An image of the tax calculator.

Discretionary Fiscal Policy

Introduction

Fiscal policy refers to the policy of the government to use tax rates and government spending to manage aggregate demand in an economy to achieve macroeconomic objectives. It can be a discretionary fiscal policy or a non-discretionary fiscal policy. In this article, we will explain discretionary fiscal policy in detail along with a brief discussion of non-discretionary fiscal policy.

What is Discretionary Fiscal Policy?

Discretionary fiscal policy refers to the policy of the government to deliberately change the tax rates and government spending to manage aggregate demand and achieve macroeconomic objectives.

It is a demand-side policy because it affects the economy through changes in aggregate demand due to changes in the government's budget.

Purpose of Discretionary Fiscal Policy

This policy is used for the following purposes:

Promoting Economic Growth

The main purpose of using this policy is to promote economic growth by increasing aggregate demand. This can be done to get an economy out of recession or to increase the growth rate of an economy by stimulating consumption, investment, and net exports, which are the main components of aggregate demand.

Reducing Unemployment

The second purpose of this policy is to reduce unemployment in an economy by encouraging businesses to invest and expand to create more jobs.

Controlling Inflation

The third purpose of this policy is to control inflation through the management of aggregate demand.

Tools for Discretionary Fiscal Policy

The following tools are used by the government in discretionary fiscal policy:

Tax Rates

Tax is the revenue the government receives from individuals and firms. In a discretionary fiscal policy, the government implements tax changes in an economy based on the economic situation and the objectives to be achieved. The increase or decrease in tax rates can influence aggregate demand, which helps the government achieve its macroeconomic objectives.

Government Spending

Government spending is the spending of the government on public projects and on providing some goods and services. It is an important component of aggregate demand. Any change in government spending through fiscal stimulus directly affects aggregate demand and helps the government achieve its macroeconomic objectives.

Types of Discretionary Fiscal Policy

The two main types of discretionary fiscal policy are expansionary fiscal policy and contractionary fiscal policy.

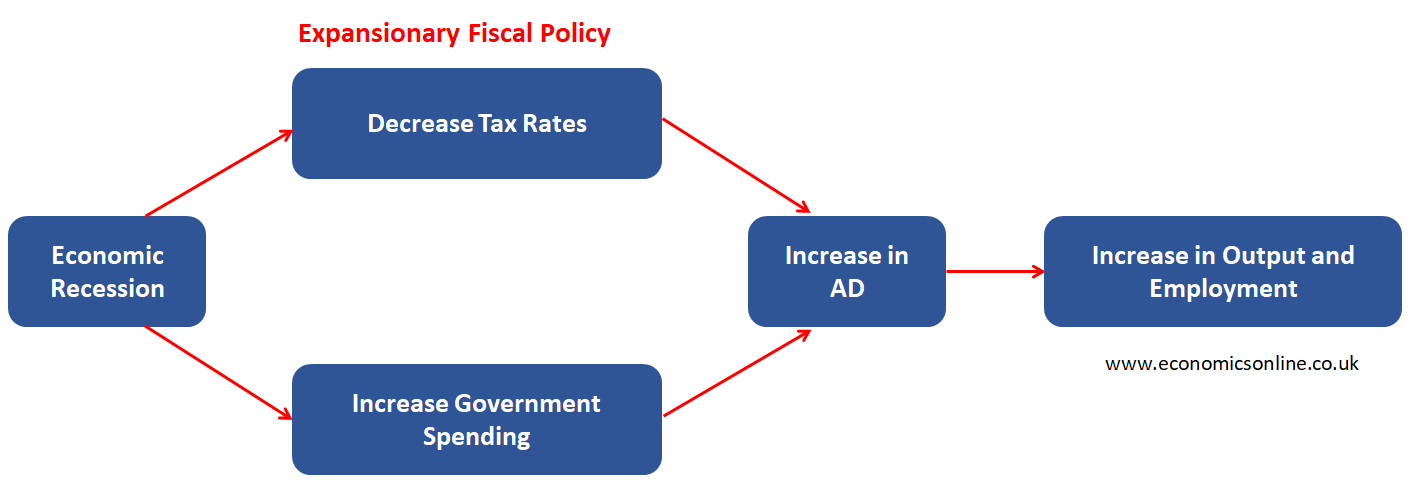

Expansionary Fiscal Policy

In an expansionary fiscal policy, the government decreases tax rates and increases government spending to stimulate economic growth and employment.

This policy is normally used to get out of recession through a budget surplus.

Working of Expansionary Fiscal Policy

During an economic downturn, the government decreases tax rates and increases government spending, leading to an increase in aggregate demand through a budget deficit.

Aggregate Demand (AD) = Consumption (C) + Investment (I) + Government Spending (G) + Net Exports (NX)

The main components of aggregate demand will increase in the following ways:

Consumption (C) will increase because people have to pay less tax due to tax cuts. For instance, a reduced income tax means a higher disposable income, which leads to higher spending by people on goods and services leading to increased consumption. This will increase aggregate demand.

When firms have to pay lower taxes, they are likely to increase their investment (I) in buying capital goods leading to an increase in aggregate demand.

An increase in government spending (G) will also increase aggregate demand.

The increased aggregate demand will boost output and employment and the economy will get out of recession.

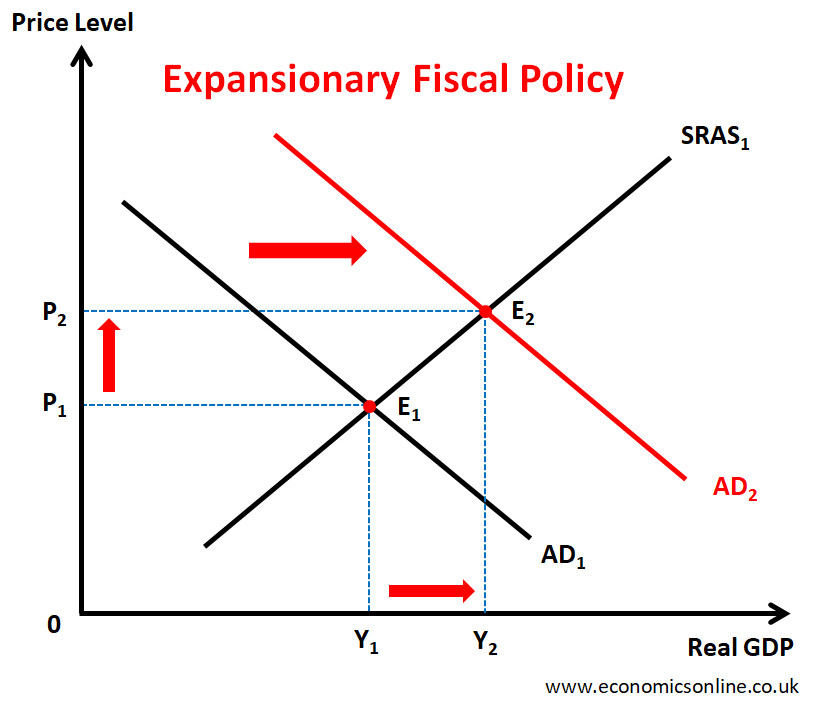

Graph of Expansionary Fiscal Policy

The following graph illustrates the effect of an expansionary fiscal policy.

In the above graph, the Real GDP is taken on the horizontal axis (x-axis) while the price level is taken on the vertical axis (y-axis). The initial equilibrium is at E1 which is the point of intersection of the aggregate demand curve AD1 and short-run aggregate supply curve SRAS1. The initial price level is P1 and the initial output level is Y1. When tax rates are decreased and government spending is increased, the aggregate demand curve is shifted towards the right from AD1 to AD2. The new equilibrium point is E1. The real GDP is increased from Y1 to Y2 showing economic growth and a fall in unemployment. The general price level is increased from P1 to P2 showing a resulting inflation which is a side-effect of an expansionary fiscal policy.

The Effects of Expansionary Fiscal Policy on Macroeconomic Objectives

The above graph illustrates the impact of expansionary fiscal policy on the following macroeconomic objectives of government.

Effect on Economic Growth

Economic growth in a country will increase as a result of using an expansionary fiscal policy, maybe through a stimulus package. In the above graph, the real GDP is increased from Y1 to Y2 indicating economic growth.

Effect on Unemployment

Unemployment in a country will decrease as a result of using an expansionary fiscal policy. In the above graph, the increase in real GDP from Y1 to Y2 indicates a fall in unemployment.

Effect on Inflation

The inflation rate will increase as a result of using an expansionary fiscal policy. In the above graph, the increase in price level from P1 to P2 indicates inflation. This is a negative effect of using an expansionary fiscal policy. The government should keep an eye on inflation and try to adjust its policies to maintain price stability.

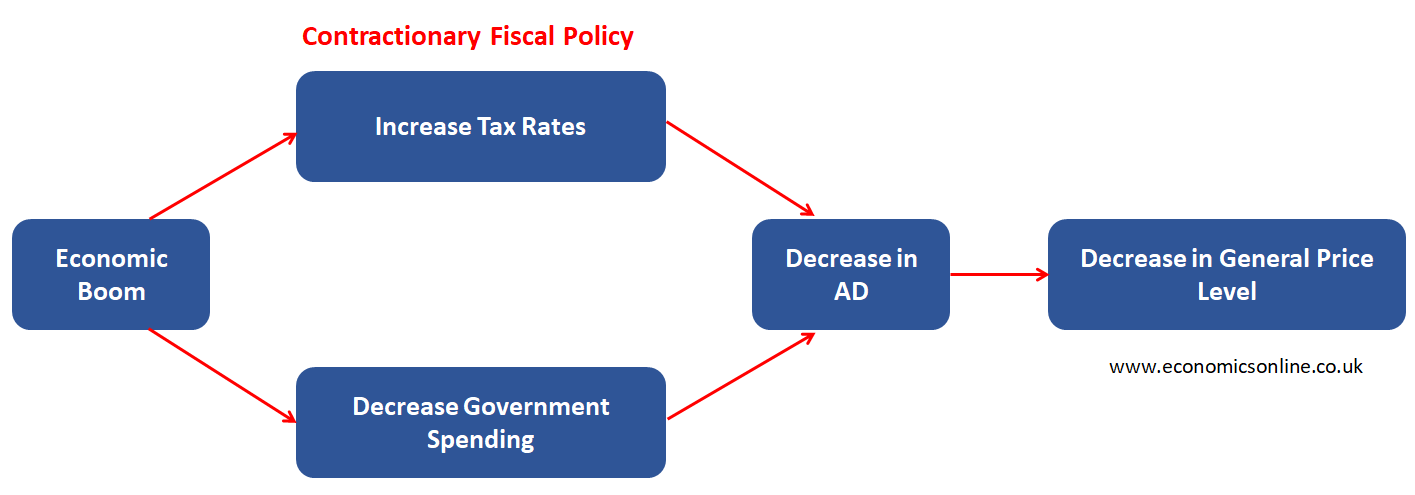

Contractionary Fiscal Policy

In a contractionary fiscal policy, the government increases tax rates and decreases government spending to control inflation.

This contractionary policy is normally used when there is a high rate of inflation which needs to be controlled in an overheating economy.

Working of Contractionary Fiscal Policy

During a period of high inflation like an economic boom, the government increases tax rates and decreases government spending leading to a fall in aggregate demand through a budget deficit. The main components of aggregate demand will decrease in the following ways.

Consumption (C) will decrease because people have to pay more taxes due to tax increases. For instance, a higher income tax means a lower disposable income which leads to lower spending by people on goods and services leading to decreased consumption. This will decrease aggregate demand.

When firms have to pay more taxes, they are likely to decrease their investment (I) in buying capital goods leading to a decrease in aggregate demand.

A decrease in government spending (G) will also decrease aggregate demand.

The decreased aggregate demand will decrease output, employment and price level and the overheating economy will slow down.

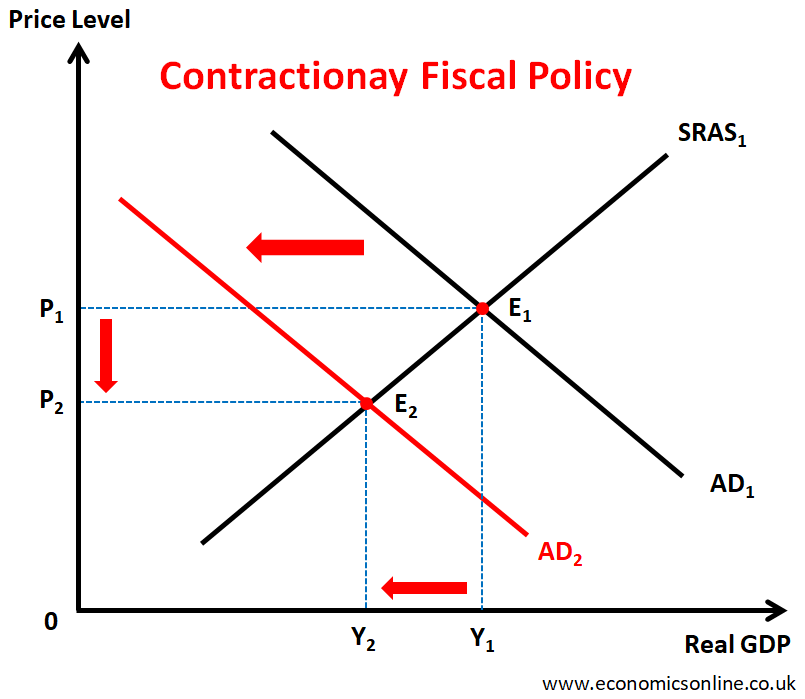

Graph of Contractionary Fiscal Policy

The following graph illustrates the effect of a contractionary fiscal policy.

In the above graph, the Real GDP is taken on the horizontal axis (x-axis) while the price level is taken on the vertical axis (y-axis). The initial equilibrium is at E1 which is the point of intersection of the aggregate demand curve AD1 and short-run aggregate supply curve SRAS1. The initial price level is P1 and the initial output level is Y1. When tax rates are increased and government spending is decreased, the aggregate demand curve is shifted towards the left from AD1 to AD2. The new equilibrium point is E1. The real GDP is decreased from Y1 to Y2 showing a fall in output and a rise in unemployment. The general price level is decreased from P1 to P2 showing a decrease in inflation.

The Effects of Contractionary Fiscal Policy on Macroeconomic Objectives

The above graph illustrates the impact of contractionary fiscal policy on the following macroeconomic objectives of the government.

Effect on Economic Growth

Economic growth in a country will slow down as a result of using a contractionary fiscal policy. In the above graph, the real GDP is decreased from Y1 to Y2 indicating a fall in output level.

Effect on Unemployment

Unemployment in a country will increase as a result of using a contractionary fiscal policy. In the above graph, the decrease in real GDP from Y1 to Y2 indicates a rise in unemployment. This is a side-effect of using a contractionary fiscal policy.

Effect on Inflation

The inflation rate will decrease as a result of using a contractionary fiscal policy. In the above graph, the decrease in the price level from P1 to P2 indicates a slowing down of inflation.

Advantages of Discretionary Fiscal Policy

The following are the main advantages of discretionary fiscal policy:

Economic Stimulus

It can stimulate the economic growth of a country by encouraging consumer spending and business investment.

Quick Response

By using this policy, the government can make a quick response to financial crises or recessions occurring in the country.

Unemployment Reduction

Promoting economic growth through an expansionary fiscal policy will also reduce the unemployment level in the economy.

Targeted Approach

This policy provides a targeted approach because the government can change taxes and its spending for some specific sectors of the economy.

Income Equality

Progressive tax policies can reduce income inequality in the economy.

Infrastructure Development

This policy promotes infrastructure development by increasing government spending on infrastructure projects such as roads, bridges, government buildings, etc.

Business Expansion

Businesses can expand as a result of expansionary fiscal policy. Business expansion means encouraging private sector entrepreneurs to grow their businesses in a country, which in turn creates more job opportunities and reduces unemployment in the country.

Social Welfare

The government increases its spending to encourage social welfare programs and support a massive population.

Long-Term Stability

This policy can provide long-term economic stability through infrastructure development in a country.

Disadvantages of Discretionary Fiscal Policy

The following are the main disadvantages of discretionary fiscal policy:

Time Lag

It is a major disadvantage of this policy because it takes time for the tools to show their effects on the economy.

Political Influence

Political parties prefer short-term benefits to long-term benefits. They look only for their beneficial purposes, not considering economic objectives. Hence, the intentions of using this policy may be compromised due to political interests.

Inaccurate Timing

This policy is sometimes aligned inaccurately with the economic cycles of a country. Inaccurate timing causes complications in correctly aligning precautionary measures on time.

Inefficiency

This policy doesn't always support efficiency in the country. It can also create inefficiency when people waste their income on useless things rather than put money into accurate or beneficial investments.

Inflationary Pressures

Inflationary pressures occur when government spending increases and tax rates decrease. If expansionary fiscal policy is not appropriately applied, then this will cause major inflation problems.

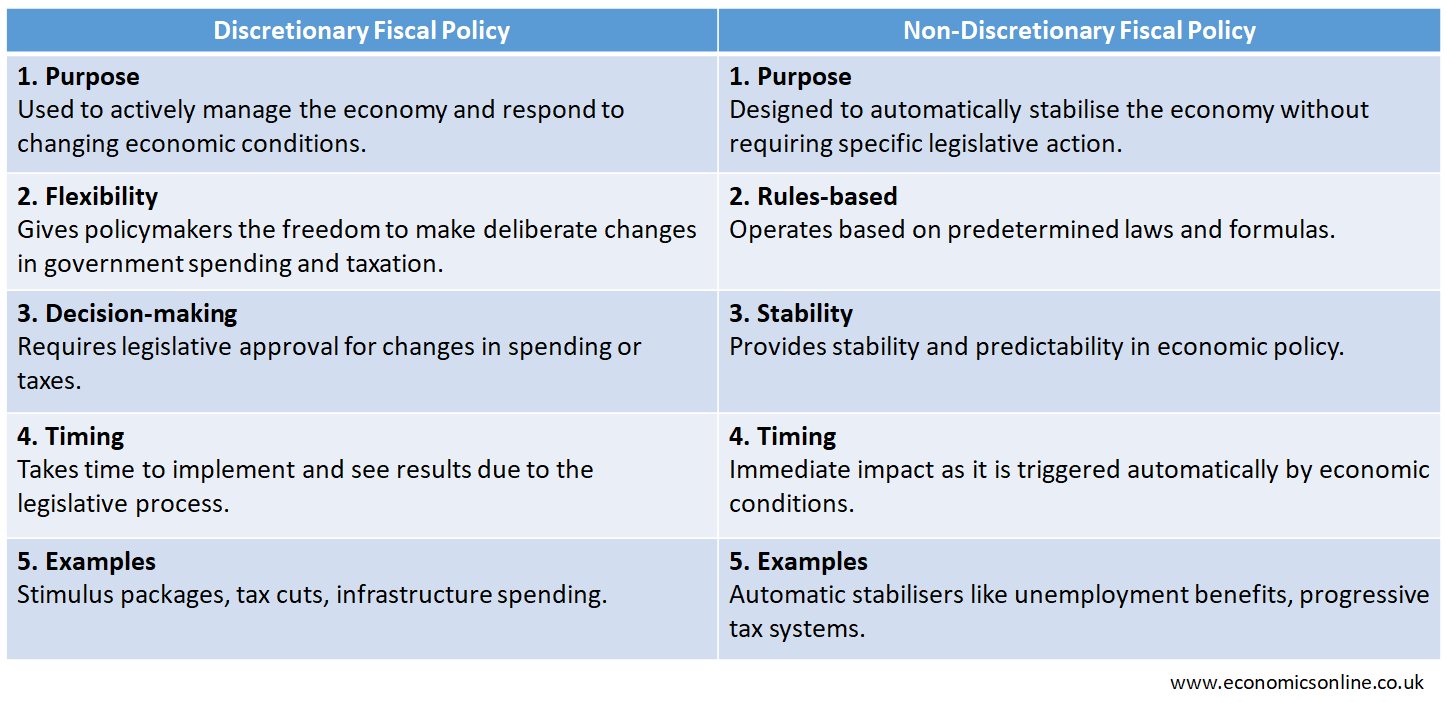

Non-discretionary Fiscal Policy

Non-discretionary fiscal policy refers to the forms of taxation and government spending that change, without any deliberate government actions, to offset the changes in the output of the country.

This policy works through automatic stabilisers.

Automatic Stabilisers

Automatic stabilisers are the types of taxes and government spending that change automatically, without any intentional government action, to offset any changes in the real GDP around different stages of business cycles.

Automatic stabilizers automatically adjust according to the current economic condition and help achieve economic stability without using discretionary fiscal policy.

For example, progressive taxes and unemployment benefits are automatic stabilisers. For instance, during an economic recession, government spending on unemployment benefits automatically increases because of more people who are unemployed. Tax revenue decreases automatically as incomes, profits and consumer spending decrease. These automatic changes will help the economy come out of recession without using any discretionary policy.

Automatic stabilisers are useful, yet, some economists question the effectiveness of these stabilisers.

Discretionary Fiscal Policy vs. Non-discretionary Fiscal Policy

The following table shows the comparison of the main features of discretionary fiscal policy and non-discretionary fiscal policy.

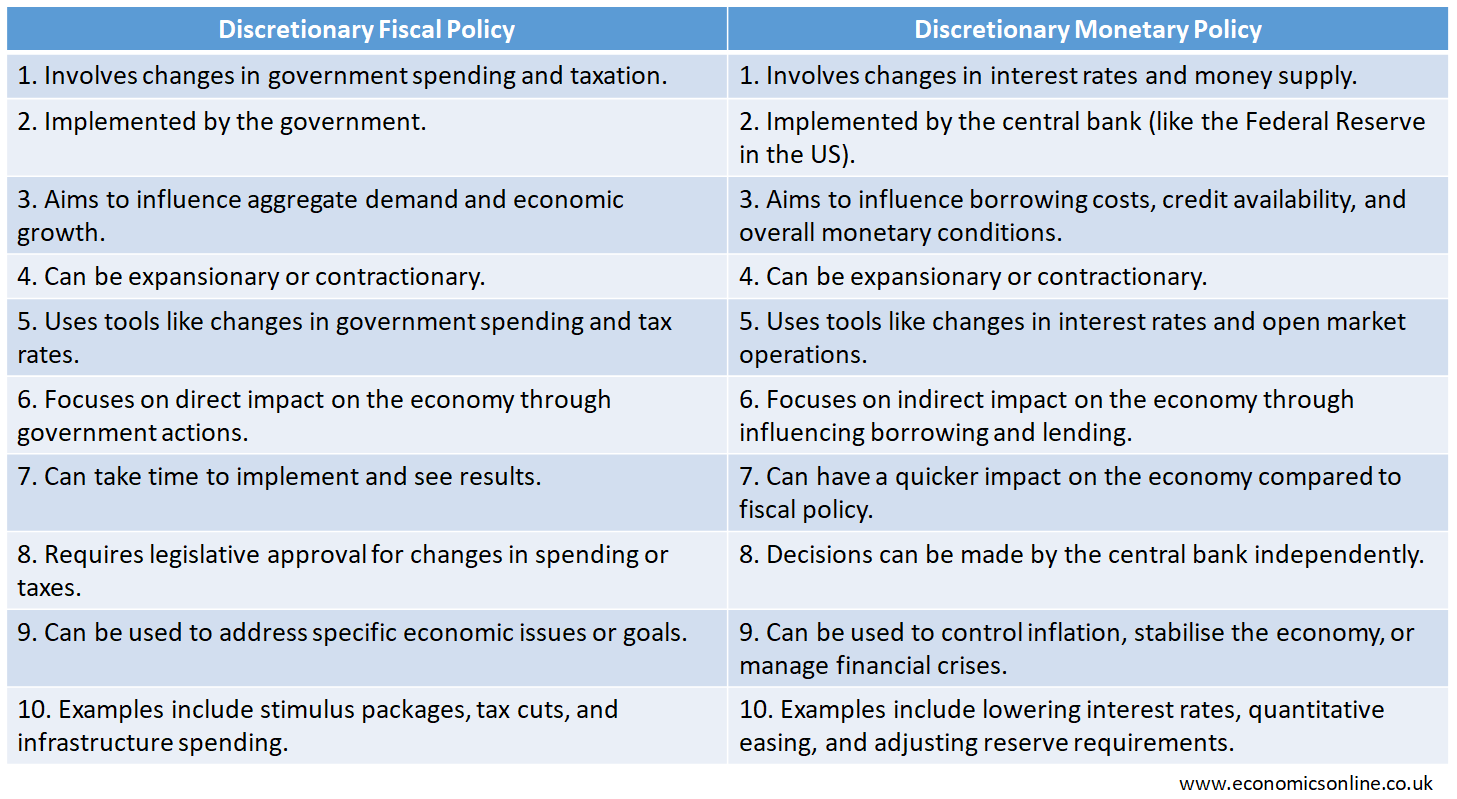

Discretionary Fiscal Policy vs. Discretionary Monetary Policy

Discretionary monetary policy is the use of interest rates and money supply to achieve macroeconomic objectives.

The following table compares the main features of discretionary fiscal policy and discretionary monetary policy.

Conclusion

In conclusion, discretionary fiscal policy revolves around taxation and government spending to manage aggregate demand. This demand-side policy is used by the government to achieve key macroeconomic objectives for creating an internal balance in an economy. Government should keep in mind, the side effects of this policy before implementing it. For example, using expansionary fiscal policy at the time of full employment will only create inflation.