Bitcoin ETFs Signal Institutionalized Acceptance of Crypto

Introduction

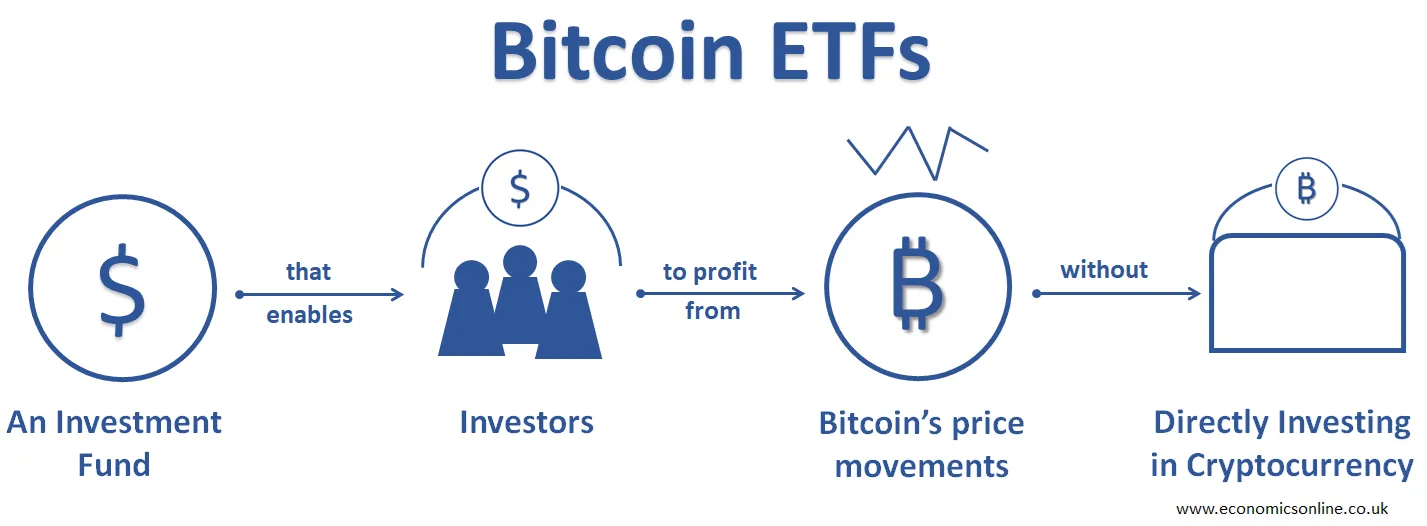

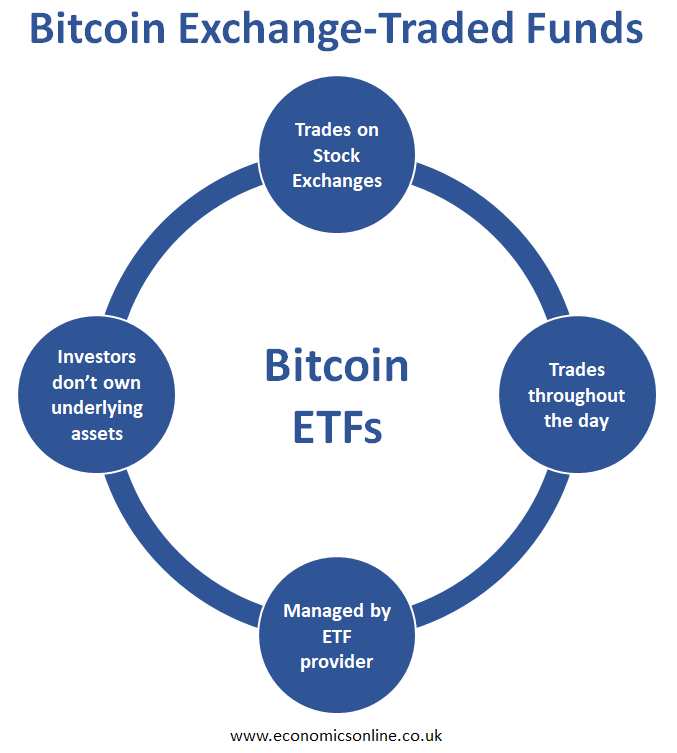

A Spot Bitcoin ETFs (Exchange-Traded Funds) are a type of financial product that is traded normally on public exchanges and monitors the performance of Bitcoin. ETFs are pooled securities that monitor the price indexes of multiple assets, such as commodities.

On January 10, 2024, 11 spot Bitcoin exchange-traded funds (ETFs) were first approved by the US Securities and Exchange Commission (SEC). The US Securities and Exchange Commission made it easy for these exchange-traded funds to be traded on the US Stock Exchange. It took a decade-long time period to be approved as a spot Bitcoin ETF. The journey of these Bitcoin ETFs contained a lot of legal battles and debates about Bitcoin and its linked investment products.

If you are wondering how to buy Bitcoins and Bitcoin EFTs and other investment vehicles, there are many safe and secure crypto exchanges available.

Who launched Bitcoin ETFs?

Many of the world’s most prominent asset managers, such as BlackRock, Fidelity, Valkyrie, VanEck, Franklin Templeton, ArkInvest/21 Shares, Grayscale, Bitwise, Invesco/Galaxy, and WisdomTree, along with Wall Street, launched their Bitcoin ETFs.

Crypto-based Exchange Traded Fund

A type of financial asset that is designed to track other assets, such as equities and commodities, is known as a crypto-based exchange-traded fund. The SEC approved Bitcoin ETFs after more than 10 years of the first filling of this crypto-based exchange-traded fund that follows the spot market price of Bitcoin.

SEC’s ETF Approval

Then, after all the legal battles and debates, the crypto industry finally announced the SEC’s final decision. The SEC’s decision is very important because of the availability of spot Bitcoin ETFs, which provide retail investors with a great opportunity for exposure and a new innovative asset class in a highly regulated environment. The SEC’s Commissioner, Hester Pierce, said in his statement that allowing spot ETFs of Bitcoin to be traded in the trade market is a positive development that promotes openness and innovation in the financial markets and also increases opportunities for all investors.

Another reason for the importance of the SEC’s approval is that it provides a path for deeper institutionalised involvement in the crypto world. Some institutional investors and major financial institutions worked for years to innovate a new crypto currency that is to be traded in the crypto market by using crypto-assets. But due to fear of volatility and regulatory uncertainty, they failed to directly use the crypto. The new crypto-asset, Bitcoin spot ETFs, provides access to new enterprises, institutional investors to a totally new crypto world that seems to deepen over time.

Criticism of Gary Gensler

In the approval phase of spot Bitcoin ETFs, SEC Chair Gary Gensler was the one who argued that approving a spot Bitcoin is not equivalent to the financial regulators who do not believe in the legitimacy, regulatory oversight, and broadness of a new crypto asset. This is also a kind of stress that SEC always remains concerned about how things are going in the crypto world. He also added in his argument that there is no willingness shown by the Commission (for the approval of spot Bitcoin ETFs) to approve new listing standards for digital asset securities. Along with that, it does not match the status of other crypto assets under federal securities laws. Without being judgmental, he also added that the majority of crypto assets are investment contracts and are also included in the federal securities law. However, the SEC’s Chairman, Caroline Crenshow, passed a different statement about these concerns.

Reasons Why SEC Approved Spot Bitcoin ETFs

One of the main reasons for the approval of spot Bitcoin ETFs by the SEC is that these spot Bitcoin ETFs will be traded on the national securities exchange, which is a way to protect investors from the risk of fraud and market manipulation and to make regulatory arrangements totally designed to identify and cope with potential abuse. The approval of the SEC paved the way for more future cryptocurrencies to be freely traded. This step also shows trust in the crypto world and allows more transparency in it.

Importance of Spot Bitcoin ETFS

The following points explain the importance of Bitcoin ETFs:

Regulatory Evolution

The approval of the spot Bitcoin ETFs are not just connected to market dynamics and liquidity; they are also part of regulatory evolution. It provides an overall framework that explains the nature of crypto. This detailed information led to the introduction of more appropriate and informed regulatory policies in the crypto market.

Increased Legitimacy

The launch of spot Bitcoin ETFs in the crypto space shifted public perceptions about crypto currency. Now, they perceive Bitcoin as a legitimate component of a diversified investment portfolio.

Democratising Access

The step of approving spot Bitcoin ETFs now acts as a bridge between traditional finance and the emerging world of crypto. It is a significant step towards inclusivity that allows investors to enter the crypto world without the technical obstacles of direct ownership.

Innovative Financial Landscapes

The spot Bitcoin ETFs are the forefather of an excess of innovative financial products and services that erase the line between traditional finance and the crypto currency world.

Market Dynamics

The ripple effects of the spot Bitcoin ETFs can lead to a redesign of market dynamics while staying closer to traditional financial markets while still having characteristics of the crypto world.

Impacts of Spot Bitcoin ETFs

The following points explain the impacts of spot Bitcoin ETFs:

The “New Nine” Bitcoin ETFs

The spot Bitcoin ETFs are also known as “New Nine”. These ETFs daily set a new record for trading volumes. For example, on February 26, BTC escalated to $54,938, as the trading volumes of all nine ETFs were $2.4 billion. According to data provided by Eric Balchunas, who was a Bloomberg ETF analyst, the total trading volume of February 26 broke the record of $2.2 billion of the first trading day on January 11.

New Institutional Interests

The ETFs approval has led to a dramatic surge in new institutional participation and interest in crypto currencies. The approval of the US Securities and Exchange Commission gave a signal to large institutions and financial market participants who are waiting for easier and more authentic access to a new class of digital assets outside of direct buys from crypto exchanges. The crypto exchanges have high volatility risks.

Interest among Retail Investors

The spot Bitcoin ETFs provide assurance of financial investors’ protection and the wide acceptance of Bitcoin encourages retailers to invest in crypto currencies. It is commonly said that where institutions go, retailers follow. Retailers use a brokerage account through which they can easily and safely access crypto. Today, buying a Bitcoin is too simple, just as we buy an ETF from an asset manager. Today, Bitcoin is also used in mainstream portfolios.

Conclusion

In conclusion, the spot Bitcoin ETFs are a type of financial product that monitors Bitcoin prices through the indexes of Bitcoin. The US SEC approval of the Bitcoin ETFs is a significant milestone in institutionalising Bitcoin and the adoption of cryptocurrency market. Gary Gensler was the one who tried hard to oppose this evolution in the exchange market. But the SEC approved this crypto currency in order to change traditional financial trading concepts. Bitcoin entered the financial markets and is making new records daily. Retailers and financial institutions are also accessing Bitcoin and it is also used in diversified investment portfolios.