Fiscal Stabilisers Discretionary Tax Policy

Fiscal stabilisation

Revenue is required by central and local government in order to pay for its spending commitments. The main source of revenue is taxation, and taxes can be used to stabilise the economy in two main ways – through the automatic stabilisers of fiscal drag and boost, and by discretionary tax policy.

Fiscal drag

If we assume that direct tax rates are progressive, which occurs when the % of income going in taxes increases with income, and welfare benefits are paid, then any increase in national income will be slowed down automatically. This process is called fiscal drag.

Fiscal drag occurs in two ways. Firstly, when incomes rise, aggregate demand will not rise at the same rate because the ‘better off’ pay proportionately higher taxes, and spending growth is constrained. Secondly, the effect on the poor and unemployed is reduced as they come off benefits, and start to pay tax. The effect is that the increases in disposable income are moderated.

Fiscal boost

Conversely, a decrease in national income is also moderated through fiscal boost. Fiscal boost means that as incomes fall the impact for the better off is ‘softened’ as they pay proportionately lower taxes, and retain more post-tax income.

Without welfare benefits, falling incomes will create more unemployment and poverty. However, because the unemployed and poor receive benefits, and spend more than they would have without such benefits, the downturn in the economy is also ‘moderated’. The chart below shows the economic cycle with and without stabilisers. When stabilisers are in-place, the volatility of the economic cycle is reduced.

Discretionary changes to tax rates

In addition to automatic stabilisation, taxes can be raised or lowered to control or expand household spending and aggregate demand. This is referred to as discretionary fiscal policy.

Income tax can be adjusted in a number of ways, such as by changing:

- The tax free allowance – all income earners are allowed to earn an amount of income before they start to pay tax. For example, the personal tax free allowance in the UK for 2014 was £10,000. Therefore, to stimulate demand, this could be increased to give households more disposable income.

- The basic tax rate – which in 2014 was 20%. Basic rate means the rate that affects most income earners.

- The number of tax bands – for example, before 2009 there were three bands of: 0 – £2320 of taxable income from savings was taxed at 10%; £0 – £34,800, taxed at 20% tax, and over £34,800 was taxed at 40%, which was the higher tax rate. By adding new lower or higher bands the level of consumption and the distribution of income can be altered. For example, in 2014 a higher rate of 45% was introduced for those earning over £150,000 of taxable income.These tax bands help narrow the income gap and so help reduce inequality.

- The range of income in each band – each band could be widened or narrowed by increasing or reducing the range of income in each band.

It should be noted that changes in individual taxes, and taxes rates, would have a short-term discretionary effect as well as altering the long-term structure of taxes and the ability of the economy to automatically self-correct after a shock.

The advantages of using taxes

Discouraging unwanted behaviour

Indirect taxes can be targeted to alter behaviour, such as to reduce polluting activities by the use of polluter-pays taxes, or to reduce cigarette and alcohol consumption by special duties on tobacco and alcohol.

Encouraging wanted behaviour

Indirect taxes can also encourage desirable behaviour, like the consumption of more merit goods such as education and healthcare. In this case, tax rates can be reduced to zero, and production and supply could be subsidised.

Supply-side incentives

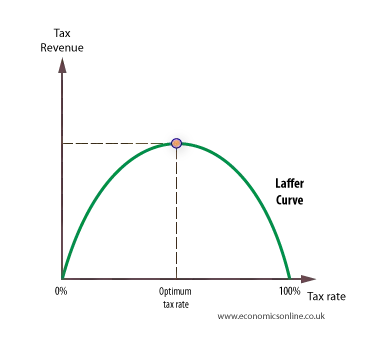

The tax system can also be used to encourage work and effort and increase the activity rate of labour. In the 1980s American economist, Art Laffer, considered the impact of higher taxes on incentives. Laffer proposed that at tax rates of 100% and 0% the government receives no revenue. At 100% tax, no one would work, and at 0% tax, no tax would be paid. However, between 0% and 100% tax rate the government derives a tax yield, the graph for which became known as the Laffer curve.

Laffer curve

As tax rates rise a disincentive effect begins. There is a substitution effect as leisure becomes more attractive and work less attractive.

However, the disincentive effect will only work under certain circumstances. To understand this we must distinguish the income and substitution effects. The substitution effect suggests that, following an increase in direct taxes, substitutes to work, namely leisure, seem more attractive and people will work less, often called the Laffer effect. The income effect suggests that an increase in taxes will reduce people’s real income, and they will need to work harder to achieve the same level of real income.

These two effects are contradictory. If the income effect is greater than the substitution effect, an increase in taxes will lead to more labour being supplied. However, if the substitution effect is greater an increase in taxes will lead to less labour being supplied. Laffer’s legacy is the raised awareness that increasing taxes to pay for public spending may, through its disincentive effect, lead to long-term supply side problems.

Automatic stabilisation

In the short and medium term, taxation can be used to automatically stabilise the macro-economy through fiscal drag and boost. These processes act as a natural shock absorber to economic shocks.

Additional measures to stimulate aggregate demand

Discretionary changes in direct taxes can help regulate aggregate demand when shocks are severe, or when other policies are ineffective, as in the financial crisis of 2008-2009. As part of an emergency package, many national governments reduced taxes, like VAT, so that they could give an extra boost to their ailing economies.

Redistribution of income

Tax policy can also be used to help re-distribute income, and help achieve equity. In terms of achieving equity, indirect taxes like VAT are regressive and create an inequitable burden, the largest burden being on the poor and low paid. Income tax and other direct taxes can be made progressive and can help achieve equity, but they may have a disincentive effect leading to inefficiencies. Hence, because equity and efficiency are in conflict, the best resolution is a ‘mix’ between direct and indirect to achieve a balance between the needs of equity and efficiency.

The disadvantage of tax policy

Complexity

Changing tax rates, allowances and bands, is highly complex, especially in comparison with changing interest rates. Because of this, changes are relatively infrequent, with only small adjustments made each year in the annual budget. Only under dramatic circumstances, as in the financial crisis, are tax changes put into effect.

Avoidance

Households may increase or reduce their savings following tax changes, so the final effect of an increase or decrease in taxes on household spending may be weak. Taxes can be avoided in other ways, and this avoidance may contribute to the rise of an unofficial hidden economy.

Time lags

There may be considerable time-lags between changing taxes and changes in household spending or other behaviour. Demand for many products is price and income elastic, so demand may not respond quickly or by a great amount to changes in indirect and direct taxes. An obvious example of this is taxation of fuel, where, despite taxes representing around 75% of the retail price of petrol, demand remains stubbornly high.