House prices

House prices exhibit three main features:

- Rising average prices in the long run

- Considerable medium-term volatility, with house price bubbles, occasionally followed by dramatic price crashes

- Considerable price variations between different regions of the UK

Rising average prices

The long run increase in house prices is caused by demand for housing outstripping supply. It has been estimated* that 175,000 more homes must be built each year to meet the future level of demand for housing. As previously noted, only around 5% of property transactions involve new properties.

*SOURCE: CAMBRIDGE UNIVERSITY

See: Housing market.

UK house price growth cools to weakest level since May 2013

By Patricia Nilsson

The annual rate of UK house growth in October slowed to its lowest rate since May 2013, according to new data that highlight the slowdown in Britain’s property market sparked by economic uncertainty and tighter consumer budgets.

Prices grew 1.6 per cent year-on-year, Nationwide said, down from an annual rate of 2 per cent in September. Economists polled by Reuters had forecast a significantly slimmer fall to 1.9 per cent. Month-on-month, prices remained flat, after a cautious growth of 0.2 per cent in the previous month.

While overall housing market activity was still subdued, the lender said recent years had seen a recovery in the number of first time buyers, helped by credit availability such as the Help to Buy scheme and low interest rates.

|

The Financial Times is offering free access to FT.com to all UK secondary schools. |

Register now at https://enterprise.ft.com/en-gb/secondary-schools/ “

Robert Gardner, Nationwide’s chief economist, said:

| This was broadly in line with our expectations, as the squeeze on household budgets and the uncertain economic outlook is likely to have dampened demand, even though borrowing costs remain low by historic standards and unemployment is at 40-year lows. We continue to expect house prices to rise by around 1 per cent over the course of 2018. |

Copyright The Financial Times Limited 2018

FT Source: Patricia Nilsson 2018 “UK house price growth cools to weakest level since May 2013” Financial Times 1st November. Used under licence from the Financial Times.

FT Source: Patricia Nilsson 2018 “UK house price growth cools to weakest level since May 2013” Financial Times 1st November. Used under licence from the Financial Times.

© The Financial Times Limited [2018]. All Rights Reserved.

Original article: https://www.ft.com/content/7a84a9c2-dda9-11e8-8f50-cbae5495d92b

House price volatility

House prices have crashed twice in the last 20 years, between 1990 and 1992, and more recently between 2007 and 2010.

As the economy came out of recession in 1992, house prices began to rise, and continued for a further 15 years. Over most of this period, house prices rose well above the general inflation rate generating a considerable wealth effect. However, during the mid 2000’s house price inflation started to slow down, and prices starting falling during 2007. House prices continued to fall throughout 2008 and 2009, and again in 2011.

House price bubbles

The general housing shortage is partly responsible for house price bubbles and subsequent crashes. Given the long term above-inflation rise in house prices, property represents a safe investment, both for homeowners, and for property developers, asset managers, and general investors. This is even more the case when alternative investment opportunities become less attractive, such as when interest rates are low, or when company profits and share prices are low, as occurred between 2007 and 2009.

House prices 2006 to 2018

Rising property prices also attract speculators hoping to make a fast return. As speculators enter the market in increasing numbers, the probability of a bubble, and then a crash, also increases. The increased securitisation of mortgage debt created the means by which developers and speculators could build new properties, and sell them to high-risk, sub-prime, borrowers. The high-risk mortgage debt could be repackaged, and sold off to largely unwitting banks. This created an extreme form of moral hazard, which meant that many lenders blindly pursued short-term profits in the belief that their potential losses from loan defaults were fully covered.

The long-term housing shortage and upward trend in house prices, also provided encouragement for first-time buyers to enter the market, and for investors and speculators to provide funds for home construction, and for lending to potential borrowers. This all works well when house prices do, indeed, rise, but when the bubble bursts the effect can be catastrophic, spreading shock waves across the national economy, and into other countries. The globalised nature of financial markets accelerated the speed of the financial crisis that followed the housing crash.

See also: the financial crisis

Regional variations

House prices vary considerably across the UK, with highest average prices in London and the South East.

Regional differences can be explained in terms of regional variations in demand and supply conditions.

High average earnings, full employment, inward migration, relatively limited housing stock, and tight restrictions on new house building in London account for high average prices in London. In contrast, lower average wages, more housing stock, and easier planning means that average prices in many of the regions are relatively low.

This regional disparity makes it difficult for individuals to move regions in search of work and reduces the geographical mobility of labour.

The effect of house price changes

House price movements can have a number of consequences, perhaps the most important of which is the effect it has on household spending. Changes in property and other asset prices affect household spending in a number of ways.

For example, an increase in asset values creates positive equity, which can lead to housing equity withdrawal and rising confidence. An asset’s equity is the difference between the market price of the asset and the mortgage, or other debts, on the asset. For example, a property valued at £200,000, with an £80,000 mortgage has equity of £120,000. With positive equity, properties can be re-mortgaged so that homeowners can use the equity to fund spending. Falling house prices reduce equity and may even create negative equity, especially for new homeowners, which creates negative consumer sentiment and is likely to lead to lower household spending.

Changes in house prices also affect the distribution of wealth in the economy. During times of rapidly rising prices, those who own property will experience an increase in their wealth relative to those who rent accommodation. When house prices crash, new owners and those with large mortgages suffer in comparison with those who rent. However, a fall in house prices may, of course, enable the low paid to get a foothold on the property ladder.

Policies to increase the supply of housing

Subsidies to private house builders

House builders can be subsidised to build more houses in areas of particular shortage, including London. However, it may take many years for private house builders to find land and undertake the necessary planning, design and construction.

Public house building

Central or local government can bypass the market and build more public housing. Low-cost social housing may be necessary in large cities like London given the difficulty of low paid workers getting onto the property ladder. However, the general shortage of available land limits the effectiveness of this option.

Relax regulations

Relaxing house-building regulations, such as making planning permission easier to obtain, would act as an incentive for private house builders to enter the market. However, many regulations are essential, including those relating to health and safety, so complete deregulation is unlikely. In addition, there is a risk that such new-build housing will be marketed at the sub-prime sector, which will increase the risk of house price crashes in the future.

Grants and tax concessions

Grants or tax concessions to builders who build on brownfield sites may encourage house building on land which is less regulated. Greenfield sites are those sites which are not currently used and brownfield sites are those which have already been built on, such as areas of city centres that are waiting to be re-developed.

Policies to regulate demand

Government or monetary authorities can implement a range of polices to regulate demand for housing, including:

Altering deposit requirements

House buyers could be required to provide bigger or smaller deposits when they make their purchase. Given the general upward trend in prices, the most likely option is to require a larger deposit, which would deter the sub-prime buyer from entering the market until they had saved a sufficiently large deposit. For example, all new buyers could be forced to put down 25% of the purchase price, taking out a mortgage on the remaining 75%. On average, a first time buyer will put down just a 10% deposit, and borrow 90%.

Altering interest rates

The Bank of England could raise or lower interest rates if house prices are seen to contribute the general inflation or deflation. However, the Bank of England does not directly target house prices, and will only consider changing interest rates if house price inflation or deflation are seen as central to the wider inflationary picture. Rising interest rates are almost certainly likely to have a slowing influence on property prices as they will be passed on to mortgage borrowers. “Lenders may simultaneously require higher deposits when they perceive market risks which could affect the security they have against homes,” comments James Durr of home sales company Property Solvers.

Encouraging variable rate mortgages

Another policy might be to get borrowers to switch from variable mortgage interest rates to fixed long-term interest rates. In this case, repayments would be constant, and the impact of interest rate changes on the housing market, and the rest of the economy, would be greatly reduced.

The affordability of housing

One of the effects of the general upward trend of house prices is the increasing difficulty that many people have in trying to purchase their own property.

With average UK house prices approaching £200,000, and with average earnings around £25,000, new buyers find it almost impossible to get on the property ladder. Lenders will typically lend up to 3.5 times earnings, so an individual on average earnings of £25,000 is only able to borrow £87,500, effectively ruling them out of the housing market.

Changes in affordability can be tracked with an affordability index, such as the Halifax Affordability Index. This measures mortgage payments as a percentage of disposable earnings.

The ONS provides a housing affordability index which looks at the ratio of median house price to median annual earnings, as shown below. As the ONS reported, on average, house prices were 7.6 times annual earnings in 2016, up from 3.6 times earnings in 1997. While property prices increased by 259% between 1997 and 2016, annual earnings only increased by 68% – significantly reducing house price affordability.

The case of rent controls

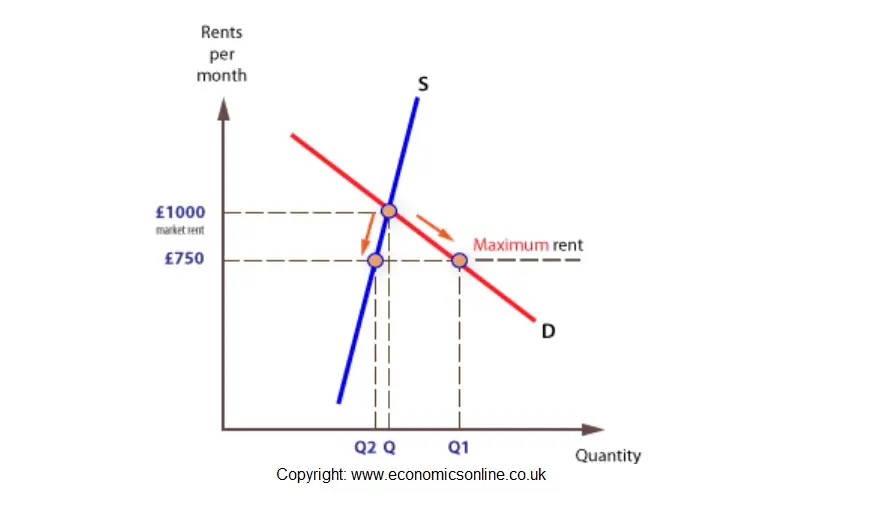

High rents are clearly a deterrent to renting and may contribute to the overall housing problem, and to homelessness. In a situation of high rents, it is important to consider whether a cap on private rents would help. Rent controls are limits, imposed by central or local government, on the rent that private landlords can charge. They are a type of maximum price, and the effect can be illustrated diagrammatically.

Unfortunately, the maximum rent has created a perverse price signal which acts as a disincentive, with some landlords taking property off the market, while at the same time more people are encouraged to seek rental accommodation. The combined effect is to create a shortage of rental property.

In the example shown, setting maximum rents at £750 would result in an excess of demand over supply.

The credit crunch and the housing market

House purchases are highly dependent on the supply of mortgages from the financial system. This, in turn, depends upon the belief of lenders, the banks and building societies, that borrowers will not default on their loans. When confidence is high, liquidity will flow through the financial system ensuring that funds are available. Liquidity refers to the ease with which an asset can be converted to cash. At times of rising house prices and general confidence, banks will be prepared to lend to each other to ease any local liquidity problem and make a guaranteed return. However, when confidence is low and with house prices falling lenders get wary of lending to new borrowers, many of whom will quickly experience negative equity and default on their loans, with the result that banks may stop lending to each other. As the number of new buyers starts to fall, the housing market will start to slow down even further. First-time buyers entering the market enable second and third time buyers to move up the housing ladder. The entry of first-time buyers is seen as central to the health of the housing market.

The current housing and credit crisis started in the US because of the collapse of its sub-prime market. As this market collapsed, the banks experienced increasing defaults on their loans, rising repossessions and the build-up of huge debts on their balance sheets. As liquidity flowed out of the system, a full-blown credit crunch ensued, with lenders unprepared to increase their exposure to more loans and even more risk. Given the interconnectedness of the US and UK financial system, the housing crisis quickly spread across the Atlantic to generate a very similar credit crisis and housing collapse.

Possible remedies

There are several policies that could be introduced to limit the effects of the credit crisis, and stimulate the housing market.

- New liquidity could be injected into the financial system, as was attempted by the US Federal Reserve, the Bank of England, and the European Central Bank (ECB). This could be achieved by giving the banks favourable loans to improve their balance sheets, or by a process called quantitative easing – effectively printing new money. The main risk associated with printing money is that it may lead to a housing price bubble.

- In August 2012 the Bank of England launched its £80bn Funding for Lending Scheme, providing cheap funds for mortgage lending and loans to small business. However, mortgage lending continued to fall, and few new mortgage products have been introduced as a result of the lending scheme.

- Nationalisation of failing banks, such as Northern Rock and Bradford and Bingly, or part-nationalisation, as in the case of the Lloyds Banking Group and the Royal Bank of Scotland (RBS).

- More effective regulation of banks, especially on a global basis, as proposed at the G20 Summit in London in April 2009.

- Reduce the cost of buying houses, especially for new buyers, such as by reducing the tax on house purchases, called stamp duty land tax – commonly known as stamp duty.

Read more:

See also: The financial crisis