Sugar tax

Soft Drinks Industry Levy (SDIL)

The Soft Drinks Industry Levy (SDIL) – better known as the ‘sugar tax’ – came into force in the UK in April 2018 and is designed to encourage manufacturers to reformulate their drinks to reduce the sugar content. The aim of the tax is to discourage consumption of sugar-rich drinks, so as to reduce the negative health effects of over-consumption of sugars – especially the effects of sugar consumption on obesity and diabetes.

Sugar taxes are now commonplace, and, by 2019, over 35 countries and states had introduced some form of sugar tax, with many more expected to introduce them in the next few years.

The soft drinks industry, which contributes some £6.4bn to UK GDP, and a further £2.9bn when the supply chain is included, started to make changes when the tax was first announced in 2016.

Since it was announced, most manufacturers of soft drinks have reduced the sugar content of their drinks to avoid having to charge the tax. Reductions in sugar content have generally been achieved by substituting sugar with artificial sweeteners.

According to the UK government, all revenues raised through the levy will fund new sports facilities in schools, and schemes like the ‘healthy breakfast clubs’ initiative.

Sugar tax rates

The rates are applied to drinks which hit one of two thresholds for sugar content:

- 24p per liter of drink if it contains 8 grams of sugar per 100 millilitres, or

- 18p per litre of drink if it contains between 5 – 8 grams of sugar per 100 millilitres.

Exemptions

Drinks are exempt if they:

- Contain at least 75% milk

- Are milk substitutes (such as soya milk) containing at least 120mg of calcium per 100ml

- Are alcohol substitutes

- Are infant formula drinks or drinks for special medical purposes

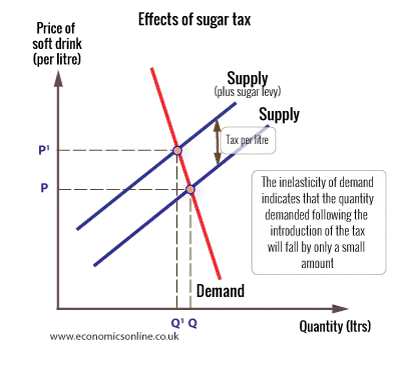

Soft drinks elasticities

Price elasticities of demand for soft drinks are estimated to be inelastic – less than (-) 1.0 , meaning that price increases may have only a modest impact on consumption.

| Type of drink | Elasticity |

| Non-dilutables | (-) 0.81 |

| Dilutables | (-) 0.92 |

| Juice | (-) 0.97 |

| Milk | (-) 0.98 |

| Water | (-) 1.07 |

Source: Adam DM Briggs, et al “Overall and income specific effect on prevalence of overweight and obesity of 20% sugar sweetened drink tax in the UK: econometric and comparative risk assessment modelling study”, British Medical Journal, 347 (2013).

Hence, any increase in price will lead to a less than proportionate fall in sales volume. Given this low price elasticity, the impact of the levy is likely to be relatively small – indeed, a study by Oxford Economics concluded that sales of those soft drinks affected by the charge will fall by 0.4%.

However, sales of energy drinks, of which 70% will be subject to the charge, are expected to fall by around 9%.

The price rises will have two effects. Firstly, a substitution effect, which suggests that, if we assume the price of less sugary substitutes remains constant, consumers will switch to them as their ‘relative price’ will have fallen. Secondly, there will be a real income effect, which, if we assume incomes and budgets remain constant, the tax will reduce real income if consumers carry on making the same quantity of purchases, and will therefore react by reducing their consumption of the now higher priced drinks. The fact that expected falls in sales are likely to be modest, we can conclude that the substitution and income effects will be quite weak.

Regressiveness

This also raises the issue of the regressiveness of the tax, and its impact on those in the lowest income bracket. All indirect taxes are regressive in nature, even when the poorest spend less on the taxed product, so it is no surprise that a sugar tax is regressive. However, a sugar tax is doubly regressive given that the poorest tend to spend more on sugary drinks.

Behavioural perspectives

From a behavioural perspective, applying the ideas of behavioural economics to developing an understanding of rising obesity levels, and to reversing the trend of increasing obesity, is seen by many as an alternative approach. For behavioural economists, obesity is considered a result of irrational behavior by individuals. For example, the idea of decision making bias may be relevant here, especially the bias for ‘optimism’, where individuals are overly optimistic that their suger-rich diet will not cause them harm. The optimism bias relates to observed findings that individuals commonly underestimate the likely ‘negative effects’ of a decision and overestimate the likely positive effects. For example, studies1 have found that individuals commonly underestimate the quantity of calories in meals.

Behavioral economists looking to devise policies would consider using a range of nudges, collectively referred to as soft paternalism. This approach is often critical of the traditional use of taxation in cases where consumers are price inelastic – as in the case of consumers of soft drinks.

-

For more on behavioural economics

1David & Wansink, Brian & R. Payne, Collin. (2009). Mindless Eating and Healthy Heuristics for the Irrational. American Economic Review. 99. 165-69. 10.1257/aer.99.2.165.