Retail Banking Investigation - CMA

CMA report into retail banking

The long-awaited report by the Competition and Markets Authority (CMA) into the UK retail banking sector was finally published this week (9/8/16). The report looked into the provision of current accounts for personal customers, and banking services for small businesses – both sectors being dominated by the ‘Big Four’ banks (HSBC, Lloyds, Barclays and RBS.)

While the CMA noted some ‘positive developments’ in the sector, including increased opportunities for digital-only banks, and new payment services, it concluded that significant competition issues still exist in a market which is ‘highly concentrated’ and dominated by ‘older and larger’ banks.

The CMA reported that existing banks do not have to work hard enough to win and retain customers, which effectively stifles innovative and significantly reduces competition. Banks will only tend to innovate, or improve the quality of their services, when they need to attract new business, or when there is a clear threat that they might lose existing customers. Neither of these two conditions are met in the existing market for retail banking.

Competition issues

The CMA identifies some specific characteristics of the market that limit competition, including:

- Complicated charging structures, which reduce transparency and the probability of switching accounts – only 3% of personal customers and 4% of business customers switch accounts in a given year.

- A lengthy and onerous process faced by small business when they wish to open an account.

- Open-ended bank-customer relationships, where there are no ‘trigger points’, as in other financial markets, such as the annual insurance renewal system in insurance.

- The difficulty of transferring overdraft arrangements between different banks.

- Limited use of the new Current Account Switching Service (CASS).

- The difficulty of shopping around for small business loans, with some 90% of all loans to taken from their main bank.

- Overdraft charges are disproportionately high.

Barriers to market entry

The CMA identified several significant barriers to entry for new retail banks resulting from the advantages that existing banks have over potential entrants, including:

- Cheaper access to deposits – Existing banks, have access to cheaper deposits given their large customer base.

- Existing banks perceived as too big to fail – The risk of lending to existing banks is seen as lower than for new entrants, given the belief that they are ‘too big to fail’.

- Funding rules benefit existing banks – The funding rules put in place after the financial crisis are seen as acting against potential entrants. For example, the capital funding requirements in the mortgage market make it especially difficult to new firms to enter.

Measures to improve competition

While the CMA rules out breaking-up existing banks, given that it would be too complex and lengthy a process, it proposes a series of measures to improve competition.

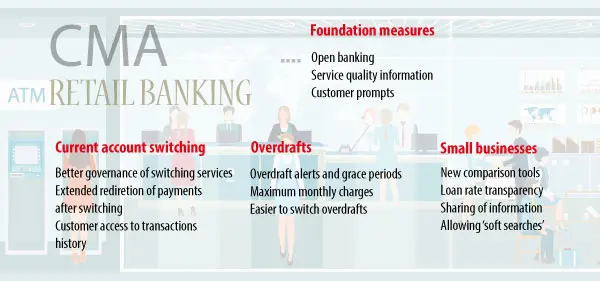

Foundation remedies

Technology

The retail banking industry should use of latest technology to develop apps which enable customers to have all their banking data in one place, and which will improve the quantity and quality of information available about alternative banking products. This will enable customers to make more informed choices, and give new entrants a chance to enter the market place through access to this technology.

Better information on service quality

Banks must publish core indicators of service quality, which will be made available through the new app.

Reminders and prompts

Banks will be forced to send customers reminders about specific events, such as information about banks closures, and annual dates. The Financial Conduct Authority (FCA) has been asked to research which behavioural prompts are most likely to change behaviour – for example, banks could be forced to inform customers that ‘25,000 people this year changed their current account’.

Switching

Retail banks will be forced to making switching even easier than it currently is by adopting Account Number Portability (ANP). This will be a similar system as the unique candidate identifier (UCI) code allocated to all UK students which they take with them when they change schools or sit different examination boards.

In addition, all banks will allow customers to get access to their account statements even after closure, which, for business, is necessary for completing accounts, or obtaining loans.

Overdrafts

The CMA looked closely at the overdraft market, where switching is very rare, and concluded that high overdraft charges were the result of weak competition in the market. To limit the negative effect of this the CMA proposed that banks should let customers know when they are about to go overdrawn, and allow grace periods where borrowers can avoid incurring charges.

In addition, the CMA proposed a new Monthly Maximum Charge (MMC) which places a cap on unarranged overdraft charges. The CMA asked the FCA to identify ways for overdraft users to shop-around.

Small businesses

In addition to the other measures listed above, the CMA also recommended the establishment of a new ‘comparison service’ for small businesses, and the adoption of a standardised account opening procedure for new business accounts.

Small businesses will also be allowed to check on rates from various banks without it affecting their creditworthiness – a process called ‘soft searching’.

All these elements will come into force by the Summer of 2018.

Bank market shares