An image showing coins of gold and silver to illustrate bimetallism.

Bimetallism Explained

What is Bimetallism?

Bimetallism is a monetary system where coins made of two metals, typically gold and silver, are used as money. Both gold and silver coins are considered unlimited legal tender, and their values are fixed by the government in relation to each other. Coins of both metals have unrestricted circulation simultaneously. There is free and unlimited coinage of both metals, and there are no restrictions on the imports and exports of these metals.

Under the bimetallic standard, the value of money is determined by the fixed ratio between the two metals. This ratio is called the mint ratio, legal ratio or the gold/silver ratio and is determined by the government.

The international monetary system before the 1870s can be considered bimetallic because both gold and silver were used as international means of payment, and the exchange rate among the currencies was determined by either their gold or silver contents.

History of Bimetallism

The history of bimetallism can be traced back to ancient civilizations such as Rome, where gold and silver coins were concurrently used as legal tender.

From the 17th to the 19th centuries, many countries adopted a bimetallic standard, where gold and silver coins circulated side by side without a fixed ratio.

Several countries in Western Europe and the USA were using bimetallism during the 19th century. The United States adopted bimetallism under the Coinage Act of 1792, which fixed the ratio between gold and silver at 15:1. France adopted bimetallism in 1803 at a fixed ratio of 15.5:1. The Latin Monetary Union was created in 1865 by France, Belgium, Italy, and Switzerland with the aim of implementing the bimetallic system on a global scale.

The challenges and imbalances associated with pure bimetallism led to its gradual abandonment in the late nineteenth century and early twentieth century.

By the mid-20th century, most nations had moved away from bimetallism altogether and adopted fiat money systems detached from specific metal backing. Today, bimetallism is of historical interest only.

Bimetallism vs. Monometallism

Bimetallism means the use of two metals, such as gold and silver, as legal tender at fixed exchange rates. In contrast, monometallism means the use of a single metal, typically gold or silver, as legal tender. While monometallic standards offer simplicity and uniformity, bimetallism offers stability and flexibility.

Bimetallism vs. Gold Standard

During the late 19th century, Bimetallism was challenged by the gold standard. The gold standard gradually became the dominant monetary system due to concerns about the stability and convertibility of silver.

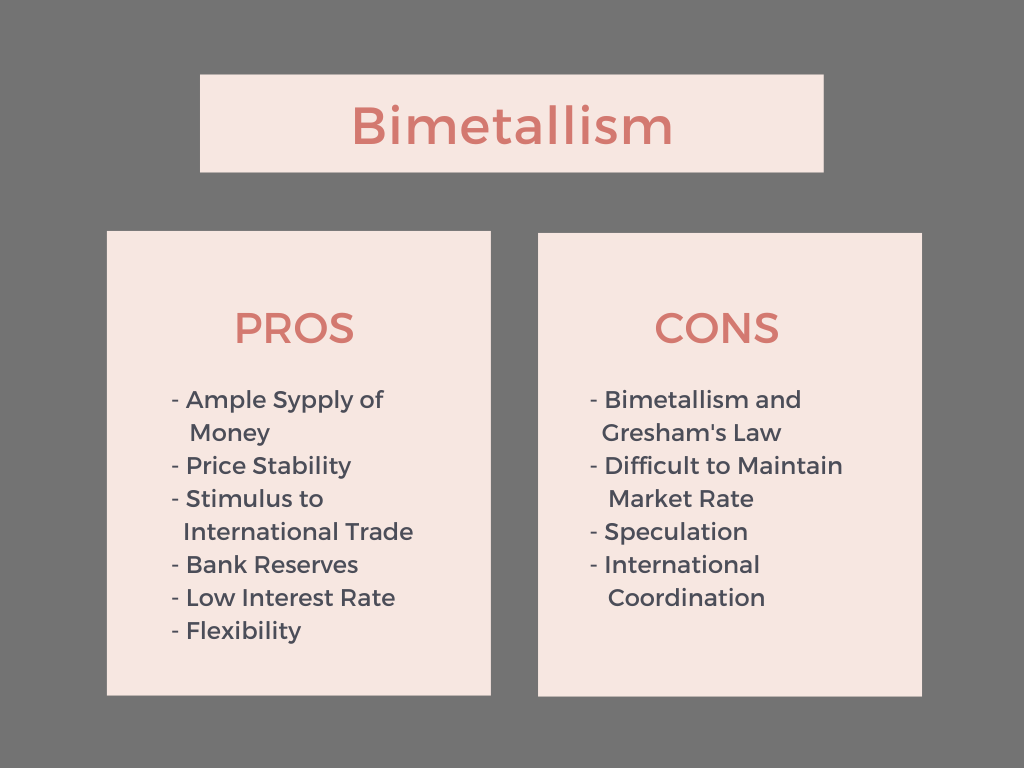

Advantages and Disadvantages of Bimetallism

Advantages of Bimetallism

Ample Supply of Money

In bimetallism, two metals were used to mint money. Hence, an ample supply of money can be made available to the general public, as compared to just using one metal. For example, in the case of a shortage of gold, silver can be used to maintain the overall supply of money.

Price Stability

Bimetallism ensures the stability of internal prices in a country. This is due to the fact that the shortage of one metal can be offset by the supply of the second metal. This reduces the risk of inflation or deflation.

Stimulus to International Trade

Bimetallism can promote international trade. A country using bimetallism can trade with any country using the gold standard, silver standard, or bimetallic standard. Under bimetallism, a country can fix its exchange rate in two metals. This can promote international trade by establishing trade relationships with many countries.

Bank Reserves

Under bimetallism, banks can hold reserves in coins made of two metals. This will make the keeping of bank reserves easy and economical, as the mintage of the coins can be done in accordance with the relative availability and market demand of each metal.

Low Interest Rate

Under bimetallism, the total money supply is higher because coins are made of two metals. This will keep the interest rate low. Firms can get loans at low interest rates, which can promote investment in a country.

Flexibility

In bimetallism, the use of two metals allows for more flexibility in adjusting the money supply, which can be beneficial in times of economic instability.

Disadvantages of Bimetallism

Bimetallism and Gresham’s Law

This law states that bad money drives out good money. Let’s assume that the mint ratio between gold and silver is 1:15. This means that 1 ounce of gold is worth 15 ounces of silver. Now, if the market rate (market ratio) is different, say, 1:16, this makes the gold undervalued (good money) and the silver overvalued (bad money). In this case, people would prefer to use silver coins for everyday transactions and hoard or export gold coins because of their higher face value (intrinsic value) than the market value. This leads to the disappearance of the undervalued metal (good money) from circulation, leaving only the overvalued metal as the dominant currency (value of silver was high). Hence, bad money (silver coins) drives out "good money" (gold coins) from circulation.

This means bimetallism is converted into monometallism. Due to the operations of Gresham’s law, bimetallism is considered a short term monetary system that cannot sustain itself in the long term unless the exchange rate between metals is kept fixed.

Difficult to Maintain Market Rate

Bimetallism can work successfully only if there is equality between the market rate and the mint ratio. In practise, it is difficult, if not impossible, to maintain equality between the two rates due to changes in the supply of both metals.

Speculation

Bimetallism can encourage speculation if the market rate continuously deviates from the mint ratio.

International Coordination

Maintaining a consistent conversion ratio across different countries requires international cooperation, which can be challenging to achieve. Countries with different economic circumstances and metal reserves had their own interests, making it difficult to sustain a universally agreed-upon fixed ratio. Deviations from the mint ratio eroded confidence in bimetallism as a viable system.

Significance of Bimetallism

While bimetallism is no longer actively practised, its principles and historical context remain relevant for economic analysis. The study of bimetallism helps economists understand the complexities of monetary systems and their impact on economies.

Why did Bimetallism Fail?

Bimetallism failed due to its challenges, including the operation of Gresham’s law, speculation, difficulties in maintaining the market rate equal to the mint ratio, and the lack of international cooperation in applying the fixed mint ratio in various countries. The economist Milton Friedman held the belief that ending bimetallism had led to instability in the financial markets.

Alternative to Bimetallism

In the modern era, economies have transitioned to fiat currency (paper money), where the value of money is not directly linked to a metal or commodity. This shift has allowed greater flexibility for central banks to manage monetary policy.

Conclusion

Bimetallism is a monetary system based on the use of two metals as the basis of a country's currency. Governments used to fix the mint ratio between two metals. The goal of bimetallism was to provide stability and flexibility in the monetary system along with an increase in international trade. Bimetallism faced a downfall after World War I, and countries moved away from this system in the early 20th century. While no longer in practise, bimetallism's legacy serves as a valuable source of knowledge for understanding the evolution of monetary systems.