The multiplier

The multiplier effect

Every time there is an injection of new demand into the circular flow of income there is likely to be a multiplier effect. This is because an injection of extra income leads to more spending, which creates more income, and so on. The multiplier effect refers to the increase in final income arising from any new injection of spending.

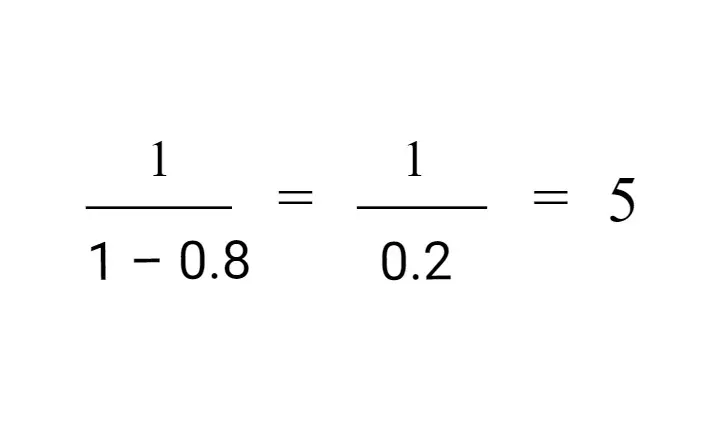

The size of the multiplier depends upon household’s marginal decisions to spend, called the marginal propensity to consume (mpc), or to save, called the marginal propensity to save (mps). It is important to remember that when income is spent, this spending becomes someone else’s income, and so on. Marginal propensities show the proportion of extra income allocated to particular activities, such as investment spending by UK firms, saving by households, and spending on imports from abroad. For example, if 80% of all new income in a given period of time is spent on UK products, the marginal propensity to consume would be 80/100, which is 0.8.

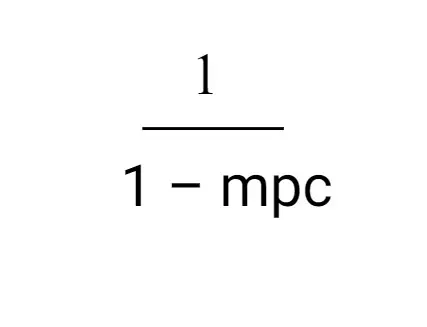

The following general formula to calculate the multiplier uses marginal propensities, as follows:

Hence, if consumers spend 0.8 and save 0.2 of every £1 of extra income, the multiplier will be:

Hence, the multiplier is 5, which means that every £1 of new income generates £5 of extra income.

The multiplier effect in an open economy

As well as calculating the multiplier in terms of how extra income gets spent, we can also measure the multiplier in terms of how much of the extra income goes in savings, and other withdrawals. A full ‘open’ economy has all sectors, and therefore, three withdrawals – savings, taxation and imports.

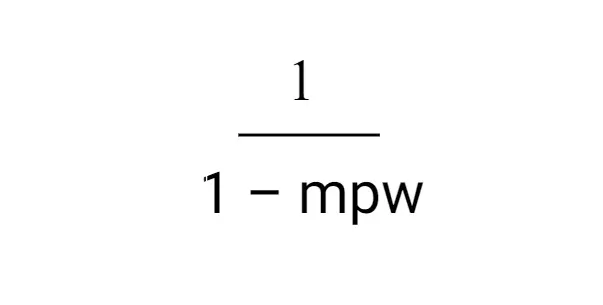

This is indicated by the marginal propensity to save (mps) plus the extra income going to the government - the marginal tax rate (mtr) plus the amount going abroad – the marginal propensity to import (mpm).

By adding up all the withdrawals we get the marginal propensity to withdraw (mpw). The multiplier can now be calculated by the following general equation:

Applying the ‘multiplier effect’

The multiplier concept can be used any situation where there is a new injection into an economy. Examples of such situations include:

- When the government funds building of a new motorway

- When there is an increase in exports abroad

- When there is a reduction in interest rates or tax rates, or when the exchange rate falls.

The downward or 'reverse' multiplier

A withdrawal of income from the circular flow will lead to a downward multiplier effect. Therefore, whenever there is an increased withdrawal, such as a rise in savings, import spending or taxation, there is a potential downward multiplier effect on the rest of the economy.