An image showing inflation with a currency rocket which is going up.

Inflationary Gap

Definition

In economics, the term "inflationary gap" refers to the surplus of actual GDP over potential GDP when the economy is at full employment, as defined by John Maynard Keynes.

Formula

Inflationary Gap = Actual GDP – Potential GDP

On the other hand, a deflationary or recessionary gap refers to a situation in an economy when the actual output level is less than the full employment level of output.

Example

Suppose that thereal gross domestic product (GDP) of an economy is $200 billion. The potential GDP is $180 billion. Since the real GDP is greater than the potential GDP, it is an inflationary gap.

Inflationary Gap = Actual GDP – Potential GDP = $200 billion - $180 billion =$20billion

Thus, an inflationary gap of $20 billion exists in the economy.

Explanation

An "inflationary gap" refers to a situation of an economy when its actual level of output (real Gross Domestic Product, or real GDP) is greater than the potential level of output (potential GDP). In other words, when the actual level of output is higher than the potential level of output, this creates an inflationary gap, and leads to inflationary pressures in the economy.

The inflationary gap represents a stage in the business cycle when the economy is growing and there is an abundance of money in circulation. This leads to increased consumer spending, driving up demand for goods and services. As production has not yet caught up with this rise in demand, prices increase to restore macroeconomic equilibrium.

In macroeconomics, the concept of an inflationary gap is closely tied to the idea of full employment. Full employment is the point at which all available resources in an economy, including labor, are being used to produce goods and services. When an economy is operating at full employment, it is producing at its potential level of output. If actual output exceeds potential output, this creates an inflationary gap and results in upward pressure on the price level.

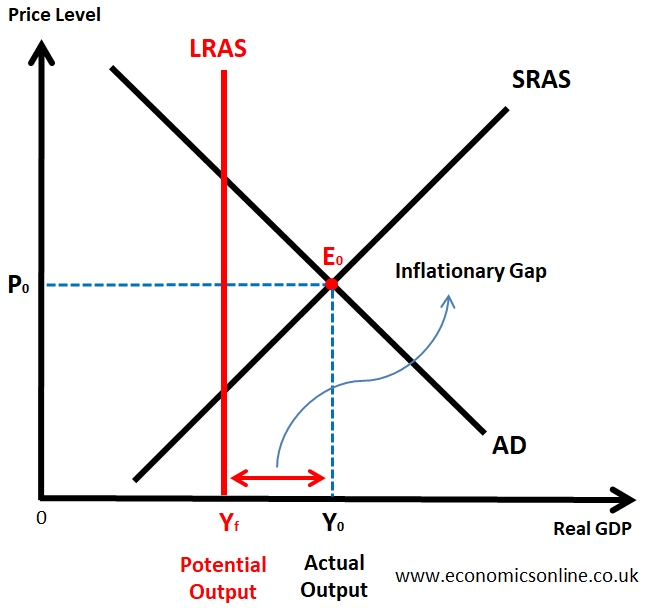

Graphs of Inflationary Gap

The following Aggregate Demand - Aggregate Supply diagram illustrates an inflationary gap.

The long-run aggregate supply (LRAS) curve is vertical at Yf which represents the the potential GDP at full employment, and the actual GDP is Y0 at the equilibrium point E0 where the short-run aggregate supply (SRAS) and aggregate demand (ADo) intersect.

In the short run, aggregate supply (SRAS) has an upward slope because firms increase output as price level rises. However, in the long run, aggregate supply (LRAS) is vertical at full employment level of resources as it depends solely on the economy's resources, rather than the price level.

In the diagram, an inflationary gap occurs when the intersection of short-run aggregate supply (SRAS) and aggregate demand (AD0) lies to the right of the long-run aggregate supply (LRAS). This results in a positive difference between the real GDP and potential GDP (Y0 - Yf) on the x-axis, representing the inflationary gap.

If there is an inflationary gap, the SRAS intersects AD to the right of the LRAS, creating a surplus between real GDP and potential GDP, indicated by a positive difference on the x-axis.

Causes of the Inflationary Gap

The inflationary gap can be caused by a variety of factors but the main cause is an expansionary fiscal policy. For example, an increase in government spending or a decrease in taxes can lead to an increase in aggregate demand, causing the actual level of output to exceed the potential level of output. Similarly, an increase in the money supply can also lead to an inflationary gap by increasing aggregate demand.

Significance of the Inflationary Gap

The inflationary gap is a significant concern for policymakers because it can lead to inflation, which can have a number of negative consequences for an economy. For example, inflation can reduce the purchasing power of consumers, leading to a decrease in their standard of living. Additionally, inflation can result in an increase in the cost of borrowing, making it more difficult for businesses and individuals to access credit.

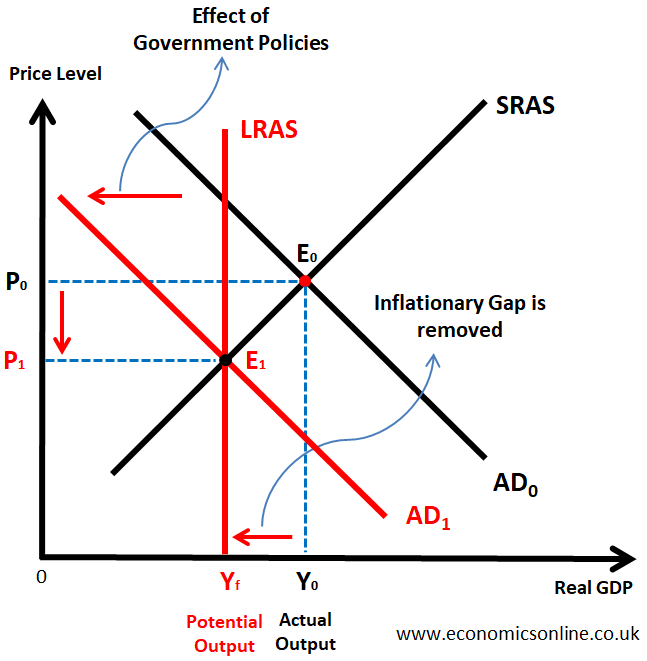

Government Policies to manage Inflationary Gap

The government can use a number of macroeconomic policies to manage the inflationary gap.

For example, a government can use contractionary fiscal policy to address an inflationary gap, by decreasing government spending, increasing taxes, issuing bonds and securities, and cutting transfer payments. These changes help to bring the economy back into equilibrium by reducing the demand for goods and services and decreasing inflation.

The government can also use contractionary monetary policy to manage the inflationary gap. For example, when the Federal Reserve raises interest rates, borrowing becomes more expensive and the amount of money available to consumers decreases, leading to lower demand and a decline in prices and inflation. This will bring the actual output back in line with potential output. Once market equilibrium is reached, the Fed or other central bank can adjust interest rates as necessary.

For example, they may raise interest rates, which will reduce aggregate demand and bring actual output back in line with potential output. Similarly, they may decrease government spending or increase taxes, which will have a similar effect.

This is shown by the following diagram.

Due to contractionary fiscal or monetary policies of government, the aggregate demand curve will shift to the left at AD1. This will result in the fall in price level from P0 to P1 and the actual GDP will also decrease to match the potential GDP at Yf. Hence the inflationary gap will be removed.

Conclusion

In conclusion, the inflationary gap is the positive difference between an economy's actual level of output and its potential level of output. When actual output exceeds potential output, this creates an inflationary gap and results in upward pressure on prices. The inflationary gap can be caused by a variety of factors, including an increase in government spending or a decrease in taxes, and an increase in the money supply. The inflationary gap is a significant concern for policymakers because it can lead to inflation, which can have a number of negative consequences for an economy. To reduce the inflationary gap, policymakers may use a variety of tools, including raising interest rates, decreasing government spending, or increasing taxes.