What Are Trade Barriers?

What Are Trade Barriers?

No matter how large or how rich a country is, their manufacturing industries will need to reach beyond their border for resources. Yet, some countries still take a stand against free trade. Some leaders still feel that free trade is not best for their economies and that it negatively affects their growth and employment. Others pose arguments for imposing trade barriers.

Being able to trade on an international level allows countries to obtain products they cannot produce on their own. Take for example many of the smaller nations in the Middle East. These regions have an abundance of oil. So much, that they have become wealthy. Even though they have obtained a wealth of money, there are many things they cannot manufacture on their own. This is why they trade oil, which there is an abundance of, for other items. For instance, oil can be traded to countries like Japan, Germany, or the US in exchange for vehicles or airplanes.

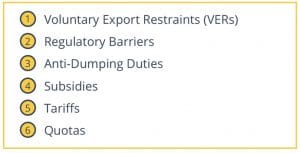

Countries have four types of trade barriers they can implement. These four main types of trade barriers include subsidies, anti-dumping duties, regulatory barriers, and voluntary export restraints.

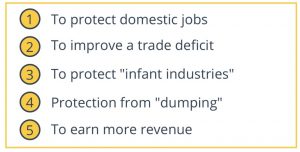

Why Governments Favor Trade Barriers

Protects Domestic Jobs from Cheap International Labor

Industrial nations often have high wages because worker output is higher than output in developing countries. Higher productivity is reflected in higher wages. This is what creates a comparative advantage for producing products. Otherwise, owners would need to reduce wages so that they would match the level of productivity. One example is the instituting an import tariff on sugar, domestically-grown sugar becomes less expensive than important sugar. This encourages consumers to purchase sugar produced in the US. The result is money staying in the pockets of farmers and producers in the US.

Improves Trade Deficits

Trade barriers decrease the demand for imports by making them more costly. The problem is that trade partners may retaliate by increasing prices for exports. This doesn’t create a fix for the problem, especially if domestically produced goods lack quality or are not competitive enough. If exports decrease, countries may choose to spend less on imports.

Protect Newly Developing Industries

Countries desire to give infant industries or newly developed ones a chance to grow and gain a competitive edge. This can be an argument for imposing trade barriers. But in some instances, this level of governmental protection doesn’t expire. Some industries only become competitive because of the trade barriers.

Prevent “Dumping” Practices

When an importer sells off products below the cost of protection, it is called dumping. It can be difficult to prove, but some nations institute anti-dumping duties when they are competing against products that are locally manufactured.

An Increase in Revenue

When governments tax imports (tariffs), they gain revenue. In some cases, an ad Valorem tax, or a specific tariff is instituted. Tariffs are used to increase prices on imported goods so their consumption is lowered in response.

6 Main Types of Trade Barriers

VERs – or Voluntary Export Restraints

Exporting and importing countries make agreements that limit the number of products that can be exported during a given period. The term uses the word “voluntary” but it’s not the case most of the time. A country can increase prices and revenue by reducing the amount they export.

Regulatory Trade Barriers

Any type of legal barrier designed to restrict imports is regulatory. Regulatory barriers are set by governments. They provide a standard that must be met before products can be exported. These include product standards, safety standards, and pollution standards. One common example affects the automobile industry. Manufacturers often need to pass specific safety ratings for the vehicle to be sold in the importing country.

Anti-Dumping Duty

When exporters sell products below their cost, it’s considered dumping. When this occurs, governments can impose duties on the good. The duty is in effect until the World Trade Organization can decide the issue. Sometimes, firms claim that goods are produced below the cost just to buy themselves more time. It can be difficult to determine how much the product costs the firm.

The Subsidy

Subsidies are often offered by governments so firms can lower their costs and be more competitive.

The Tariff

Tariffs are levied as a tax on imports. A tariff is used to raise the price of imports so they are not consumed. It might be in the form of an ad valorem tax or a specific tax. When the price increases, consumers are more likely to choose local options.

The Quota

Quotas are types of trade barriers that restrict how much of a product can be imported into a country. A quota and a tariff are the same, however, the government collects revenues from tariffs, and exporting firms collect revenue from quotas.

An Example of the Effects of Trade Barriers

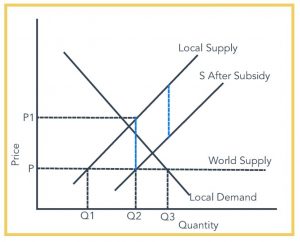

P = world price

Q1 = produced by the domestic industry

Q2 = local demand

Q1Q2 = imported goods

Subsidies reduce the price a firm pays per unit which results in a shift away from the local supply. The consumer pays less since it is being subsidized by the government. However, eventually, a subsidy becomes the burden of the taxpayer.