An image showing human brain.

Availability Bias

What is the Availability Bias?

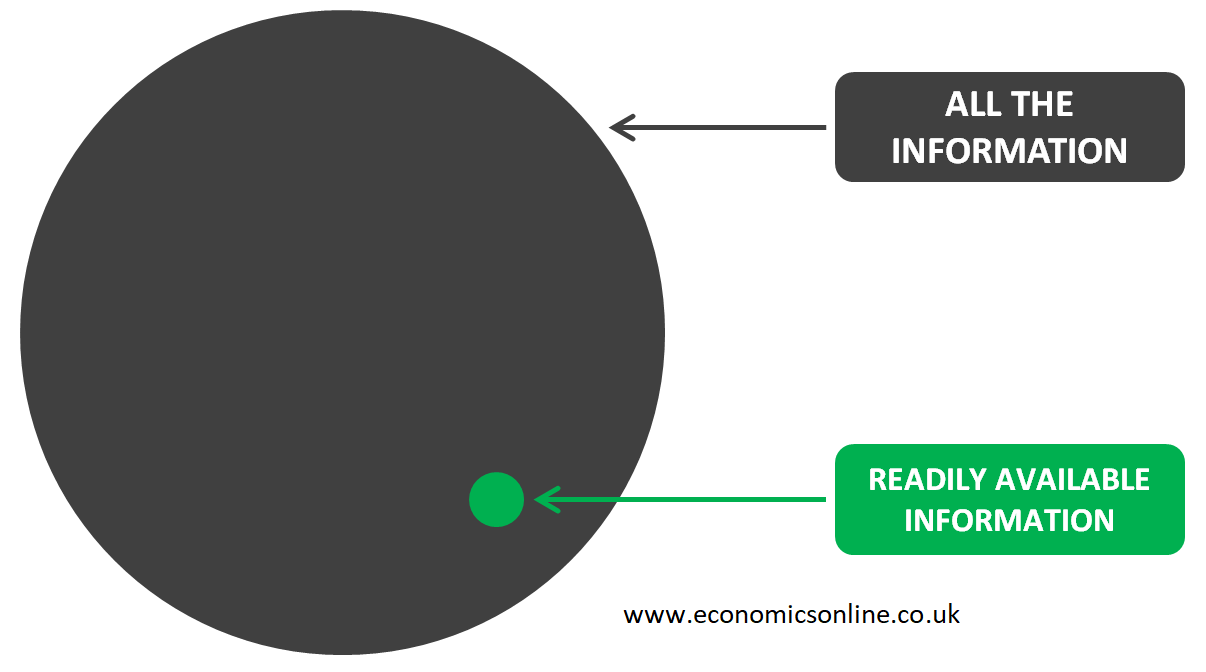

Availability bias, also known as the availability heuristic, refers to the tendency of human beings to use readily and easily available information for making judgements and decisions instead of using all the information. The availability bias can cause people to make suboptimal decisions because they use the pieces of information readily available to them instead of using complete information.

In other words, availability bias is a cognitive bias in which people tend to give more weight to the pieces of information that are readily available to them. It is a mental shortcut that people use when making judgements and decisions based on the pieces of information that come to mind quickly and easily, rather than using a more thorough analysis of all available information.

Understanding the Availibility Bias

Bias or biasness refers to the tendency or inclination of human beings towards a particular perspective or opinion. Bias occurs because of our perceptions, personal beliefs, experiences, media coverage, social and cultural influences, or even subconscious thoughts. Bias can lead to a distorted or incomplete understanding of a situation or issue and can affect decision-making, judgement, and behaviour negatively.

In availability bias, people tend to rely heavily on the pieces of information that come to their mind easily and quickly instead of getting complete information about the issue or decision at hand. This easily recalled information may be stored in their minds through information input from recent news, social media, or events that have recently happened. This information is mostly incomplete and does not depict the whole situation, yet people wrongly believe that the partial information they have easily recalled is complete and full, and hence their decisions and judgements are negatively affected.

Availability bias causes people to overestimate the importance of partial information based on the ease with which they can recall it. When people are asked to make decisions, they tend to rely on their immediate memory and ignore other relevant information that may not be very clear in their minds. For example, someone who has recently experienced a stock market crash may be less likely to invest in stocks in the future, even though they have historically been profitable investments over the long term.

The Origin of the Availability Bias

The concept of availability bias was first introduced in 1973 by Nobel Prize-winning psychologists Amos Tversky and Daniel Kahneman as part of their seminal work on cognitive biases. They found that people tend to rely more on information that is easily available in their minds rather than considering all available information when making decisions. Tversky and Kahneman's work on cognitive biases has had a profound impact on the fields of psychology, behavioural economics, and decision-making research.

Examples of the Availability Bias

Fear of Flying

Statistically, flying is one of the safest ways to travel, but after a plane crash, many people fear flying. This fear is often fueled by availability bias, as the vivid and dramatic images of a plane crash are more likely to be remembered by people than the many successful flights that take place every day. Moreover, people may prefer car travel over flying, even though car accidents occur more frequently than plane crashes.

Smoking

People may be influenced by the availability bias when assessing the risks of smoking. For example, if someone knows a smoker who has lived a long and healthy life, they may assume that smoking is not as harmful as it is often portrayed. This is because the image of the healthy smoker is readily available and easier to remember than the statistics about the health risks of smoking, which may not be as vivid or memorable for individuals. This leads to people smoking more, which is a wrong decision.

Shark Attacks

People can be subject to availability bias when assessing the risk of shark attacks. If there has been a recent high-profile shark attack reported in the news, people may be overestimating the risk of being attacked by a shark while swimming in the ocean. This is because the image of the shark attack is more readily and easily available to them than the statistical probability of a shark attack, which is actually very low. As a result, they may fear swimming in the ocean and avoid it altogether, even though the risk of shark attack is much lower than the risk of drowning.

Lottery Tickets

People may be victimised of the availability bias when buying lottery tickets. If someone has recently heard about lottery winners, they may be more likely to buy lottery tickets, even though the odds of winning are very low. This is because the recent news about the jackpot win is easily available and memorable to them, making winning the lottery more likely than it actually is. As a result, they may spend more money on lottery tickets than they can afford, which is a bad decision.

Impact of Availability Bias on Economic Decision-Making

Availability bias can have a significant impact on economic decision-making, leading to suboptimal choices and outcomes. Here are some examples of how availability bias can influence economic decisions:

Investment Decisions

Availability bias can lead investors to overestimate the likelihood of a particular investment outcome based on recent news or events. For example, if a company's stock has recently performed well, investors may infer that it will continue to do so in future, despite evidence from the past few years to the contrary.

Pricing Decisions

Availability bias can impact pricing decisions by making companies set prices based on the most readily available information, such as competitor pricing, rather than considering other more relevant factors, such as the income of consumers and production costs.

Promotion Decisions

Managers may be influenced by the availability bias when making promotion decisions. For example, if a particular employee has recently completed a high-profile project or received positive feedback from clients or customers, the manager may be more likely to promote that employee, even if other employees have more relevant experience or better performance records. This bias can lead to suboptimal decisions if the manager does not consider all relevant information about the employees being considered for promotion.

Avoiding the Availability Bias

Here are some ways to avoid the availability bias:

Increase Awareness

Simply knowing the possibility of availability bias can help individuals make more rational decisions. People can avoid making decisions based on partial information by taking the time to evaluate all available information rather than relying on the first thing that comes to mind.

Seek Different Perspectives

Seeking different perspectives and opinions can help people understand the situation more fully and make more informed decisions.

Use Data and Analytics

By relying on data and analytics, people can mitigate the impact of availability bias by using objective criteria to evaluate options and make decisions.

Conclusion

Availability bias can have a significant negative impact on economic decision-making, leading to poor choices and outcomes. By increasing awareness, seeking out different perspectives, and using data and analytics, people and firms can mitigate the impact of availability bias and make better decisions.1.