Visual representation of Ethereum price forecasts for 2019, highlighting expected fluctuations and trends.

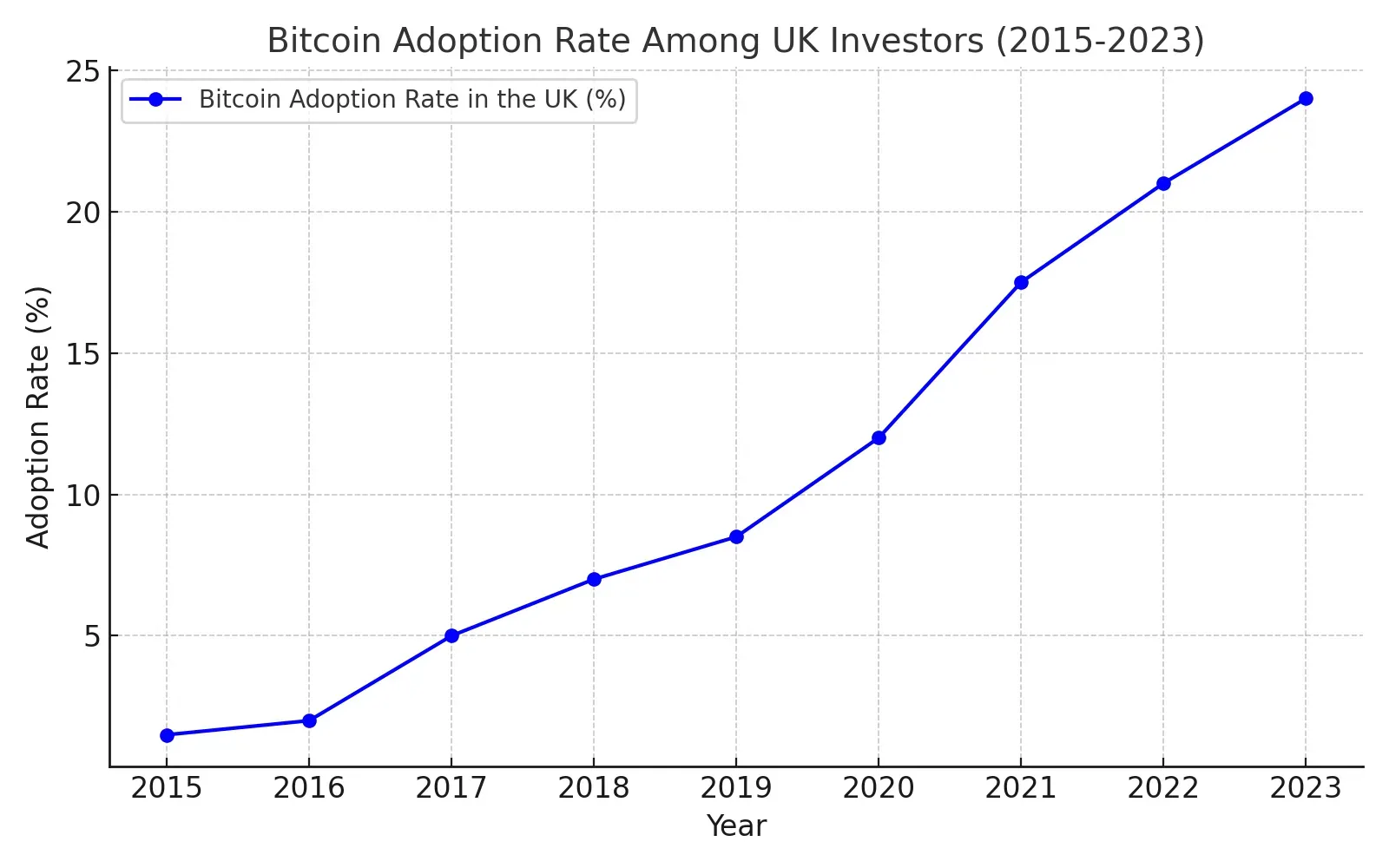

Cryptocurrency Adoption in the UK: A Growing Trend Among Investors

Cryptocurrencies have experienced significant growth in adoption over recent years. For many individuals and institutions, digital currencies are no longer merely optional investment alternatives but essential components of their overall investment strategies. In the United Kingdom, an increasing number of investors are considering the possibility of incorporating cryptocurrencies into their investment plans. This trend is fueled by the perception that cryptocurrencies, such as Bitcoin, serve as a hedge against inflation while offering a high degree of risk and reward. Bitcoin, in particular, has drawn attention due to its limited supply, which appeals to many investors seeking unlimited growth potential. This paper will explore the rising interest among British citizens in digital currencies and how UK investors are accessing these assets through various platforms.

Bitcoin as a Hedge Against Inflation

To some people, one of the main reasons why they want to invest in Bitcoin is in the belief that Bitcoin could serve as a protection against inflation.

There is usually a tendency for inflation to occur for most traditional currencies such as the British pound. In this regard, many central banks including the Bank of England practice money printing which increases the supply of money overtime and thus diminishing its value, eroding savings and even bonds.

In contrast, Bitcoin functions in a different manner and there ever will only be 21 million, with a fixed total supply. Many find its scarcity a plus, considering it mimics a deflationary good. Suffice to say, it is nearly impossible to get Bitcoin without considering its similar characteristics to gold, which has in the past been a storage of value in times of financial crises. Simply put, quite a number of investors are inclined to the modeled and finite nature of Bitcoin, because it prevents their funds from being eaten over time by inflation.

As monetary policies of the world’s central bankers have geared towards aggressive use of actions such as quantitative easing in the current period; stores of values in terms of traditional assets have become less appealing to the investors. In the same vein, a lot of investors in Britain do not mind investing in Bitcoin, as they believe that it offers them a better option to combat inflation against the fiat currency.

Asymmetric Risk and Reward

One of the most appealing aspects of investing in Bitcoin is its asymmetric risk profile. This means that the upside potential is greater than the downside risk, making it a desirable high-risk addition to any diversified portfolio.

Unlike traditional stock markets, where shares or bonds generally follow broader market trends, Bitcoin has demonstrated behavior distinct from conventional financial systems on multiple occasions. This lack of correlation with traditional assets helps investors achieve diversification, thereby minimizing overall risk. While Bitcoin's volatility is undeniable, its asymmetric nature means that, when appropriately sized within a portfolio, it can offer more rewards than losses—or at worst, a total loss.

UK investors seeking substantial growth without excessive downside risk have found this potential mispricing attractive. Many financial advisors now recommend allocating between 1% and 5% of a portfolio to Bitcoin for those pursuing long-term investment strategies.

Beyond Bitcoin: Diversifying with Other Cryptocurrencies

Although Bitcoin remains the leading cryptocurrency by market capitalization and investor interest, other digital currencies are gaining prominence. Smaller cryptocurrencies like Solana, Avalanche, Chainlink, and Immutable X have attracted attention due to their unique features and potential for investment diversification.

Solana, for example, is known for its speed, making it popular in decentralized applications (dApps) and DeFi platforms. It is one of the fastest blockchain networks globally and has found applications in several sectors, including NFTs and gaming.

Avalanche is another cryptocurrency of interest, utilizing scalable blockchain technology. This platform allows for fast and cost-effective DeFi transactions, making it an important player in the expanding DeFi ecosystem and a worthwhile consideration for a diversified portfolio.

Chainlink is a decentralized oracle network that enables smart contracts across different blockchains to interact safely with external data sources, APIs, and payment platforms. Its technology is crucial for linking off-chain data to blockchain-based applications, facilitating decentralized financial agreements and making real-world contracts immutable.

Immutable X has emerged as a breakthrough in the crypto world, especially in the NFT space. It offers attributes distinct from main cryptocurrencies like Bitcoin, providing a Layer 2 scaling solution for Ethereum-based NFTs, allowing users to perform transactions quickly and affordably. While it may seem like just another token, its rapid growth has positioned Immutable X among the leading names in the NFT market.

These assets offer higher growth potential but come with greater risks than Bitcoin. Many investors consider investing only small amounts in these cryptocurrencies. Financial advisors recommend that those planning to invest significant sums in non-Bitcoin cryptocurrencies limit their total allocation to 1-3% of their portfolios. Nevertheless, including these assets can enhance diversification and exposure to innovative blockchain developments beyond Bitcoin.

Increasing Accessibility to Cryptocurrencies

Numerous financial technology companies in the UK have recognized the growing interest in cryptocurrencies. Several firms are working to ease access to digital currencies through platforms designed for British investors. Some even allow customers to integrate cryptocurrencies into tax-free retirement accounts.

Recently, cryptocurrencies have become available through popular UK websites such as eToro, Binance, and Coinbase. These platforms are widely used by retail traders due to their user-friendly interfaces and features. Users can easily convert British pounds into Bitcoin and other cryptocurrencies, making the process straightforward even for first-time users. Additionally, these platforms educate prospective investors about the risks and rewards of digital asset transactions.

The development that has attracted much attention, though, is about introducing digital money into pensions by some service providers based in the UK, which can be added through specialized online financial services into personal savings accounts intended for retirement. Among these companies is Oanda Crypto, which enables individuals to include the most popular one, Bitcoin, in their Self-Invested Personal Pension (SIPP) or Individual Savings Account (ISA). These accounts are tax-efficient, making them a good vehicle for holding cryptocurrencies without paying tax on capital gains for a long period.

This opportunity for individuals to allocate some or all of their retirement savings into cryptocurrencies represents significant progress in the UK's crypto market, positioning it as a conventional asset class for long-term investment. Although these retirement accounts are still relatively small compared to the entire market, their rapid growth indicates increased acceptance among UK residents of cryptocurrencies as viable investment options.

Conclusion

Investment opportunities have broadened significantly among British nationals, accumulating the need of seeking alternative modes of investment, primarily, stocks and reserves weapons to contain alarming inflation. The predisposition of volatility in the supply of currency in relation to the next treatment by issue form the major estimated values between the two conditions of driver and networth as those involve the present and planned government policy. However, this is not the case when it comes to more speculative altcoins such as RAMP, BSCPAD and STARL.

On the other hand, the aforementioned asset classes can facilitate and limit investor’s inflows and this is because of the varying volumes of risks arisen. Nowadays there is increased crypto trading and hex coin price appreciation causes people to view their retirement accounts differently.