An image showing an increasing profit.

Profit Maximisation

What is Profit Maximisation?

Profit maximisation means producing and selling an output that gives the greatest positive difference between total revenue and total cost.

Maximising the profit is a key corporate objective of many private sector firms.

Why to Maximise Profit?

Although there are many other corporate objectives that firms pursue, including business growth, increasing market share, increasing shareholder value, corporate social responsibility, sales maximisation, revenue maximisation, yet, profit maximisation has its own significance.

Many firms try to maximise profit for the following reasons:

Reward for the Owners

Profit is the reward for the owners or shareholders because they take the risk of making an investment in the business. Owners risk their money, and they deserve the reward in the form of profit. In the absence of this reward, owners might not be willing to take the risk of investing money in the firms.

Business Growth

Profit is also needed for business growth. Profit serves as a source of finance for investing it back into the business in order to expand its size. A higher profit means that the business will have a good amount of money for expansion.

Research and Development

Profit is also needed for research and development (R and D) into new profits and processes. Innovation is expensive, and higher profits can be invested in developing new products and processes that are essential for survival and future sales.

Success Symbol

Profit is also a symbol of a successful business. Generating a higher profit means that the business is successful in selling its goods and services.

Profit Maximisation Rule

An important question arises here about how firms will maximise profit and the answer is by using profit maximisation rule.

This rule states that the profit of a firm will be maximum at an output for which,

- Marginal Revenue (MR) = Marginal Cost (MC)

- The marginal cost curve cuts the marginal revenue curve from below.

These two conditions form the profit maximisation rule or the profit maximisation principle. This rule is used by firms to find profit maximisation output.

Here, marginal revenue (MR) is the additional revenue generated by selling an additional unit of output, while marginal cost (MC) is the extra cost of producing an extra unit of output. The profit maximization rule means that a firm should produce an additional unit of output as long as the additional revenue generated exceeds the additional cost incurred. This rule is derived from the principle of marginal analysis, which focuses on analysing incremental changes in revenue and cost.

By comparing the marginal cost with the marginal revenue, firms can assess the profitability of each additional unit produced. If the marginal revenue exceeds the marginal cost, producing more units will lead to increased profits.

Profit Maximisation in Perfect Competition

The perfection competition is a market structure where many small firms sell identical products. Each firm in a perfectly competitive market is a price taker, meaning it has no control over the market price. Since firms have no market power to influence the price in the market, the price and the marginal revenue are constant in perfect completion. This means that the marginal revenue curve is a horizontal straight line while the total revenue curve is an upward sloping straight line.

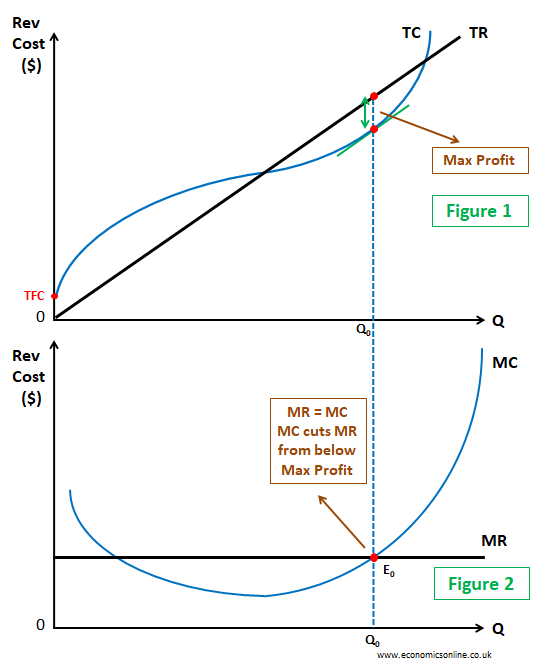

The following graphs illustrate the use of profit maximisation rule for a perfectly competitive firm.

Figure 1 shows total revenue (TR) and total cost (TC) curves. Profit is maximum at Q0, where the positive difference between the TR and TC curves is maximum.

For output Q0, tangents drawn at the TR and TC curves are parallel. Hence, the gradients of TR and TC are equal, which indicates that MR = MC.

Figure 2 shows MC and MR curves. For profit max output Q0, at point E0, MR = MC, and MC cuts MR from below.

Hence, Q0 is the profit maximisation output which gives the highest profit.

Profit Maximisation in Imperfect Competition

The imperfection competition is a market structure where firms have some degree of market power and can influence prices (monopolies and oligopolies). The profit maximization rule still applies. Here firms are price makers and the shape of the MR curve is downward sloping.

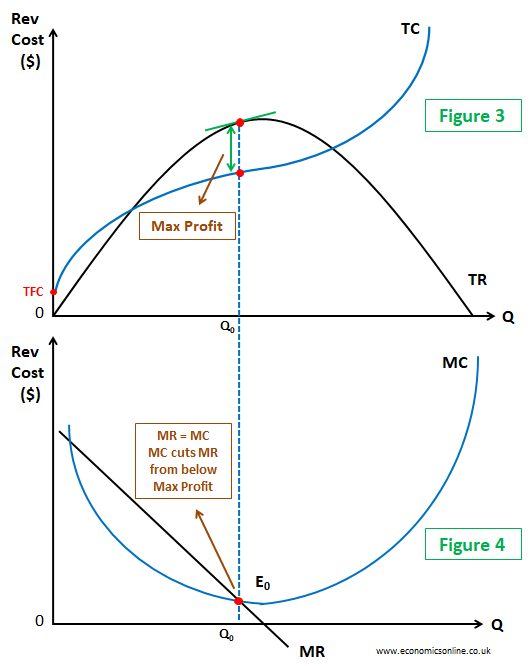

The following diagrams illustrate the use of profit maximisation rule for firms in imperfect competition.

Figure 3 shows total revenue (TR) and total cost (TC) curves. Profit is maximum at Q0 where positive difference between TR and TC curves is maximum.

For output Q0, tangents drawn at TR and TC curves are parallel. Hence gradients of TR and TC are equal which indicates that MR = MC.

Figure 4 shows MC and MR curves. For profit max output Q0, at point E0, MR = MC and MC cuts MR from below.

Hence Q0 is the level of output which generates maximum profits.

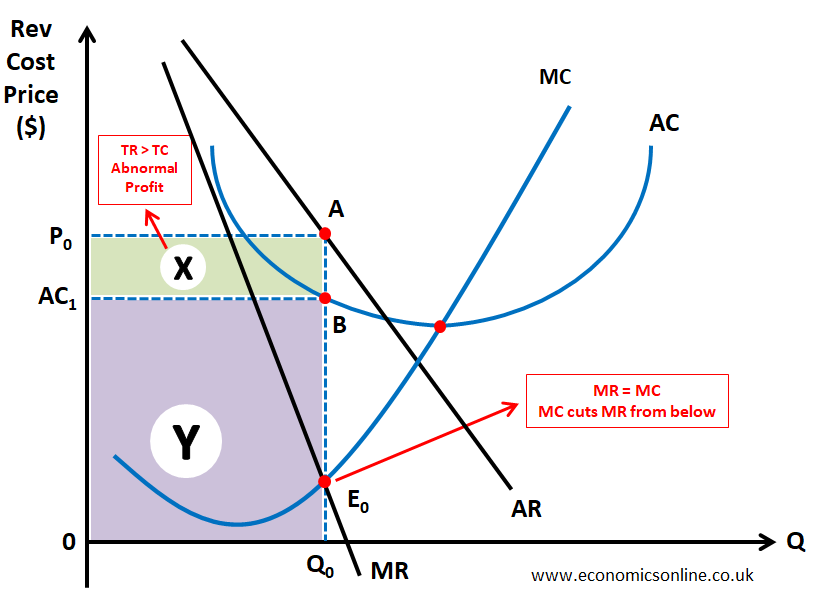

While firms in perfect competition make normal profit in the long run, monopolies generate abnormal profit (positive profit). The following diagram illustrates the monopoly profits generated in the long run.

In above diagram, curves are shown for marginal revenue (MR), average revenue (AR) and marginal cost (MC). The average cost curve (AC curve) is also shown. This is also called average total cost (ATC). Average variable cost (AVC) curve is not drawn in the long run. The x-axis shows the quantity (Q) or the quantity of output while the y-axis shows revenue, cost and price. The AR curve is also firm's demand curve.

The profit maximization formula is used to find equilibrium point E0.

By drawing a perpendicular from point E0 on X-axis, we find Q0, which is profit maximisation output. P0 is the equilibrium price.

For output Q0, total revenue is shown by areas X and Y while total cost is shown by area Y. Total monopolist's profit is represented by area X shown by a shaded rectangle. Since total revenue (area X and Y) is greater than total cost, the monopolist firm is making abnormal or supernormal profit.

Limitations

While the profit maximisation rule provides a useful framework for decision-making, it has the following limitations.

- High profit will attract competitors, which can take it away.

- Owners of small firms may want to retain control and independence instead of maximizing profit.

- Focusing only on profit maximisation means disregarding other important factors such as social welfare, environmental sustainability, and ethical concerns. Critics argue that solely pursuing profit maximisation can lead to negative externalities and harm stakeholders in the long run.

Conclusion

The profit maximisation rule is an extremely important concept in economic decision making. By aligning marginal revenue with marginal costs, firms can optimise their profitability. However, it is important to recognise the limitations of a purely profit-oriented approach and consider its broader societal and ethical implications.