An image of a person holding a leather bag.

Mid Luxury Sector Grows Amidst Economic Recession

Introduction

The global economy is currently facing a number of challenges, including inflation, supply chain disruptions, the Ukraine crisis, and the Israel-Palestine war. These challenges have led to a decline in consumer confidence and spending in many sectors, including normal goods and high-end luxury goods.

During challenging times like economic recessions, when consumer income and spending fall, the sectors for normal goods and luxury goods are expected to be negatively affected, and this is a normal expected result in economics.

However, there is one sector that appears to be relatively resilient in the face of economic challenges, including the COVID-19 pandemic: the mid-luxury sector.

In this article, we will explore the factors determining the growth of the mid-luxury sector during tough times like economic recessions.

Defining the Mid-Luxury Sector

The mid-luxury sector refers to the luxury brands that offer high-quality products at a price point that is more affordable than traditional high-end luxury brands.

In other words, the mid-luxury sector refers to a niche within the luxury market that offers high-quality, premium products and experiences that fall just below the ultra-luxury or high-end luxury segment.

It includes brands like Michael Kors, Coach, Marriott and Santoni Shoes, providing a more attainable luxury experience compared to iconic brands like Chanel or Ferrari.

Resilience in Economic Recession

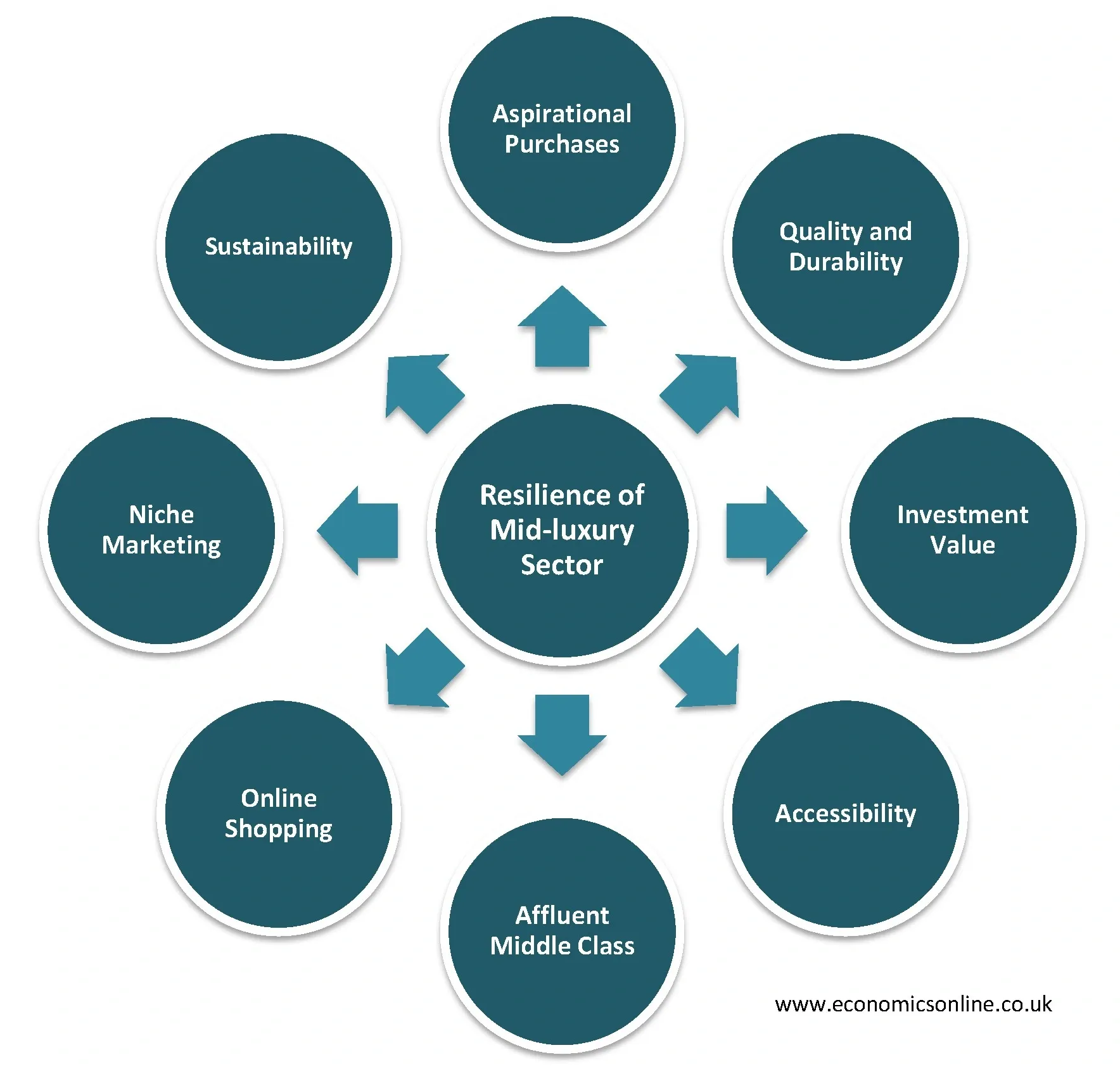

Why is the mid-luxury sector growing during a recession? This question is extremely important regarding the paradoxical growth behaviour of the mid-luxury sector.

While economic recessions typically lead to reduced consumer income and spending, the mid-luxury sector has proven to be remarkably resilient.

There are a number of reasons why the mid-luxury sector is growing during a recession.

Aspirational Purchases

During tough financial times, consumers may not be willing to spend on ultra-luxury items. However, they still want to enjoy a sense of luxury. Mid-luxury brands offer attainable luxury experiences, allowing consumers to fulfill their aspirations without breaking the bank.

Quality and Durability

Mid-luxury products are often associated with higher quality and durability than their mass-market counterparts. Consumers are willing to invest in products that offer both luxury and longevity, making mid-luxury items a cost-effective choice in the long term.

Investment Value

Some mid-luxury products, like designer handbags, fashion shoes, or fine watches, hold their value well over time. This makes them not only a luxurious indulgence but also a potential investment, which is appealing to many consumers.

Accessibility

Mid-luxury brands are often more accessible to consumers than traditional luxury brands. Mid-luxury brands are often sold in department stores and other mainstream retailers, making them easier to find and purchase.

Affluent Middle Class

The global affluent middle class is expected to grow from 1.1 billion people in 2021 to 1.9 billion people in 2030. This growing group of consumers has the disposable income to spend on luxury goods, but they are also more value-conscious than the ultra-wealthy. The mid-luxury sector offers them the perfect combination of quality and affordability.

Online Shopping

The rise of e-commerce and online retail platforms has significantly contributed to the mid-luxury sector's growth. Online shopping offers a level of convenience that is particularly attractive during economic downturns. The current economic challenges accelerated the shift to online shopping, and the mid-luxury sector has benefited from this trend. Online shopping makes it easier for consumers to compare prices and find the best deals. It also gives consumers access to a wider range of mid-luxury brands than they would find in brick-and-mortar stores.

Additionally, e-commerce platforms often feature special promotions and discounts, making mid-luxury items more accessible during times of financial uncertainty. This, in turn, encourages consumers to make purchases they might have otherwise delayed.

Niche Marketing

Many mid-luxury brands have mastered the art of niche marketing and branding. They create a sense of exclusivity and identity that resonates with their target audience. This personalised approach makes consumers feel a stronger connection to the brand, making them more willing to invest in mid-luxury products even when budgets are tight.

Sustainability

In recent years, sustainability and ethical practices have become integral to consumer choices. Mid-luxury brands often lead the way in these areas, with a focus on responsible sourcing, fair labour practices, and environmentally friendly production methods. This aligns with the evolving consumer values, making mid-luxury products not just about luxury but about conscious consumption.

Mid-luxury Brands and the Current Economic Climate

Mid-luxury brands are capitalising on the current economic climate by offering discounts and promotions to attract consumers. Moreover, they are expanding their distribution channels to reach more consumers, making investments in new product development, and improving existing products to meet the changing needs of consumers.

Tips for Success in the Mid-luxury Sector

Even though the mid-luxury sector is relatively resilient to economic downturns, there are a few things that brands can do to succeed during these difficult times:

Focus on Value

Consumers are more price-sensitive during a recession, so brands need to focus on offering value for money. This could mean offering discounts, promotions, or bundling products together.

Invest in Digital Marketing

Online shopping is booming, so brands need to invest in digital marketing to reach their target customers. This could include social media marketing, search engine marketing, and email marketing.

Focus on Sustainability

Consumers are increasingly interested in sustainable and ethical luxury goods. Brands should focus on offering more sustainable products and practices to meet this demand.

Expand into New Markets

The mid-luxury market is growing rapidly in emerging markets such as China and India. Brands can expand into these markets to reach new customers and boost sales.

Collaborate with other Brands

Collaborating with other brands can be a great way to reach new customers and create new and exciting products. For example, Michael Kors has collaborated with Disney and Sesame Street to create limited-edition collections.

Host Experiential Events

Experiential events can help brands connect with their customers on a deeper level. For example, Tory Burch hosts events such as trunk shows and fashion shows.

Give Back to the Community

Consumers are more likely to support brands that give back to the community. Brands can support their communities by donating to charities, sponsoring events, or volunteering their time.

Personalise the Customer Experience

Consumers are more likely to spend money on brands that make them feel valued. Brands can personalise the customer experience by offering loyalty programmes, personalised recommendations, and exclusive promotions.

Offer a Strong Buying Experience

Consumers want to be able to shop with brands in the way that is most convenient for them. Brands should offer a strong omnichannel experience that allows consumers to shop online, in-store, or over the phone.

Focus on Customer Service

Customer service is more important than ever during a recession. Brands should make sure that they are providing their customers with the best possible customer service.

Conclusion

The mid-luxury sector's growth amidst the economic recession is a testament to its ability to adapt to changing consumer preferences and needs. As consumers continue to seek quality, value, and meaningful experiences, mid-luxury brands are well-positioned to thrive. Their resilience in the face of economic challenges marks the enduring appeal of attainable luxury during an unpredictable economic climate.