Photo by charlesdeluvio / Unsplash

Actuarial Science vs. Economics

Actuarial Science

Actuarial science is an area of study that is involved in estimating the financial risks in insurance and other fields of finance by using mathematical and statistical methods. It uses probability and statistical methods in order to analyse the financial risks of uncertain events which will occur in near future. Traditional actuarial science revolves around analysing mortality, the production of life tables, and the use of compound interest in financial problems.

The actuarial science is used to identify the risk of upcoming events occurring in the near future by using probability analysis so that their financial impact can be predictable. Actuaries typically use actuarial science in the insurance industry. Actuaries use mathematical methods to predict and forecast the event happening so that an insurance company can easily allocate funds to pay out the claims and maturities that can be the result of an event.

Historical Background

In the late 17th century, actuarial science became a formal mathematical discipline because of the increased demand for long-term insurance coverage. Actuarial science consists of many major disciplines of study, such as finance, statistics, mathematics, probability theory, economics, and computer science. Historically, this field used ancient models in the construction of tables and premiums. During the past 30 years, science has gone through revolutionary changes due to the increase in high-speed computers and the connection of actuarial models with modern financial theories.

Actuaries

Those people who are typically hired by the insurance companies to design and decide which policies and premiums are going to be charged by different firms are called actuaries. Actuaries are only bound to carefully analyse each policy to determine whether it is profitable and beneficial for firms to utilise or not. Actuaries are the ones who can work for multiple types of companies, such as government industries, pension companies, and consulting firms, where they handle their health insurance, casualty, life, and property-related policies. They collect statistical data, analyse the data, and then present it to government officials, shareholders, executives, or other clients. Sometimes, they use and create charts or graphs to better explain their calculations and new policy plans.

Economists

The social scientists who study the production and distribution of resources, goods, or services are called economists. Economists use financial data and mathematical models to analyse economic issues and predict future results. They can work as experts in education, government, and private industries. Economists provide consulting services, conduct research, or teach multiple courses in educational institutes. Economists may have specialised knowledge in many fields, such as microeconomics, macroeconomics, econometrics, managerial economics, development economics, behavioural economics and international economics.

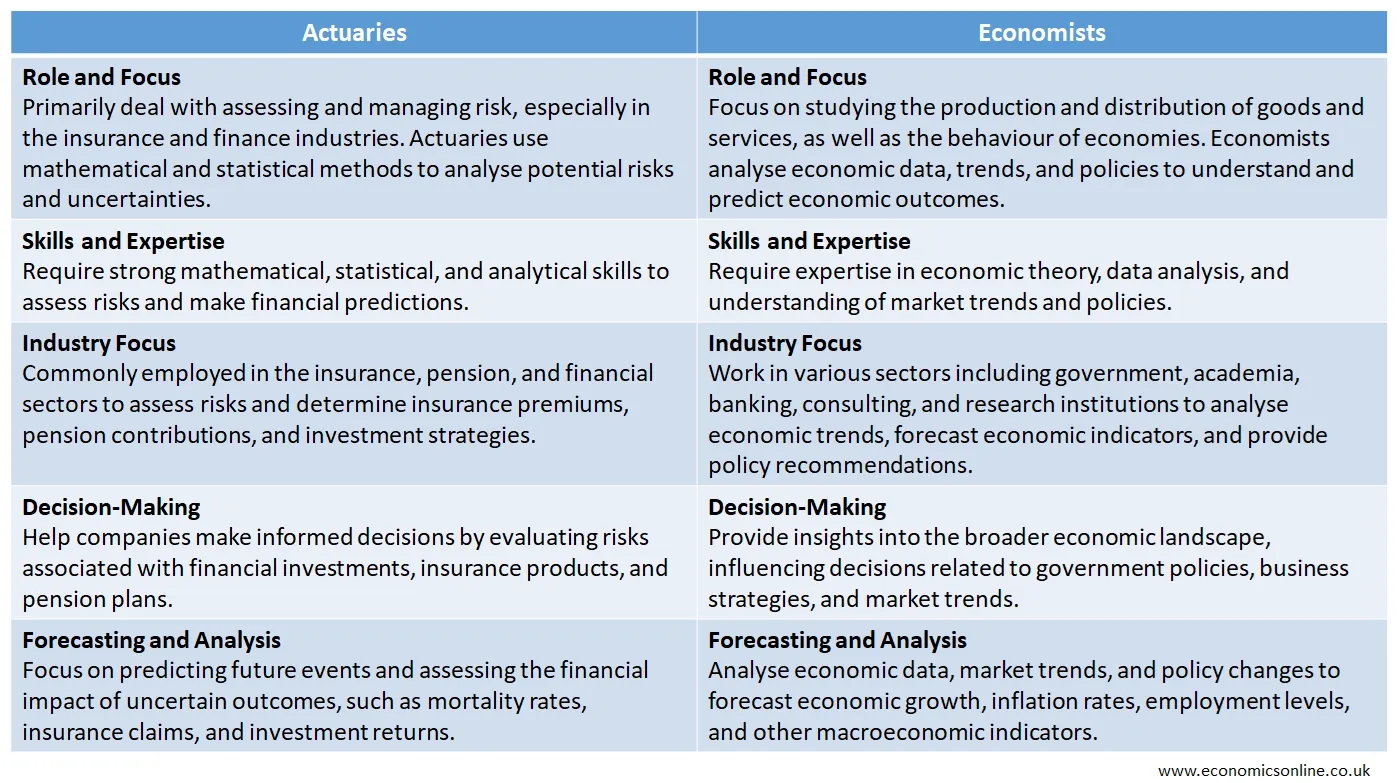

Differences between Actuaries and Economists

The following table contains the main points of difference between actuaries and economists:

Econometrics

A term that is used to describe the use of mathematical and statistical models in economics is called econometrics. Econometrics is concerned with the use of statistical models to analyse economic data. This field is also related finance. Econometrics is also involved in testing various economic policies and their impact on the economies of countries. Some tools of econometrics are regression analysis, probability, and correlation analysis.

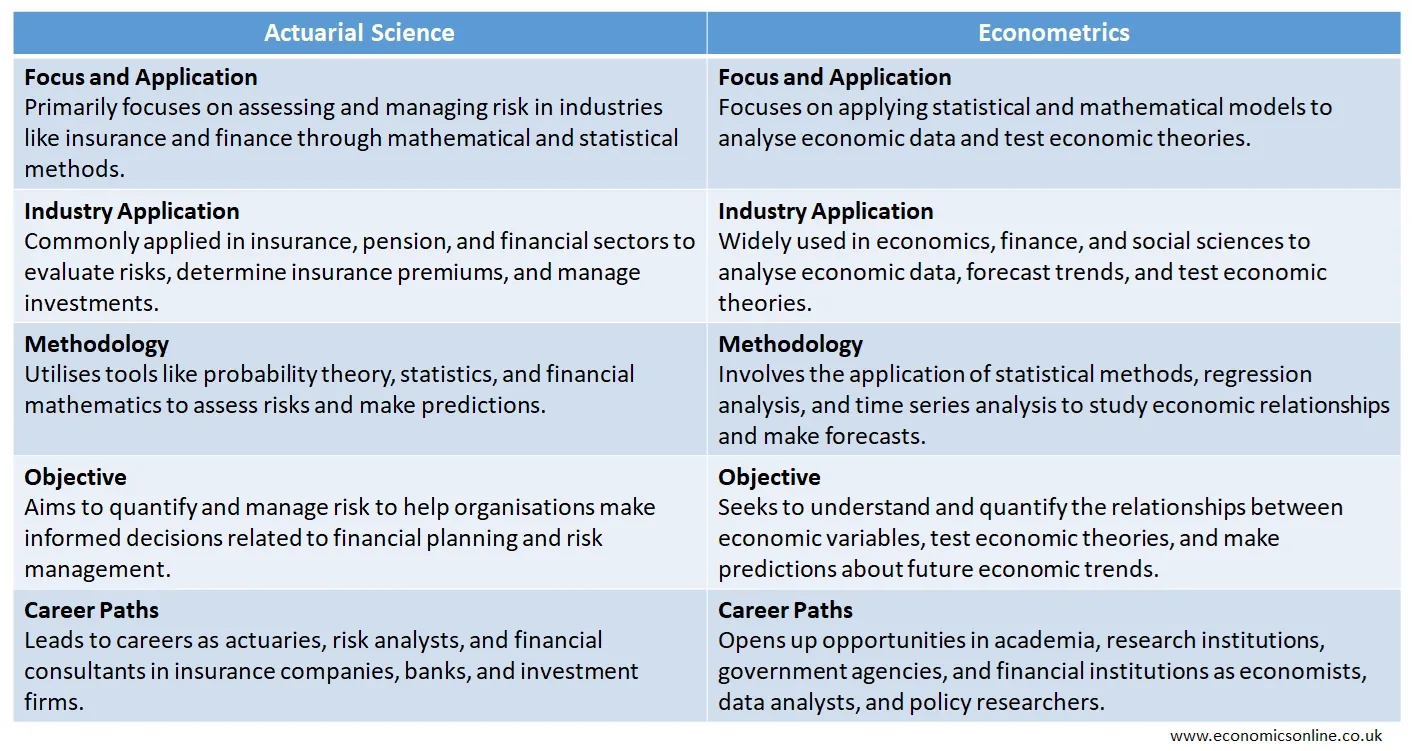

Differences between Actuarial Science and Econometrics

The following table contains the main points of difference between actuarial science and econometrics:

Applications of Actuarial Science

Actuarial science has two main applications, which are life insurance and pension plans. It is also applied in the study of financial organisations in order to analyse their liabilities and improve their financial decision-making. Actuaries use this science to evaluate the economic, financial, and other business applications of future events.

Life Insurance

In modern health insurance, actuaries include employer-provided plans and social insurance, along with analysing the following rates:

- The disability rate in the given population is the risk associated with a group of people who have a high probability of being disabled.

- The rate at which a disease occurs in a population.

- The mortality rate in a given population due to a certain disease.

- Fertility rate, which shows the number of children born.

Pensions

A benefit plan, which consists of contributions from employers which are set aside during the work life of employees and paid out at the time of their retirement, is called a pension plan. Pension plans can be affected by short-term and long-term bonds and investment strategies, and bonds are the debt instruments that are issued by governments that pay periodic interest payments to their holders. For example, a pension plan in a low-interest-rate situation is difficult to earn from a bond that a person is invested in. This situation increases the probability that this pension plan will run out of money in the near future.

In this industry, the actuaries identify and compare the costs of multiple strategies with respect to design, funding, and accounting, along with maintaining and redesigning pension plans.

Universities and Professional Certifications

Many universities and educational institutions are offering degrees and professional courses in actuarial science.

Universities

The Society of Actuaries (SOA) reports on and identifies colleges that meet one of the following levels of recognition:

UCAP-Introduction Curriculum

Universities that established course requirements for two professional actuarial exams along with other approved course requirements.

UCAP-Advanced Curriculum

Universities that established course requirements for four professional actuarial exams along with other approved course requirements.

Centre of Actuarial Excellence

Universities that require eight requirements in connection with a variety of matters. This refers to the highest tier of competency recognised by the SOA of a university.

Till December 2022, there were 25 Centres of Actuarial Excellence schools in the United States, Australia, Singapore, the UK, and China.

Professional Designations and Credentials

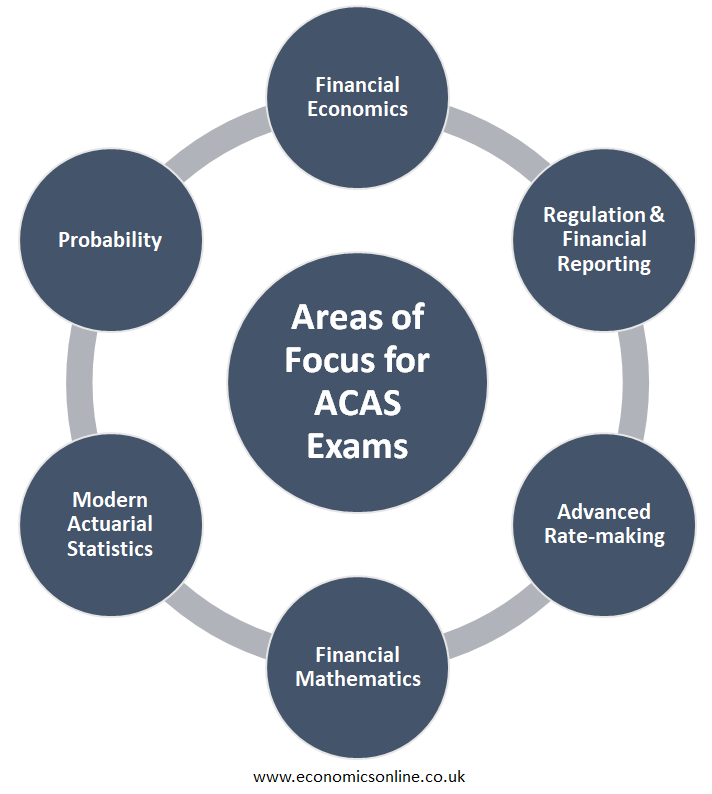

There are a large number of professional designations and credentials an actuary can have to further gain credibility in their field. The Casualty Actuarial Society offers multiple Associate (ACAS) and Fellow (FCAS) membership levels, each consisting of advanced requirements. The areas of focus for the ACAS exams are:

- Financial Economics

- Regulation and Financial Reporting

- Advanced Rate-making

- Financial Mathematics

- Modern Actuarial Statistics

- Probability

Multiple Actuarial Exams

The Society of Actuaries offers and promotes multiple actuarial exams in order to show competency in this field.

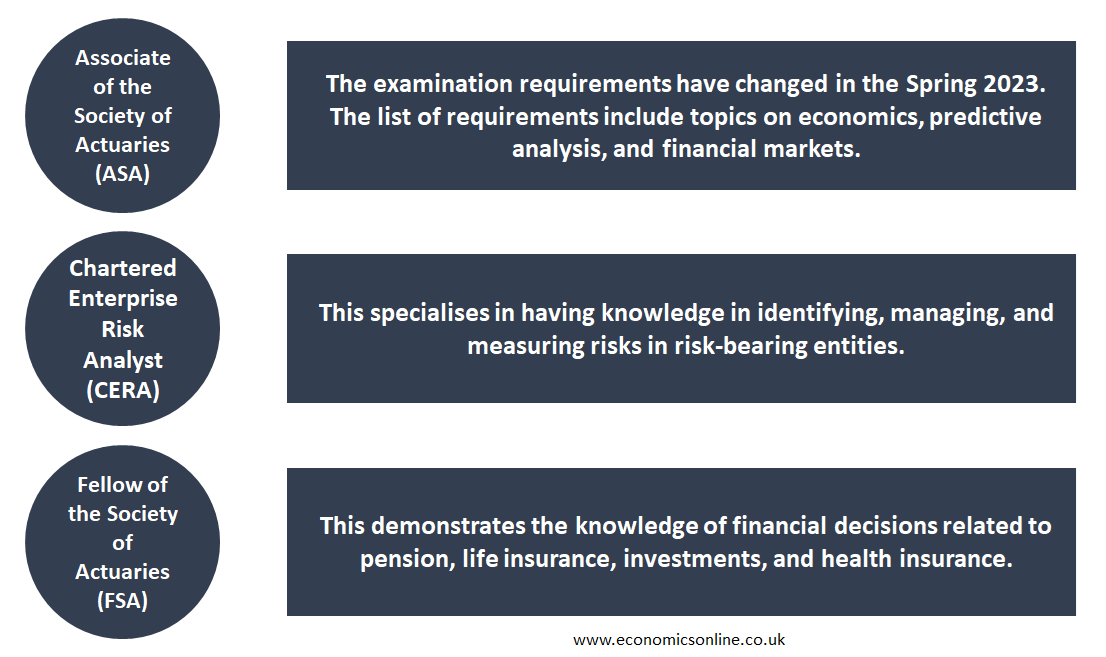

Associate of the Society of Actuaries (ASA)

This exam explains the fundamental concepts of modelling and managing risk. The exam requirements have changed in the spring of 2023. The list of requirements for examination includes topics on economics, predictive analysis, and financial markets.

Chartered Enterprise Risk Analyst (CERA)

This specialises in having knowledge of identifying, managing, and measuring risks in risk-bearing entities. The CERA requirements consist of professional courses that are similar to the ASA.

Fellow of the Society of Actuaries (FSA)

This demonstrates knowledge of financial decisions related to pensions, life insurance, investments, and health insurance. It also demonstrates in-depth knowledge of multiple techniques in different areas.

Conclusion

In conclusion, actuarial science is the study of mathematically predicting the probabilities of events happening in the future and giving that event a financial value. Different industries, such as insurance companies, pension funds, and other agencies, totally rely on actuaries to develop models that are used in identifying risks and making policies in order to reduce the risk of potential failure. On the other hand, economics is related to the study of human behaviour between limited resources and unlimited wants.