Comparative advantage

Comparative advantage

It can be argued that world output would increase when the principle of comparative advantage is applied by countries to determine what goods and services they should specialise in producing. Comparative advantage is a term associated with 19th Century English economist David Ricardo.

Ricardo considered what goods and services countries should produce, and suggested that they should specialise by allocating their scarce resources to produce goods and services for which they have a comparative cost advantage. There are two types of cost advantage – absolute, and comparative.

Absolute advantage means being more productive or cost-efficient than another country whereas comparative advantage relates to how much productive or cost efficient one country is than another.

Example

In order to understand how the concept of comparative advantage might be applied to the real world, we can consider the simple example of two countries producing only two goods - motor cars and commercial trucks.

Comparative advantage

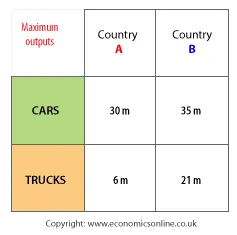

Using all its resources, country A can produce 30m cars or 6m trucks, and country B can produce 35m cars or 21m trucks. This can be summarised in a table.

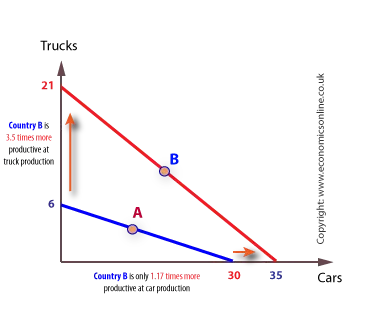

In this case, country B has the absolute advantage in producing both products, but it has a comparative advantage in trucks because it is relatively better at producing them. Country B is 3.5 times better at trucks, and only 1.17 times better at cars.

However, the greatest advantage - and the widest gap - lies with truck production, hence Country B should specialise in producing trucks, leaving Country A to produce cars.

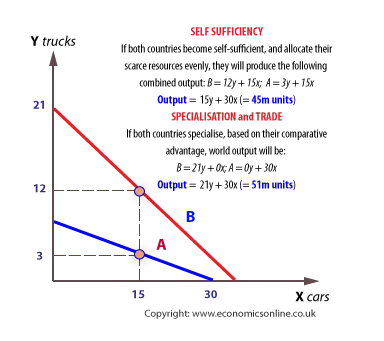

Economic theory suggests that, if countries apply the principle of comparative advantage, combined output will be increased in comparison with the output that would be produced if the two countries tried to become self-sufficient and allocate resources towards production of both goods. Taking this example, if countries A and B allocate resources evenly to both goods combined output is: Cars = 15 + 15 = 30; Trucks = 12 + 3 = 15, therefore world output is 45 m units.

Opportunity cost ratios

It is being able to produce goods by using fewer resources, at a lower opportunity cost, that gives countries a comparative advantage.

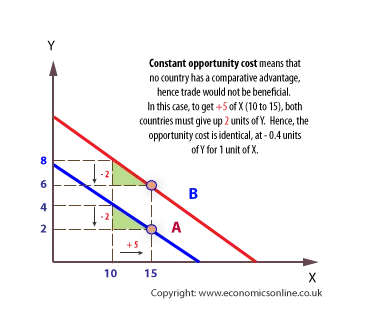

The gradient of a PPF reflects the opportunity cost of production. Increasing the production of one good means that less of another can be produced. The gradient reflects the lost output of Y as a result of increasing the output of X.

Having a comparative advantage in X, Country A sacrifices less of Y than Country B. In terms of two countries producing two goods, different PPF gradients mean different opportunity costs ratios, and hence specialisation and trade will increase world output.

Only when the gradients are different will a country have a comparative advantage, and only then will trade be beneficial.

Identical PPFs

If PPF gradients are identical, then no country has a comparative advantage, and opportunity cost ratios are identical. In this case, international trade does not confer any advantage.

Criticisms

However, the principle of comparative advantage can be criticised in a several ways:-

- It may overstate the benefits of specialisation by ignoring a number of costs. These costs include transport costs and any external costs associated with trade, such as air and sea pollution.

- The theory also assumes that markets are perfectly competitive - in particular, there is perfect mobility of factors without any diminishing returns and with no transport costs. The reality is likely to be very different, with output from factor inputs subject to diminishing returns, and with transport costs. This will make the PPF for each country non-linear and bowed outwards. If this is the case, complete specialisation might not generate the level of benefits that would be derived from linear PPFs. In other words, there is an increasing opportunity cost associated with increasing specialisation. For example, it may be that the maximum output of cars produced by country A is only 20 million (compared with 30), and the maximum output of trucks produced by country B might only be 16 million instead of 21 million. Hence, the combined output from trade might only be 46 million units (instead of the 51 million units initially predicted).

- Complete specialisation might create structural unemployment as some workers cannot transfer from one sector to another.

- Relative prices and exchange rates are not taken into account in the simple theory of comparative advantage. For example if the price of X rises relative to Y, the benefit of increasing output of X increases.

- Comparative advantage is not a static concept - it may change over time. For example, nonrenewable resources can slowly run out, increasing the costs of production, and reducing the gains from trade. Countries can develop new advantages, such as Vietnam and coffee production. Despite having a long history of coffee production it is only in the last 30 years that it has become a global player. seeing its global market share increase from just 1% in 1985 to 20% in 2014, making it the world's second largest producer.

- Many countries strive for food security, meaning that even if they should specialise in non-food products, they still prefer to keep a minimum level of food production.

- The principle of comparative advantage is derived from a highly simplistic two good/two country model. The real world is far more complex, with countries exporting and importing many different goods and services.

- According to influential US economist Paul Krugman, the continual application of economies of scale by global producers using new technology means that many countries, including China, can produce very cheaply, and export surpluses. This, along with an insatiable demand for choice and variety, means that countries typically produce a variety of products for the global market, rather than specialise in a narrow range of products, rendering the traditional theory of comparative advantage almost obsolete.

- Modern approaches to explaining trade patterns and trade flows tend to use gravity theory - which explains trade in terms of the positive attractiveness between two national economies - based on economic size (in a similar fashion as planets attracting each other based on their mass) - and the 'economic distance' between two economies. Economic size attracts countries to trade, and economic distance makes trade harder. Economic distance is increased by barriers to trade, and cultural, political and linguistic differences. One advantage of gravity theory is that it can help economists predict the likely effect of changes in government policy on trade patterns, including decisions regarding joining (or leaving) trading blocs.

- Despite these significant criticisms, the underlying principle of comparative advantage can still be said to give some ‘shape’ to the pattern of world trade, even if it is becoming less relevant in a globalised world and in the face of modern theories.