How to Calculate Warehouse Rental Value: A Total Cost and Unit Economics Framework

Firms should be aware that in the area of industrial real estate, the rent expressed in the lease for warehouses for lease is normally not reflective of the economic cost associated with that space. By properly evaluating the various options available to them, firms can better understand which costs are hidden and/or added to their overall occupancy cost. In addition to base rent, firms should evaluate all other charges related to warehouse leases that will contribute to their actual cost of utilizing industrial space.

As such, decision-makers will only consider the total value of warehouse rental, not just the quoted base rate that is found in the lease agreement. To accurately determine total warehouse rental value, decision-makers will need to evaluate all of the various types of costs incurred, including common area maintenance (CAM) fees, property taxes, insurance, maintenance, and utilities, and express these costs as a single cost per square foot for purposes of comparison.

When an economist calculates warehouse rental value, it illustrates what a company has spent on average over time to use warehouse space; it does not reflect what a company would pay on a marginal basis, or the amount identified in its warehouse lease.

This guide will assist firms in determining warehouse rental value across the various functions of distribution, logistics, and manufacturing through a framework that may be utilized for budgeting purposes, site selection analysis, and unit cost modeling.

Understanding the Cost Components of Warehouse Rental Value

2.1 Base Rent Metrics: Rent per Square Foot / per Square Meter

All warehouse lease calculations start with base rent, which represents the rate originally published by the lessor and multiplied by the rental area of the facility.

Industrial warehouse rents are typically expressed as annual rates per square foot in many regions of the world; however, some regions outside of the U.S. report industrial warehouse rents as an annual cost per square meter. To create apples-to-apples comparisons, companies need to maintain consistency in the way they make these comparisons. All quotes received for industrial warehouse rental rates must be determined based on a per-square-foot annualized basis before being divided; if need be, companies may take the annualized per-square-foot value and divide it monthly. This will give businesses a consistent annualized dollar value that can be used to accurately compare each geographic area based on the rental price of industrial warehouse space across all cities and lease categories.

2.2 Operating Expenses and Total Warehouse Occupancy Cost

While base rent is not all-encompassing in terms of warehouse rental costs, it does not encompass other costs that are incurred during tenure at a warehouse. In addition to base rent, these additional costs may include CAM fees and other operational expenses such as property taxes, insurance, and utility bills associated with warehouse ownership.

For triple net leases (NNN), where tenants pay operational expenses directly to the landlord, it is common for companies to compare occupancy costs based on combined rent and operating expenses expressed in dollars per square foot. Using combined occupancy costs ($/sqft), a company can assess the total cost of occupying a warehouse property. The contract costs, by contrast, identify only the base rental amount.

Establishing a normalized average based on combined occupancy costs enables firms to use this average when determining the appropriate amount of capital to allocate toward a lease and provides the ability to make comparisons across multiple warehouse facilities.

2.3 Physical and Functional Drivers of Industrial Space Rental Value

Both physical and functional features of a warehouse influence its rental value. For example, clear height, number of docks, truck court depth, available yard area, column spacing, and distance to customers or shipping ports all affect how efficiently a business can operate.

Facilities that are specialized, such as cross-docks, last-mile delivery hubs, and temperature-controlled storage facilities, typically carry a premium on rental rates. These facilities influence where companies select to locate their warehouses as well as the long-term logistics budget of the firm.

Using the Market to Anchor Warehouse Rent Estimates

3.1 Gathering Industrial Market Rental Comparables

Before a firm can establish a reasonable rate for warehouse space, it must first collect comparable industrial market rental data. This information typically consists of completed leases or active lease listings for warehouses of similar size and quality, located within the same submarket as the space under consideration.

Potential sources for this data include industrial brokers, landlord quotes, listing services, as well as conversations with existing tenants in proximity to the warehouse. Each comparable should be matched by warehouse subtype (distribution, logistics, or manufacturing), zoning requirements, and location strategy.

3.2 Normalizing Rates and Benchmarking Against Market Rent

All comparables collected must be adjusted to reflect an annual warehouse lease rate per square foot or per square meter. This analysis requires converting quoted rents from monthly to annual terms and adjusting for any landlord-provided free rent periods or rent inducements included in quoted rates.

By separating NNN warehouse rent from gross lease rent, companies can ensure that a consistent cost methodology is applied when comparing options; as a result, the margin of error in rent-per-square-foot analysis and comparative market assessment is reduced.

3.3 Adjusting for Use Case and Building Type

The operations of a business affect the way that business performs. Each type of warehousing operation has a different cost structure and therefore should be evaluated based on its own requirements. Examples of warehousing operations are:

(1) 3PL

(2) Shared warehouses

(3) Flexible warehouse

(4) Dedicated distribution centre

Newer buildings often have a higher effective rent than older buildings because they typically have a greater dock density, higher quality office space and more extensive offices. There is generally a greater allowance for tenant improvement costs for newer than older buildings. Transportation and the local/regional infrastructure will also have an effect on the cost of the property and the long-term viability of the property.

Step-by-Step: Calculating Warehouse Rental Value

4.1 Defining Space Requirements and Effective Area

Determining accurate estimates of space needed by a company is essential to develop reliable estimates for the associated rental expenses. Firms are encouraged to convert their operational needs (e.g., pallet locations, aisle widths, staging areas, and office space) into square footage and cubic capacity.

Most landlords lease property (rentable) which includes access to the common areas as well as private units (e.g., hallways). To avoid confusion between the tenant and the landlord, it is recommended that prospective tenants ask landlords to provide a definite means of determining square feet and cubic feet (volume) before signing their lease. When assessing their future growth, tenants will be able to continue effectively using their space throughout the duration of the lease(s).

4.2 Building a Warehouse Lease Cost Calculation

You can use the rental rates provided to determine the cost of occupying that space, as a firm would if it rented a comparable location elsewhere. Using this method, firms can assess whether it costs different amounts to rent a similarly sized warehouse in another city.

It is easy to determine it would cost an organization to lease warehouse space by taking all operating expenses associated with the facility and multiplying that figure by the total number of square feet of the warehouse.

Corporate tenants under a gross lease will typically not be billed for operating expenses separately because this is included within their rent payments; while tenants on a triple net lease, however, will also be responsible for paying all operating expenses directly to the landlord, as well as the base rent.

Both lease structures provide for an overall total occupancy cost which can help establish budgetary figures as well as provide for comparative purposes.

4.3 Converting Costs into Unit Economics

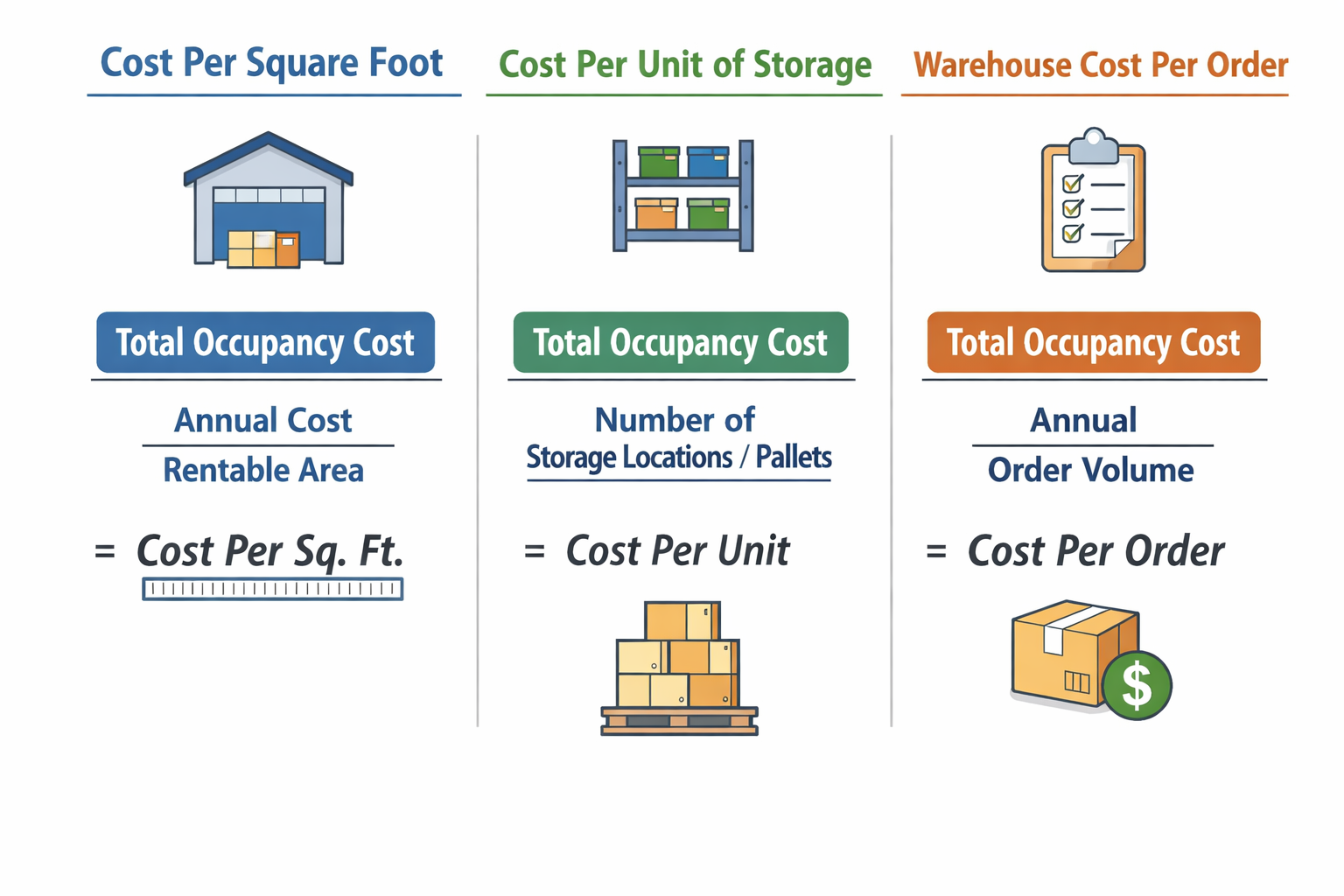

Total occupancy cost includes annual cost and rentable area, which must be divided by each other to determine per-square-foot cost. Occupancy cost can also be divided by number of storage locations or pallets to find a per-unit cost for storage.

When calculating the fulfillment operation, the occupancy cost is divided by annual order volumes to find a warehouse cost per order, which connects directly to pricing models, profit margin calculations and operational cost structure considerations.

4.4 Sensitivity Analysis and Break-Even Rent

Firms should validate their assumptions using multiple scenarios prior to signing a lease agreement, including rent increases, changes in operating expenses, and fluctuations in shipment volume. Sensitivity analysis allows firms to identify break-even warehouse rent levels and assess exposure to cost volatility.

Strategic Considerations: Lease Structure and Warehouse ROI

5.1 NNN vs Gross Lease Structures

When it comes to warehouse rental prices, the structure of the lease can greatly affect its amount. Under a net lease (usually a triple net lease), the tenant pays most of the operating costs. In contrast, under a gross lease (or modified gross lease), most operating expenses are included in the stated rent. Usually, the higher rent offsets these additional expenses.

You should always be sure to compare total occupancy costs (rent, taxes, insurance and utilities) on a normalized basis.

5.2 Lease vs Buy Decisions and Term Length

Deciding whether to rent or buy warehouse space requires effective calculation of warehouse rentals. Renting gives a company the flexibility and mobility it needs, while buying gives greater control over future long-term operating costs and the opportunity for future asset appreciation.

After deciding to rent or buy warehouse space, the next thing a business must determine is the duration of the lease. Generally, longer lease durations may result in lower monthly payments. However, as businesses change their supply chain, a long lease may create less adaptability and flexibility to respond to that change.

Conclusion: Key Takeaways

The process for determining the rental value of a warehouse has four parts: compiling costs related to warehouse space, benchmarking against similar warehouses, converting all costs into unit economics, and determining how these costs fit into a company’s logistics strategy.

This allows a company to calculate occupancy cost per square foot and determine how it compares with local market benchmarks prior to signing or renewing a warehouse lease.