The Housing Market

The Housing Market

The stock of housing in the UK includes privately owned and occupied houses and apartments, privately rented and local authority rented accommodation, and property managed by housing associations.

Total number of households

Households by type

In the early 20th Century, less than 10% of all homes were owner-occupied, but by the early 21st Century, this figure had risen to around 62% – just above the EU average. By 2017, there were just over 27 million households in the UK (27.23m).

As the chart shows, the significance of local authority housing has declined, while renting privately and through housing association schemes has increased.

(Source: ONS 2018).

Privately owned property

In the UK, privately owned property is either freehold or leasehold. Freehold ownership means that the land is owned as well as the property on the land, and leasehold means the land is not owned, and the owner buys the right to use the land and property for a period of time, usually over 100 years when the lease is first granted. As each year goes by, the lease becomes shorter until the land and property reverts to the landlord. It is common for leaseholders to purchase an extension to the lease when it falls below 60 years.

Mortgages

The majority of freehold and leasehold property is bought with the aid of a long-term loan, called a mortgage. Mortgages can be for any period of time, but 25 years is the most common. Mortgage repayments usually include two elements; repayment of the loan, called the capital, and repayment of the interest on the loan.

Since the late 1980s, securitisation of mortgages has meant that mortgage debt has been repackaged to provide a flow of income to third parties, including investment banks. This approach has been deeply implicated in the global financial crisis of 2008-09.

Mortgage approvals

Privately rented property

With privately rented property, the landlord rents out property through a short tenancy agreement, usually for 6 months, though this can be renewed. Tenants typically pay a monthly rent, though other payment periods may exist.

Local government – local authority – rented property

In the case of local authority rented property, tenants pay a weekly or monthly rent, which is commonly subsidised, and below commercial market rates. Property is allocated to individuals based on need and not just their income. Most local authorities do not have sufficient properties to meet demand and have long waiting lists.

Housing Association property

Housing Associations offer affordable properties for part-ownership and part-rental.

New built houses and existing property

The housing market is unlike many other markets given the relative importance of second-hand transactions, compared with purchases of newly built property. According to the UK’s largest mortgage lender, the Nationwide Building Society, only around 5% of transactions involve the purchase of new properties. Indeed, 95% of transactions involve the purchase of either ‘old’ property, which is defined as property built before the start of the Second World War, or ‘modern’ property, which is property built after 1945. The relative dearth of new property is one of the key factors driving the upward trend of UK property prices in the long run.

The importance of the housing market

The housing market in the UK is extremely important for two main reasons.

- Firstly, housing usually represents a household’s biggest single purchase, and a house represents the largest single item of consumer wealth.

- Secondly, changes in house prices can have considerable effects on the rest of the economy.

A change in house prices affects the value of household wealth, creating a positive or negative wealth effect. A positive wealth effect means that, following a rise in house prices, the ratio of the market value of the property to the debt on that property, typically in the form of a mortgage, rises creating an increase in equity. This can trigger housing equity withdrawal (previously called mortgage equity withdrawal) and can be a significant boost to consumer spending.

Changes in interest rates, which are a key policy tool to regulate the UK economy, often have a more significant effect on consumer spending in the UK than in other economies. This is due to the relatively large proportion of home ownership in the UK, and the general spending sensitivity of UK consumers to interest rate changes.

The long-term trend for UK house prices is upwards, but changes in house prices are extremely cyclical.

Property prices, debt and equity

While the debt on properties falls over time, as repayments are made, property prices tend to rise. This means that an owner’s equity in their property also rises. Equity is the difference between the market price of a property and the debt owed at a point in time.

Rising equity creates a positive wealth effect, which can lead to housing equity withdrawal. This occurs when homeowners release some of their equity by taking out a bank loan secured against the equity in the property.

Recent changes in housing equity withdrawal

A negative wealth effect is created when house prices fall creating a fall in equity. Prices may even fall to a level that creates negative equity, as in the crashes of 1990 and 2008. Negative equity exists whenever the amount of debt on a property is greater than the market value of the property. Negative equity reduces consumer confidence, and is likely to discourage spending.

Demand for private housing

The demand for private housing is determined by a number of factors, including house prices.

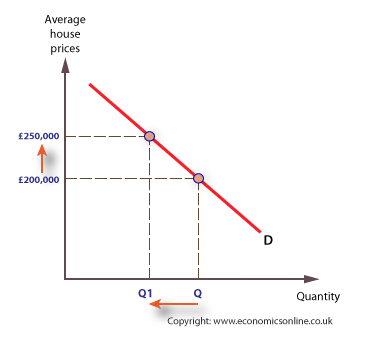

As expected, there tends to be an inverse relationship between house prices and demand. As with all goods, the inverse relationship can be explained with reference to the income and substitution effect.

At higher prices, real incomes will fall and individuals will reduce their demand. In addition, at higher prices, the alternatives to owning a property, such as renting, appear more attractive and individuals are more likely to rent. When house prices are lower the reverse is true, with individuals encouraged to buy because of a rise in their real income and because renting seems less attractive. However, the demand for property is also partly speculative, so that a rise in prices can lead to a rise in demand as buyers anticipate a speculative gain.

The non-price determinants include:

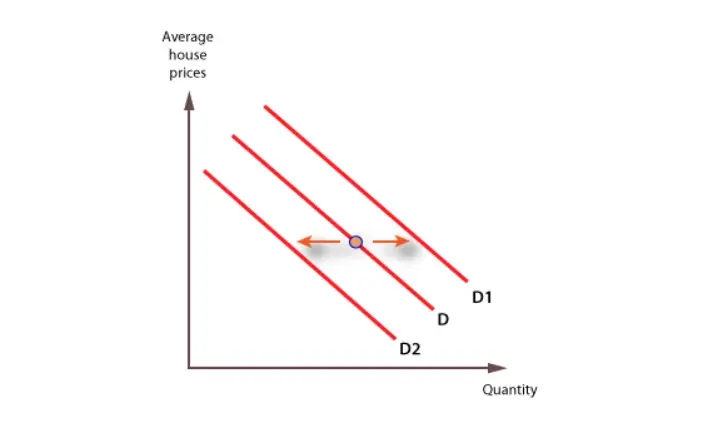

In addition to changes in price, which cause a movement along the demand curve for housing, other non-price factors are also important, and changes in these cause a shift in the demand curve.

Population

Total demand for property is determined by population size and changes in the structure of the population caused by migration and long-term changes in the birth and death rates. An aging population will increase the overall demand for property.

Incomes of households

Changes in both the level of national income, and its distribution, can have a significant effect on the demand for property. As houses are normal goods with a high income elasticity of demand, increases in income can trigger a larger percentage increase in demand. As their income rises many individuals switch from renting to home ownership, or move to bigger property. Some may buy a second property as holiday homes, or to rent out. Hence, the demand curve for private housing will shift to the right as incomes rise.

Social trends

Social and lifestyle trends, such as a preference for late marriages, can alter the pattern of demand for houses, and the total demand. The preference for later marriages had led to an increase in the number of single households, and to a rise in the demand for flats and apartments.

Interest rates

Changes in general interest rates may be passed on by lenders such a building societies and banks, and this will also the amount of monthly repayments for those on variable-rate mortgages. Higher rates make property less affordable, and the demand curve will shift to the left.

Interest rates, which had been averaging around 4.5%, started to fall dramatically in late 2008, to reach their lowest level on record. Since then, Bank of England base rate has remained at 0.5%. However, mortgage rates did not fall so dramatically, as lenders looked to maintain their liquidity and increase their profitability. Also, many borrowers were on fixed-rate mortgages, and could not take advantage of low rates in the short term.

Average variable rate mortgages from banks and building societies fell to 3.8% in early 2009, and continued to fall to reach 2.4% by early 2018.

Availability of credit

The availability of credit is also important in determining the demand for property. During the banking and financial crisis of 2008-09, the supply of credit fell which reduced the demand for housing, and led to a fall in house prices.

UK supply of loans for homes

Fashion

Owning property has become increasingly fashionable in the UK over the last 25 years. One reason is the number of television programmes featuring property purchases, renovations, and ‘make-overs’, which have all increased interest in housing and the housing market.

Price of substitutes

Renting property is an alternative to ownership, and changes in rental prices can affect the demand for private property.

Buy-to-let demand

The increase in the availability and popularity of buy-to-let mortgages in the 1990s created a new market for property as an investment and gave a boost to an already buoyant market.

Expectations

There is an important speculative element in the demand for property. Property developers and ordinary householders often base their current demand for property on expectations of future price changes. Rising house prices encourage speculation and falling house prices discourage speculative buying.

Changes in demand

Changes in any of the underlying determinants of demand for houses will shift the demand curve to the left or right.

The supply of private housing

Price

The supply of private housing is partly determined by house prices, together with a number of underlying determinants. In terms of house prices, the relationship between supply and price is positive, with higher prices encouraging supply. Rising prices encourage house builders to construct more housing, and existing owners are encouraged to sell.

The supply of housing is positively related to house prices, and the supply curve is upward sloping. However, supply is frequently inelastic because of time lags and legal complexities and, in the case of new-builds, because of the difficulty of obtaining planning permission.

Non-price factors

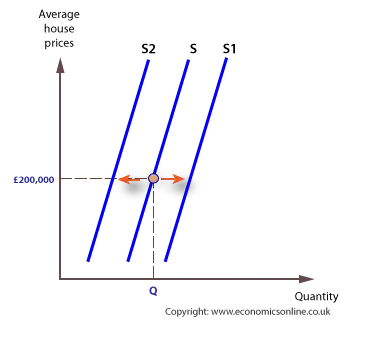

A change in house prices will lead to a movement along the existing supply curve for property. Other, non-price factors will cause a shift in the supply curve.

Availability of factors

As indicated, new house building depends upon the availability of land, which may be very limited in the short run. An increase in the availability of land will shift the supply curve to the right. Availability of labour is also important. For example, a shortage of bricklayers would reduce the supply of new houses.

Costs

In the case of new-builds, building costs may also have a significant effect on supply. These costs include raw materials and labour costs. A shortage of labour, for example, could push up the wage rate and increase building costs, which would cause the supply curve to shift to the left.

Government legislation

Legislation can also affect the supply of housing in a number of ways. The strict requirement for planning permission for new house building may deter house builders. Conversely, relaxation of regulations, as happened in the London Docklands, is likely to encourage building. Government can also tighten or relax restrictions on building in rural areas, such as the green belt.

In 2007 the UK government introduced Home Information Packs (HIPS) in an attempt to speed up the house-buying process. However, critics argued that they added a new layer of bureaucracy into an already over-regulated market, and the requirement to provide these packs was eventually scrapped in 2010.

Subsidies

Subsidies given to house builders are also likely to encourage supply, such as the subsidies given to builders of ‘affordable’ homes for key workers, including police, fire, and ambulance workers.

Technology

The application of new building methods, such as ‘pre-fabrication’, and the use of new building materials have increased the speed at which new houses are built, and hence increased the supply of property. This has tended to increase the elasticity of supply of properties at the cheaper end of the market.

Shifts in supply

Changes in an underlying determinant of supply will shift the supply curve.

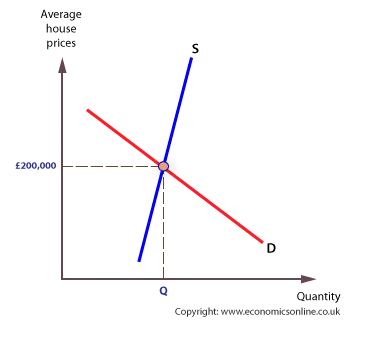

Equilibrium house prices

House price reflect both demand and supply, and, as in all markets, equilibrium price will occur at the price that matches current demand to available supply. In the short run, supply is relatively inelastic given that it takes a long time to build new houses. Hence, increases in demand have an especially big effect on house prices.

Over time, demand for housing in the UK has risen continuously while the supply has remained stable. UK house building in recent years has been one of the lowest in Europe, and this has contributed to the rising level of average prices.

House prices and interest rates

Interest rates are an increasingly important determinant of the demand for housing. A small fall in interest rates can trigger a large increase in the demand for property. Lower interest rates lead to lower mortgage rates, and encourage new entrants as well people looking to buy second homes as an investment.

With low interest rates, people with excess funds to invest will get a better rate of return by investing in property rather than from a bank deposit account. This additional demand drives up house prices.