Photo by Viacheslav Bublyk / Unsplash

Sticky Wages

Definition

A concept in economics that describes how nominal wages respond slowly to changes in the economy and labour market conditions is called sticky wages. Sticky wage theory suggests that nominal wages are rigid and sticky in their very nature. Nominal wages increase slowly, at least in the short run, because of long term employment contracts and the firm's efficiency targets. In particular, wages are sticky-down, which means that they can move up easily but are less likely to move down. This is because workers hinder the nominal wage cuts in the real world. Moreover, firms don’t want negative publicity or trade union’s industrial actions. In other markets, prices can adjust freely according to the demand and supply in the market, but wages respond slowly to the change in the labour market. This dullness or laziness is termed “sticky wages,” and will be discussed in detail in this article.

Origin

John Maynard Keynes was the one who introduced the sticky wage theory and named it “nominal rigidity” of wages. The sticky wage theory states that when economic conditions change, such as an increase in unemployment or an economic recession, the wages of the employed workers remain the same or increase at a slower rate rather than decreasing with the decrease in labour demand.

Sticky-Up Wages

Those wages that can easily be put down but go up with difficulty are called sticky-up wages.

Sticky-Down Wages

Those wages that can easily move up but slow down with difficulty are called sticky-down wages.

Flexible Wages vs. Sticky Wages

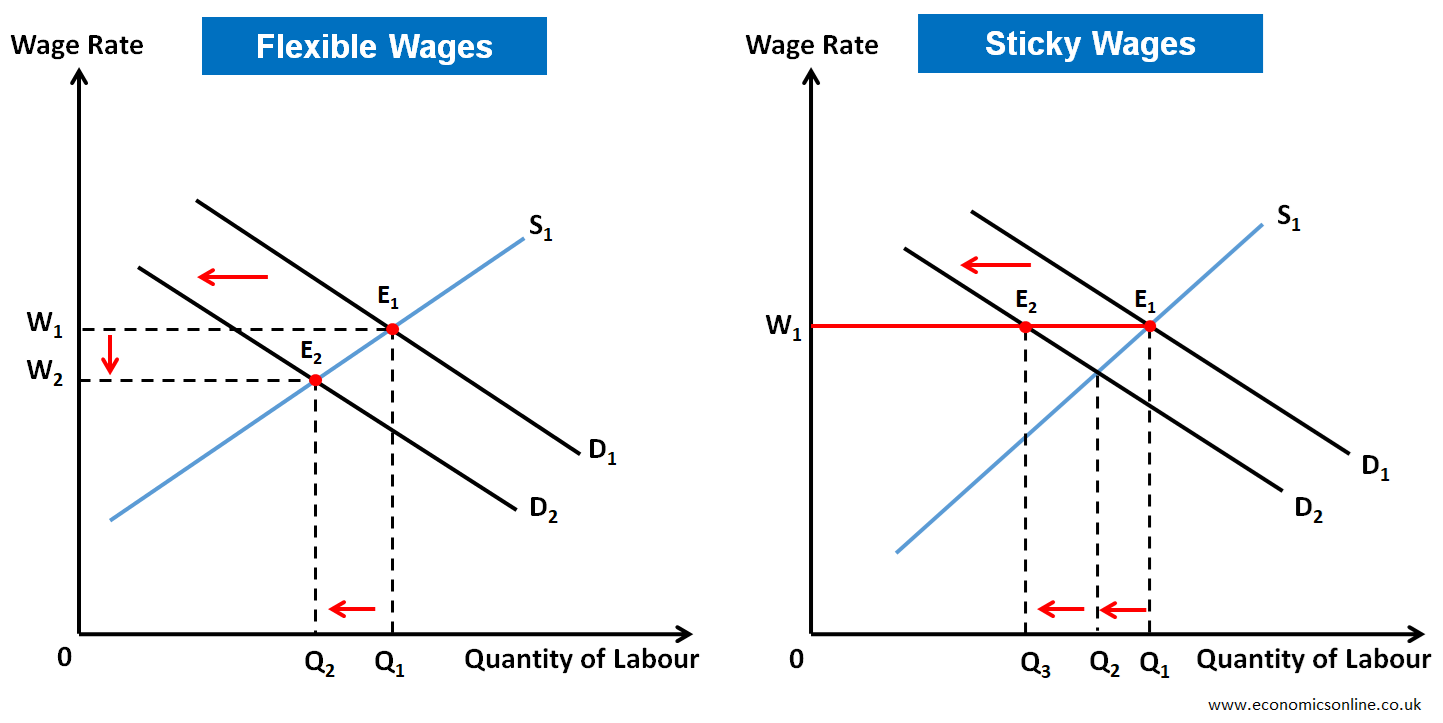

The following graphs illustrate a comparison between sticky wages and flexible wages.

Both graphs are plotted between wage rate on the vertical axis (y-axis) and the quantity of labour on the horizontal axis (x-axis). The graph on the left side is for flexible wages, and the right one is for sticky wages. Both graphs represent demand for labour and supply of labour. In the flexible wages graph, if labour markets are perfectly competitive, then a change in demand for and supply of labour will cause a change in wages. In the case of a fall in demand for labour, firms respond by cutting wages to the equilibrium wage of W2 and the level of employment decreases from Q1 to Q2. In the sticky wages graph, wages remain at W1 and if demand for labour decreases from D1 to D2, then firms cannot cut the wage rate, rather, they respond by decreasing the level of employment from Q1 to Q3. Hence, with sticky wages, there is more unemployment, as illustrated by the above graphs. In the real world, there are a variety of factors that prevent the wage rate from falling.

Reasons for Wage Stickiness

There are some of the main reasons why wages show stickiness:

Efficiency Wage Theories

There is a concept that when firms pay high wages to employees, it increases their morale, loyalty, and willingness to work hard for their firms. A nominal cut in their wages is a psychological storm that can reduce workers morale and productivity. Therefore, firms realise that the cost savings through lower wages will translate into lower productivity.

Employment Contracts

Workers work for firms on a contract basis, stating a 3%, 5% or 10% increase in their wages per year in return for productivity. If there is a decrease in the labour demand due to recession or unpopularity of a product, firms are bound to follow the contract and are unable to cut their wages, at least for the short term.

Minimum Wage Legislation

This law states the minimum legal wage which employer must pay to workers. Payment of wage below the national minimum is illegal. Due to this law, firms are unable to cut the wage rate below the national statutory minimum wage.

Trade Unions

Trade unions also hinder wage cuts because they are more concerned about the wages of those in work as compared to those who are unemployed or not in a trade union. The unemployed workers are willing to work at lower wages as compared to the employed ones, who do not want to see the wage cut at all.

Cost Associated with Labour

Labour is not that kind of commodity, like buying inputs of raw material for production. Once a worker is trained and doing his work productively, managers or owners of firms do not want to lose the worker or cut wages because of the human costs involved.

Annual Contracts

Wages are set on a yearly basis, so, in the short term, wages are inflexible and fixed, but in the long term, wages are more flexible than in the short term.

Nominal Rigidity and Deflation

At times of very low inflation or deflation, wages are more sticky because if the inflation rate is 9%, then firms increase nominal wages to 8% to gain a real wage cut of 1%. But if inflation is 0%, in order to attain the same real wage cut, firms are bound to cut nominal wages by 1%. This nominal wage cut is a greater psychological storm for workers as compared to the increase in nominal wages of 8% at the time of inflation.

Keynesianism and Sticky Wages

The nominal wage rigidity, or sticky wages, was a main concept in “The General Theory of Employment, Interest, and Money,” written by the economist John Maynard Keynes. In this book, he argued that in a recession, when prices fall, wages do not reduce to restore the state of equilibrium, although this can lead to real wage unemployment. He also pointed to factors like aversion to nominal wage cuts. In the 1930s, the great depression occurred, and countries faced a period of deflation and a great rise in the rate of unemployment.

According to Keynes, sticky wages were not a purely supply side problem. The solution to this problem was not to make wages flexible and force wage cuts but to boost aggregate demand, which automatically increased the demand for labour. Keynes also argued that if firms cut wages during periods of deflation or recession, it would cause a lower worker’s income; due to this, aggregate demand fell and the demand for labour also decreased. He argued for expansionary fiscal policies to enhance the demand for labour.

Classical Economics and Sticky Wages

Both classical and monetarist economists are sceptical of sticky wages. They have more faith in that the labour markets should clear and wages should fall to attain equilibrium wages. But in times of unemployment, they may point to the barriers to free markets, like the impact of trade unions, minimum wages, etc. Wages can become less sticky and attain equilibrium levels by removing these barriers to free markets.

Employment and Sticky Wages

The theory of sticky wages states that when stickiness enters the labor market, then change in one direction will favour change in other directions. As wages are known as sticky-downs, wage movements will be in an upward direction rather than downward, leading to an upward trend in wage movements. This propensity is usually referred to as “creep” or the ratchet effect.

Some economists have also proposed theories that stickiness can be contagious, in effect spilling from one affected market area to the other unaffected areas.

Some also warned that this kind of stickiness is only an illusion, as real income will be reduced in terms of buying power of money due to inflation over time. This is called wage-push inflation.

If the wage stickiness enters into one area or industry sector, then it will also bring stickiness to other areas or industry sectors due to the competition for jobs and the efforts of companies to keep the wages competitive.

Stickiness of wages can also have significant impacts on the global economy. For example, foreign currency rates can overreact in an attempt to account for price stickiness. This will lead to a substantial degree of volatility in exchange rates around the world. This phenomenon is called overshooting.

Importance of Sticky Wages

The importance of sticky wages is because it separates the link between macroeconomics and microeconomics, which means that deflation and inflation can have significant impacts on economic growth and stability.

Analysis of Sticky Wages

The following points explain the analysis of sticky wages:

Nominal Wages can Fall

At the times of the Great Depression, nominal wages were reduced in many manufacturing industries globally. The actual weekly earnings of many manufacturing workers were reduced by 33.6% between 1929 and 1932.

Stickiness of Wages and Prices

Wages and prices are both interlinked. If wages are sticky, prices can automatically be sticky too. However, prices tend to be more flexible as compared to wages. But a study found that wage stickiness is more striking as compared to price stickiness.

Consequences of Sticky Wage Theory

The following are some consequences of sticky wages:

Unemployment

During recessions, sticky wages hinder labour market clearing at low wages, which leads to unemployment because firms choose layoffs rather than pay cuts.

Inflationary Pressures

Those firms that are facing cost pressures from sticky wages may choose to increase prices instead of cutting wages. This practice of firms contributes to inflationary tendencies in the economy.

Slow Recovery

When aggregate demand declines, sticky wages obstruct aggregate supply adjustments, which can potentially increase the duration of economic downturns.

Policy Implications of Sticky Wage Theory

The following are two main policy implications of sticky wage theory:

Demand-Side Policies

Keynesian theory suggests enhancing aggregate demand by using fiscal and monetary measures to boost output and hiring, reducing the need for wage cuts and adjustments.

Income Policies

Some Keynesians recommend temporary interventions, like wage price control, to address long periods of severe economic downturns.

Criticisms of Sticky Wage Theory

The following are two main criticisms of sticky wage theory:

Oversimplification

Critics of sticky wage theory claim that this theory oversimplifies and overlooks factors like wage differentiation and wage adjustments within firms.

Empirical Evidence

Critics also argued that wage adjustments are not that immediate and not as rigid as Keynes suggested in his theory.

Conclusion

In conclusion, the sticky wage theory of Keynes has a significant impact in macroeconomic analysis and is used to highlight the difficulties of labour market dynamics and their interaction with economic fluctuations. However, despite being criticised, the theory is still present in policy discussions and guide interventions that aim at achieving full employment and economic stability in the countries.