The Free Rider Problem

Understanding free-riding

The free-rider problem is an economic concept wherein consumption of a good or service cannot be restricted to only those who pay the fair market price for its use. If I can gain benefit from a good or service for free, why should I pay for it?

Public goods

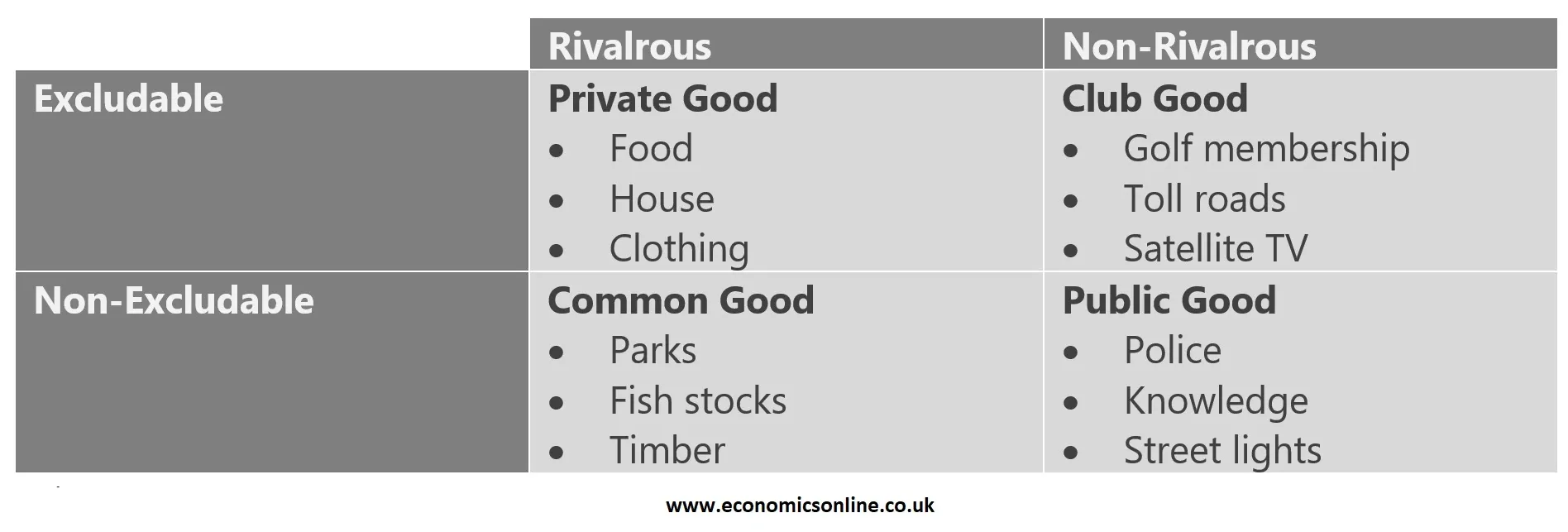

Before we can understand the implications of free-riding and how it arises, we must understand the nature of a public good. A public good has the following two properties that make it susceptible to free-riding:

1. Non-excludability: Consumption of the good cannot be restricted. Thus, once the good has been initially supplied, future consumption occurs at a marginal cost of zero.

2. Non-rivalrous: Consumption of the good by one individual does not diminish the ability for it to be used by others, now or in the future.

Some common examples of public goods include:

· Lighthouses used for navigation by ships

· National defence

· The air we breathe

· Access to free-use websites such as Wikipedia

Public goods are susceptible to free-riding since, once they have been created, they can be utilised at no additional cost by anyone wishing to benefit from what they have to offer.

You might be thinking, “Wikipedia could simply require membership to access their site.” This is true. And in such a case the good would become excludable and thus no longer public. We should not think of excludability as a binary property, but a continuous level of difficulty. Some goods are more easily made excludable than others.

Not all goods fit perfectly to one of the four buckets listed in figure 1. For more, see our article on quasi-public goods.

Initial investment

Meeting the two key criteria of a public good are necessary but not sufficient conditions for a free-rider effect to arise. The good must also require some initial investment for the first unit of consumption to occur.

Consider, using our examples above, that a lighthouse must be constructed before the first sailor can use it for navigation. Hence, the first sailor must pay some fixed construction cost to build the lighthouse. It is only once the lighthouse has been constructed that other sailors can follow and make use of the already established lighthouse. The lighthouse will suffer from a free-rider effect as the sailors benefit from the investment of another to gain costless use of the shared good.

The air that surrounds us, however, although both non-excludable and non-rivalrous, did not require any initial investment before we could begin breathing it in. Yes, we do gain benefit from using this shared resource at no marginal cost of consumption, but the good will never be under supplied since we already receive just the amount we want to consume. Hence, no market failure occurs.

Impact of free-rider effects

The inability to restrict consumption of a public good results in a failure of the free market system. Since rents cannot be collected against consumption, there is no incentive for private investment into supply of these goods. Quantity supplied and consumed will not be regulated by free market forces.

No single consumer is willing to pay the initial investment to create the public good in the knowledge that they can enjoy costless consumption if someone else covers the initial cost. Thus, the good will not be supplied and demand for the shared resource will not be met. This comes despite the fact that initial investment would be provided if every individual consumer contributed some portion of their willingness to pay.

Hence, in the absence of regulation or other similar mechanisms, the market will reach a deficient equilibrium wherein the public good is undersupplied and a lower level of demand is met.

Distinction from the tragedy of the commons

As a side note, if we relax the condition of a good being non-rivalrous, free-rider effects will still occur. As long as both the non-excludability and initial investment conditions hold, as there is still an inability to restrict consumption of the shared good to those who have paid for its use. Such goods are called “common goods”.

However, any market failure arising from free-rider effects are largely dominated by another type of market failure called the tragedy of the commons. Not to be confused with free-riding, a tragedy of the commons occurs since individuals are incentivised to overuse the shared, rivalrous good to satisfy their immediate consumption until the good is depleted. This is also a deficient equilibrium as coordinated action could prevent depletion by sacrificing immediate consumption for prolonged future consumption.

Note that we can relax the assumption of an initial investment being required for a tragedy of the commons outcome to arise, as the depletion of the common good with each unit of consumption means that market will eventually be undersupplied. This happens regardless of whether an initial investment was required or not. Consider natural resources such as forests used for logging, or river systems used for irrigation as examples.

Addressing free-rider effects

There are three main strategies to avoid the realisation of free-rider effects in the market for public goods:

1. Taxes: Local and federal governments collect taxes on the income of consumers to cover the cost of common goods. Although taxation policies vary across geographies, the general idea is that tax revenue will be redeployed to pay for the use of public goods. For example, national spending on defence to protect cities from foreign invaders.

2. Privatisation: Remember when we said that excludability of consumption should not be seen as a binary attribute, but a continuous level of difficulty? This strategy takes advantage of the fact that many non-excludable goods can be made excludable. This will likely increase the initial investment required to provide the good, but allows for rents to be collected against consumption. The good goes from being a public good to a club good, and free-riding effects are eliminated through the incentivisation of private investment. An example would be charging TV owners to access certain channels.

3. Altruistic behaviour: In some instances, free-rider effects may be eliminated through rents on consumption being paid by consumers even in the absence of external forces. Factors contributing to this might be public perceptions and reputation where the good is shared by a small local community. Or maybe the consumers simply see the value that the public good provides to the wider population and so are willing to cover the cost of ensuring it’s availability. An example might be a donation drive by a local school to fund a new gym.

Summary

Free-riding effects are a market failure where a good is undersupplied. This happens because consumers are unwilling to pay for initial investment costs, in the knowledge that they might eventually be able to enjoy costless consumption.

The three conditions required for free-riding to occur in a market are:

1. Non-excludability

2. Non-rivalry

3. Initial investment costs