Price discrimination

Price discrimination is the practice of charging a different price for the same good or service. There are three types of price discrimination – first-degree, second-degree, and third-degree price discrimination.

First degree

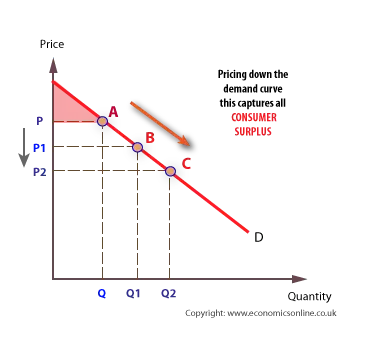

First-degree price discrimination, alternatively known as perfect price discrimination, occurs when a firm charges a different price for every unit consumed.

The firm is able to charge the maximum possible price for each unit which enables the firm to capture all available consumer surplus for itself. In practice, first-degree discrimination is rare.

Second degree

Second-degree price discrimination means charging a different price for different quantities, such as quantity discounts for bulk purchases.

Third degree

Third-degree price discrimination means charging a different price to different consumer groups. For example, rail and tube travellers can be subdivided into commuter and casual travellers, and cinema goers can be subdivide into adults and children. Splitting the market into peak and off peak use is very common and occurs with gas, electricity, and telephone supply, as well as gym membership and parking charges. Third-degree discrimination is the commonest type.

Necessary conditions for successful discrimination

Price discrimination can only occur if certain conditions are met.

- The firm must be able to identify different market segments, such as domestic users and industrial users.

- Different segments must have different price elasticities (PEDs).

- Markets must be kept separate, either by time, physical distance and nature of use, such as Microsoft Office ‘Schools’ edition which is only available to educational institutions, at a lower price. Time based pricing – also called dynamic pricing – is increasingly common in goods and services sold online. In this case, prices can vary by the second, based on real-time demand related to consumers’ online activity.

- There must be no seepage between the two markets, which means that a consumer cannot purchase at the low price in the elastic sub-market, and then re-sell to other consumers in the inelastic sub-market, at a higher price.

- The firm must have some degree of monopoly power.

Diagram for price discrimination

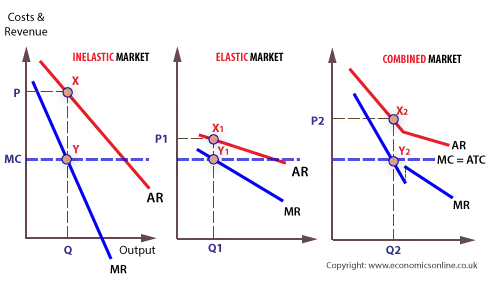

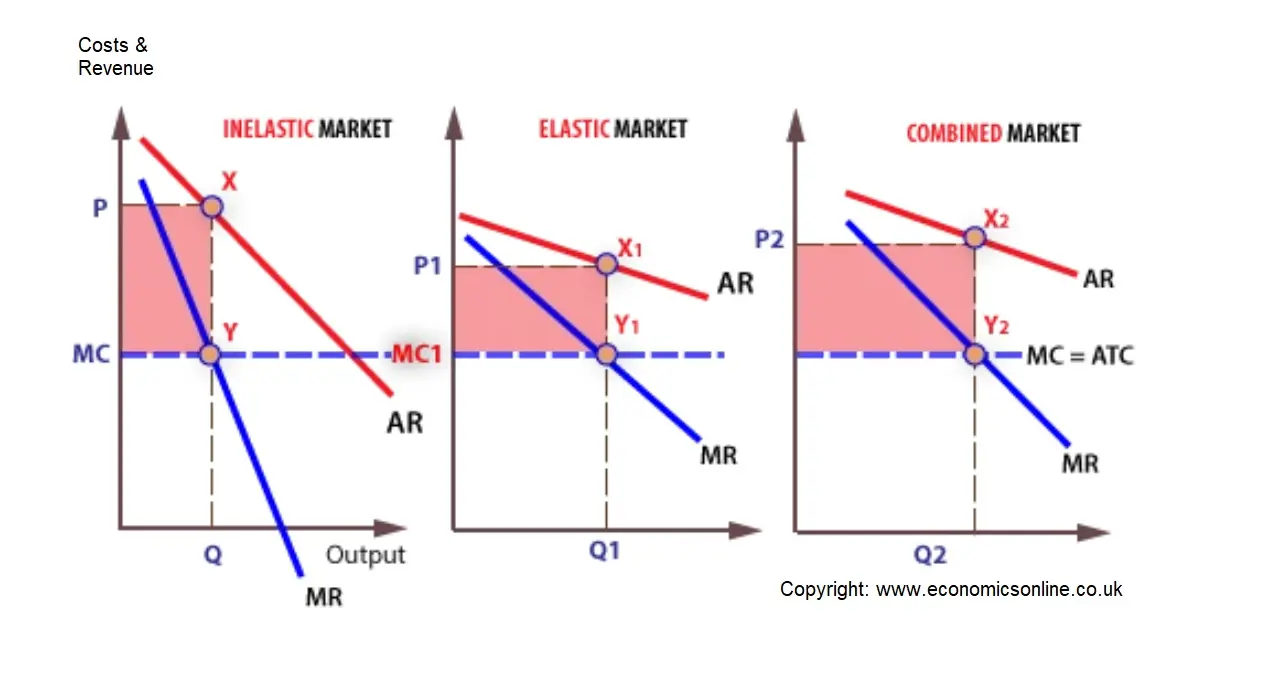

If we assume marginal cost (MC) is constant across all markets, whether or not the market is divided, it will equal average total cost (ATC). Profit maximisation will occur at the price and output where MC = MR. If the market can be separated, the price and output in the relatively inelastic sub-market will be P and Q and P1 and Q1 in the relatively elastic sub-market.

When the markets are separated, profits will be the area MC, P,X,Y + MC1,P1,X1,Y1. If the market cannot be separated, and the two submarkets are combined, profits will be the area MC2,P2,X2,Y2.

If the profit from separating the sub-markets is greater than for combining the sub-markets, then the rational profit maximizing monopolist will price discriminate.

Market separation and elasticity

Discrimination is only worth undertaking if the profit from separating the markets is greater than from keeping the markets combined, and this will depend upon the relative elasticities of demand in the sub-markets. Consumers in the relatively inelastic sub-market will be charged the higher price, and those in the relatively elastic sub-market will be charged the lower price.

Costs of separation

The effectiveness of price discrimination will be weakened if the costs of preventing seepage are significant, and reduce the profits accruing from discrimination. For example, it might be necessary to introduce costly monitoring and enforcement systems to ensure that consumers do not break any conditions of sale which exist to keep markets separate. Employing ticket inspectors or other security systems adds to the cost of preventing seepage in public transport.

Note

In the above example we are assuming that the price at which consumers in the relatively elastic sub-market (students, for example, looking to travel into a major city) are prepared to enter the market is lower than those in the relatively inelastic sub-market (commuters, for example). This gives the combined demand (AR) curve an outward kink, and the combined MR curve a discontinuous portion (indicated by the vertical dotted line.) If, however, both types of consumer are prepared to enter the market at the higher price then the combined demand (AR) curve is simply shifted further to the right, and will not have the kink. This is illustrated in the diagram below:

In all cases it should be noted that that profit maximisation must occur where MC = MR. This means that profit maximising equilibrium for the discriminating monopolist must occur where MR is positive, which means that, irrespective of the gradient of the demand curves in the submarkets, the price will always be set in the elastic portion of the demand curve (individually, and when combined).

Evaluation of price discrimination

Advantages

From the firm’s perspective

From a firm’s perspective price discrimination can offer many advantages, making it one of the commonest pricing strategies used by local, national and global companies. Benefits to firms include:

Profit maximisation

Firstly, matching prices to the specific characteristics of the market, and its various segments, is a profit maximising strategy (see above), where the firm can extract some (or even all) of the consumer surplus available in the market, and turn it into producer surplus (i.e. profits).

Economies of scale

Given that charging different prices can increase sales volume, especially as a result of new consumers entering the market, attracted in by the discounted prices, firms can benefit from the economies of scale which arise from increased output and production.

Efficient use of infrastructure

Price discrimination can benefit firms with high fixed costs associated with the building of infrastructure, and its maintenance. This includes natural monopolies such as gas, electricity supply, and transport services. For example, having more passengers on a train that is going to run anyway provides additional revenue to the train operators. This revenue may be used to add to profits (given that the marginal cost of one extra passenger is virtually zero) or to cover new fixed costs, such as track or safety improvements.

Better use of space

Similarly, price discrimination may also enable manufacturing and retail firms to clear their existing stocks quickly when required – hence making better use of their shop or factory space.

Managing the flow customers

Price discrimination according to the time of day means that the flow of customers into retail stores can be managed more effectively, which might provide a better experience for shoppers and spread out the work for staff. For example, having a ‘happy hour’ or ‘early bird’ prices may encourage shoppers to adjust their shopping times so that queues are shortened at more peak times, as well as ensuring that staff are better employed throughout the day.

Understanding the market

Firms may wish to trial new products in different locations, and may match their prices to the specific demand conditions found in those local markets. Also, firms can offer discounts in order to get consumer feedback on these trialled products, and on existing ones.

Similarly, price discrimination may enable firms sell to export markets, basing their prices on what consumers are prepared to pay in each territory – which can vary considerably from country to country. From a macro-economic perspective, international trade is likely to be created by price discrimination.

Enables survival

As a result of generating additional revenue, price discrimination can enable firms to survive. For example, small cinemas might be better able to survive if they can offer low priced off-peak cinema tickets to the over-65s for day-time screenings.

From the consumer’s perspective

Possibility of lower prices

From the consumer’s point of view, some, especially those in the highly elastic sub-market, may gain consumer surplus as a result of lower prices. Lower prices could also result from the application of scale economies (as above).

Benefits to groups of consumers

If we look specifically at goods and services consumed by children, but where adults are needed to accompany them, it can be argued that charging children a much lower price enables families as a whole to benefit, and gain increased group utility. For example, if cinemas or theme parks set low prices for children (or even zero price for those under a certain age), or offer with family discounts, more parents will be able to attend, and accompany their children. This means that, in the longer term, cinema chains and theme parks will increase their revenue and profits. The same logic can be applied to travel and holidays, with child and family discounts encouraging demand and helping generate revenue.

Enables flexibility

Having different prices may enable consumers to match their purchasing and shopping to their own free time. For example, ‘early bird’ prices can benefit individuals who are retired, or who work flexible hours.

Generating positive externalities

We can extend the analysis to consider the role of price discrimination in reducing market failure, such as enabling wider consumption of merit goods. For example, if ‘private’ schools charge relatively high tuition fees for those who can afford them, and where demand is inelastic, the revenue generated allows them to cover their costs and run classes. With fixed costs covered, they can then offer places at discounted fees (to cover the variable costs only) to those who cannot afford them. Given that the demand for private education by less well-off parents is likely to be price (fee) elastic, the lower price will encourage greater demand. The benefit to ‘society’ is that more education is ‘consumed’ and more positive externalities generated.

Survival

Consumers can also gain from the fact that firms can more easily survive, so that future generations can derived continued benefit.

Disadvantages

Exploitation of captive markets

However, it could be argued that consumers in a captive sub-market are being unduly exploited due to their inelasticity. This is especially relevant when we look at transport, and the high ticket prices charged for peak travel, compared with off-peak. The same could be said for energy prices, where existing and loyal customers often pay higher prices, which subsidises the discounts available to ‘new’ customers.

Limitations

Ultimately, the ability to price discriminate may be limited because the conditions necessary are not fully met. In other words, there are limits on the extent to which different prices can be applied.

Conclusion

Clearly, with global commodities, world markets tend to settle on one price at any one time, given the process of arbitrage.

The growth of new trading and selling technologies, apps, online auction bidding, and price comparison websites mean that consumers have increasing information, which may reduce the possibility of price discrimination. However, the widespread use of dynamic pricing models by online sellers means that time-based pricing in increasingly common.

So, at one extreme, price discrimination is still highly possible with locally provided services, and where technology can provide flexible pricing, while at the other, globally traded commodities are subject to the ‘law of one price’, where price differences are very quickly eroded away. Manufactured and branded goods fall somewhere between these two extremes, with price discrimination possible – especially in terms of new online pricing models – but where price differences may also be eroded through technology, trade and arbitrage.

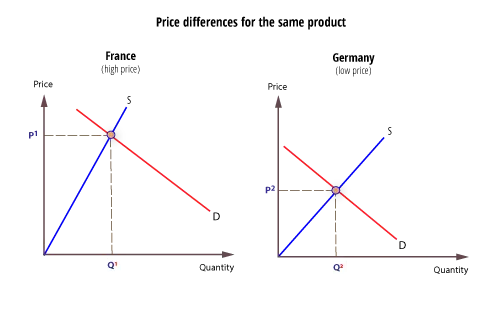

The effects of arbitrage

Arbitrage is a process where traders, acting as either buyers or sellers, can exploit price differences for identical products – buying where the price is lower and selling where it is higher.

The effect of this is to make prices converge, given the different effects of buying and selling in the market.