An image of a bear and a bull.

Stock Market Crash of 1987

Introduction

A stock market is the collection of buyers and sellers of shares and other financial instruments. The stock market plays an important role for companies to raise funds and for individual investors to sustain their wealth. A stock market crash is a sudden decline in the prices of shares in a stock market. There are many major instances of stock exchange crashes, including the stock market crash of 1929 and the 2020 COVID-19 crash. However, the crash of 1987 has its own historical importance. In this article, we will discuss the stock market crash of 1987 along with its causes in detail.

What is the Stock Market Crash of 1987?

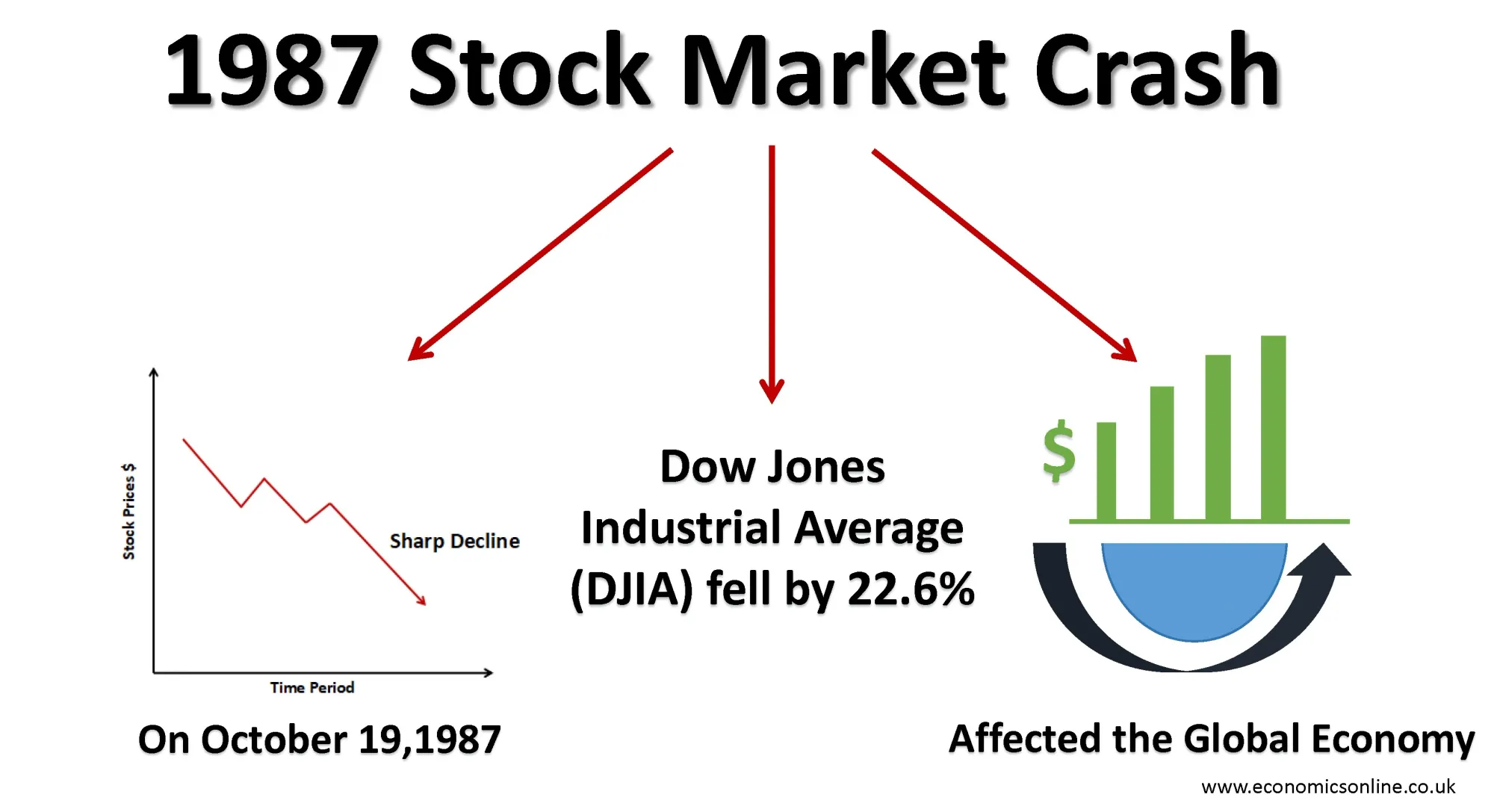

The stock market crash of 1987 is also known as “Black Monday.” Thirty-six years ago, on Monday, October 19, 1987, the US stock market experienced the largest one-day percentage drop in stock prices in its history. This stock market crash not only affected the US but also the rest of the world.

What Happened on Black Monday?

Here is a list of things that happened on Black Monday.

- The Dow Jones Industrial Average (DJIA) went down by 508.65 points or by 22.63%, on October 19, 1987, from $2,247.39 to $1,738.74 in a single day.

- The amount of the points drop on DJIA was four times bigger than the previous record.

- 22.63% is the biggest single day percentage loss till date.

- $500 billion of capital was lost on October 19, 1987.

- More than $1.7 trillion was the total estimated loss on Black Monday, as all the stock exchanges were negatively affected on a single day.

- The stock prices on the New York Stock Exchange, London Stock Exchange and other stock markets fell by up to 25% in a single day.

Causes of Stock Market Crash of 1987

The 1987 stock market crash was massive and its impact was global. Here are some major causes that led to the stock market crash in 1987:

Wall Street’s Asset Bubble

Wall Street’s asset bubble was formed when advancements in computer technology took place. This technology made it easy for banks to earn profit within minutes by capitalising on the smaller changes in the prices of stocks. At that time, in the 1980s, the markets were growing beyond their normal growth rates. The DJIA Index increased by 250% from 1981 to 1987 before the crash happened. This created an asset bubble and an overvalued stock market. This bubble of excessive valuation levels burst when the stock market crash of 1987 happened.

Portfolio Insurance

Another major cause of the crash in 1987 was “portfolio insurance.” This strategy is used to protect a stock portfolio by short-selling stock index futures from markets risks and is one of the hedging techniques used by traders. Portfolio insurance was introduced by Mark Rubinstein and Hayne Leland in 1976. This technique is used to limit or reduce the losses of a portfolio of stocks due to a decline in their prices. It is used to hedge or limit losses by using stock index futures as a portfolio shield. In this strategy, investors tend to sell in the falling market, leading to a crash which happened in 1987. The main problem was that all big investors and companies were using this same hedging technique, and the automated computer programmes started to liquidate the stock in the market when stock prices were falling, leading to an increase in stock sales. That caused the crash in a single day in 1987.

Triple Witching

Triple witching is the quarterly buying and selling of stocks and is used to prevent high losses. At that time, due to triple witching, all three types of stock options expired at the same time on Friday, October 16th, just before Black Monday. This had led to the high sale of options, causing the stock market crash in 1987.

Jim Baker’s Threats

Another cause of the crash was the anxieties of investors due to economic reports of a U.S. trade deficit, along with the threat of Jim Baker, the US Treasury Secretary. Jim Baker’s announced the possibility of the devaluation the dollar on international currency markets leading to the sale of shares by traders. This sale of shares created downward pressure on the share prices in the stock exchange, leading to the stock market crash of 1987.

Program Trading

The buying and selling of different stocks and future contracts by using computer systems and algorithms is known as program trading or automated trading. These computer programs can act on traders behalf based on pre-set rules, without much human interventions or interactions, can make decisions very quickly based on their reactions to market data, and can do high-frequency trading. Program trading is fast opposite to the slow process of human trading. The program trading must be according to the trading strategy listed on the U.S. Federal Stock Exchange. The downfall of the stock market began a week before the crash. At that time, the S&P 500 index showed a 9% downfall because selling orders began to pile before October 19, 1987. In the crash week, the S&P 500 and Dow Jones Industrial Average both collectively showed a decline of more than 20.6% (probably 508 points) from their original values. On Black Monday, computers traded too many stocks and that too very quickly, leading to the Wall Street crash in a single day.

Insights Gained From the Crash

The following are some insights or lessons gained from the stock market crash in 1987:

Stock Market Volatility

The first lesson learned from Black Monday is that the stock markets are highly volatile and anything can happen in them. Any unexpected and unplanned sequence of events can cause the stock markets to crash. Investors and traders should take precautions and keep in mind the inherent risks involved due to stock market volatility.

Stock Market Recovery

Another lesson is that the stock markets eventually recover after experiencing crashes. The markets have successfully recovered from the crashes of 1929, 1987 and 2020. In most cases, after recovery, the stock markets started performing way better than in the past. This means that investors and traders should adapt the long term perspective in mind for effective investing.

Afternoon Triple Witching

After Black Monday, the market regulators shifted the stock market towards afternoon triple witching. In triple witching stock orders, stock index futures, and other stock index options expire on a quarterly basis. The regulators set the afternoon hours for trading instead of the morning hours to help prevent the opening of the market with a large market selloff by the institutional investors.

Circuit Breakers

After Black Monday, the regulators also add circuit breakers to the trading system. Circuit breakers are the temporary strategies used by trading systems to stop trading to suppress the panic-selling of stocks on stock exchanges. Circuit breakers temporarily hold the overall position of the stock market. The following are the main circuit breaker rules:

When the downfall happens before 3:25 p.m. and the stock index decline is 7% or 13%, then the trading system will stop for 15 minutes.

But when the downfall happens at any time of the day and the decline is 20%, the trading process stops immediately, and is suspended for the rest of the day, and will begin the next day.

Role of the Federal Reserve

The central banks, like the U.S Federal Reserve, played an important role in maintaining the position of the stock market. Within 16 hours, on Tuesday, the US Fed’s response came in the form of a statement to serve as a source of liquidity to support the financial system. Just like 1907’s banking panic, the banks did not faced a deposit run, and as a result, the S&P 500 index and the Dow Jones Industrial Average reopened within two trading sessions and repaired all the losses of Black Monday. The Federal Reserve announced that they were available to help before the market reopened after the crash. When the market opened on October 20, 1987, this statement rebuilt the confidence of investors to trade in the system again.

Quantitative Easing

Quantitative easing is a policy of the central banks to increase money supply and boost liquidity in the economy by buying bonds. This technique was also used by the Federal Reserve. The Federal Reserve had lowered interest rates by half a percent and injected billions of dollars in the economy with long-term treasury buybacks.

Financial Liquidity

The Federal Reserve binds other banks to offer loans on their usual terms to maintain liquidity in the stock market. The banks also expanded their lending to support the liquidity needs of the brokers and dealers.

With the help of these strategies, this stock market crash in 1987 has recovered within two years as compared to the crash in 1929, which led to economic recession in the form of the Great Depression.

Conclusion

In conclusion, the stock market crash of 1987 was a major event in the history of the US stock exchange. This crash caused a great downfall in the stock market due to triple witching, portfolio insurance, and the threat of dollar devaluation. However, the Federal Reserve took charge and controlled the situation before it got worse.