Photo by Abhinav Bhardwaj / Unsplash

Consumption Function

Introduction

A function is a relationship between two or more variables. In the Keynesian theory of income and employment determination (Keynesian economics), different functions are included, such as consumption function, saving function, tax function, imports function, net exports function, and aggregate expenditure function. In this article, we will explain the theory of the consumption function.

What is Consumption Function?

A direct or positive relationship between consumption and household disposable income is called consumption function. It is also called Keynesian consumption function.

Consumption function explains how disposable income of consumers affects their consumption.

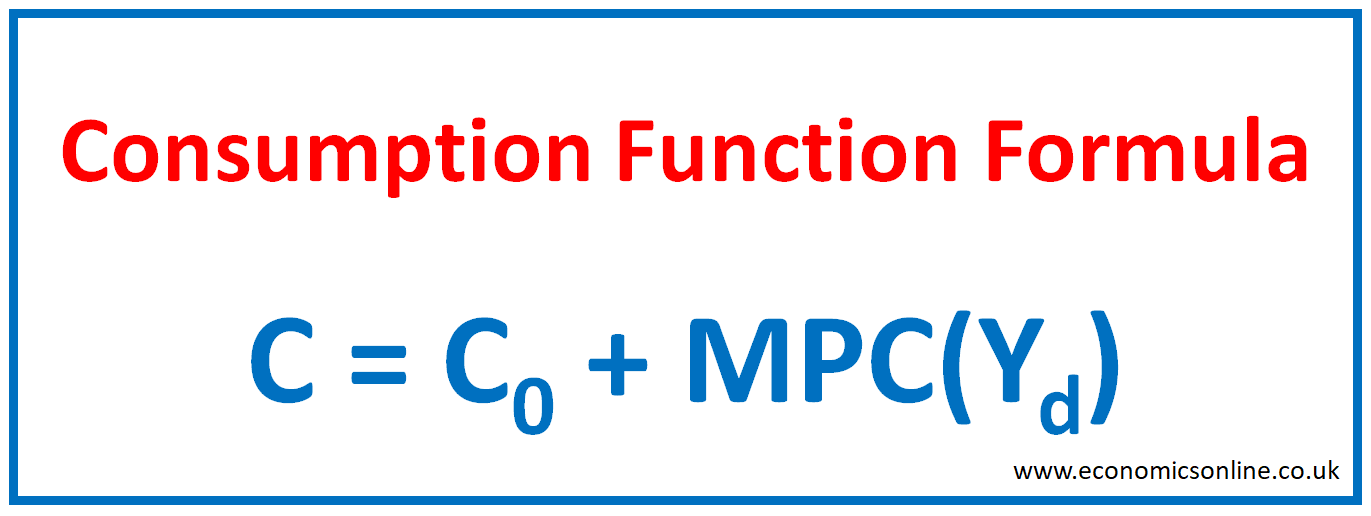

Consumption Function Formula

Mathematically, consumption function is represented in the form of a formula, which is given below.

Here,

C0 = Autonomous Consumption

MPC = Marginal Propensity to Consume

Yd = Personal Disposable Income

Yd = Household Income – Direct Tax + Transfer Payments

Like any function, consumption function is also a relationship between two variables: household disposable income and consumption. Household disposable income is the independent variable, while consumption is the dependent variable.

When we say that consumption is a function of income, we mean to say that consumption depends upon income. Even though, there are many factors affecting consumption, income is the most important. Since consumption function is a positive or direct relationship between consumption and income, an increase in income will increase consumption, while a decrease in income will decrease consumption.

Assumptions of Consumption Function

The following are some assumptions of consumption function:

Ceteris Paribus

This is the major assumption of consumption function. It means that all the factors affecting consumption (except income) remain constant. These factors are interest rates, wealth, prices of goods or services, population size and expectations about future income. According to the ceteris paribus assumption, all the factors affecting consumption are neglected or assumed constant, and only income and consumption are directly studied by economists.

Rational Consumer Behaviour

The economist assumes that consumers follow rational behaviour in the purchase of goods or services according to the information available in their surroundings. This rationality assumption makes the behaviour of consumers predictable.

Constant Marginal Propensity to Consume (MPC)

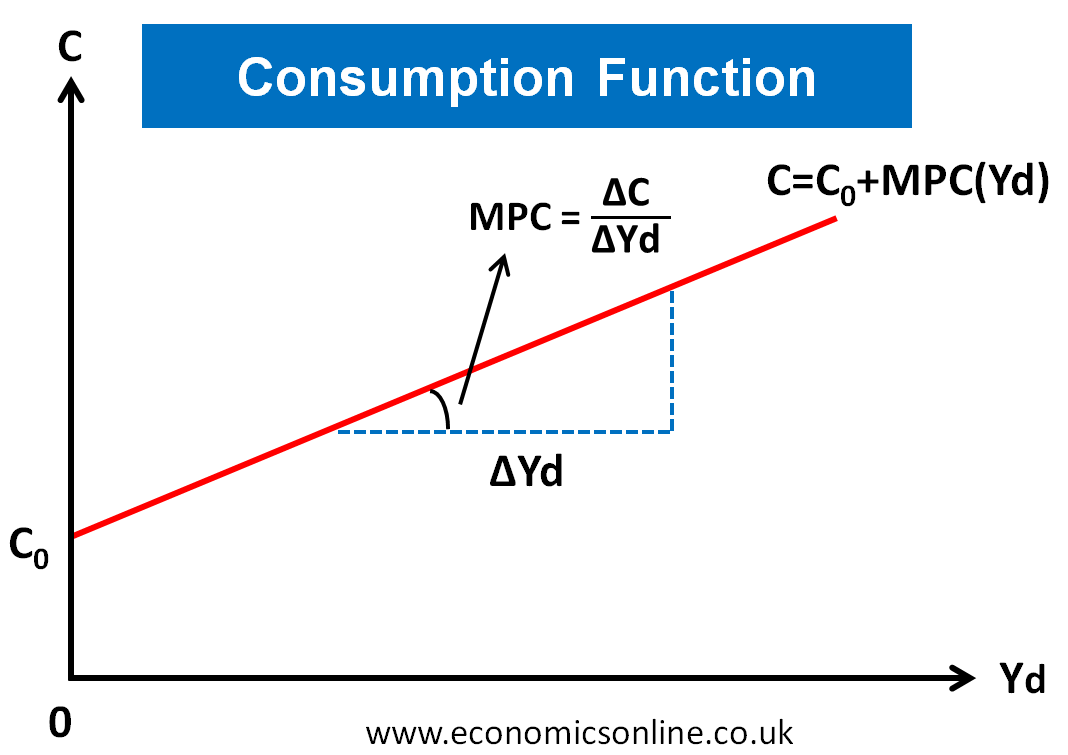

It is also assumed that the marginal propensity to consume remains constant for a specified period of time. Due to constant MPC, the graph of consumption function is a straight line.

Consumption (C)

The portion of household disposable income which households spend on buying goods and services to satisfy their needs and wants is called consumption. e.g. spending on food, clothing, education. Consumption is also called consumer expenditure. It is the demand of household sector and is a component of aggregate demand.

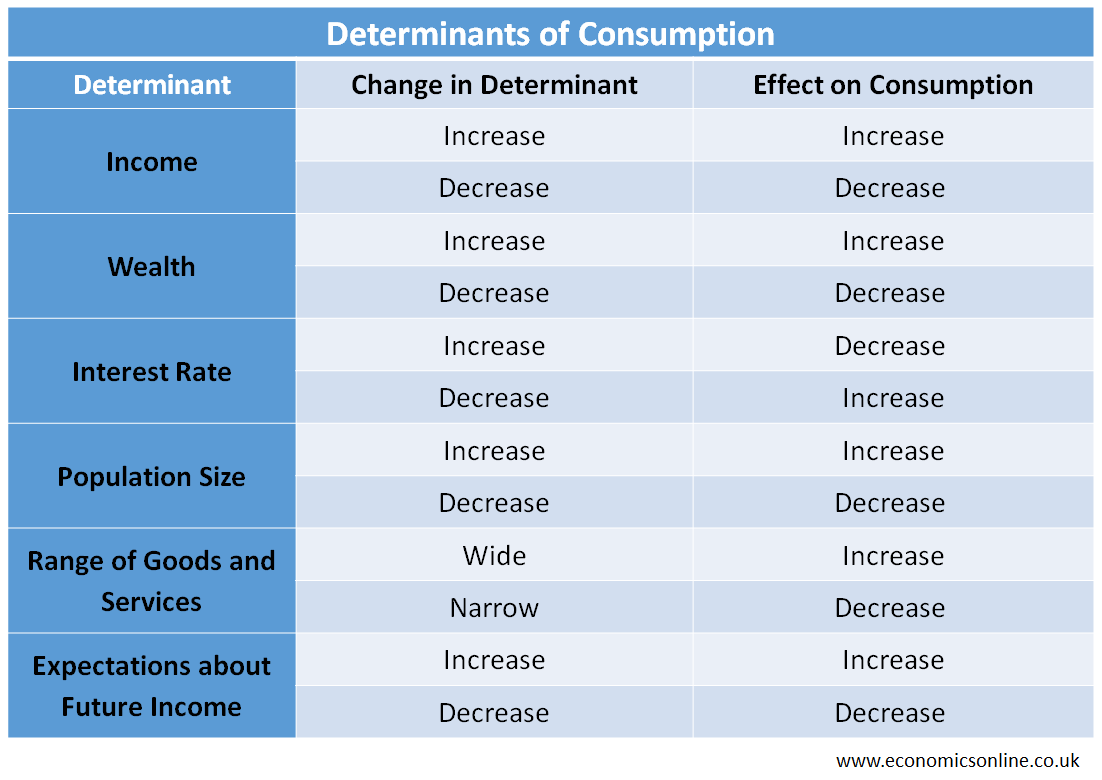

Consumption is affected by many factors called determinants of consumption. Some factors are given in the following table.

In consumption function, we assume that income is variable, while all the other determinants of consumption remain constant.

Disposable Income (Yd)

The income after subtracting income tax and adding transfer payments is called disposable income.

Disposable Income = Income – Direct Tax + Transfer Payments

Components of Consumption Function

The consumption function has two components, that is, autonomous consumption and induced consumption. These components are explain below along with their graphs.

Autonomous Consumption (C0)

The portion of household consumption which remains fixed and does not change with the change in disposable income is called autonomous consumption and is denoted by C0. It has the following features.

- It is the portion of total consumption.

- It is the amount of money spent when income is zero.

- It is the spending of households on basic necessities for survival.

- It case of zero income, this fixed consumption is financed by previous savings or borrowing.

- It does not change with increase or decrease in income.

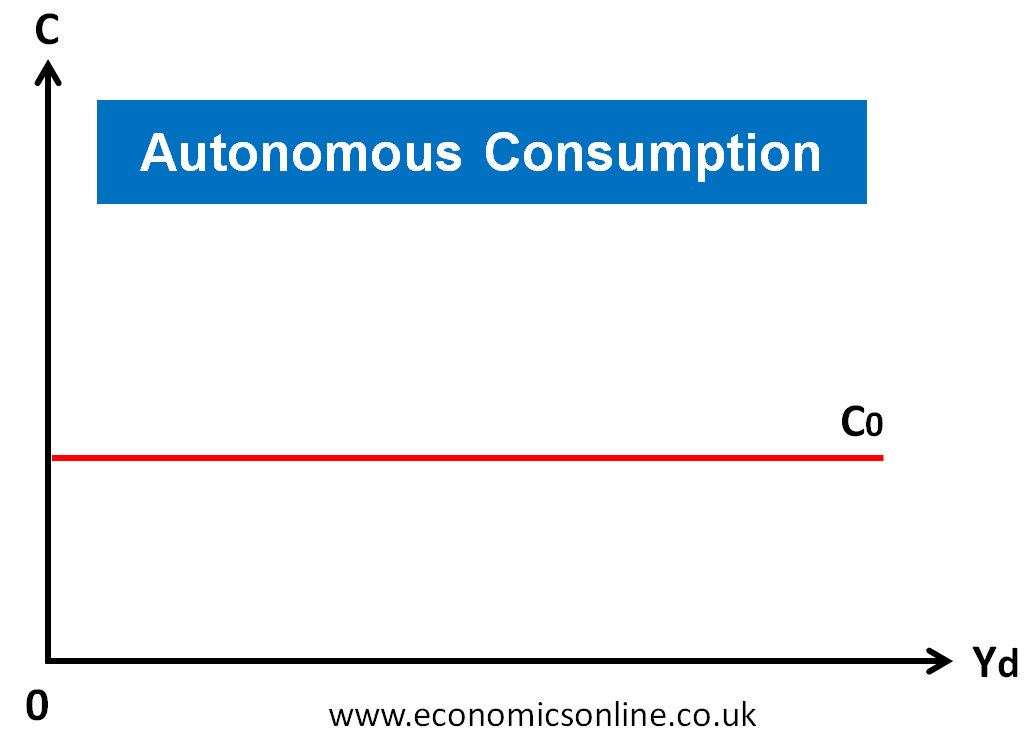

The graph of autonomous consumption is given below.

The above graph is a horizontal line parallel to x-axis (horizontal axis) because autonomous consumption is fixed and it does not change with the change in disposable income.

Induced Consumption (MPC*Yd)

The portion of household consumption which varies directly with the change in disposable income is called induced consumption and is denoted by MPC (Yd). It has the following features.

- It is the portion of total consumption.

- It varies directly with change in disposable income.

- It increases with an increase in income and vice versa.

- It case of zero disposable income, induced consumption will be zero.

- MPC is the slope or gradient of induced consumption.

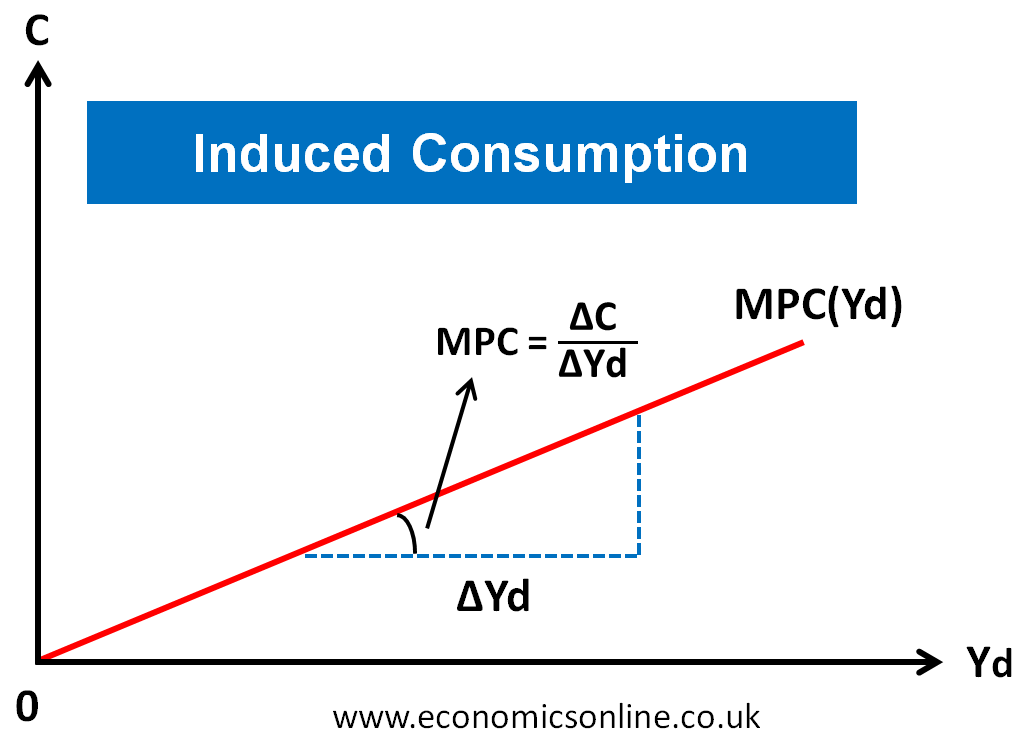

The graph of induced consumption is given below.

The above graph is starting from zero and is upward sloping because induced consumption varies directly with the change in disposable income.

Graph of Consumption Function

Total consumption is the sum of autonomous consumption and induced consumption.

Total Consumption = Autonomous Consumption + Induced Consumption

C = C0 + MPC (Yd)

The graph of consumption function is given below. The horizontal axis (x-axis) is labeled with disposable income while the vertical axis (y-axis) is labeled with consumption.

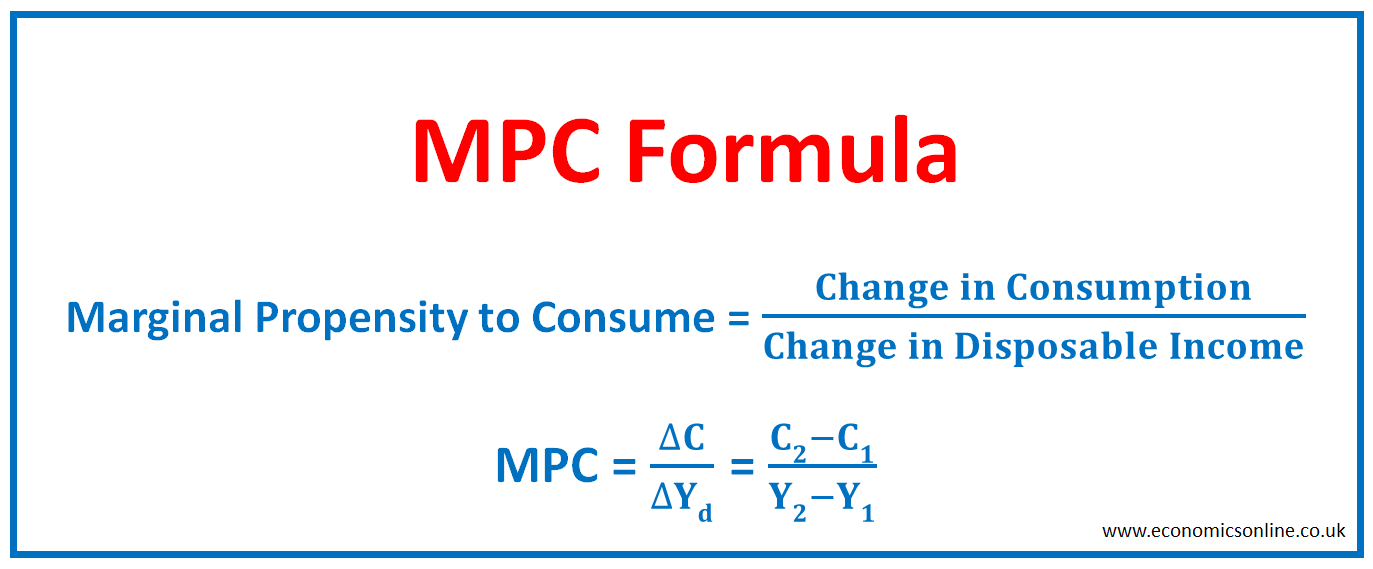

Marginal Propensity to Consume (MPC)

Additional consumption because of an additional dollar of income is called marginal propensity to consume (MPC). It is the slope of the consumption function. MPC formula is given below.

MPC = Change in consumption / Change in Income

Example

Suppose that household disposable income is increased from $500 to $600 and the consumption is increased from $430 to $490. Here, the change in income is $100, while the change in consumption is $60. MPC will be calculated as follows:

MPC = Change in consumption / Change in Income = %60 / $100 = 0.6

The interpretation of this 0.6 is that out of every extra income of $1, $0.60 is consumed.

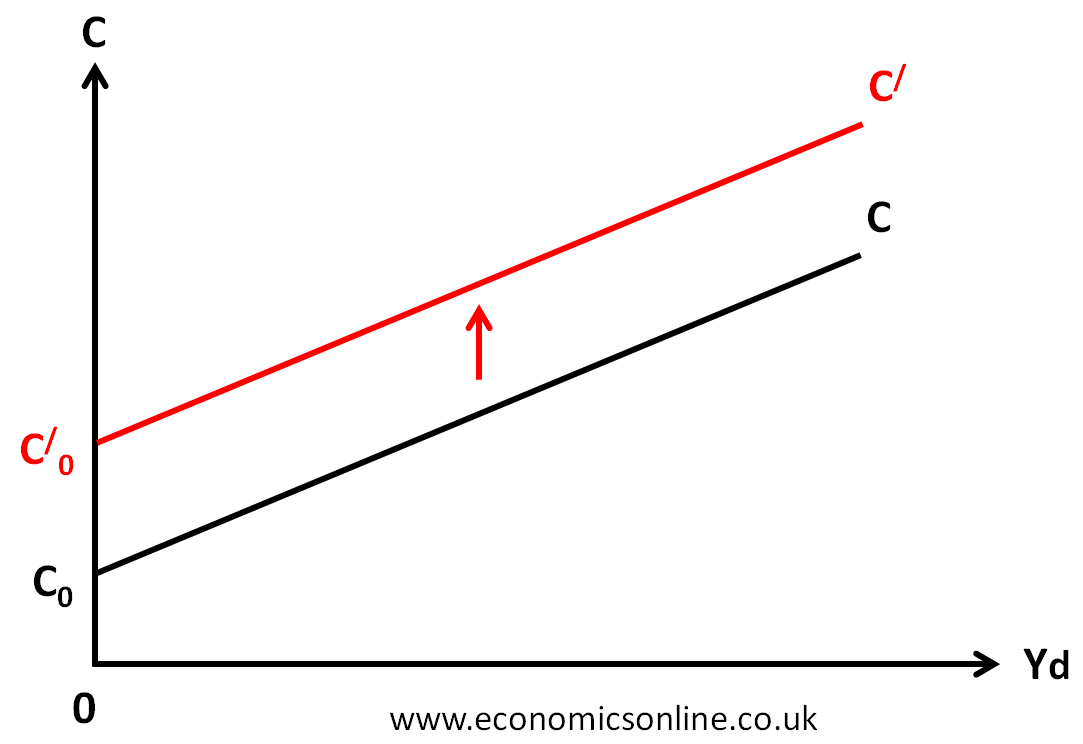

Shifts in Consumption Function

The shifts in consumption function can be due to the following reasons.

Due to Change in Autonomous Consumption

There will be a parallel upward or downward shift in consumption function due to an increase or decrease in autonomous consumption. An upward shift in consumption function is shown below.

An increase in autonomous consumption means that households have to spend more money on their basic needs. It may be because of an increase in the general price level (inflation) of goods and services.

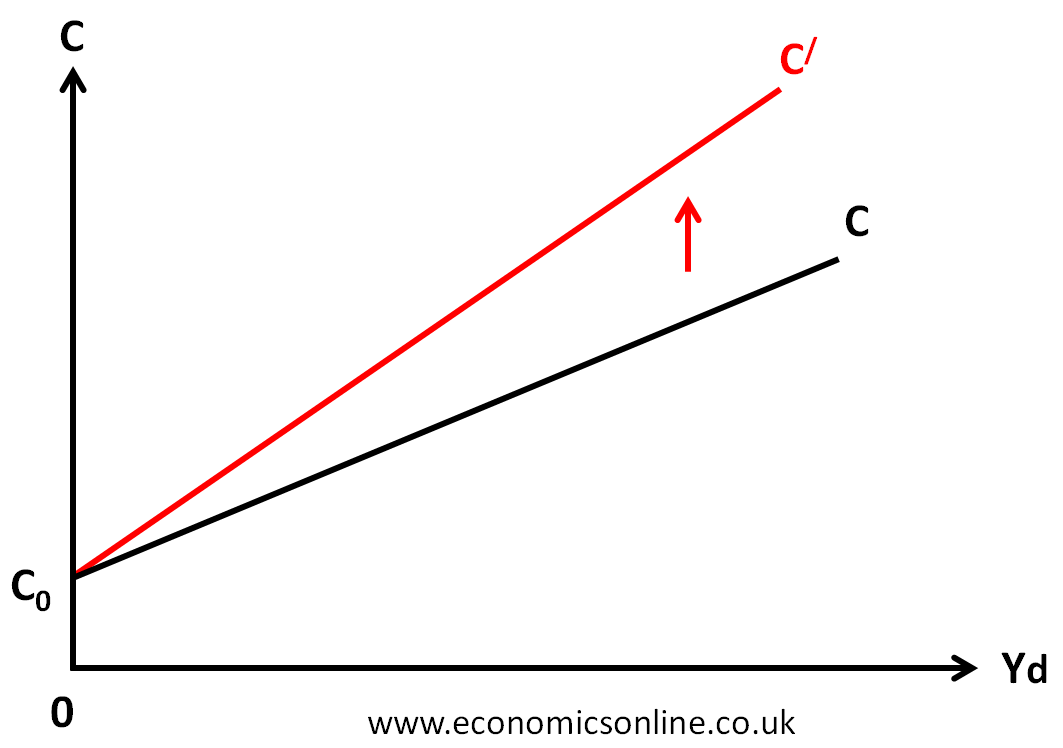

Due to Change in MPC

There will be a pivotal upward or downward shift in consumption function due to an increase or decrease in marginal propensity to consume (MPC). An upward shift in consumption function due to an increase in MPC is shown below.

An increase in MPC means that households are spending a higher percentage of their additional income on buying goods and services. It may be because of an increase in their wealth, confidence, or an increase in the general price level (inflation) of goods and services.

Uses of the Consumption Function

The following are some uses of the consumption function:

Predicting Consumer Spending

The concept of consumption function is used to predict consumer spending behavior with respect to their income. With the help of the consumption function, we can analyse consumer spending and predict the overall situation of economic activities in a country. For example, we can predict the consumption changes due to income changes.

Deriving Savings Function

Another use of this concept is that it helps in deriving the graph of the savings function. The graph of consumption function is used ailing with Keynesian 45-degree line to derive the graph of the savings function.

Informing Fiscal Policy

This concept is also used by the government to make informed fiscal policies. These fiscal policies clearly state the new tax changes and government spending on infrastructure. Any tax change will affect disposable income and hence consumption will also be affected. The policymakers keep the consumption function and the value of MPC in mind while designing fiscal policy.

Studying National Income Equilibrium

Consumption is a component of aggregate expenditure. In income-expenditure approach of studying national income equilibrium, any change in consumption will affect the aggregate expenditure and hence the national income equilibrium. In this way, the consumption function plays an important role in the study of national income equilibrium.

Calculating the Multiplier

The multiplier is an important figure and the value of marginal propensity to consume is used to calculate the multiplier. The strength of the multiplier depends on the value of marginal propensity to consume.

Limitations of Consumption Function

The following are some limitations of the consumption function:

Simplified Assumption

A major limitation of the consumption function is that it has simplified assumptions. These assumptions do not fully cover the concepts of income and consumption and their impact on the overall economy of a country.

Ceteris Paribus Assumption

The basic assumption of consumption function is ceteris paribus which means that all the factors affecting consumption (except income) remain constant. In real life, this is not true. Consumption is affecting by many variables and this makes the consumption function less useful.

Constant Marginal Propensity to Consume (MPC)

It is also assumed that the marginal propensity to consume remains constant for a specified period of time. However, this is not true. MPC changes with the change in income. For example, MPC of the poor may be low, while MPC of the rich may be high. So the real graph of the consumption function will not be a straight line.

Ignoring Psychological Factors

In consumption function, we assume that the consumers are rational. In real life, different psychological factors affect consumer spending. Consumers may behave irrationally, and their consumption may be affected by their psychological conditions, which this concept ignores.

Lack of Consideration for Heterogeneity

A major limitation of this concept is that it treats all individuals in such a homogeneous manner that all consumers’ spending behavior is the same. But there is heterogeneity in the country. Every individual’s income, spending patterns, and consumption behavior are different from those of other individuals living in the same society or even in the same house.

Other Theories of Consumption

The following are some other theories of consumption:

Life-cycle Hypothesis

This theory was proposed by Richard Brumberg and Franco Modigliani in 1950s. According to this hypothesis, consumers plan their day-to-day consumption and spending according to their income levels. Individuals plan their consumption according to their ages and income levels. The income of individuals varies from time to time, which is why they change their patterns accordingly. At early stages of age or income, individuals prefer spending rather than saving. At the age of maturity, individuals save for their future instead of spending. Individuals plan their consumption according to their life cycle. That is why this is known as the life-cycle hypothesis.

Permanent Income Hypothesis

This theory was proposed by Milton Friedman in 1957. According to this hypothesis, consumers plan their consumption according to their long-term average income. Consumers are relaxed when they know they have had a permanent income for a long period of time. In this hypothesis, consumers make decisions about their consumption on the basis of long-term income. This is known as the permanent income hypothesis.

Conclusion

In conclusion, consumption function is a concept used in macroeconomics to understand the relationship between income and the consumption behavior of individuals or consumers in a country. This concept is also useful for the government to estimate consumer spending so that they can impose taxes or increase the prices of products or services accordingly. But this concept does not fully cover all the factors affecting consumption like wealth, prices, interest rate, expectations about future income, etc.