An image showing coins.

Monetary Base

What is Monetary Base?

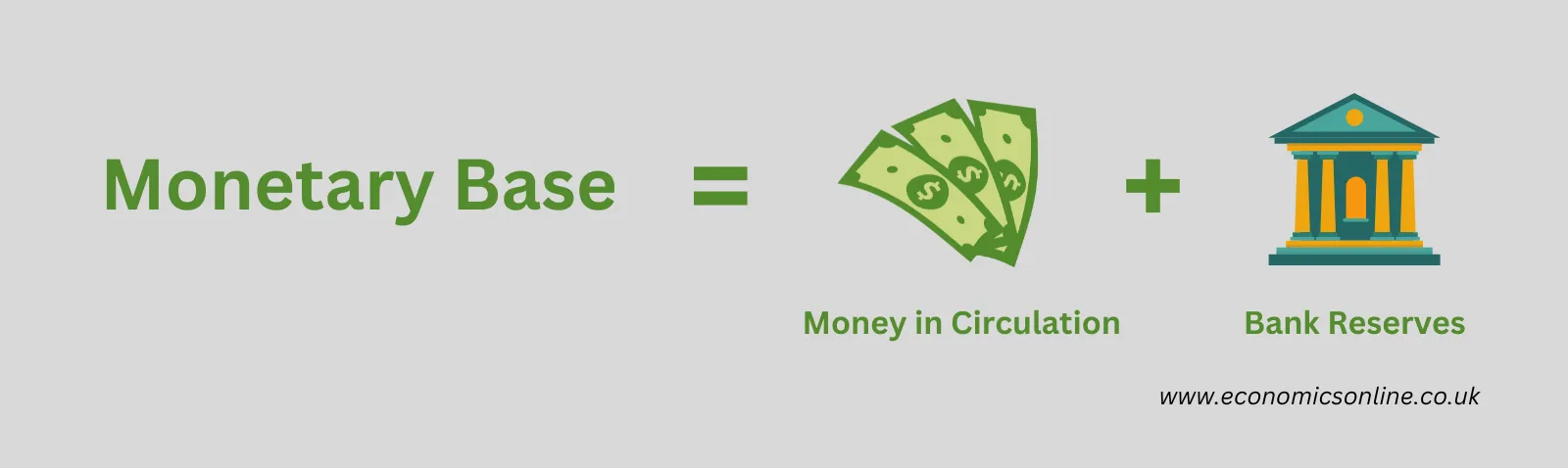

Monetary base means the total amount of money in an economy, either in the form of notes and coins or held as reserves by commercial banks. It is also called base money, narrow money, or high powered money.

Monetary base is an important concept in economics for understanding monetary policy and the role of a country's central bank in regulating an economy. It is the most basic form of money in an economy, as it is used to create other types of money, such as bank deposits and credit.

Monetary Base = Notes + Coins + Bank Reserves

Components of Monetary Base

There are two components of the monetary base.

Money in Circulation

"Money in circulation" means the physical currency that is in circulation in an economy, including banknotes and coins. It includes all the physical money in an economy that is not held by banks or the central bank.

Bank Reserves

Bank reserves refer to the funds that commercial banks are required to hold in reserve with the central bank of the country in which they operate. These reserves are used to ensure that banks have enough liquidity to meet the demands of their customers.

Monetary Base vs. Money Supply

The monetary base is different from the money supply, which includes not only notes, coins, and bank reserves but also other forms of money such as checkable deposits, saving deposits, and time deposits. Hence, the monetary base can be considered a part of the money supply in an economy.

Monetary Base and the Money Multiplier

The monetary base is closely related to the "money multiplier" or "credit multiplier," which refers to the amount of money that can be created by commercial banks for every unit of reserves they hold. It is reciprocal to the cash reserve ratio. For example, if the cash reserve ratio is 20% (for every $100 deposited in commercial banks, they must hold $20 as cash reserves), the money multiplier will be 5. The size of the money multiplier determines the amount of deposit money created by commercial banks through the process of fractional reserve banking.

Significance of Monetary Base

The monetary base is an important part of the total money supply in an economy, as it serves as the foundation upon which other types of money are created. The size of the monetary base can be used to track changes in the money supply, and hence, it is considered an important indicator of the health of an economy. The following points explain the importance of a monetary base in an economy.

Money Supply

The monetary base is used to create other forms of money, such as bank deposits and credit. Banks use the monetary base to create deposit money through the process of fractional reserve banking. When banks extend loans, they create new deposits that become part of the money supply. The amount of deposit money that banks can create through lending is limited by the cash reserve requirement, which is the percentage of deposits that banks must hold. The governments and the central banks control the money supply in an economy by controlling the monetary base. Changes in the monetary base can have a significant impact on the money supply of an economy, and it is part of monetary policy that governments use to achieve macroeconomic objectives.

Inflation

The monetary base plays an important role in determining the level of inflation in an economy. When the monetary base increases, it can lead to inflation, as there is more money in circulation in the economy. When governments want to control inflation, they decrease the money supply by shrinking the monetary base as a part of contractionary monetary policy.

Central Banking

The monetary base is one of the key tools used by central banks in order to implement monetary policy. Central banks can change the monetary base along with interest rate on the instructions of government in order to exert control over the whole economy. Central banks do this through open market operations, which involve buying and selling government securities in the open market to influence the level of bank reserves and hence the monetary base. When the central bank buys government securities, it injects reserves into the banking system, which increases the monetary base and allows banks to create more deposit money. This increase in the money supply can help governments achieve various macroeconomic objectives, including economic growth and low unemployment.

Economic Growth

The size of the monetary base can affect economic growth in an economy. When the monetary base is increased, it can lead to increased consumption and investment, which can stimulate economic growth through a rightward shift in the aggregate demand curve.

Conclusion

The monetary base is a critical component of the money supply in an economy, and it serves as the foundation for the creation of other forms of money. It is a device used by central banks in order to apply monetary policy.