Deflation

Deflation

Deflation is a fall in the average level of prices over time. Deflationary policy means contracting the economy through tighter monetary or fiscal policy.

-

Read more on inflation and deflation

If the price level falls, an economy experiences price deflation. Rising prices create a number of economic problems. Because changes in the price level cannot be measured precisely, increases of less that 1% a year are considered to be deflationary, and also warrant intervention. Deflation can cause the following economic problems:

Delayed consumption

Consumers may delay consumption, waiting for prices to fall even further. This can have a negative impact on aggregate demand, output and incomes.

Rising real interest rates

Given that nominal interest rates cannot fall below zero, falling prices cause real rates to rise. For example, if nominal interest rates are currently 5% and inflation is 1%, real interest rates are 4% (which is 5% – 1% = 4%). However, if the price level falls by 2%, real interest rates (5% – [-2%]) rise to 7%. Of course, nominal rates can be reduced, but deflation tends to put upward pressure on real rates.

A rise in debt burdens and a deterrent to borrowing

Deflation will cause debt burdens to rise for households that have borrowed in the past. Many consumer and corporate debts are fixed, including fixed mortgages and personal loans, and repayments do not fall as prices fall, making the real price of the debt rise. For firms, falling prices also create a debt burden because, although revenues fall, debt repayments may remain at the old level, increasing the real debt burden.

Recession

This is because economic confidence begins to fall as households and firms save rather than spend. Long term recession following deflation is often called the Japanese disease, given that, for a long period during the 1990s, Japan seemed trapped in a deflationary spiral.

Causes of deflation

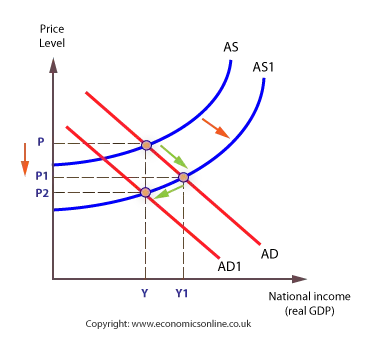

Following a positive supply shock, AS to AS1, prices fall from P to P1. Consumers may expect prices to fall further, and delay their consumption. This causes AD to shift to the left, from AD to AD1. Firms now cut prices further to boost sales and reduce stocks.

Deflation can be triggered by an increase in supply. As business and consumer confidence in the economy declines, AD falls, resulting in recession.

As confidence falls, and wages begin to fall, consumption falls further. Real interest rates rise, and savings rise.

Investment falls due to a negative accelerator effect triggering further price reductions as firms must compete with each other to attract increasingly scarce consumers. This creates a downward deflationary spiral, which is extremely hard to get out of.

Evolving Views on the Impact of Deflation

Most economists believe that deflation is a bad thing because it can lead to higher unemployment and more defaults on loans. To try to avoid this, central banks usually adjust monetary policy so that there is a consistent increase in the money supply, even if this means causing chronic inflation. This encourages debtors to borrow too much.

As British economist John Maynard Keynes warned, deflation can lead to a downward spiral of economic pessimism during recessions. This is because when asset prices fall, owners of assets become less willing to invest. Irving Fisher, an economist who developed an entire theory for economic depressions based on debt deflation, argued that the liquidation of debts after a negative economic shock can reduce the supply of credit in the economy, leading to deflation and putting even more pressure on debtors. This can spiral into a full-blown depression.

In recent years, economists have increasingly challenged the old interpretations about deflation, especially after a 2004 study by economists Andrew Atkeson and Patrick Kehoe. After reviewing 17 countries across a 180-year time span, Atkeson and Kehoe found that 65 out of 73 deflation episodes had no economic downturn, while 21 out of 29 depressions had no deflation. Now, a wide range of opinions exists on the usefulness of deflation and price deflation.

Debt and Equity Financing

With deflation, it becomes less attractive for businesses and consumers to use debt financing. However, deflation also increases the economic power of equity financing that is based on savings. This is because when prices are falling, each dollar of savings can buy more goods and services than before. As a result, those who have saved money have more purchasing power than those who have borrowed money.

From an investor's point of view, companies that have large cash reserves or little debt are more attractive under deflation. The opposite is true for businesses with a lot of debt and no cash. Deflation also causes yields to rise and increases the risk premium on securities.