Trading Automation Penetrates the Cryptocurrency Sector

Introduction

The cryptocurrency sector has grown exponentially since the inception of Bitcoin in 2009. Over 400 million people around the globe use cryptocurrency. Many developments have taken place in this sector, including privacy improvements, security improvements, regulatory developments, and the use of artificial intelligence (AI) in crypto trading. One such groundbreaking development is the integration of trading automation in the cryptocurrency market. In this article, we will explain various aspects of trading automation in the cryptocurrency sector.

Understanding Trading Automation

What is Automation?

Automation refers to the use of machines and technology to perform tasks without direct human involvement. The purpose of automation is to increase speed, reduce human intervention, and enhance efficiency.

What is Trading Automation?

Trading automation refers to the use of algorithms, computer programmes, and bots for buying and selling on financial markets. This is also called algorithmic trading or automated trading. Trading automation was introduced by Richard Donchain in 1949, and hence it is not a new concept in traditional financial markets.

Trading Automation in the Cryptocurrency Sector

Buying and selling cryptocurrencies is considered risky, and it is critical for crypto investors to fully understand all the risks associated with crypto trading. In the past, these investors needed to do extensive research and data analysis manually in order to use trading strategies and make profitable trading decisions. In recent years, the use of trading automation has reduced the need for manual research and data analysis by investors in the cryptocurrency sector. Automated trading systems, also known as trading bots, are designed to analyse market data, execute buying and selling, and manage risks without human intervention. This means quick decision-making, less manual work, and reduced risk for crypto investors.

How does Trading Automation Work in Cryptocurrency Sector?

Automated cryptocurrency trading systems are based on algorithms and bots developed by third parties and available for purchase or subscription. Deploying these bots for crypto trading requires at least a basic understanding of coding and technical analysis.

To use automated crypto trading bots, investors connect them to cryptocurrency exchanges (like Binance) through an Application Programming Interface (API).

Investors set some parameters for automated trading. Common parameters include price, time frame, and order volume.

Choosing these trading parameters along with market indicators is essential for the better functioning of automated trading. Once market conditions align with predetermined parameters, the bot automatically executes trades on behalf of the trader.

The automated crypto trading bots have direct access to the crypto assets of the investor and can execute trades.

Investors should only employ bots from reputable sources and conduct thorough backtesting of trading strategies across various market scenarios to enhance profitability in live markets.

Main Components of Trading Automation

Here are some major components of trading automation:

Algorithmic Trading Strategies

The set of pre-defined rules and conditions that determine when to buy or sell crypto are called algorithmic trading strategies. These strategies can be simple or highly complex and may involve many technical indicators, statistical models, and machine learning algorithms.

Market Data Analysis

Automated trading systems rely on analysing the real-time market data to make informed decisions. This includes prices, trading volumes, and other relevant information to identify trends, patterns, and anomalies.

Risk Management

Trading automation uses rules to manage risks by controlling the volume of trades, setting limits for trade, and managing the overall risk of the whole portfolio of financial digital assets. This helps to protect investors against huge losses.

Order Execution

Automated trading systems place orders in the market once the criteria set by the investor is satisfied. The timing and the size of order is also controlled according to the trading strategies used by the investors. A large number of orders can be executed at a high speed by using trading automation.

Back-testing

Back-testing means doing a test run of the algorithm using historical data before deploying the algorithm in the live market. Back-testing helps investors check the potential effectiveness of a particular trading strategy by using past data. This testing reduces the risk of using a particular trading strategy to a large extent.

Monitoring and Maintenance

Automated trading systems need continuous monitoring for their proper and correct functioning. Some periodic adjustments may be necessary to incorporate new market conditions or optimise performance.

Advantages of Trading Automation in Cryptocurrency

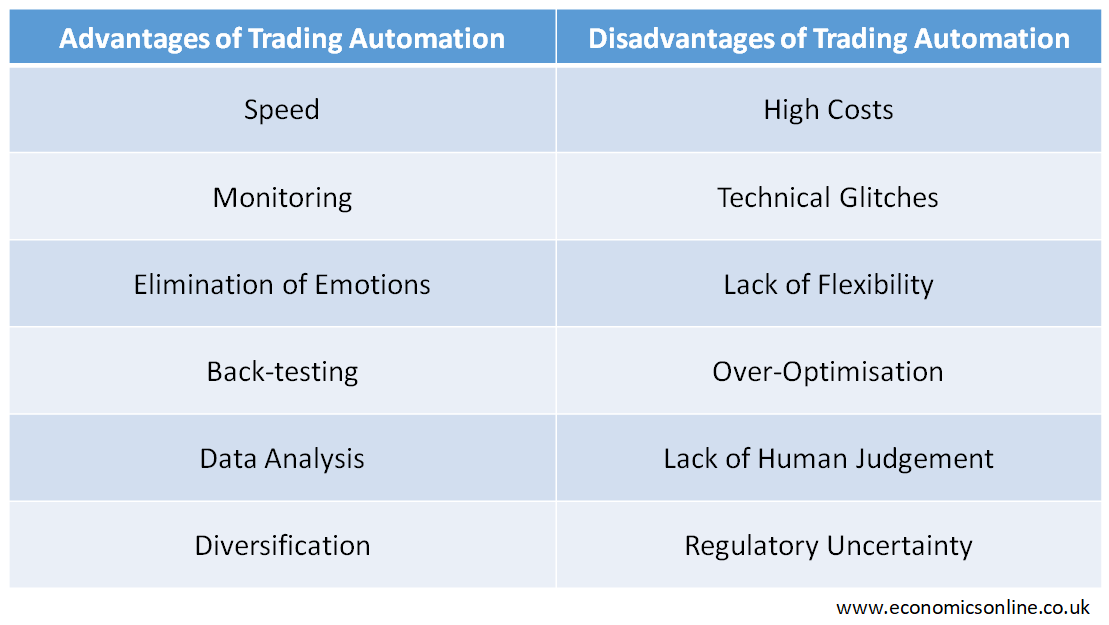

Trading automation in crypto markets has a number of advantages, some of which are given below:

Speed

One of the primary advantages of trading automation in the cryptocurrency sector is the speed it brings to the trading process. Unlike human traders, algorithms can process vast amounts of data in real-time and execute transactions in milliseconds. This saves huge amount of investor’s time and makes the response to the crypto market changes extremely quick when the opportunities arise.

Monitoring

The cryptocurrency market operates 24/7, and its decentralised nature means that it is not bound by traditional market hours. Crypto trading bots can work continuously without taking rest. This is a clear advantage of automated systems over manual trading practices. Trading automation enables continuous market analysis, allowing bots to execute trades at any time, including weekends and holidays. This non-stop functionality gives crypto traders a competitive edge in a market that never sleeps.

Elimination of Emotions

Human emotions often play a significant role in trading decisions. Fear, greed, and panic can lead to impulsive actions and poor judgment. Trading bots operate based on predefined algorithms, eliminating emotional bias from the decision-making process. This results in more disciplined and rational trading strategies. This is a major advantage to the reactionary type of investor who do trading based on fear or greed.

Back-testing

Trading automation allows for rigorous back-testing of strategies using historical data. This enables traders to fine-tune and optimise their algorithms before deploying them in live markets. Back-testing helps identify the strengths and weaknesses of a strategy, leading to better decisions in the live markets.

Data Analysis

Trading automation can do extensive data analysis at lightening speed. This can be a major advantage where huge amount of data has to be analysed quickly for making trading decisions.

Diversification

Trading automation allows investors to use several accounts and various platforms at the same time. This means that the trading portfoilio will be diversified which can reduce the risk of loss by a large extent.

Disadvantages of Trading Automation in Cryptocurrency

Some disadvantages of trading automation in crypto sector include:

High Costs

Developing and automated trading system can be expensive and time consuming. This is major drawback of trading automation. The software and hardware needed to build these systems can be costly. Additionally, the operating costs of these systems can also be high and may include the costs of hosting and virtual private service (VPS). Moreover, automated systems also need maintenance and upgradation for these smooth running.

Technical Glitches

Another disadvantage is the risk of technical glitches or system failures. A malfunctioning algorithm, an API problem or a connectivity issue can result in significant financial losses, if some timely decisions are not made.

Lack of Flexibility

Automated trading systems lack flexibility because they follow pre-defined rules. These systems are not designed to go beyond the set rules and cannot adapt to the new market condition. This means that some trades might be done poorly or some new opportunities might be missed out.

Over-Optimisation

Excessive backtesting and optimisation can lead to overfitting, where a trading algorithm performs well on historical data but performs poorly in live market. This can result in poor performance in real-time trading.

Lack of Human Judgement

Automated systems analyse data patterns and trends without any human judgement. This can be an advantage because it limits bias and irrational decision-making. However, there may be some situations that require human experience, expertise, and judgement. For instance, market sentiments or a world event can bring some opportunities that trading bots cannot judge.

Regulatory Uncertainty

The regulatory landscape for cryptocurrency trading is still evolving. Investors using automated systems may face legal challenges and uncertainties as regulatory bodies make new laws for automated crypto trading. Moreover, there may also be security risks when bots use the account details of an investor to do trades.

Is Automated Crypto Trading Legal?

The use of automated crypto trading is legal in countries where cryptocurrency is legal. In many countries the use of cryptocurrency is legal and hence the automated trading systems. However, adherence to local financial regulations is essential. Traders must be aware of licensing requirements, compliance standards, and potential restrictions imposed by regulatory authorities. Additionaly, this should be kept in mind that crypto bots are illegal and many fraudulent activities take place in the crypto trading as well.

Is Automated Crypto Trading Profitable?

Using automated trading does not guarantee profits. The profitability of automated crypto trading is influenced by the trader's understanding of the technology, the quality of the trading bot and the trading strategy. Investors must carefully design the algorithms by keeping in mind the risks, market trends and technical factors.

Is Automated Crypto Trading Safe?

Automated crypto trading can be safe when proper precautions are taken. Security risks include technical glitches, system failures, and potential exposure to fraud. To enhance safety, investors should choose reputable trading bots, implement strict API controls, and use the software's security features. Using strong authentication measures can add an additional layer of protection. Intermediaries such as the Immediate Connect Platform play an increasingly important role in facilitating secure transactions.

Future of Trading Automation in Cryptocurrency

As technological innovation continues to advance and the cryptocurrency market matures, the role of trading automation is expected to expand. Some key developments include:

Integration of Artificial Intelligence (AI)

The incorporation of artificial intelligence and machine learning into trading algorithms is likely to enhance the adaptability and learning capabilities of trading bots. AI-driven systems can analyse complex data sets and continuously improve their strategies based on changing market conditions.

Increased Institutional Adoption

Along with individual cryptocurrency investors, institutional traders are also increasingly recognising the efficiency and scalability of automated trading systems, leading to the growth in the adoption of these systems.

Regulatory Clarity

The cryptocurrency market is gradually gaining regulatory clarity, which is essential for the wider acceptance of trading automation. Clearer regulations will provide a framework for the responsible development and use of automated trading systems.

Conclusion

Trading automation has firmly penetrated the cryptocurrency sector, revolutionising the way investors approach the market. The advantages of speed, efficiency, and emotionless execution make trading bots an attractive option for both individual and institutional investors. However, the challenges associated with algorithmic trading require careful consideration and risk management strategies. As technology continues to advance and the regulatory landscape evolves, the role of trading automation in the cryptocurrency market is bound to grow, shaping the future of cryptocurrency trading.