Image showing buildings in a high income city.

Income Effect

What is an Income Effect?

The income effect of a price change refers to the change in consumption or quantity demanded of a good due to a change in the real income of the consumer, keeping money income constant. The income effect is part of the price effect.

Price Effect

The term price effect refers to the change in consumption or quantity demanded of a good due to a change in its price. There are two parts to the price effect.

- Substitution Effect

- Income Effect

Price Effect = Substitution Effect + Income Effect

Substitution Effect

Price effect refers to the change in consumption or quantity demanded of a good due to a change in its relative price, keeping other things constant.

If the price of a good X is decreased, keeping the money income and the price of other goods constant, good X becomes relatively cheaper. A rational consumer will prefer a relatively cheaper good over an expensive one, and hence the quantity demanded of good X will increase. This is called the substitution effect of a price change.

Explanation of Income Effect

The income effect is a concept in economics that describes how changes in prices can affect consumers' purchasing power or real income while keeping the money income constant.

Money income is the income expressed in terms of money, while real income is the income expressed in terms of purchasing power. In other words, the real income is the number of units of a good that a consumer can buy with the given amount of money income.

Real Income = Money Income / Price

When the price of a good is changed, it can affect the real income and, hence, the quantity demanded of that good. This is called the income effect of a price change.

When the price of a good is changed, the consumer’s real income is also changed, and hence the consumer changes the quantity demanded of the good. This is the income effect.

The income effect is one part of the logic of a downward slope of the normal demand curve.

Features of Income Effect

- Income effect is the part of price effect.

- Income effect is different for different types of good.

- For normal goods, income effect works in the opposite direction of the price change.

- For inferior goods, income effect works in the same direction of price change.

- Due to income effect, a consumer moves to a higher or lower indifference curve.

- If good X is normal good, a decrease in its price will cause an increase in real income and the consumer will increase the quantity demanded of good X due to income effect.

- If good X is an inferior good, a decrease in its price will cause an increase in real income and the consumer will decrease the quantity demanded of good X due to income effect.

How does the Income Effect Work?

The income effect works due to the change in consumers' real income. When the price of a good X decreases, the consumer’s real income increases, and as a result, the consumer will change the quantity demanded of good X.

For example, a consumer has money income of $12 and the price of good X is $3. Consumer’s real income will be

Real Income = Money Income / Price

Real Income = $12/$3 = 4 units of X

Now, if the price of good X is decreased to $2, the new real income will be

Real Income = $12/$2 = 6 units of X

This shows that due to a decrease in the price of good X, the consumer can now buy 6 units of good X (instead of 4), which shows an increase in real income. This change in real income will bring about a change in the quantity demanded of good X as well, which is called the income effect of a price change.

Income Effect for Different Types of Goods

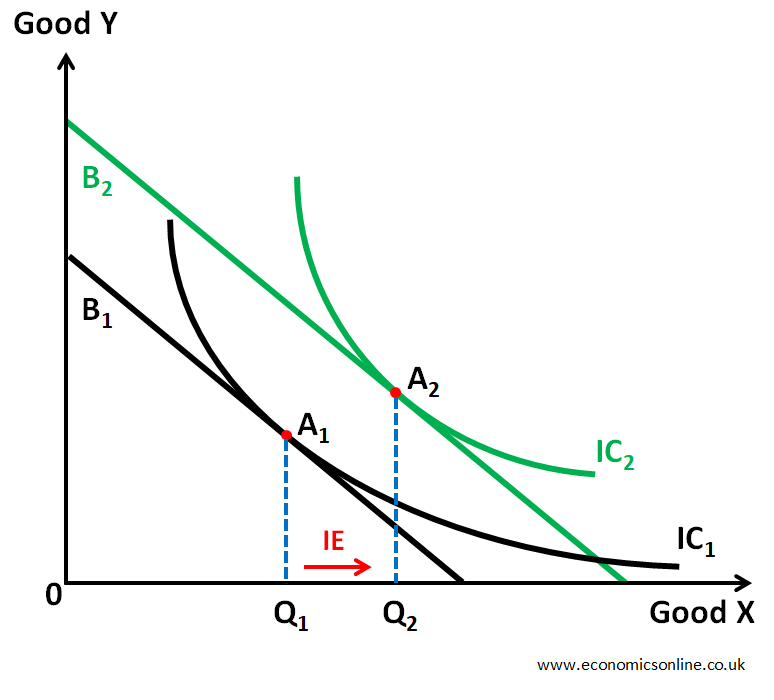

Income Effect for Normal Goods

Normal goods are the goods that people will buy more of when their income increases. Normal goods have positive income elasticity of demand. The following diagram illustrates the income effect for a normal good when its price is decreased.

Suppose that good X is a normal good. In the above diagram, point A1 is the point of intersection between the initial budget line B1 and the initial indifference curve IC1. The quantity demanded by the consumer is Q1.

When the price of good X is decreased, the consumer’s real income increases, as shown by the outward shift of the budget line from B1 to B2. Point A2 is the new point of intersection between budget line B2 and indifference curve IC2. The quantity demanded by the consumer is now Q2. The income effect is seen in Q1-Q2, which shows an increase in the quantity demanded of good X (normal good) due to a decrease in its price.

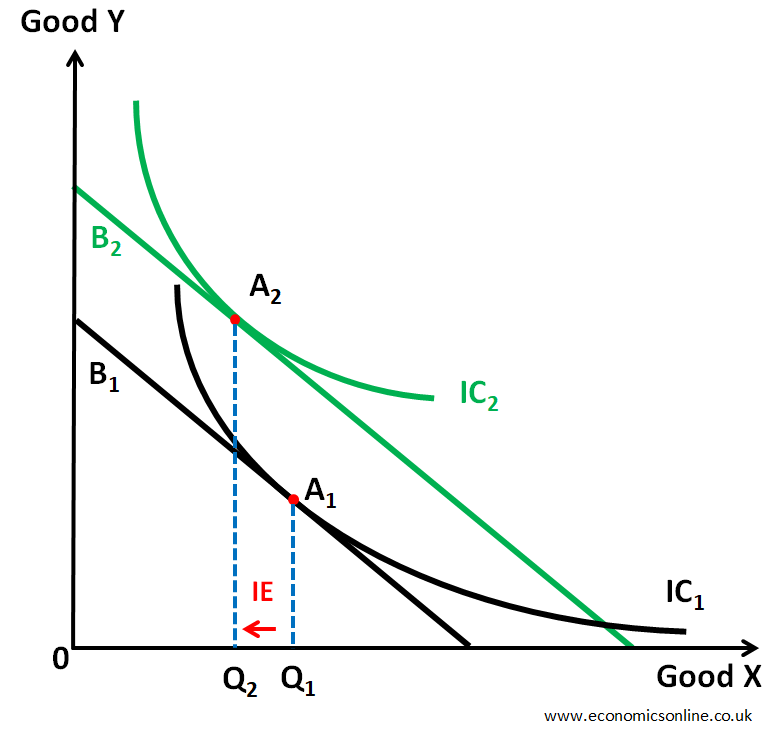

Income Effect for Inferior Goods

Inferior goods are the goods that people will buy less of when their income increases. Inferior goods have negative income elasticity of demand. The following diagram illustrates the income effect for an inferior good when its price is decreased.

Suppose that good X is an inferior good. In above diagram, point A1 is the point of intersection between the initial budget line B1 and the initial indifference curve IC1. The quantity demanded by the consumer is Q1.

When the price of good X is decreased, the consumer’s real income increases, as shown by the outward shift of the budget line from B1 to B2. Point A2 is the new point of intersection between budget line B2 and indifference curve IC2. The quantity demanded by the consumer is now Q2. The income effect is seen in Q1-Q2, which shows a decrease in the quantity demanded of good X (inferior good) due to a decrease in its price.

The income effect can be seen in a wide range of economic scenarios. For example, consider the impact of a tax cut on consumer spending. When taxes are cut, consumers have more disposable income, which can lead to increased spending on goods and services.

Likewise, when prices for a particular good or service increase, consumers may reduce their consumption of other goods and services to compensate. For example, if the price of healthcare increases, consumers may have to reduce their spending on other items like entertainment or travel to afford their medical bills.

Conclusion

The income effect is an important concept in economics that describes how changes in prices can impact consumers' purchasing power, which then leads to a change in the quantity demanded of a good. The income effect is different for different types of goods. The income effect plays a critical role in shaping consumer behavior.