An image of word tax on the top of gold coins

Indirect Tax

Introduction

Tax is the revenue of the government that is received from individuals and firms. Governments impose taxes to generate funds for their spending. Governments need funds from tax revenue to provide public goods (street lights, defence, and flood control systems), emergency services (fire brigade and police), and merit goods (education and health services). Governments have administration expenses, and they also give subsidies to firms and welfare payments to needy people.

Governments can impose a wide variety of taxes to generate revenue. This article will explain the indirect tax in detail.

What is an Indirect Tax?

Indirect tax refers to a type of tax that is imposed on the spending of people and firms. Unlike a direct tax, which is imposed on the income of individuals and firms, an indirect tax is charged on producers, levied on goods and services, and paid by consumers indirectly when they spend money on buying goods and services. In other words, indirect taxes are imposed on people by increasing the prices of goods and services, collected by intermediaries and businesses, and then sent to the government.

Examples of an indirect tax are VAT (value-added tax), GST (goods and services tax), HST (harmonized sales tax), sales taxes, customs duties, excise tax, stamp duty, etc.

Types of Indirect Tax

The following are different types of indirect tax:

Value-Added Tax (VAT)

A value-added tax is imposed on each stage of production and distribution of goods or services in any sector. VAT system is the most common example of an indirect tax. This tax is imposed on firms that are involved in adding value to goods and services through business operations.

Sales Tax

This type of tax is imposed on goods or services at the retail sales stage. Sales tax is a consumption tax collected directly by the sellers at the time of the purchase of goods or services by customers. It is then collected by the government at the local or state level.

Excise Duty

This type of tax is imposed on specific goods or services, such as alcohol, tobacco, drugs, fuel, and luxury items, when they cross inland borders.

Custom Duty

This type of tax is also known as import duty or export duty. Customs duties are imposed on those goods or services that are directly imported or exported across international borders. This type of tax is collected by customs authorities.

Sin Tax

A sin tax is imposed on those goods or services that are dangerous to human health as well as to the environment. Goods like alcohol, cigarettes, tobacco, etc.

Fuel Tax

Fuel tax is also called gasoline tax or petrol tax. This type of tax is imposed on the sale or consumption of fuel. Fuel tax is used to fund transportation infrastructure and minimise environmental impact.

Entertainment Tax

This type of tax is imposed on some types of entertainment, like movie tickets, sports events, concerts, video game arcades and amusement parks.

Luxury Tax

This tax is only imposed on luxury or posh items consumed by the elite class. Luxury cars, sports cars, diamond jewellery, yachts, or five-star hotels are considered luxury goods or services.

Specific Tax vs. Ad-Valorem Tax

Specific Tax

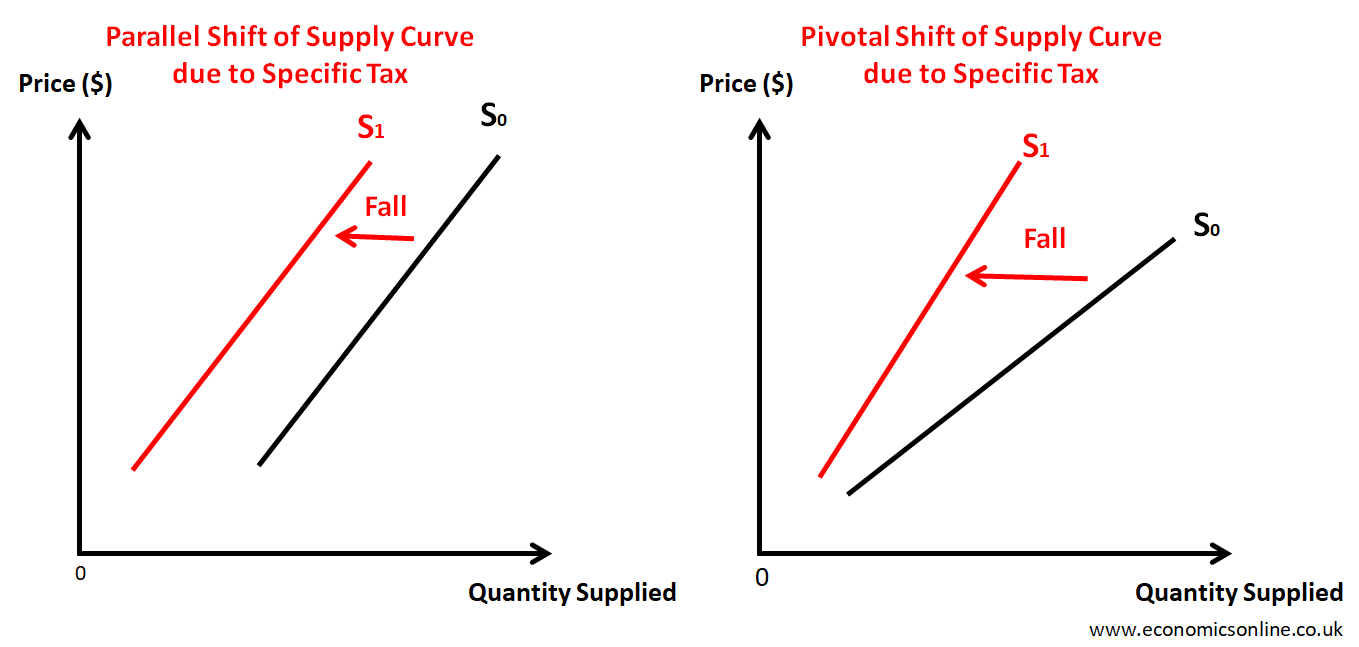

A specific tax is a type of indirect tax that remains fixed for every unit purchased and does not increase with an increase in the price of the product. A specific tax is a fixed amount on every unit purchased. For example, if the specific tax is $2 per unit, it will remain the same and does not increase whether the price is $10 or $15. There will be a parallel shift in the supply curve due to a specific tax, as shown in the diagram below.

Ad-Valorem Tax

Ad-valorem tax is a type of indirect tax that increases with an increase in the price of a product. Ad-valorem tax is a percentage of price, and hence the amount increases with an increase in price. For example, if ad-valorem tax is 10% and the price of a product is $20, the amount of tax will be $2 per unit (10% of $20). But if the price of the product increases to $30, then the amount of tax will be $3 per unit (10% of $30). Even though the tax percentage remains the same in ad-valorem tax, the amount of tax increases with an increase in the price of the product. There will be a pivotal shift in the supply curve due to the ad-valorem tax, as shown in the diagram below.

Tax Incidence

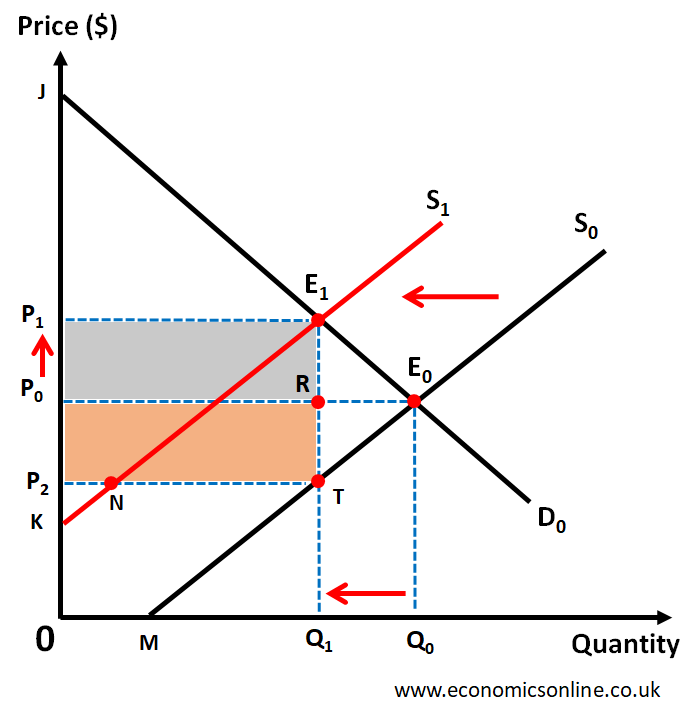

The distribution of the burden of an indirect tax between producers and consumers is called tax incidence. It is an important concept in microeconomics. Let’s understand the mechanism of tax incidence with the help of a diagram by taking the case of a specific indirect tax.

Before Tax

In the above diagram, before the imposition of an indirect tax, the market equilibrium is at E0, P0 and Q0. The equilibrium price is P0, and the equilibrium quantity is Q0

Consumer Surplus = Area JE0P0

Producer Surplus = Area P0E0M0P0

After Tax

When a specific indirect tax is imposed by the government on producers, there is a parallel leftward shift in the supply curve from S0 to S1.

New market equilibrium is at E1, P1 and Q1.

New equilibrium price = P1

New equilibrium quantity = Q1

The price which consumers are paying = P1

The price which producers are receiving = P2

New Consumer Surplus = Area JE1P1

New Producer Surplus = Area P2NK

Tax per unit = Vertical distance between two supply curves = E1T = P1P2

Tax Revenue of Government = Area P1E1TP2

Tax Burden on Consumers = Area P1E1RP0

Tax Burden on Producers = Area P0RTP2

Effects of Specific Indirect Tax

The following points give the effects of specific indirect taxes on various parties.

On Consumers

The price of the product is increased from P0 to P1 while the quantity traded is decreased from Q0 to Q1. Consumers are negatively affected because they have to pay a higher price and are getting less quantity of the product. Moreover, the consumer surplus is decreased by an area of P1E1E0P0. This shows a decrease in the welfare of consumers. The tax burden on consumers is the area P1E1RP0. Overall, consumers are negatively affected because of the indirect tax.

On Producers

Even though consumers are paying the price P1, yet, out of this price, producers pay tax to the government equal to P1P2 and the price that producers are receiving is P2 which is less than P0. The quantity traded is decreased from Q0 to Q1. This means that the producers are able to sell a smaller quantity of the product, and they are receiving a lower price for the product. This is a negative effect of indirect tax on producers. Moreover, the producer surplus is decreased by areas P0E0TP2 and KNTM0. This shows a decrease in the welfare of producers. The tax burden on producers is the area P0RTP2. Overall, producers are negatively affected because of the indirect tax.

On Government

The government is better off because this indirect tax is generating its revenue, which is equal to the area of P1E1TP2.

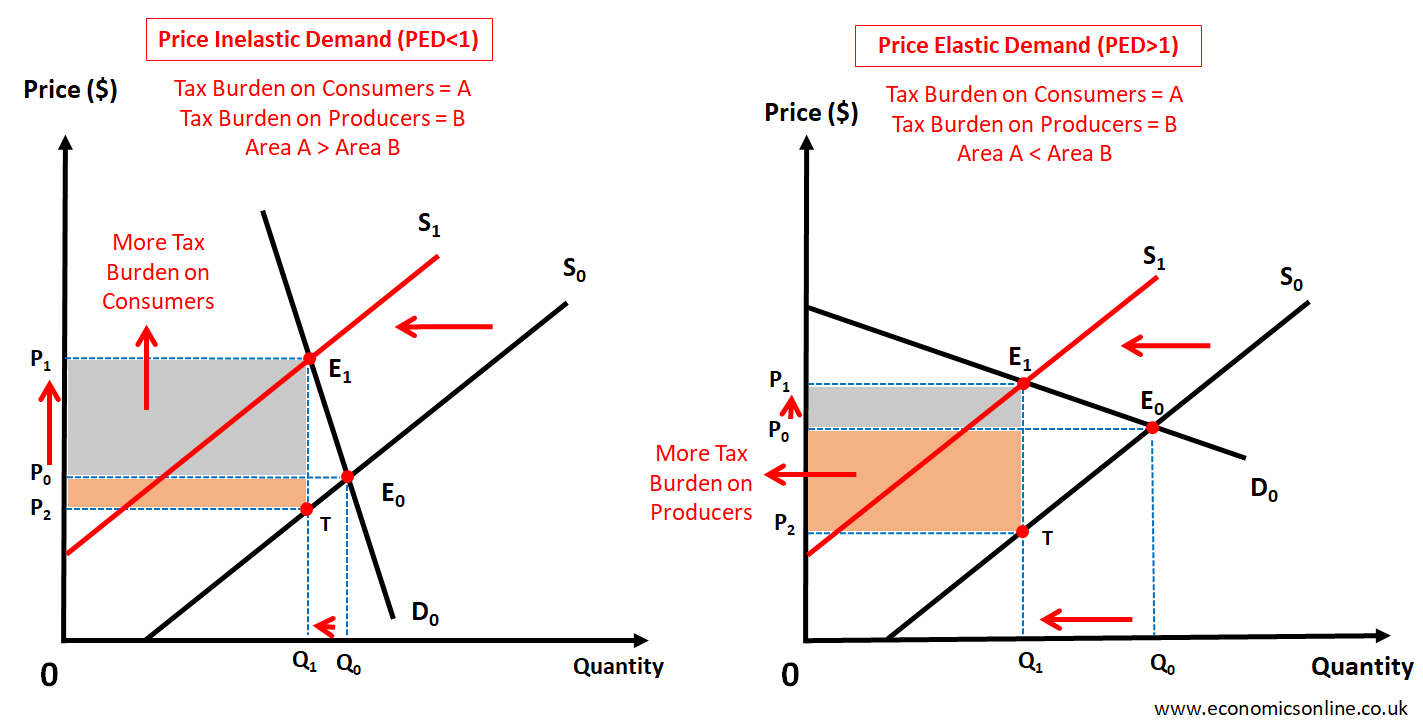

Tax Incidence and Elasticity

Tax incidence depends on the price elasticity of demand. In cases of price elastic demand, producers face a higher burden of tax, while in cases of price inelastic demand, producers are able to increase the price by a greater percentage, and they can shift a higher burden of tax onto the shoulders of consumers. This is illustrated by the following diagrams:

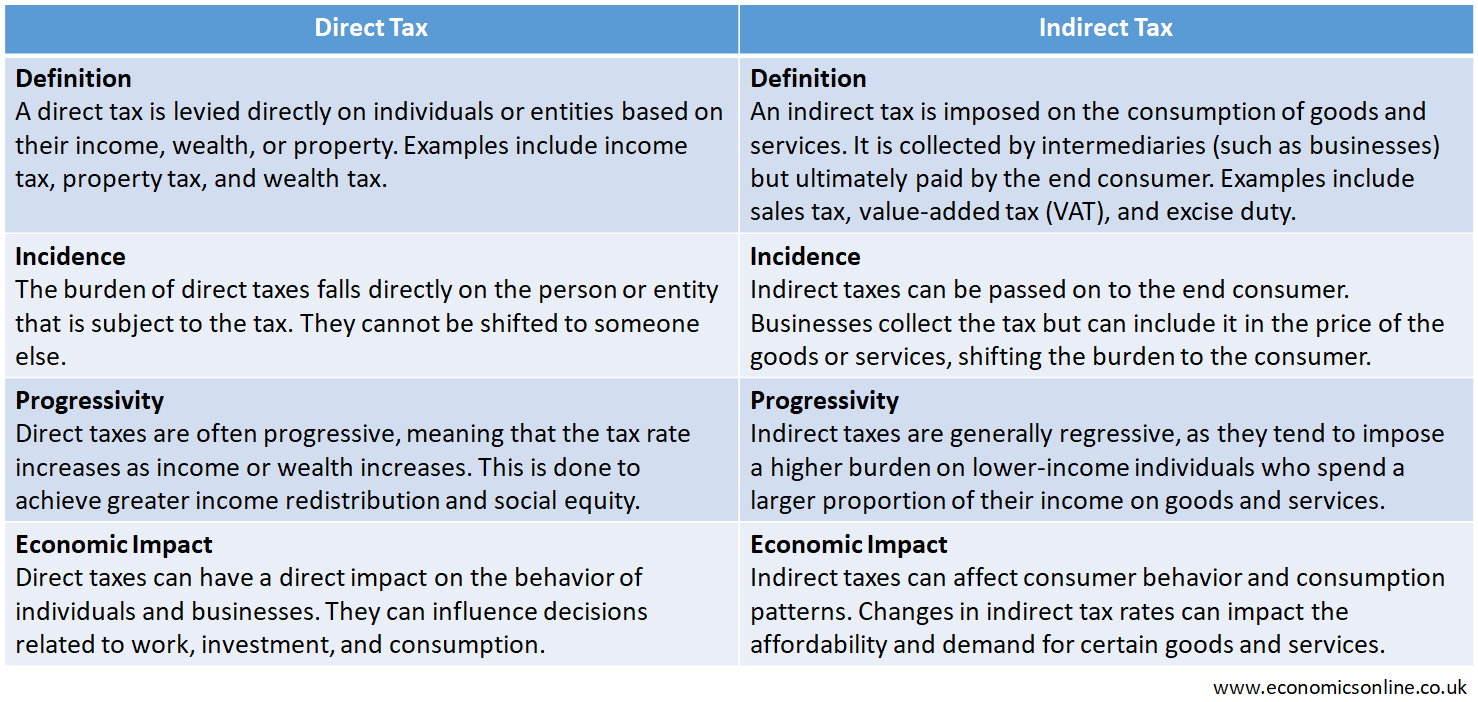

Direct Tax vs. Indirect Tax

The following table compares the main points of difference between direct tax and indirect tax.

Advantages of Indirect Tax

The following are some advantages of indirect tax:

Convenience

Indirect taxes are easy to pay and collect. Consumers buy products, and the tax is included in the price of the product, which is paid at the time of purchase without the need to file a tax return statement.

Revenue Generation

Indirect taxes are a good source of government revenue. In some countries, the government's revenue from indirect taxes is higher than the revenue from direct taxes.

Correction of Market Failure

Indirect taxes are used by governments to correct market failures arising from negative externalities. For example, a tobacco tax can discourage the consumption of harmful tobacco products by including the external cost of smoking in the price of the product as a tax.

Broader Scope

Indirect tax can be applied to a range of goods and services, which makes its scope broader than direct tax.

Disadvantages of Indirect Tax

The following are some disadvantages of indirect tax:

Regressive Nature

Indirect taxes are regressive in nature as compared to direct taxes, which are mostly progressive (such as income tax). Even though indirect taxes are included in the prices of the products, the rich and the poor pay the same price for buying these products; however, higher prices make the people with lower incomes spend a higher portion of their income on buying the product, making the indirect tax regressive.

Inflationary

Indirect taxes increase the prices of goods and services and can contribute to inflation.

Discourage Production and Consumption

Indirect taxes can discourage the production and consumption of products by making them expensive. This may be considered desirable in the case of demerit goods but may be undesirable in the case of normal goods.

Conclusion

In conclusion, indirect tax is a tax on the spending of people and firms and is used to generate revenue for governments. Indirect taxation increases the prices of goods or services that customers pay when buying transactions take place. Examples of indirect taxes are VAT (value-added tax), GST (goods and services tax), sales taxes, customs duties, and excise tax. Indirect taxes can correct market failures arising from negative externalities, yet they are considered regressive in nature.