Multinationals and tax avoidance

Multinationals and tax avoidance

In January 2016 Google settled its tax bill with the UK tax authorities for £130m, including £117m in back taxes and £13m in interest payments, covering the period from 2005 to 2015. The new Diverted Profits Tax (DPT), which was introduced in the UK last year, came too late to make much impact on the settlement, and while the figure seems very low given the £4.6bn of revenues generated in the UK in 2015 (and up to £17bn generated over the tax period covered), the Chancellor, George Osborne, hailed it as a success.

When Scottish economist Adam Smith, writing in the late 18th Century, described how an efficient tax system should operate, he could not have imagined the impact that globalisation was to have on economic activity, and on how sophisticated systems to avoid taxation would evolve in a post-industrial world. The growing significance of intellectual property, including brands, patents, designs and trademarks was also not something Smith could have foreseen. If he had he would have no doubt included two more ‘canons’ of taxation, along with the principles of certainty, equity, efficiency and convenience. Smith would, no doubt, have argued that a tax should be designed to make it very hard to avoid paying it. He would have also proposed that, in a globalised world, the power to set tax rules should not rest with individual nations – to put it simply, that there should be a level playing field when it comes to tax. Globalisation has indeed made the very idea of a national tax system almost redundant when applied to the activities of multinationals such as Apple, Google, and Facebook.

The origins of taxation go back a long way. Well before Smith began to lay down the guiding principles regarding ‘good’ taxes, governments had imposed a variety of taxes on a range of commercial activities. Economic activity largely involved the manufacture and sale of physical goods, the importing of commodities from abroad, upon which customs duties were paid, and exporting. Indeed, the first commercial taxes in the UK included an export tax on wool, imposed in 1203 by King John, and a tax on wine, introduced some 70 years later by King Edward I.

Physical goods and resources had a clear country of origin, and manufacturers were located within a single national boundary and responsible for paying taxes in definable tax jurisdictions, with tax authorities who could clearly identify the economic activity that it could tax. Those following Smith, including David Ricardo, were able to clarify and develop the idea of what constitutes an activity that could be taxed – either directly on income earned by individual factors of production, including land, labour, capital and enterprise, or indirectly on spending on goods and service. Indeed, the first tax on land was introduced in 1692, and some 100 years later, income tax was introduced by William Pitt the Younger to pay for weapons and equipment in preparation for the Napoleonic Wars (though the first ‘permanent’ British income tax was introduced in 1842). By 1803 fairly sophisticated categories (schedules) of tax had been introduced, covering different types of income, including income from ‘commercial’ activities.

During the late 19th and early 20th centuries, tax systems became more refined and sophisticated, although it was not until the Finance Act of 1965, that individuals and companies in the UK were treated as different tax entities. From the 1960s onwards, the structure of personal income tax and corporation tax began to diverge in the UK, with the latter becoming increasingly complex as companies looked to reduce their tax liability by finding ‘loopholes’ in the existing corporation tax rules. The faster these were closed, the quicker other loopholes were identified and exploited.

Rapid globalisation in the late 20th century provided the opportunity and incentive for multinational companies to develop smart strategies to limit their tax liability. While countries established tax treaties between themselves regarding how non-residents would be taxed, multinationals were able to create complex corporate structures. Such structures might, typically, involve them spreading their economic activity across several territories – perhaps undertaking research and product development in one territory and granting licenses to produce and sell through subsidiaries in other ones. Globalisation effectively meant that different business activities could be located almost anywhere. With company profits being taxed at very different rates in different tax jurisdictions it made sense for multinationals to create a corporate structure which minimised global tax liabilities. Subsidiaries, including ‘shell’ companies, could be created and located anywhere, for any reason, including the avoidance of tax. Indeed, if these subsidiaries are established as the legal owners of intellectual property then income in the form of royalties to the owners can be transferred to a tax haven, such as Bermuda or the Cayman Islands. At the same time, the payment of fees for the use of such intellectual property can be used to reduce tax liabilities for the other subsidiaries that pay them. Subsidiaries can be formed to deal with all the various aspects of a business, with final profits declared in a territory with the lowest tax rate. Of course, minimising tax liability is not only within the law, but a requirement of Directors.

Today, at least six major offshore tax heavens exist, where profits are not taxed, including the Bahamas, Bahrain, Bermuda, the Cayman Islands, Guernsey, the Isle of Man, and Jersey. In addition, countries with low corporation tax include Bosnia, Bulgaria, Georgia, Gibraltar, Hong Kong, Ireland, Kuwait and Paraguay. This contrasts with the EU average corporate tax rate of 22%, and the average global tax rate of 23.87%.

The Double Irish Tax Strategy

The Double Irish tax avoidance strategy, which seems to have its origins with US giant, Apple, in the late 1980s, is one of many schemes which have evolved over the last 20 years. Such schemes usually involve shifting income from economic activity from a higher tax territory to a lower tax territory. The Double Irish strategy takes advantage of certain historical features of the Irish tax system – most notably that it does not levy taxes on Irish subsidiaries located outside of Ireland. It is referred to as Double Irish because to make the system work it requires the establishment of at least two different subsidiaries in Ireland. One of these subsidiaries needs to have its residence for tax purposes in a no-tax territory – a tax heaven. In the case of a US multinational, one subsidiary will own the rights to exploit intellectual property (usually created in the US) in territories outside the US. This company then licenses the right for other Irish subsidiary to exploit this intellectual property, for a fee. As these fees are tax deductible, the fee paying subsidiary declares a low profit, and pays tax in Ireland at the local tax rate of 12.5%.

While efforts have been made in recent years in Ireland to counter such tax avoidance, including a new law to force companies that are incorporated in Ireland to be a tax resident there, this is only for new company registrations, and it will not be applied to pre-existing registrations until 2020.

The Dutch sandwich

Generous tax rules in the Netherlands make it an ideal ‘middleman’ in the process of minimising tax liability. In the Double Irish system there is still the possibility of the multinational’s subsidiaries being subjected to withholding taxes in Ireland if payments are made to entities outside the EU. However, this withholding tax can easily be avoided by involving a Dutch subsidiary, where the intellectual property owning Irish subsidiary licenses the property to the Dutch subsidiary who in turn licenses it back to the non-property owning Irish subsidiary. Such royalty payments are not subject to withholding taxes in the Netherlands. After fees are charged, any remaining profit is transferred to the off-shore entity. The Irish tax authorities are effectively frozen out of the loop by the Double Irish and Dutch Sandwich scheme, with the bulk of the profits finding their way to Bermuda or the Cayman Islands.

Why not get tough on multinational tax avoiders?

Governments have tended to push for lower and lower taxation of business activity following the widespread acceptance of supply-side theories, which claim that there is a strong disincentive effect of having high tax rates. In the UK for example, the corporation tax rate has been progressively reduced, from 28% in 2010 to 26% in 2011, 23% in 2013, and down to 20% in 2015, with the plan being to reduce it to 18% by 2020. While low business taxes can clearly bring about benefits to a country in terms of encouraging FDI, creating jobs, and promoting economic growth, tax avoidance has become a dominant issue for many given that populations across the developed world have had to face increasing austerity in an attempt to reduce public sector debt. So what not get tough on the multinational tax avoiders?

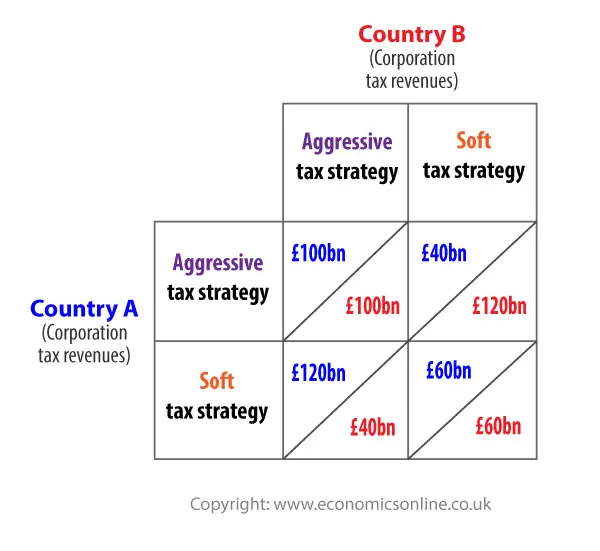

If we apply some basic game theory to the issue of co-operation vs competition between different tax authorities in different territories, we can see that there is a ‘Prisoner’s Dilemma’.

If country A raises corporation tax, or adopts a more aggressive attitude to dealing with tax avoidance, while country B adopts a ‘soft’ strategy for dealing with tax avoidance, country A does badly and achieves the lowest possible pay-off in terms of collected tax, at a mere £40bn. So A is forced to adopt a soft strategy when it believes that other countries are adopting a soft strategy. However, this softly-softly approach generates combined tax revenues of only £120bn. So although adopting a more aggressive approach could lead to joint tax revenues of £200bn, unless there is co-operation, the only solution is to adopt a soft strategy.

If country A raises corporation tax, or adopts a more aggressive attitude to dealing with tax avoidance, while country B adopts a ‘soft’ strategy for dealing with tax avoidance, country A does badly and achieves the lowest possible pay-off in terms of collected tax, at a mere £40bn. So A is forced to adopt a soft strategy when it believes that other countries are adopting a soft strategy. However, this softly-softly approach generates combined tax revenues of only £120bn. So although adopting a more aggressive approach could lead to joint tax revenues of £200bn, unless there is co-operation, the only solution is to adopt a soft strategy.

While tax authorities around the world have a relatively weak hand, the power of the large multinationals has, some would say, effectively put them beyond the control of national governments and tax authorities – hence the requirement for tax authorities and governments to negotiate, rather than enforce existing rules or tighten them up.

Some see this as evidence that the UK cannot go-it-alone when dealing with multinationals, and that if it wants to gain its ‘fair share’ of tax from them then cooperation with other countries is essential, and that co-operation is at the global level.

Collective strategies

So it would seem that collective and co-operative strategies are really the only way forward. This includes the joint OECD and G20 ‘Base Erosion and Profits Shifting’ (BEPS) initiative. This involves tackling some of the tax avoidance schemes that have evolved, including Treaty Shopping and hybrid financial instruments.