An image of a house and keys.

Robert Shiller and the Housing Market

What is the Housing Market?

The collection of buyers and sellers of houses in a particular country or region is called the housing market. It is also called the real estate market or the property market. The buyers generate the demand for houses and the sellers generate their supply. The interaction of demand for and supply of houses determine the market price of houses. The buyers and sellers are interested in the average house prices and the recent trends in house prices. The buying and selling of houses by individuals for the sake of living or renting is also the part of housing market.

Who is Robert Shiller?

Robert James Shiller, a world famous American economist, is serving as a Sterling Professor of Economics (the highest academic rank) at Yale University, and the Professor of Finance and Fellow at Yale School of Management. In 2008, Robert J. Shiller was was ranked among the 100 most influential economists in the world. In 2013, Robert Shiller jointly received the Nobel Prize in Economic Sciences with Eugene Fama, and Lara Peter Hansen.

Robert Shiller correctly predicted the .com bubble in 2000 and the collapse of the US housing market (after hosuing bubble or housing boom), leading to financial crisis in 2007. He is also known for his work on the concept of “irrational exuberance” in the housing market. Robert Shiller also developed an index that is used to measure the changes in US national house prices. This index is known as the Case-Shiller Home Price Index or the S&P CoreLogic Case-Shiller U.S. National Home Price Index.

Key Terms to Understand the Housing Market

In order to understand the housing market, let’s define some key terms.

Market Value

The approximate value at which a property is going to sell in the current housing market is known as the market value of that property.

Nominal House Prices

These are the monetary values of the houses that are not adjusted for inflation.

Real House Prices

These are the monetary values of the houses that are adjusted for inflation. Let’s suppose the nominal house price is increased by 20% and the inflation rate is 8%, then real house price is increased by 12% in the housing market.

Listing Price

The listing price is the price of a property that is listed in the housing market for sale. This price is only listed by the sellers.

Mortgage

A mortgage is a loan provided by banks to finance the purchase of a property by individuals.

Mortgage Equity Withdrawal

When individuals re-mortgage their property and withdraw equity from banks.

Affordability Index

The affordability of housing in a specific region is known as the affordability index.

Generation Rent

This is a type of payment that must be paid by teenagers as rent because they do not have enough money to buy a house.

Capital Gain

The profit earned by the sellers of properties when the sale price is higher than the purchase price of that property.

House Price Index (HPI)

House Price Index (HPI) is a number that is used to calculate the changes in the average house price (based on the market data) over a period of time, just like the consumer price index. For example, in February 2024, the average house price in the UK was £280,660 and the UK house price index was at 147.2, which was 0.2% less than 2023.

Main Forms of Housing Ownership

The following are the three main forms of housing:

Home Ownership

This is a form of ownership obtained by individuals by mortgaging or self-financing their own properties.

Private Renters

This is a form of ownership obtained by renting properties from private renters or landlords.

Social Renters

This is a form of ownership by renting properties from local authorities or social renters like housing associations.

The Workings of the Housing Market

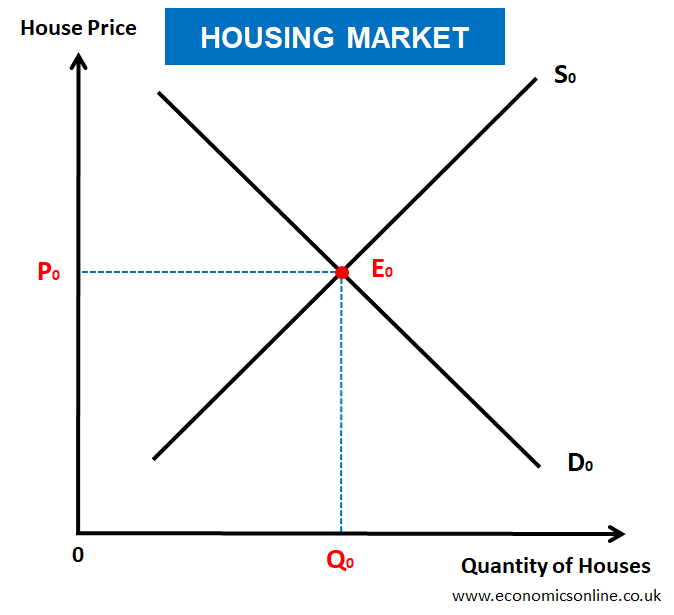

The house price is mainly determined by the interaction of the demand and supply of houses in the housing market. Just like other goods in economics, the law of demand and the law of supply also work for the housing market to determine home prices.

In the above graph, we have quantity of houses on the horizontal axis (x-axis) and house price on the vertical axis (y-axis). Both the demand curve and the supply curve intersect each other at points E0 which shows the housing market equilibrium at price P1 and quantity Q1.

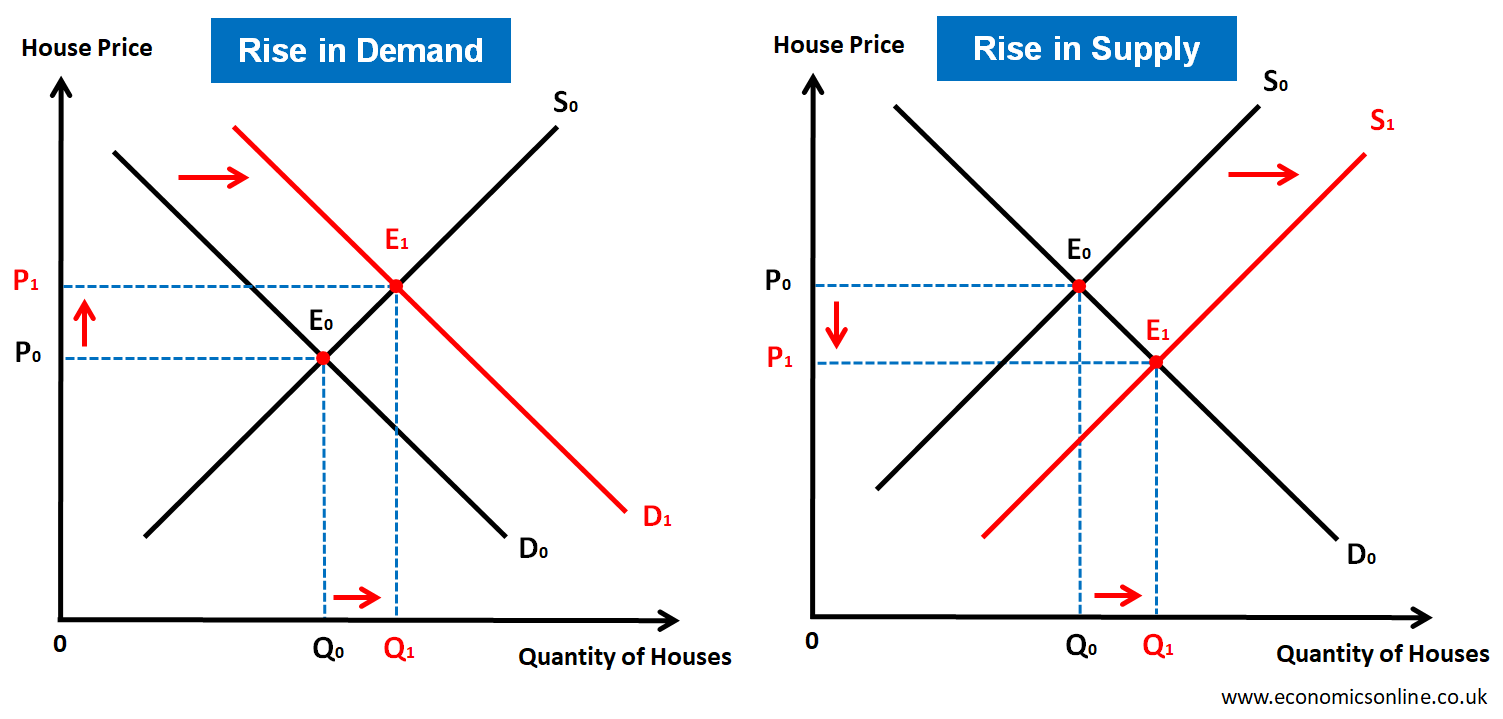

Any changes in the demand for housing and/or supply of housing will affect the price of housing in the market. This is illustrated by the following graphs:

In the above graphs, it can be seen that a rise in the demand for house will increase the house price, while a rise in the supply of houses will decrease the house price.

Factors affecting the Housing Market

There are many factors affecting the housing market, which are broadly divided into the factors affecting demand for houses and the factors affecting the supply of houses.

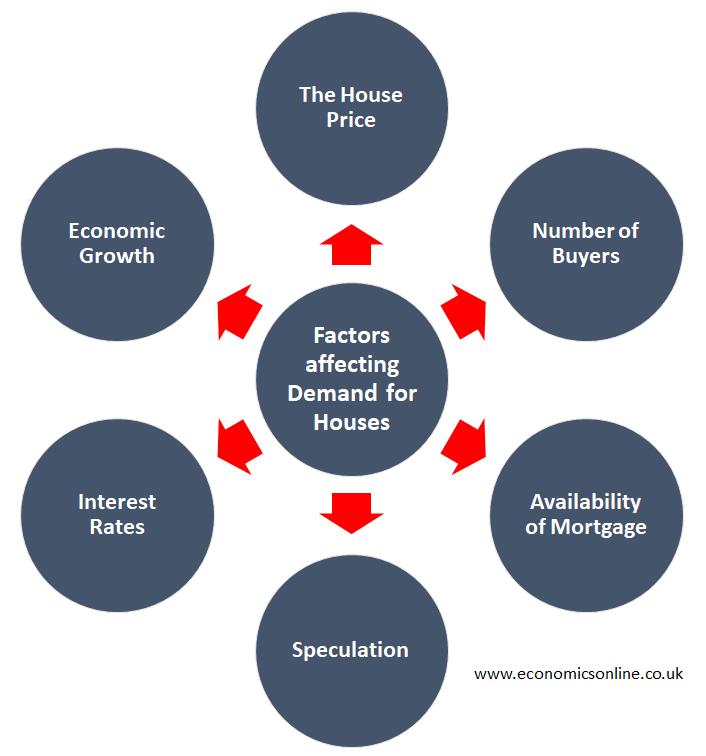

Factors affecting the Demand for Houses

The following factors affect the demand for houses:

The House Price

The house price is the most important factor affecting the demand for houses. An increase in the house price decreases the willingness as well as the ability of individuals to buy houses because the price may go beyond their purchasing power. Similarly, a fall in the house price means more people will be willing and able to buy houses.

Number of Buyers

The number of buyers in the housing market also affects the demand for houses. When there are a large number of buyers in the market, the demand for houses increases. But when the number of house buyers are less, the demand for houses decreases.

Availability of Mortgage

A mortgage is a loan provided by banks to fund the purchase of houses. When there is a high availability of mortgage loans, the demand for house increases.

Speculation

Speculation is the act of purchasing an asset at a low price with an intention of selling it at a higher price in order to make profit. When the house prices are expected to increase, the investors and smart people buy more houses leading to higher demand.

Interest Rates

Interest rate is the money paid by the borrowers to the lenders for the use of the amount of loan that is borrowed. When interest rates are low, loans get cheaper and there is a little incentive for saving money in banks. In that case, people, including new buyers, prefer to buy more houses, resulting in an increase in the demand for houses. With higher rates of interest, the demand for houses decreases.

Economic Growth

Economic growth is an increase in the real GDP of a country. During economic growth, the income of households increases, which means that they have a higher purchasing power. This leads to a positive influence and an increase in the demand for houses.

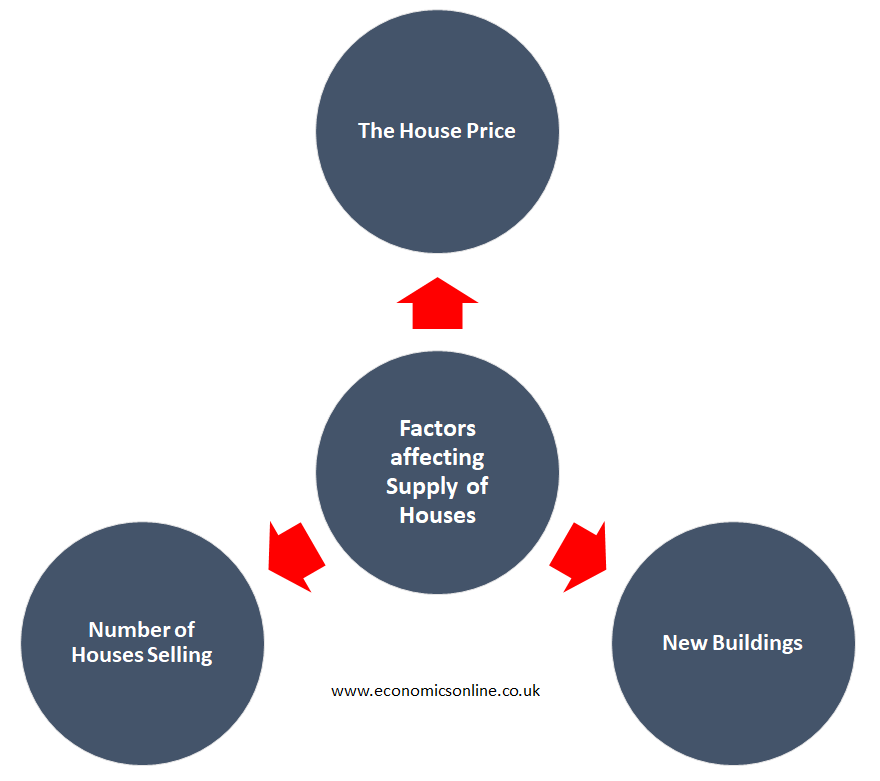

Factors affecting the Supply of Houses

The following factors affect the supply of houses:

The House Price

The house price is the main factor affecting the supply of houses. An increase in the house price increases the willingness of the house owners to sell their houses because they will receive a good amount and may get the benefit of capital gains as well. Similarly, a fall in the house price means fewer people will be willing to sell their houses.

New Buildings

The supply of houses is also affected by the number of newly constructed buildings which are available for sale. An increase in the number of new buildings will increase the supply of houses, and vice versa.

Number of Houses Selling

Another factor is the number of houses on sale. If there are more number of houses selling in a market, the supply of houses will increase, and vice versa. This is also affected by natural disasters, such as floods, earthquakes, and wind storms, which may destroy or damage the existing housing inventory on sale. This will lead to a fall in the supply of houses.

Robert Shiller on the US Housing Market

The U.S. housing market has seen years of steady growth in the house prices since 2012 (a decade-long rally), and the price hike accelerated during COVID-19 pandemic. These prices are very, very high by historical standards. Robert Shiller, a Yale University professor of economics, is not predicting a crash or boom in the US housing market, but a soft landing. The short-run fall in housing prices during late 2022 was seasonal, and such patterns can be observed during the summer and winter months. These seasonal patterns do not last long. The buyers of houses should adapt the long term approach when making investments in houses.

Conclusion

In conclusion, housing market is an important market in a country due to the huge monetary value of transactions involved. Just like other types of goods, house prices are also determined through the interaction of the market forces of demand and supply. Robert Shiller, case-shiller index co-founder, is known for his extensive research on the dynamics and predictions of the housing market and the stock market.