A photo of a human hand.

Types of Takeovers in Economics

Definition

When one company makes a successful bid to acquire or assume control of another firm, this is called a takeover. Takeovers can be held by purchasing a large number of shares of the target firm. It can also be done through the merger and acquisition process. In the case of a takeover, the firm that wishes to make the bid is called the acquirer, and the firm that they are going to purchase or merge with is called the target.

The process of takeover is typically initiated by large firms that wish to take control over small firms. Takeovers are voluntary actions that can be done with the mutual understanding of both firms. But sometimes, takeovers are unwelcome, in which the acquirer firm goes without informing the target firm or without its full agreement.

In the corporate finance sector, takeovers can be structured in a variety of ways. The acquirer company seeks to take control over the controlling interest of the firm’s outstanding shares (issued shares) of the target firm, buy the whole firm’s outright, merge with the target firm to make new alignments, or take over a firm as a subsidiary.

Examples

The following are some main examples of a takeover:

Tata Steel’s Acquisition of Corus Group (2007)

India’s largest steel manufacturer, Tata Steel, made a historic acquisition by taking over the UK-based Corus Group in 2007. This was the biggest achievement for an Indian company. This move helped Tata Steel become famous in the global marketplace, and then he became one of the largest steel manufacturers around the world.

Birla Group’s Takeover of Novelis (2007)

An Indian multinational compound, the Aditya Birla Group, took over Novelis, which was the world’s largest aluminium rolling and recycling company, in 2007. This takeover allowed the Aditya Birla Group to expand its identity in the aluminium industry worldwide.

Reliance Industries’ Acquisition of Future Group’s Retail Business (2020)

The Reliance industries, which are the largest collaborators, took over retail and wholesale business of Future Group in 2020. This takeover was helpful for the reliance industry to make its position stronger in the retail industry and expand its business globally.

Reasons for the Takeover

The following are some reasons why a company wants to take over another firm:

Business Growth

Companies acquire another firm to expand their own business. With the takeover of small firms, they become larger and reach more customers.

New Market

Takeovers are done when firms want to enter new markets where they don’t operate or work. By taking over another firm in the target market, they are more likely to be profitable than if they started from scratch.

Advanced Technology and Skills

The acquirer company, which wants to have advanced technology and skills, takes over the target firm to make better use of that technology and skills.

Cost Saving

The process of takeover is cost-saving. After the takeover, firms save money by combining their operations. For example, they reduce the number of workers in their firms and share resources with each other, leading to synergic benefits.

Reduced Competition

Companies takeover their rival firms in order to reduce competition. This practice helps them charge high prices from customers and have more control over rival firms.

Financial Benefits

Sometimes investors and shareholders of the target firms want to sell their shares, then buyers bid appealing prices to make the deal, which provides financial gains.

Takeover Targets

Those firms that are traded at a low value as compared to their potential can be qualified for takeover. When the firm’s performance is low, it can be seen in the share price of that firm. Due to this, takeovers attracted more to those firms because they could assume that they could turn them around.

Examples

Examples of takeover targets are Liverpool F.C., Sainsbury’s (rejected offer at 600p but trading below that now), and Fox News’s wish to buy Sky.

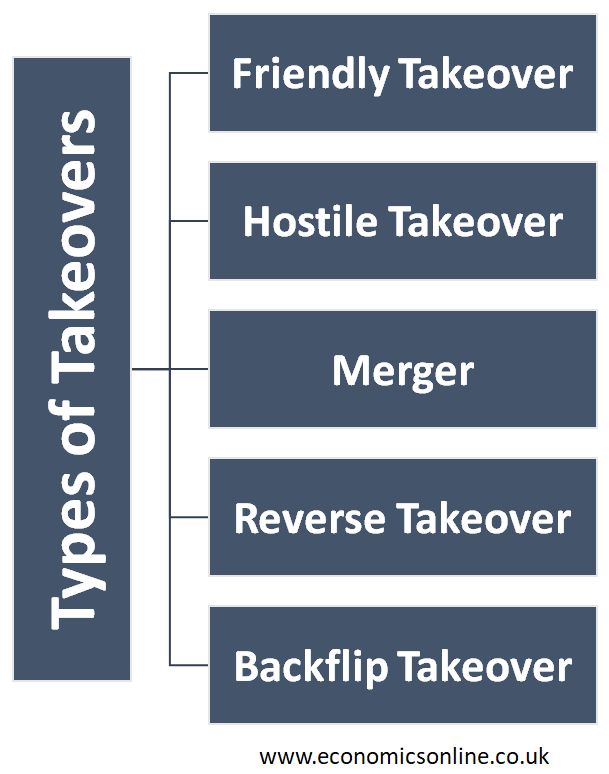

Types of Takeovers

The following are some types of takeovers:

Friendly Takeover

A form of takeover in which the boards of directors of both firms negotiate and approve the bid is called a friendly takeover. The board of the target company approves the acquisition terms, and shareholders have the opportunity to vote in favour of or against the takeover. For example, Aetna by CVS Health Corporation (in December 2017) was an example of a friendly takeover, as both firms benefited from the takeover. The chief executive officer, Larry Merlo, said in a press release that, by delivering the combined capabilities of our two leading firms, we can enhance the consumer health experience and construct healthy communities with the help of a new advanced healthcare model that is local, easier to use, cost-friendly, and provides easy access to care.

Hostile Takeover

A form of takeover in which an acquiring company has a desire to acquire another company but the targeted company’s board of directors has no desire to be acquired or be merged with another company because they find the bid price not favourable is called a hostile takeover. The target company does this because they think that the acquiring company has devalued their company’s potential. For example, Aphria and Green House Brands attempted to take over Aphria in December 2018. The Green House Brand offered an all-stock offer with a significant price to Aphria, but the board of directors of Aphria rejected the offer, which has a valuation of $2.35 billion, because they thought that the acquiring company devalued their potential.

Strategies used in Hostile Takeover

The following are two main strategies used in a hostile takeover by the acquiring company:

Tender Offer

In a tender offer, the acquiring company offers to purchase the shares of the target company at a premium price as compared to the market price.

Proxy Vote

In a proxy vote, the acquiring company convinces the shareholders to vote out the existing management.

Merger

A type of takeover in which two companies combine together to form a new business is called a merger. The process of takeover consists of combining the management, operations, and assets of two totally different companies. Mergers are also of two types: friendly mergers and hostile mergers. In the case of a friendly merger, two firms or businesses combine for their mutual benefits. In the case of a hostile merger, one firm or business forcefully targets or merges another business and manages their business operations and assets.

Reverse Takeover

A type of takeover in which a private firm takes over a public firm is called a reverse takeover. The reason for reverse takeover is to achieve listing status without going through an initial public offering. In this way, with reverse takeover, a private company becomes a public company with already-listed companies. The acquiring company decided to take over a public firm because it seemed like a good decision instead of applying for an IPO. The process of listing for an IPO is very costly and requires a lot of paperwork. For example, J. Michaels was taken over by Muriel Siebert’s brokerage firm in 1996 in order to form Siebert Financial Corporation.

Backflip Takeover

A type of takeover in which the acquiring company becomes a subsidiary of the target company is called a backflip takeover. This is called a backflip because the target company is the only surviving entity, and the acquiring company becomes a subsidiary of the merger. The reason behind the backflip merger is the strong brand recognition of the acquiring company. For example, the takeover of AT&T by SBC in 2005 is an example of a backflip takeover. The SBC purchased AT&T for $16 billion and then named it AT&T because it has strong brand recognition.

Funding for Takeover

The funding for the takeover is an important step in the takeover process. Takeovers often need a sum of capital, and businesses have required funding in many ways. The following are some methods for the funding of a takeover:

Investment Requirements

A huge investment is needed for takeovers to buy a target firm’s shares or assets.

Several Funding Options

The acquiring firm has a number of financing options to help the target firm raise the money they need. The financing options can be debt insurance, cash reserves, bank loans, equity financing, and asset sales.

Interest and Debt

The financial stability and gearing of the acquiring firm can be affected by the long-term debt and interest liabilities that are due to using debt for financing.

Equity Dilution

The need for funding in the form of equity can be part of the shareholder’s ownership stake in the takeover firm, which is being diluted.

Strategic Points to Remember

The funding process that is selected should be in line with the strategic point negotiated with the target firm along with the firm’s long-term financial strategy.

Advantages of Takeovers

The following are some advantages to takeovers:

- Takeovers are essential because they enable dynamic firms to acquire inefficient firms and then turn them into more profitable and efficient firms.

- The new firm may benefit from synergy, economies of scale and sharing knowledge by taking over from a potential firm.

- With the help of a takeover, the great profit can lead to a path for investment in research and development. For example, a huge investment is required in pharmaceutical firms because they are connected with risky investments.

Disadvantages of Takeovers

The following are some disadvantages of taking over:

- A takeover can be done to cherry-pick a firm, sell out useful or valuable assets, and then close the less attractive parts of the firm, leading to job losses.

- A takeover done with a firm that is not understandable for the potential firm is being sold out to another firm, resulting in the clash of cultures.

- Takeovers can cause job losses, which lower the value and morale of the new firm.

- Due to the takeover, there is an increased market share in the oligopoly market, which can cause fewer options and high product prices for consumers.

- The new firm formed, with the acquisition process, may face diseconomies of scale, not economies of scale.

Conclusion

In conclusion, a takeover is a method of rapid business growth in which one firm buys another firm for the sake of reducing competition and being able to expand its global reach. Takeover can occur due to many reasons, such as entering new markets, profit gains, expanding business operations, new technology and skills, and reducing competition. Takeovers result in the rapid expansion of a business, which is less likely in case of organic growth.