Fiscal boost

Fiscal boost

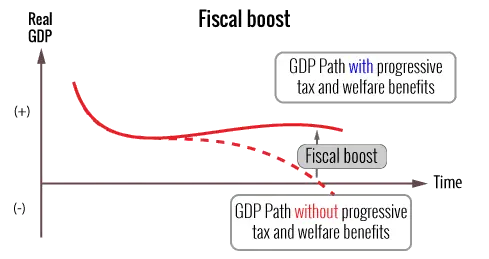

Fiscal boost and fiscal drag are the counter-cyclical effects of progressive direct taxes and welfare benefits on the movement of GDP over time.

In the case of fiscal boost, a downturn in GDP during a recession would be accompanied by a fall in real incomes. However, the tax and benefits system provides a cushion against this fall.

This arises for two reasons – firstly, without progressive taxes and welfare benefits, a recession would cause some level of unemployment, resulting in a fall in personal incomes. However, with welfare benefits acting as a safety net, the extreme effect of the increase in unemployment would be eliminated – so some level of spending would continue. Some of the income and spending ‘withdrawn’ from the economy at a time of recession would be ‘injected back in’ via the benefits system.

Secondly, in an economic downturn, some individuals and firms will pay less tax, and hence retain more income than if the tax system was not progressive. Furthermore, some individuals may drop down a tax band (say from 40% to 20%) again retaining more income from which to spend.

The net result is that any fall in income and the consequential downward multiplier effect, would be less extreme.

Graphically, the downturn will not be as steep when fiscal boost is taken into account.

-

More on fiscal boost

The combined effect of fiscal boost and drag is to automatically stabilise the macro-economy following an economic shock.