An image of people walking through a triangle tunnel.

Trilemma: A Comprehensive Guide

What is a Trilemma?

A trilemma refers to a situation in which three options are available, but only two can be chosen at a time. It is a situation in economics and international finance in which all three possible options are difficult or nearly impossible to achieve.

Unlike a dilemma, which has two options, a trilemma has three options, all of which cannot be selected at once.

Trilemma in Economics

The impossible trinity is an example of a trilemma in economics. In an impossible trinity, a country can’t have a fixed exchange rate, independent monetary policy, and free capital movement all at once. A country can achieve only two out of the three policy objectives. The impossible trinity involves a third option as a trilemma constraint, which cannot be achieved with the selected two options. It means that the selection of any two options will make it necessary to sacrifice the third beneficial option. It is like a three-way trade-off.

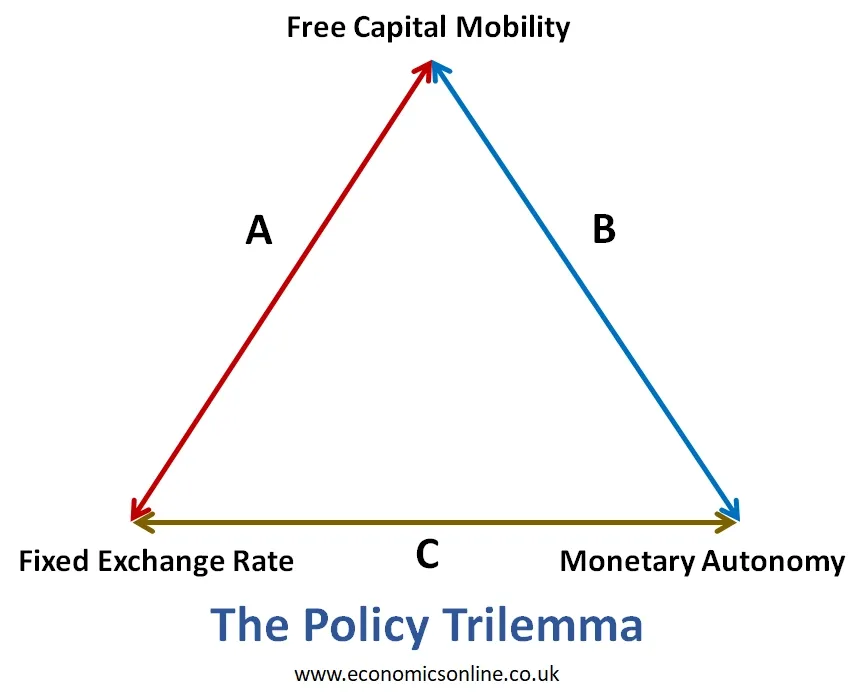

The Policy Trilemma Diagram

The following diagram is a simple representation of the policy trilemma, or the impossible trinity, faced by economies.

The above diagram illustrates that the government can’t have a fixed exchange rate, free capital movement, and monetary autonomy all at once. The government has to select any one option out of the following three options:

A: Fixed exchange rate and free capital mobility (Monetary autonomy is sacrificed)

B: Free capital mobility and monetary autonomy (Fixed exchange rate is sacrificed)

C: Fixed exchange rate and monetary autonomy (Free capital mobility is sacrificed)

Causes of the Policy Trilemma

Option A: Fixed Exchange Rate and Free Capital Mobility

By selecting this option, the government will set a fixed exchange rate and permit free mobility of capital; however, monetary autonomy will be sacrificed. This is due to the fact that to maintain a fixed exchange rate, the interest rate cannot be freely changed; otherwise, there will be pressure on the exchange rate due to the free flow of capital.

Option B: Free Capital Mobility and Monetary Autonomy

By selecting this option, the government and central banks will have monetary policy independence and allow free mobility of capital; however, a fixed exchange rate will not be possible. This is due to the fact that the change in interest rate and the free international capital flows will put pressure on the exchange rate, which cannot remain fixed.

Option C: Fixed Exchange Rate and Monetary Autonomy

By selecting this option, the government will set a fixed exchange rate and have monetary independence; however, the capital movement cannot be free. This is due to the fact that changes in the interest rate at a fixed exchange rate will demand control over the movement of capital; otherwise, a fixed exchange rate cannot be maintained. Moreover, maintaining a fixed exchange rate also required changes in international reserves and, hence, free capital movement.

Factors affecting the Trilemma

The following factors affect the trilemma, which are explained as follows:

Fluctuating Demand

The fluctuating demand for goods or services in a country negatively affects the fixed exchange rates. But this allows for free capital movement and independent monetary policies to be implemented in the country to encourage economic growth.

Weather Conditions

Industries that are heavily influenced by seasonal variations, such as tourism or agriculture, can pose challenges in balancing the trilemma due to the fluctuating nature of their activities.

School Schedules

The academic calendar can impact the availability of labour, especially for jobs that are popular among students, resulting in seasonal unemployment and affecting the trilemma.

Holiday Cycles

Certain industries experience peak demand during specific holiday seasons, leading to temporary employment and potential conflicts with the trilemma.

Natural Resources

Countries heavily reliant on natural resources, like oil or minerals, may face challenges in managing the trilemma due to the volatility of commodity prices and their impact on the exchange rate and monetary policy.

Mundell-Fleming Trilemma Model

The trilemma model was first explained by economists Robert Mundell and Marcus Fleming. That is why this model is known as the Mundell-Fleming trilemma model, which is named after the names of its developers for its identification. This model explains another dimension, which is the stable economy of a country.

The trilemma usually refers to three policy goals: fixed exchange rates, free capital movement, and independent monetary policy. But this model adds another goal of stabilising the economic condition of a country, including factors like inflationary pressures, the unemployment rate, etc.

The Mundell-Fleming model explains that it is difficult for countries to achieve all four objectives. For example, when a country wants to establish a fixed exchange rate and have an independent monetary policy, it has to limit the free movement of capital in the country. But when a country wants to put free capital movement in it along with an independent monetary policy, then it might fluctuate the fixed exchange rate.

Academic Influences on the Trilemma

The following economists contribute to the development and understanding of trilemma configurations and the academic influences on it:

Paul Krugman

Paul Krugman, a Nobel laureate and renowned economist, has made significant contributions to international economics and trade theory. While not directly focused on the trilemma, his work on exchange rates, monetary policy, and globalisation has influenced the understanding of the trilemma and its implications for policy.

Other Economists

Numerous other economists have contributed to the academic understanding of the new patterns of the trilemma through their research and writings. This includes economists such as Maurice Obstfeld, Barry Eichengreen, and Dani Rodrik, among others.

Trilemma in other Fields

The examples of trilemma in other fields are explained below:

In Law

In legal ethics, there is a trilemma known as the "ethical trilemma." It presents lawyers with three conflicting obligations: their duty to the client, their duty to the court, and their duty to uphold the rule of law. Lawyers often face difficult decisions when these obligations come into conflict.

In Philosophy

In philosophy, the trilemma is often associated with the "Münchhausen trilemma." It highlights the challenges of providing a logical foundation for knowledge or justification. The trilemma suggests that any attempt to justify beliefs leads to an infinite regress, circular reasoning, or dogmatic assumptions.

In Economics

We've already discussed the trilemma in economics, which focuses on the trade-offs faced by policymakers in managing exchange rates, capital mobility, and monetary policy autonomy.

In Politics

The political trilemma refers to the challenge of reconciling national sovereignty, democracy, and globalisation. It suggests that it is difficult to have all three simultaneously, as globalisation can limit national sovereignty and democratic decision-making.

In Business

In the business world, the trilemma often arises when companies have to balance the trade-offs between cost, quality, and speed. Achieving all three simultaneously can be challenging, and businesses often have to make strategic decisions based on these competing factors.

In Computing and Technology

In computing and technology, the trilemma can be observed in the context of the CAP theorem, which states that in a distributed system, it is impossible to achieve consistency, availability, and partition tolerance simultaneously.

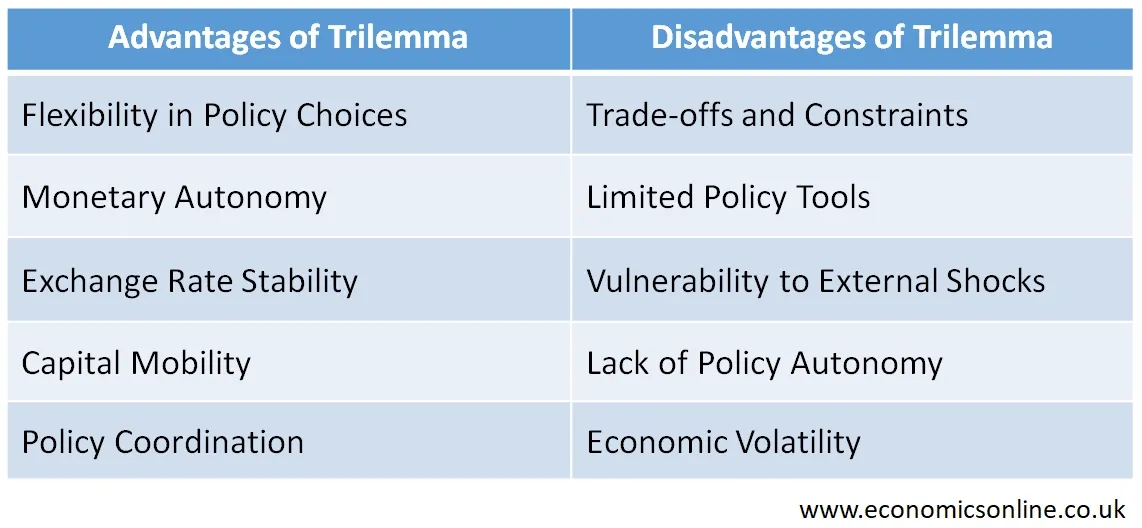

Advantages of Trilemma

The following points explain the advantages of a trilemma:

Flexibility in Policy Choices

The flexibility in policy allows policymakers to choose the best possible option that is good for the country’s stake and the situation of the economy.

Monetary Autonomy

The trilemma gives countries the ability to have an independent monetary policy, which can be crucial in managing inflation, interest rates, and overall economic stability. However, it also indicates that monetary policy alone cannot achieve financial stability in a country.

Exchange Rate Stability

By choosing to have a fixed exchange rate, countries can promote stability in international trade and investment, making it easier for businesses to plan and operate.

Capital Mobility

Allowing free capital movement can attract foreign investment, stimulate economic growth, and facilitate the transfer of funds across borders.

Policy Coordination

The trilemma encourages policymakers to find a balance between the three aspects, fostering coordination and collaboration with other countries to achieve mutually beneficial outcomes in the long run.

Disadvantages of Trilemma

The following points explain the disadvantages of the trilemma:

Trade-offs and Constraints

Trade-offs and constraints are a major disadvantage of the trilemma, as they make it difficult for policymakers to consider all three options accordingly. This makes the choices difficult to achieve.

Limited Policy Tools

The trilemma limits the range of policy tools available to policymakers, as pursuing one objective may hinder their ability to effectively address other economic challenges.

Vulnerability to External Shocks

When a country's policy choices are constrained by the trilemma, it can leave them more vulnerable to external shocks, such as financial crises or sudden changes in global economic conditions.

Lack of Policy Autonomy

The trilemma can restrict a country's ability to fully control its monetary and exchange rate policies, as it may need to align its decisions with global market forces and international financial institutions. However, professor Hélène Rey argued that capital flows, asset prices, and credit growth can move together across countries in a global financial cycle.

Economic Volatility

Striking a balance between the trilemma's three objectives can be challenging, potentially leading to economic volatility, as policy adjustments may be required to manage changing economic conditions.

The following table summarises the advantages and disadvantages of the trilemma.

Bretton Woods and the Eurozone

Bretton Woods, the international monetary system after the world war II that founded the international monetary fund (IMF), saw numerous nations fixing their exchange rates with the US dollar (currency pegs) while striving to preserve their monetary autonomy. Consequently, during the post-war era, many countries implemented various forms of capital controls. The disintegration of the Bretton Woods system was partly attributable to the difficulties related to controlling the capital flows.

In the Eurozone, member countries have essentially adopted a fixed exchange rate and committed to the free movement of capital. Consequently, the nations in the euro area had to sacrifice their individual monetary independence. The European Central Bank (ECB) dictates interest rates to all the member countries.

Conclusion

In conclusion, a trilemma refers to a situation in which three options are available, but only two can be chosen at a time. Some factors, such as school schedules, holiday cycles, and fluctuations in demand, affect the trilemma. A trilemma has both advantages and disadvantages. Trilemma can be seen in many fields, such as law, politics and psychology.