and short-term growing conditions playing a large part.

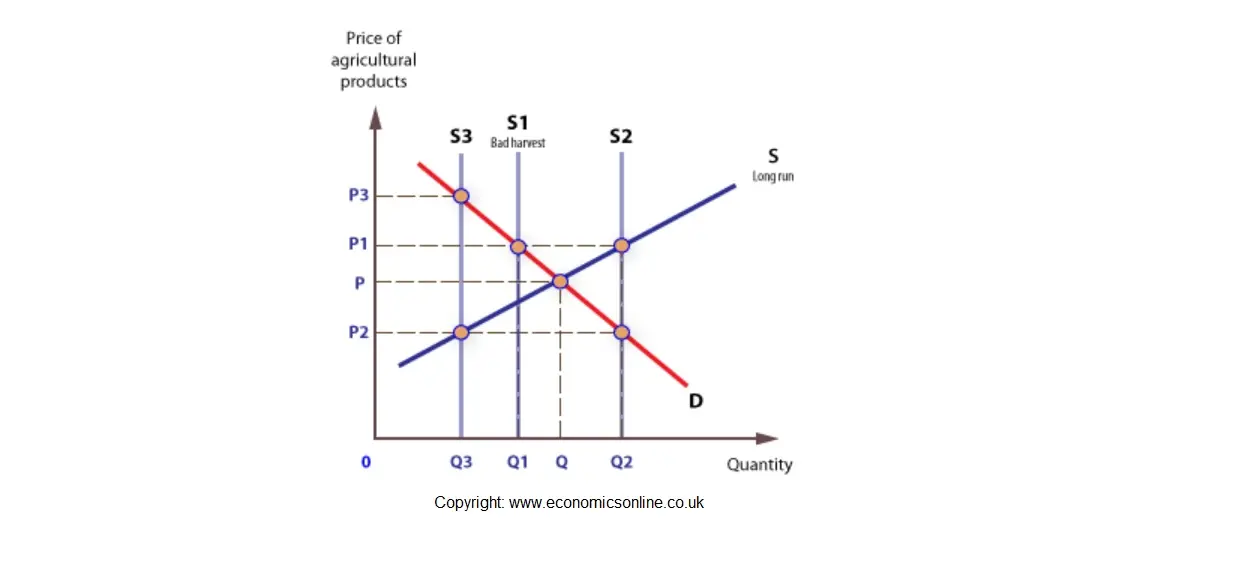

The cobweb diagram can be used to explain the tendency for price instability of agricultural products and commodity markets. Initially, we can assume a stable equilibrium price, followed by a negative supply shock, such as a crop disease, bad weather, political unrest or a war.

Cobweb diagram

Short run supply (Q1, at S1) ends up significantly less than planned (Q). Price is now driven up to P1. Next year, planned output rises to Q2, but this drives price down to P2.

The process continues until the price is so low that producers are driven out of the market. There is clearly a significant information failure – farmers and growers are not fully aware of the impact of their decisions in one year on the price of products in the following year.

A cobweb effect can also be triggered by a positive supply shock, such as an exceptionally good harvest.

Remedies

Go to: price stabilisation schemes