An image of an empty price tag.

Understanding Shadow Price

What is Shadow Price?

Shadow price refers to the estimated monetary value of something for which the market price is not available. It is the estimated monetary value of those things which do not have a market price due to the absence of any competitive market. In other words, shadow price is the estimated monetary value assigned to an abstract or intangible commodity which is not bought and sold in the market.

For example, the estimated monetary value of the time saved by commuters due to a new ‘traffic relief bridge’ constructed by government which has reduced traffic congestion is the shadow price or shadow cost. There is no market price available for the saved minutes of travel time; hence, the shadow price is used for that.

The concept of shadow price or shadow cost is used by economists and policymakers to estimate the monetary value of those things that are not traded in the market.

Shadow Pricing

Shadow pricing refers to the process of estimating the monetary value of something for which the market price is not available. It is used in assessing the value of those things which are not directly priced in the market. In simple words, shadow pricing is the practice of estimating the monetary value of something by determining what its price would be if it were traded in a competitive market. Shadow pricing is commonly used by governments to estimate the monetary value of positive and negative externalities while doing cost-benefit analysis of different projects.

Example of Shadow Price

Many countries produce electricity by burning coal. There is a market for electricity, and its market price is available. However, the burning of coal affects the environment negatively through carbon emissions, leading to negative externality or external cost. The monetary value of this negative affect on the environment due to the burning of coal is not available because of the absence of its market price because these are non-marketed goods. Here, the concept of shadow price will be used to numerically quantify and estimate the value of this negative externality of coal-burning. This shadow price will help economists make decisions about the allocation of resources for electricity generation. In cases of highly negative impacts on the environment, policymakers can take the resources away from coal-burning and re-allocate them to generate electricity through other methods.

Why is Shadow Pricing Needed?

A question may arise here: if there is no market for something and its market price is not available, then why is it essential to find its shadow price?

A simple answer is that economists and policymakers need these shadow prices in order to make important decisions. Let’s take an example to understand this.

Suppose that a company is planning to locate its chemical factory in a residential area where a public park is situated. If the factory is constructed, the public park will be removed, and the residents and their kids can no longer enjoy the benefits of the public park. This chemical factory will create jobs for the people living nearby, but it will also create pollution and noise. Should this factory be constructed? Should the public park be removed? Should the government give permission to the company to locate the factory by removing the public park?

The decision is important because the output produced by this factory will contribute to national output, and employment will increase. However, there are some aspects of this decision that are not covered by the established markets. These aspects are the negative or positive externalities.

The private company will calculate and compare the cost of making the factory (private cost) with the revenue that will be earned from its operations (private benefit). The company will ignore the externalities associated with this factory. However, the government will also estimate the value of negative externalities (external cost) and positive externalities (external benefit) along with private costs and private benefit. The comparison of social costs and social benefit will help the government decide whether permission should be granted to build the chemical factory.

For example, the government will estimate the monetary value of the enjoyment that residents get from the park. This is shadow pricing. The government can also make estimates of the costs of the pollution and noise created by the factory through shadow pricing.

In the absence of shadow pricing, governments cannot do cost-benefit analysis properly and hence may fail to increase the social welfare of the people.

Shadow Pricing Graph

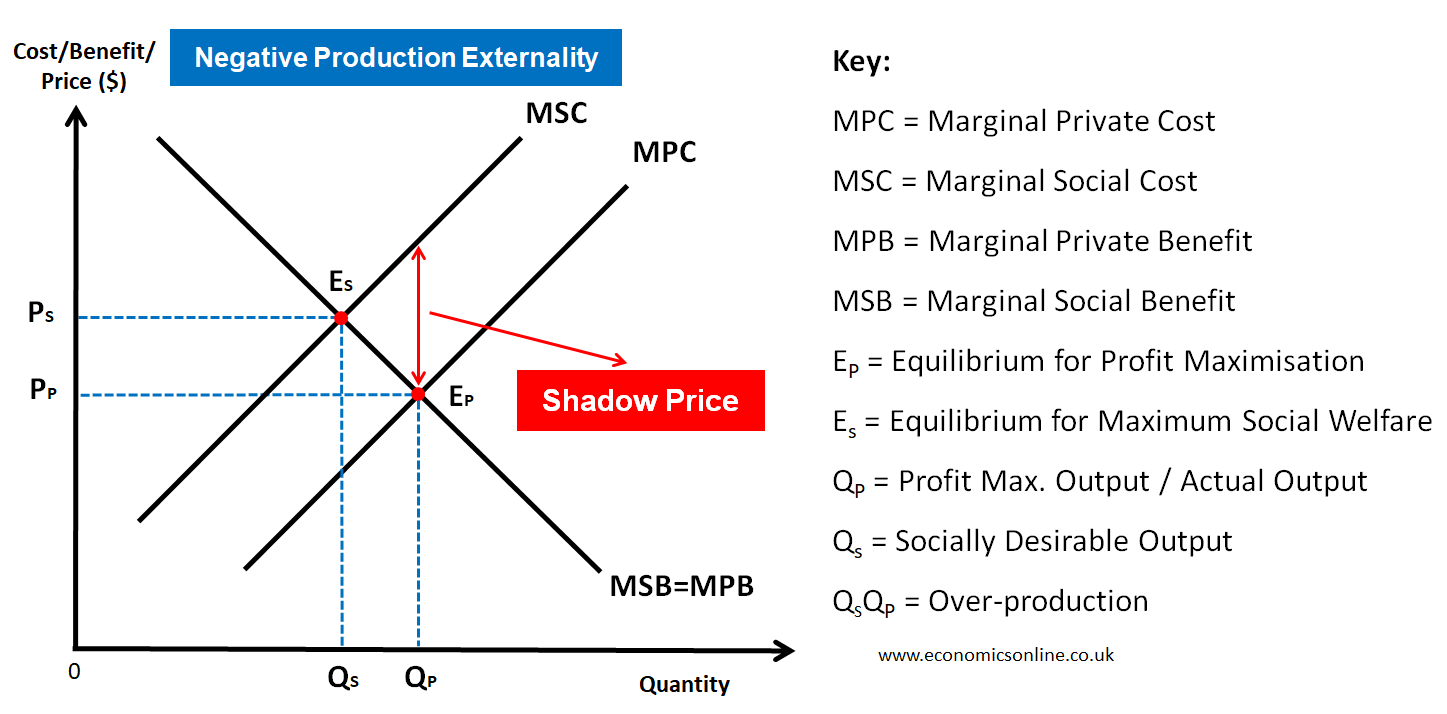

The following graph illustrates the use of shadow pricing in estimating the monetary value of the negative production externality (pollution, noise etc.) in cost-benefit analysis.

In the above graph, we have the quantity on the horizontal axis (x-axis) and the cost/benefit/price in dollars on the vertical axis (y-axis). QP is the profit maximization output while Qs is the output for maximising social wlefare. The vertical distance between the marginal social cost and marginal private cost is the negative externality for which the shadow pricing is used. Private producers ignore this negative externality, which results in over-allocation or resources, leading to market failure. Governments consider this negative externality and include it in decision making by using shadow pricing. The government can also correct this market failure by imposing tax on producers equal to the shadow price. This is just one way in which shadow pricing works.

Ways to Calculate the Shadow Price

Now, let’s explore some methods to calculate the shadow price:

Contingent Valuation

This method involves the use of survey in estimating the value of externalities by asking the people directly. In these surveys, people are asked on how much money they will pay for some intangible benefits or to avoid some intangible negative effects. For example, a direct question can be asked to the residents about their willingness to pay money to keep the public park and not building the chemical factory there. Or how much money a person can pay to avoid the stress of traffic congestion? Different people will be willing to pay different amounts, and the shadow price will be the average of those amounts.

Revealed Preferences

This method involves the use of observations of the real-world behaviour of people to determine the value of non-monetary aspects of something. For example, if a person is willing to pay 5% premium to live near a public park, then this suggests that the value of the benefit of the public park for that person is 5% of the house price away from Public Park.

Travel Cost Method

This method involves the use of the travel cost incurred by people in order to estimate the value of a recreational site. People may be willing to visit a recreational place by incurring various costs such as transport cost, accommodation cost and parking fee. This cost will give an idea about the economic value of the recreational benefit which people get from that site.

Applications of Shadow Price

Shadow pricing is used in different areas where regular prices do not show how valuable things actually are. The following are some applications of shadow pricing:

Cost-Benefit Analysis

Cost-benefit analysis is a numeric technique of decision-making used by governments to evaluate different projects by considering all of their costs and benefits. Shadow pricing helps in assigning monetary values to the negative and positive externalities in benefit-cost analysis. This helps the governments select those projects that will increase social welfare.

Correcting Market Failure

One of the major reasons of market failure is the presence of production and consumption externalities. Government can use shadow pricing to calculate the amount of tax or subsidy which should be used to correct market failure.

Public Goods

Government can use shadow pricing to estimate the value of public goods. For example, the value of a flood-control system can be estimated. Based on this shadow price, government can decide the quantity of public goods and allocate resources accordingly.

Environmental Valuation

Shadow pricing is also used in environmental economics. In environmental valuation, shadow pricing is used to estimate the value of environmental degradation and environmental impact on the economy. This also helps policymakers and government analysts make sustainable development policies.

Limitations of Shadow Price

The following are some limitations of shadow price:

Subjectivity

A major limitation of shadow pricing is that it is estimated using subjective opinions. Sometimes, people providing estimated values are themselves not sure about the value they assign to something intangible that they never bought from or sold in the marketplace. This limits the usefulness of shadow pricing. Moreover, two individuals calculating the shadow price of the same thing may end up with different estimates. This makes the decision-making process difficult.

Complexity

Another limitation of the shadow price is its complexity. Estimating shadow prices needs knowledge and expertise in making judgements about various intangible things and their impact. This can be complicated for those who lack experience and expertise.

Lack of Accuracy

Lack of accuracy is another limitation. There are high chances of estimating the wrong shadow prices. If the estimates get wrong or inaccurate, the decisions may also go wrong.

Bias

Human judgement is used in estimating shadow pricing. This means that there are chances of deviation from the true value. This bias can lead to the wrong value of shadow prices.

Conclusion

In conclusion, the shadow price, or shadow value, is the estimated monetary value of something that is intangible or abstract. It is a way in economics to consider the value of something not traded in the market. One should keep in mind the limitations of shadow pricing, along with its usefulness, before using it in decision making.