Photo by Evgeniy Alyoshin / Unsplash

Expected Utility Theory

Definition

Expected utility theory is a decision-making tool used by economic agents to analyse situations when the outcomes of decisions are uncertain.

Expected utility is a probability-weighted average of the value of an uncertain outcome. It is calculated by multiplying the probability of an outcome by its value for the entity or organisation invloved in decision-making. The probability serves as a weight, which is multiplied by the value of an uncertain future outcome to calculate the expected utility.

This theory assumes that the decision-makers are rational and will choose the outcome with the highest expected utility.

The expected utility hypothesis says that individuals are sensible and look to maximise their overall well-being by assuming the potential benefits and risks of different choices.

Example

Suppose that Mr. A is facing a decision-making situation with two job options. One job option provides a high salary but carries high risk and uncertainty. The second job option provides a low salary but a stable and excellent work environment. According to expected utility theory, Mr. A will select the job option with the highest expected utility. Expected utility theory says that people make decisions to maximise their expected utility according to their risk tolerance.

Historical Background

The historical background of expected utility theory has its roots in the work of a Swiss mathematician, Daniel Bernoulli, in the 18th century. Expected utility theory is founded on Bernoulli’s famous paper, “Exposition of a New Theory on the Measurement of Risk”, which was published in 1738.

Further development in expected utility theory was done in the mid-20th century by economist John Von Neumann and mathematician Oskar Morgenstern.

They introduced the concept of expected utility theory in their book, “Theory of Games and Economic Behaviour", which was published in 1944.

Expected utility theory has become a fundamental concept for understanding human behavior and also has traces in other fields like economics, finance, psychology, and public policy.

Applications of Expected Utility Theory

Expected utility theory has some major applications in decision theory. Here are some examples of applications of expected utility theory:

Investment Decisions

The expected utility theory can be applied to investment decisions, in which individuals choose the most suitable investment option by considering the value of outcomes and their probabilities. Then individuals decide to opt for an investment option that has a higher expected utility based on their risk preferences.

Location Decision

The expected utility theory can be used to make location decisions in a business. Suppose that a manager has to make a location decision to open a store either in Town A or in Town B. The annual returns are estimated for each location, along with the probabilities of success and failure based on economic conditions in each town. The manager will calculate the values of expected utility for both towns and choose the location with the higher value of expected utility.

Risk Management

Expected utility theory is also used in risk management strategies. For example, insurance companies calculate premiums based on their expected outcomes and utility of losses for policyholders by considering individuals’ risk preferences.

Consumer Behaviour

Consumer behaviour also uses expected utility theory to choose between different product options. Consumers evaluate the expected outcomes of different alternatives by considering different factors, such as price, quality, and personal preference, when making a purchase decision.

Environmental Decisions

Expected utility theory is also applied in environmental decision-making and economics to evaluate the costs and benefits of different environmental actions. It helps to make decisions that maximise the overall expected utility of outcomes.

Public Policy

Expected utility theory is also used to analyse the impacts of different policy options. This theory helps policymakers evaluate the expected utility of different options and make decisions that enhance the social welfare of society.

Advantages of Expected Utility Theory

Expected utility theory has several advantages that help in decision-making:

Rational Decision-making

Rational decision-making is an advantage of expected utility theory. Individuals evaluate expected outcomes and make choices according to their personal preferences and the expected utility associated with each outcome.

Incorporates Risk Preferences

Expected utility theory helps to incorporate their risk preferences associated with different possible outcomes into their decision-making by considering the probabilities of outcomes. By using expected utility theory, individuals can evaluate benefits and drawbacks and make choices according to their risk tolerance capacity.

Quantifies Preferences

Expected utility theory provides a quantitative way to measure and compare different alternatives and preferences. By identifying future outcomes and calculating expected utilities, individuals can compare different options and make decisions.

Versatility

Expected utility theory can be applied to various decision-making circumstances, ranging from personal choices to business decisions and public policy. This theory provides a versatile framework for decision-making in different contexts and preferences.

Disadvantages of Expected Utility Theory

Expected utility theory has several disadvantages as well, which are explained as follows:

Unrealistic Assumptions

Expected utility theory assumes that people totally rely on their own preferences and assign utility values to expected outcomes accurately. But individuals’ preferences are complex and may not be based on assumptions about the theory.

Difficulty in Assigning Utility Values

Expected utility theory provides difficulty in assigning utility values to expected outcomes as it is difficult to quantify individuals’ preferences. It is also difficult to correctly measure and compare utility values, especially when dealing with intangible factors or subjective experiences.

Qualitative Factors

Expected utility theory only focuses on monetary factors or outcomes and does not fully consider or ignore non-monetary factors, like social, emotional, or environmental considerations, that can influence decision-making. This disadvantage limits the accessibility of this theory.

Complexity in Calculating Probabilities

Expected utility theory requires individuals to correctly estimate and assign probabilities to expected outcomes. Calculating accurate probabilities is a complex situation that can impact the accuracy of expected utility values.

Risk Preferences in Expected Utility Theory

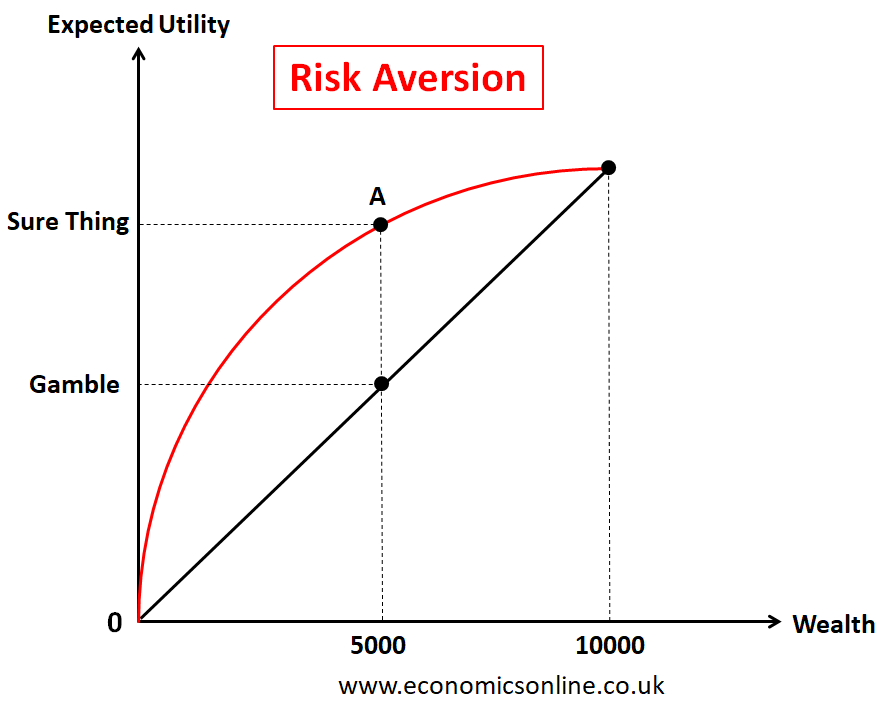

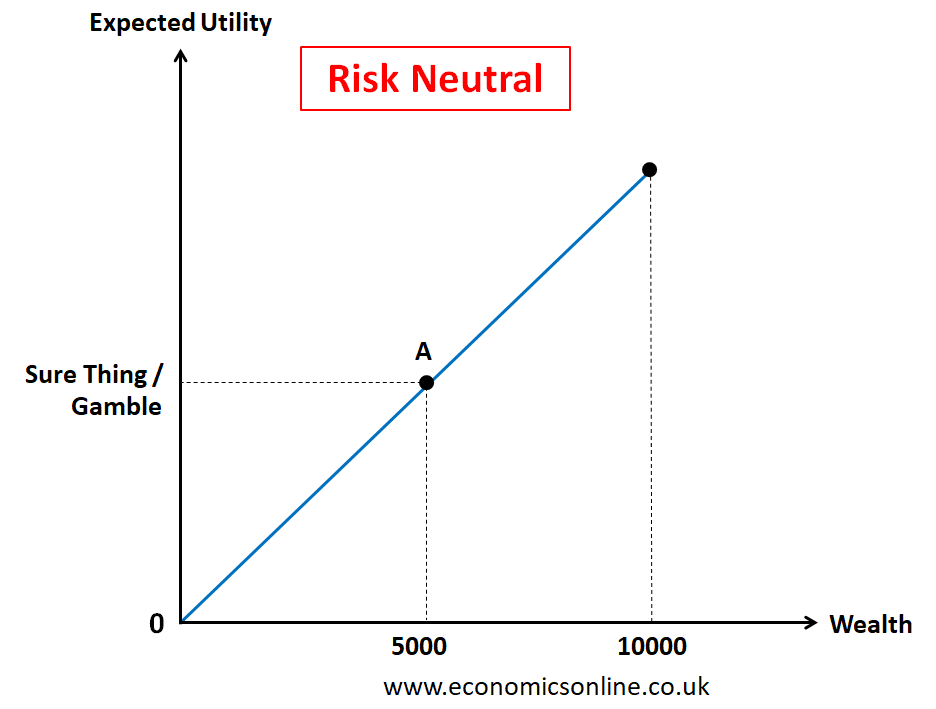

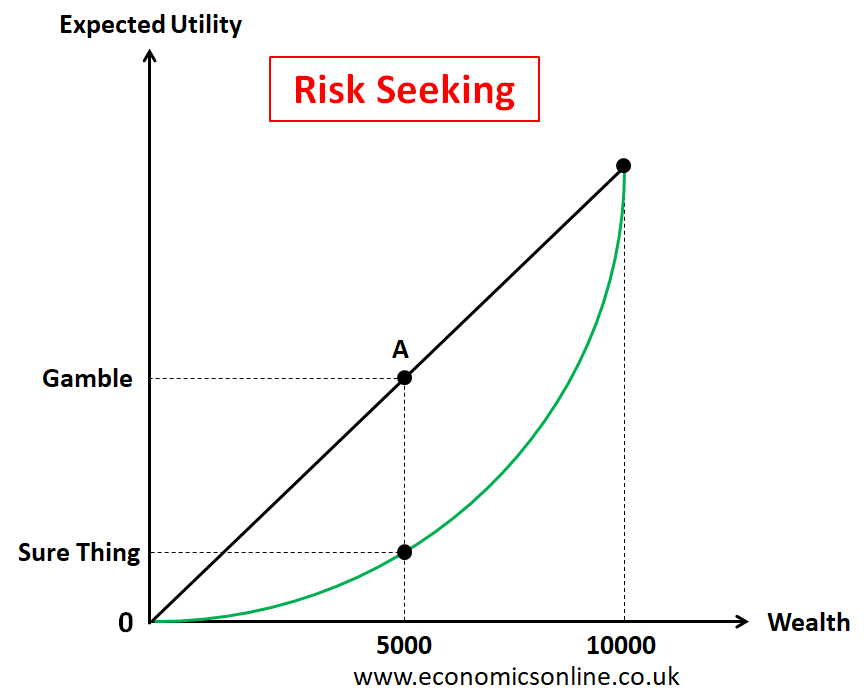

Risk preferences can be understood by considering an example of a hypothetical situation of lottery tickets, which can be represented by a risk-aversion graph, a risk-neutral graph, or a risk-seeking graph.

Risk Aversion

In the above graph, we have taken wealth on the horizontal axis (x-axis) and utility on the vertical axis (y-axis). The red upward curve shows the value of expected utility with respect to wealth. The person who is playing the simple lottery goes with the sure thing because he is risk-averse and less tolerant of risk. This person doesn't prefer to gamble, as the utility value of gambling is low and consists of low returns.

Risk Neutral

In the above graph, the blue curve shows risk-neutral behavior. The person is risk-neutral in this situation because the utility-wealth curve is a straight line.

Risk Seeking

In the above graph the green downward curve shows risk-seeking behavior, and the person is more likely to take a risk because the value of utility to wealth is less shown as a sure thing in the graph. This person prefers to gamble instead of choosing a sure thing.

Criticism of Expected Utility Theory

Expected utility theory has been criticised in many ways. Some of which are given below:

Violation of the Independence Axiom

Expected utility theory assumes that individuals make choices based on expected utility outcomes. But the researchers explain that people are rational, and their choice depends on how the option is presented or framed. This violates the independence axiom of expected utility theory.

Inadequate Treatment of Risk Aversion

Expected utility theory assumes that individuals are either risk-neutral or risk-averse. But studies have found that people’s behavior towards risk can vary and may not align with the assumptions of this theory. Some individuals have risk-seeking behavior in some conditions.

Neglect of Context and Emotions

Expected utility theory only considers the expected outcomes and the utility values associated with them. This theory neglects the contextual and emotional factors in decision-making. Individuals’ choices can be changed by emotional factors, like social norms, past experiences, and emotional or psychological states, which are not completely captured by expected utility theory.

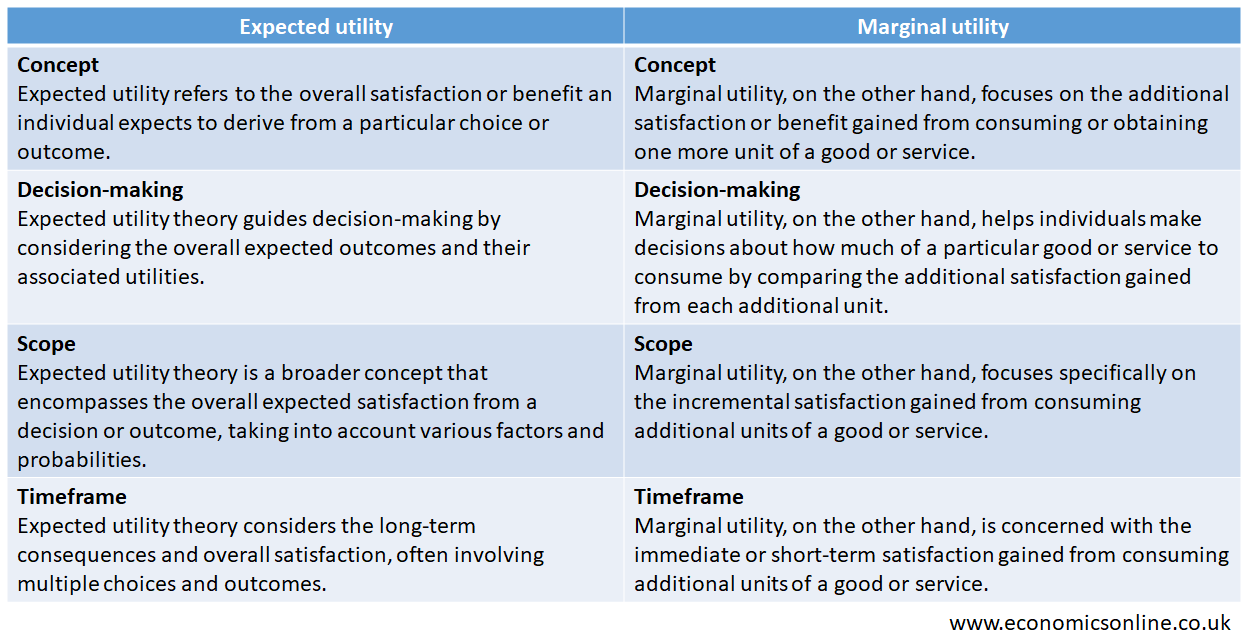

Expected Utility vs. Marginal Utility

The following table compares the main points of expected utility with marginal utility.

Alternative theories

The following are the two main alternative theories:

Prospect Theory

The prospect theory was developed by Daniel Kahneman and Amos Tversky, which explains that individuals evaluate outcomes based on gains or losses relative to a reference point instead of relying on absolute utility.

Regret Theory

The regret theory, which was proposed by Graham Loomes and Robert Sugden, focuses on the anticipation of regret in decision-making. This theory suggests that individuals consider not only the expected utility of outcomes but also the regret they experience if their choices turn out wrong.

St. Petersburg Paradox

The St. Petersburg paradox challenges the assumption that individuals make decisions based only on expected monetary value. Due to the high expected value of the game, some people or individuals are not willing to pay such a high entry fee to participate in the game. This paradox highlights that individuals’ preferences and decision-making or risk aversion are totally dependent on factors that are far beyond expected monetary values due to the uncertainty involved in the outcomes of decisions.

Bernoulli's Formulation

According to Bernoulli, the marginal utility of money decreases as wealth increases. Daniel Bernoulli explained that individuals do not evaluate outcomes in terms of their monetary values but in terms of outcomes derived from that utility. This concept explains that individuals are willing to pay a premium to save themselves from uncertainties that may result in losses. This formulation explains how individuals make decisions under uncertainty.

Von Neumann-Morgenstern Utility Theorem

This theorem is named after John Von Neumann and Oskar Morgenstern and states that under some conditions, a decision-maker can be represented by a utility function that assigns numerical values to different outcomes. This utility function carefully explains the individuals’ preferences and allows for consistent decision-making under uncertainty.

Conclusion

In conclusion, expected utility theory is used for the decision-making process in behavioral economics when the outcomes are uncertain. This theory is considered a normative theory of decision making. Along with its wide application in many fields, this theory also has some limitations, such as risk-aversion, neglect of contextual and emotional factors, violation of the independence axiom, etc. Critics also criticised this theory, saying it does not always align with real-world behaviour. The prospect and regret theory provides alternatives and offers different perspectives that accommodate some of its limitations.