Exchange rates

Exchange rates

Exchange rates are extremely important for a trading economy such as the UK. There are several reasons for this, including:

- Exchange rates represent a cost to firms, which arises when commission is paid on the exchange of one currency for another.

- Exchange rate changes create a risk to those firms that hold assets in currencies other than Sterling.

- Exchange rates affect the price of exports, which form a significant part of aggregate demand, and the price of imports, and hence the balance of payments.

The Monetary Policy Committee of the Bank of England will often take the exchange rate into account when setting short term interest rates, hence changes in the exchange rate have another transmission route into the economy, via their effect on interest rates.

Measuring exchange rates

Exchange rates can be measured in two ways:

Bi-lateral rates

A bilateral rate is the rate of exchange of one currency for another, such as £1 exchanging for $1.50.

Multi-lateral rates

A multilateral rate is the value of a currency against more than one other currency. Economists calculate multi-lateral rates to understand what is happening to the exchange rate, on average. This is achieved by using an index that reflects changes in one currency against a basket of other currencies. The use of a trade weighted index enables a country to measure its effective exchange rate.

Effective exchange rates – the Sterling Exchange Rate Index (ERI)

In the UK, Sterling’s average rate is measured by the Sterling Exchange Rate Index. (ERI)

This index tracks changes over time, starting with a base year index of 100, and is weighted to reflect the relative importance of different countries in terms of UK trade. It is an example of an effective exchange rate.

It has come in for criticism because the weights get adjusted too infrequently, and changes to the pattern of UK trade take too long to be included in revised weightings. In the early 2000’s, many observers argued that the index required modification, including the Chief economist at the HSBC, who argued that the index understated Sterling’s strength by around 5%.

As a result of these criticisms, in 2005 the Bank of England introduced a new version of the index which can adjust more rapidly to changes in trade patterns.

Changes in trade patterns

Weights for the ERI are adjusted to reflect changes in trade patterns. For example, the weighting of the Chinese yuan and Indian rupee have increased over the last 15 years, while the weighting of the US dollar the Japanese yen and the euro have been reduced, reflecting the increased significance of trade with the BRIC economies compared with the UK’s traditional markets and trading partners in the euro-area, Japan and the US.

Countries are included in the ‘narrow’ exchAnge rate index if their share of either UK imports or exports on average over the latest three-year period is greater than 1%.

Real Effective Exchange Rates (REERs)

The Real Effective Exchange Rate (REER) for a currency is found by adjusting the nominal exchange rate index to take into account relative inflation rates between a country and its trading partners.

For example, if the UK experiences a lower rate of inflation compared with a single trading partner, such as India, the normal rate of exchange of Sterling to the rupee is adjusted upwards (reflated). Hence, if UK inflation is running at 2% and the rate in India is 7%, the rupee is adjusted downwards by the average price difference – that is by 5%.

To calculate the REER, the value of the ERI (the effective exchange rate) will be adjusted by taking into account relative inflation rates for all those currencies in the index.

Exchange rate regimes

An exchange rate regime is a system for determining exchange rates for specific countries, for a region, or for the global economy. Throughout history, three basic regimes have existed:

Floating

A floating regime is one where currencies are allowed to move freely up and down according to changes in demand and supply.

Fixed

Fixed rates are currency values which are tied to a precious metal such as gold, or anchored to another currency, like the US Dollar.

Managed

Managed exchange rates exist when a currency partly floats and is partly fixed, such as happened between 1990 and 1992, when Sterling was managed in the Exchange Rate Mechanism (ERM) of the European Monetary System. This system preceded the European Euro (€), which was launched in 1999.

Floating exchange rates

Under a floating system a currency can rise or fall due to changes in demand or supply of currencies on the foreign exchange market.

Changes in exchange rates

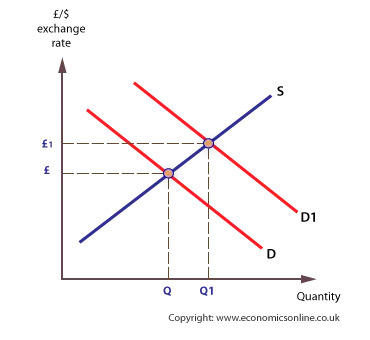

Changes in the exchange rate in a floating system reflect changes in demand and supply of currencies. On a demand and supply diagram, the price of a currency such as Sterling (£) is expressed in terms of the other currency, such as the USD ($).

An increase in the exchange rate

For example, an increase in UK exports to the USA will shift the demand curve for Sterling to the right and push up the exchange rate of the pound against the US dollar

Changes in interest rates

Changes in interest rates affect a country’s currency. Higher interest rates lead to an increase in the demand for a country’s financial assets, and an increase in the demand for a currency.

Lower interest rates reduce speculative demand for assets and reduce demand for a currency. These speculative flows are called hot money.

Increases in supply of a currency

An increase in the supply of a currency will depress its price. This could result from and increase in imports relative to exports, or speculative selling of the currency.

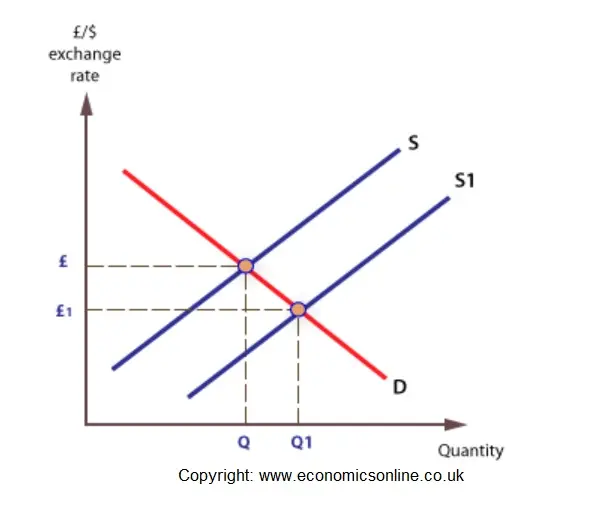

Equilibrium exchange rates

An ‘equilibrium’ exchange rate is the specific rate where export revenue and import spending are equal.

Equilibrium

At currency ‘£’, import spending equals export revenue, at ‘Q’. At a higher rate, say at £1 imports now appear cheap in the UK, and spending increases to Qm, and exports appear expensive abroad, and fall to Qx. This opens up a trade gap (Qx to Qm).

Those in favour of a floating exchange rate regime argue that allowing exchange rates to float will enable trade to balance more quickly.

Fixed exchange rates

The IMF system

A fixed exchange rate regime involved currencies being fixed against a precious metal or against another currency, or basket of currencies.

The International Monetary Fund (IMF) was conceived in 1944, at Bretton Woods, New Hampshire (USA) and became operational in 1945. Its aim was to stabilise the world economy through a system of fixed exchange rates. The IMF was one of three pillars to support the development of post-war economies, the other two being GATT (The General Agreement on Tariffs and Trade), later to become the WTO (World Trade Organisation), and the International Bank for Reconstruction and Development, later to be called the World Bank.

The IMF system involved the US$ as the anchor for the system with the US$ given a specific value in terms of gold, and other currencies were then given a value in terms of the US$, such as £1 = $2.40c.

However, the system collapsed in 1971 for a number of reasons, including the build up of US debts abroad as a result of the need to fund the war in Vietnam. In addition, inflation in the USA and growing doubts about the stability of the US$ caused intense speculative activity against the US$. Speculators frantically sold US$s during 1971 until President Nixon, took the US out of the system.

Managed regimes

Managed regimes involve a mixture of free-market forces and intervention.

A recent example is the European Exchange Rate Mechanism (ERM), which operated from 1979 to 1999.

In this system, currencies were kept inside an agreed band of (+/-) 2.25% for most members. This was achieved by the monetary authorities either raising or lowering interest rates, or by buying or selling currency.

Exchange controls

Some currencies are subject to exchange controls, which mean that the relevant Central Bank will only allow buying and selling through its own system, rather than be subject to fluctuations associated with fully floating rates. Although most countries abandoned these controls many years ago, some, like China and Cuba, still practice very strict exchange rate control.

Advantages of floating exchange rates

Flexibility and automatic adjustment

Over time, an economy may experience changes in imports and exports, and this can lead to a balance of payments disequilibrium (deficit or surplus). Under a floating regime, the deficits and surpluses will lead to adjustments in the exchange rate, which alter relative import and export prices in the future. Therefore, imports and exports can readjust to move the balance of payments back towards a desirable equilibrium. Exogenous shocks, like the financial crisis of 2008-09, can occur from time to time and floating exchange rates can help the readjustment process.

Freedom

Policymakers are free to devalue or revalue to achieve specific objectives, such as stimulating jobs and growth and reducing inflationary pressure.

Advantages of fixed regimes

Stability for firms

Exporting firm’s prices are more stable, as are importing firm’s costs. This is the main reason the Chinese Yuan has been fixed against the US Dollar for nearly 20 years, creating a very stable framework for Chinese manufacturing.

Predictability and confidence

Firms can plan ahead and are likely to invest more. Confidence is a necessary condition for investment.

Discipline

Another advantage of fixed exchange rates is that policy makers cannot devalue the currency in an attempt to hide inflation or a balance of payments deficit. Deliberately holding a currency down would reduce export prices abroad and nullify any domestic inflation, as well as providing a boost to exports. In addition, policy makers cannot revalue to keep a currency artificially high to reduce imported cost-push inflation.

Recent UK Exchange rates

After leaving the European Exchange rate mechanism (ERM) in 1992, Sterling fell rapidly against the Euro-area currencies, reaching a low in 1996.

From 1996 to 2006, the UK economy prospered, with unemployment falling, household spending rising, but with interest rates also rising. At that stage Sterling was ‘undervalued’, and speculators sought to buy Sterling. High levels of FDI also helped push Sterling to record levels, peaking in 2000.

This coincided with a weakness in the newly launched Euro, with speculators unsure about whether it would work. Between 2003 and 2008, the Euro regained much of its value against Sterling, the main global weakness being the US Dollar.

Following the global financial crisis in 2008, Sterling fell against most major currencies. This was the result of speculators believing that the UK economy would be hit particularly hard given the significance of its financial sector to overall economic performance.

Sterling recovered against major currencies from 2013, and by April 2014 it reached a five-year high against the USD of $1.67.

In early 2016 Sterling took a tumble against most major currencies as a result of the uncertainty surrounding the EU referendum, falling to $1.39 in February 2016.

Brexit-effect: Sterling falls by 17.5%

Sterling fell by 17.5% between December 2016 and January 2017, with most of the fall occuring in the days and weeks after Brexit, in June 2016. While this is likely to generate imported cost-push inflation, there was an immediate upward effect on share prices, with share values in companies based in the UK, but valued in US dollars, seeing considerable gains. Export-led growth throughout 2017 is also likely to be a positive consequence of the fall in Sterling.

See: US dollar hits 9-year high against the Euro

See: Exchange rate policy