Picture showing a bar chart with upward trend.

Ricardian Equivalence

What is Ricardian Equivalence?

Ricardian Equivalence is a theory that focuses on the relationship between government spending, taxation, and private consumption. It states that an increase in government spending through borrowing or taxation has no effect on the total demand for goods and services in an economy and hence on economic growth. This theory is also called the Barro-Ricardo equivalence proposition or Ricardian equivalence theorem.

This theory was proposed by a British economist named David Ricardo in the early 19th century. However, the modern form of this theory owes much credit to the American economist Robert Barro, who advanced and propagated the concept in the 1970s and 1980s. Barro's work on Ricardian equivalence has had a major effect on macroeconomic theory and has been extensively studied and pondered by economists ever since.

The Basic Idea of Ricardian Equivalence

The basic idea of this theory is that individuals are rational and they understand the impact of government policies on their future income and consumption. Therefore, individuals will adjust their behavior to reflect changes in government spending and taxes, regardless of whether the changes are due to borrowing or taxation.

In other words, if the government increases spending and decides to borrow money to fund that spending (government deficit), individuals expect that the government will have to repay that borrowing in the future. Therefore, they spend less and save more to prepare for their future tax obligations.

Assumptions of Ricardian Equivalence

Ricardian equivalence is based on the following assumptions.

Individual Rationality

Individuals are rational and can anticipate the future. They understand the impact of government policies on their future income and spending.

Perfect Capital Markets

Individuals have access to perfect capital markets. This means that they can borrow and lend at the same interest rate, allowing them to smooth out their spending over time.

Permanent Income Hypothesis

Individuals base their consumption on their expected permanent income, rather than their present income.

No Liquidity Constraints

Individuals do not face any liquidity constraints which mean that they have access to enough funds to even out their spending over time, regardless of their present income.

No Uncertainty

Individuals have perfect information about future taxes and government spending. This means that they can accurately predict the future tax obligations required to repay any borrowing used to finance government spending.

Working of Ricardian Equivalence

According to Ricardian Equivalence, if the government funds its spending through borrowing, consumers expect future tax increases to repay the debt and will adjust their spending accordingly. This means that the increased government spending will have little to no impact on aggregate demand in the short-term, and it will stay equivalent , as consumers will reduce their current spending to save for future tax increases.

On the other hand, if the government finances its spending with taxes (budget deficits), consumers and private sector firms will expect tax cuts in the future and will spend more now. In this case, the increase in government spending will also have little to no impact on aggregate demand and, hence on GDP, as consumers will increase their current consumption to offset the tax increase.

Overall, Ricardian Equivalence suggests that the methods used to fund government spending (through borrowing or debt-financed) do not affect aggregate demand in the economy, as consumers will adjust their behavior to accommodate any changes in taxes or borrowing.

Implications of Ricardian Equivalence for Policymakers

The implications of Ricardian equivalence are significant for the policymakers, as it suggests that fiscal policy may not be an effective tool for promoting aggregate demand in the short run, and that other policy tools, such as monetary policy, may be more effective.

The Ricardian equivalence suggests that the burden of government borrowing falls on future generations rather than the current generation. This is because the current generation understands that the government will have to repay any borrowing in the future, which means that the taxpayers will adjust their spending patterns to account for possible future tax liabilities. Therefore, the theory of Ricardian equivalence suggests that the current generation doesn't benefit from government spending funded through borrowing, and that the burden of debt falls on the future generation in the long run.

Difference between Ricardian Equivalence and Keynesian Theory

Ricardian equivalence and Keynesian theory are two contrasting views on the role of government in managing the economy.

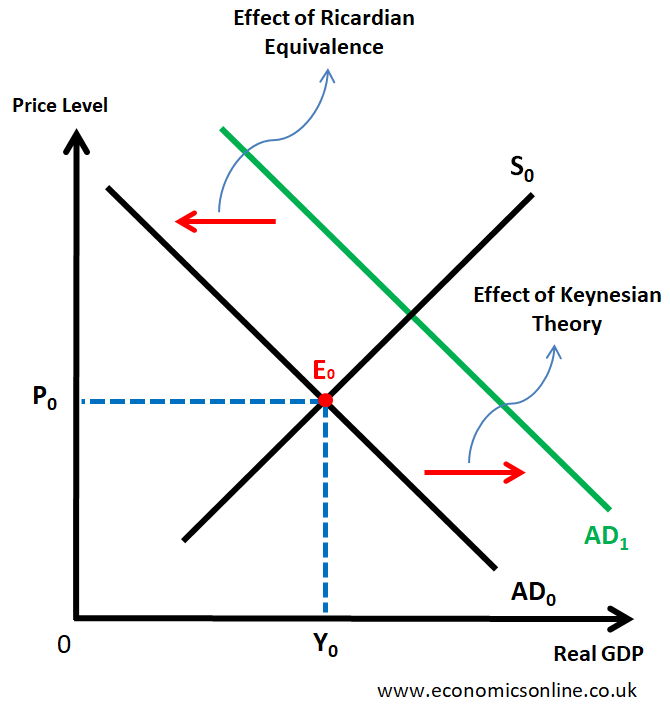

The following diagram is used to illustrate that difference.

Keynesian theory, developed by John Maynard Keynes, argues that government intervention is essential to stabilize the economy. In case of economic recession, the government should increase its spending and cut taxes to stimulate aggregate demand. This approach is known as expansionary fiscal policy. The effect of Keynesian theory is shown by the rightward shift of the Aggregate Demand curve from AD0 to AD1.

In contrast, Ricardian Equivalence suggests that government spending and taxation have no effect on aggregate demand and it stays at AD0 position as shown in the diagram. The consumers will adjust their behavior to offset any changes in government policy. So, the government intervention is largely ineffective and the market forces should be left to operate freely.

While both theories have their strengths and weaknesses, they have important implications for policymakers. Keynesian theory suggests that in times of economic downturns, the government should be proactive in stimulating demand, while Ricardian Equivalence suggests that policymakers should be cautious about the long-term implications of government policies on future tax liabilities and debt. Ultimately, policymakers must weigh the costs and benefits of government intervention and choose the approach that is best suited to their economic goals and circumstances.

Criticism on Ricardian Equivalence

Firstly, the assumption of perfect capital markets is unrealistic. In reality, individuals face various constraints, such as borrowing constraints, transaction costs, and credit market imperfections, which prevent their access to credit on the same terms as the government. As a result, individuals may not be able to even out their consumption over time in the way as suggested by the theory.

Secondly, the Permanent Income Hypothesis, may not be true in real life. Individuals may not base their consumption decisions only on their expected permanent lifetime income, but also on their current income and other factors, such as the credit availability and social norms.

Thirdly, the assumption of no uncertainty is unrealistic. In practice, individuals may not have perfect information about future taxes and government spending, so they may not be able to predict future tax obligations accurately. This means that the individuals may not adjust their behavior in the way that the theory predicts.

Fourthly, the assumption that there are no liquidity constraints is unrealistic. In practice, individuals may face liquidity constraints, especially during economic recession, which can limit their ability to smooth their spending over time.

Finally, individuals may not be as forward-looking and rational as the theory suggests. Many individuals may not understand the implications of government financing decisions or may not adjust their behavior accordingly.

Although the assumptions of Ricardian Equivalence provide a strong theoretical foundation for the theory, they have been criticized for being unrealistic and not reflecting the real world complexities. As a result, the predictions of Ricardian equivalence may not hold in practice, and policymakers need to be careful when applying the theory to real-world situations.

Conclusion

Ricardian equivalence is an important economic theory that challenges the traditional views of government spending and its impact on the economy. It suggests that traditional Keynesian economics may not be as effective as previously thought, and that the burden of government debt falls on future generations. Understanding Ricardian Equivalence can help policymakers make more informed decisions about government spending and taxation.