Monetary policy

Monetary policy

Monetary policy involves altering base interest rates, which ultimately determine all other interest rates in the economy, or altering the quantity of money in the economy. Many economists argue that altering exchange rates is a form of monetary policy, given that interest rates and exchange rates are closely related.

The Monetary Policy Committee

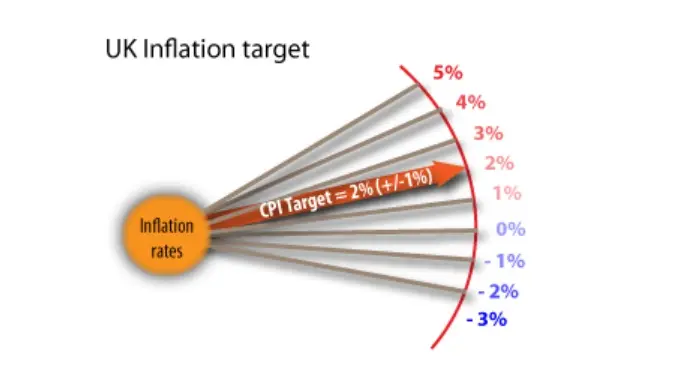

The Bank of England’s Monetary Policy Committee (MPC) has responsibility for monetary policy in the UK. The MPC has nine members, four of whom are appointed by the Chancellor. The MPC has one goal – to hit its inflation target of 2%.

The inflation target is symmetrical because a rate of inflation below the target is considered as damaging as a rate of inflation above the target.

Changing the official base rate, which alters the cost of borrowing across the economy, is the most visible tool used by the MPC. The MPC’s team of experts meet each month to discuss current and future monetary policy options, and set a rate which they believe will steer the economy towards achieving the target inflation rate.

The official moneymarket rate

The rate set by the MPC is the repo rate, which is the rate that the Bank of England will charge in the moneymarkets for short-term loans to other banks or financial institutions. Other rates of interest in the economy, such as mortgage and credit card rates, will adjust in line with changes to the official rate.

How does interest rate policy work?

Interest rates are set so that the inflation target can be met in the future. It takes up to two years for a rate change to affect inflation, so the Bank of England must try to predict the state of the economy two years in advance.

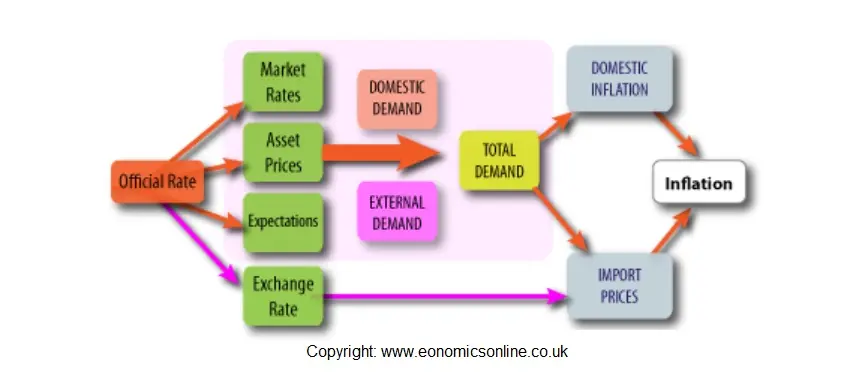

The interest rate transmission mechanism

Interest rates transmit their way to aggregate demand in the following ways:

- Household demand is affected because changes in interest rates affect savings, which indirectly affect spending.

- For households or firms with existing debt, such as a mortgage, a change in rates affects repayments, and hence individuals have more (or less) cash after servicing their debts. Changes in rates affect the cash-flow of firms and households.

- In the case of new debt to fund spending, borrowing is also encouraged (or discouraged) following interest rate changes.

- Interest rates also affect consumer and business confidence, which in turn affects spending.

- Asset values are also affected by interest rates. A fall in rates will tend to increase the profitability of firms and they may pay higher dividends to shareholders. This can trigger an increase in household spending. Similarly, a rate fall makes savings less attractive and property more attractive, increasing the value of property and household wealth.

- Finally, interest rates may affect the exchange rate, which can also influence export demand. For example, a rise in interest rates may raise the exchange rate, pushing up export prices and reducing overseas demand. Changes in the exchange rate also affect the price of imports, which also affect the inflation rate.

Summary of the transmission mechanism of monetary policy

Recent UK interest rates

In recent years. interest rates have been adjusted to reflect changing inflationary pressure, and general macro-economic conditions.

Interest rates 1997 – 2018

Time line

1999 – 2000

Rates were relatively high at 6% to restrict demand

2000 – 2003

In order to stimulate demand, between 2000 and 2003 rates were pushed down to what was then their lowest level for 25 years.

2003 – 2007

Rates were pushed up into a neutral zone at around 5% and edged towards the restrictive zone by the middle of 2007.

2008 – 2016

Rates were pushed down to a record low of 0.5% to stimulate household spending in the wake of the credit crunch, financial crisis and recession.

2016 (August) – 2017

Base rate was reduced to 0.25% as part of the monetary stimulus package in the wake of post-Brexit uncertainly.

2017 (Jan) – 2018 (August)

Rates were pushed back up to 0.5% as fears of Brexit uncertainty began to fade.

2018 (August) –

Rates were raised to 0.75% as the labour market tightened (with record employment and low unemployment) and fears of inflation returned (with inflation standing at 2.4%).

Showing the effect of a reduction in interest rates

If we assume the economy has an output gap, then a reduction in interest rates by the Bank of England will increase aggregate demand because saving is discouraged, new borrowing and spending is encouraged, and confidence and investment will increase. The effect of the increase in aggregate demand on real output and the price level depends upon the elasticity of aggregate supply.

Lower interest rates

Assuming the economy is at or very near to full employment, a reduction in interest rates may over-stimulate aggregate demand beyond the capacity of the economy to respond in the short run.

In this case, the effect is mainly on the price level rather than output and jobs.

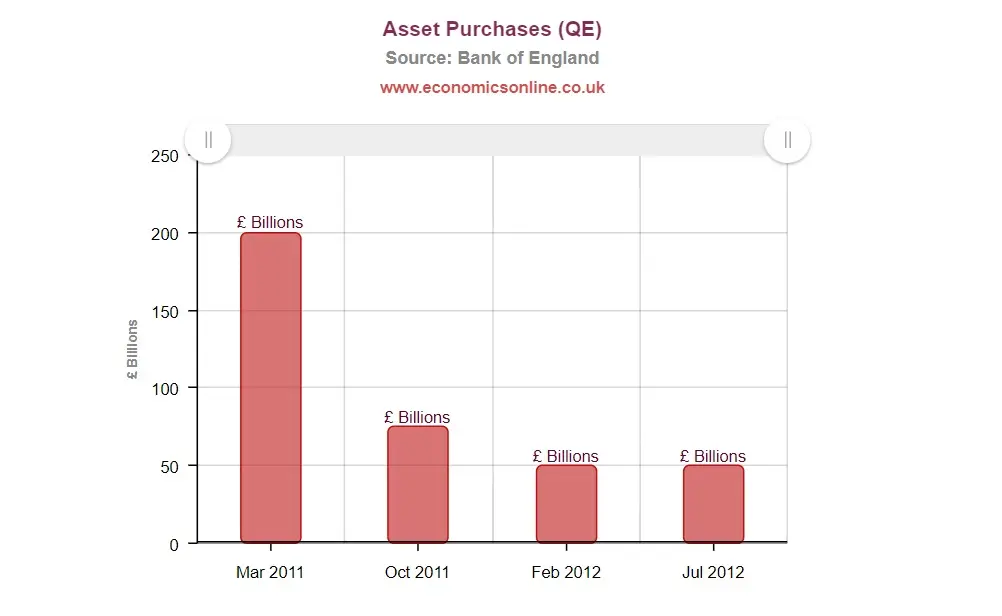

Quantitative easing

Quantitative easing is a method of introducing new liquidity into the economy when interest rates are very low and approaching zero.

Evaluation of monetary policy

The advantages

- Evidence shows that, in normal conditions, interest rates have a direct and powerful effect on household spending, which suggests that UK consumers are highly interest rate elastic.

- The Bank of England’s Monetary Policy Committee is independent from government and can make decisions free from political interference.

- Interest rates can be adjusted on a monthly basis, which contrasts with discretionary fiscal policy which cannot be adjusted at such regular intervals.

- While the full effects of interest changes may not be experienced for up to a year, there is often an immediate effect on confidence. The time-lag on output is estimated to be around one year, and on the price level, around two years.

The disadvantages

- There are still time lags to see the full effects, and there are some negative effects.

- Raising interest rates can negatively affect on investment spending and the housing market, and the exchange rate and hence the balance of payments.

- There is also the problem of the dual economy – are high rates set for the booming service sector, or low rates for the depressed manufacturing and export sector?

- The money supply is difficult to control in practice, so controlling interest rates is preferable.

- Interest rates may fall to very low levels during a deep recession, and while the demand for credit may rise, the supply may become trapped in the system, known as the liquidity trap.