AI Investments Surge: Chipmakers’ Capitalization Jumps $200 Billion

Investor enthusiasm reignited once more after news of more significant fundraising rounds and partnerships in the AI space. The combined market capitalization of leading chip manufacturers increased by $200 billion in one trading session. The surge was attributed to OpenAI announcing a $500 billion valuation, along with announcements of memory supply deals with Samsung and SK Hynix, and speculation of a potential AMD-Intel partnership.

These events have already propelled shares of TSMC, Foxconn, and other related companies higher so far in 2023 and reflect that the ramifications of the AI boom are broadly felt in global markets. It traditionally disturbs stock indexes of all stripes globally, including the Chinese market - the Hang Seng is up over 30% year to date.

In the grander scheme of things, as part of a global phenomenon, the correlation between "tech" giants and S&P 500 and Nasdaq futures have become significantly stronger amidst the recent developments in the AI industry. For instance, Microsoft is developing its own AI chips and data centers, which directly influences the dynamics with the exchanges every time there is news, news, such as products launching early — instead of being delayed — for example, the Braga AI Chip. Any of these timing adjustments – typically, not only are we tracking the stock price at the time of the announcement – but the relationship between tech and the exchanges becomes even more correlated as they are all based on new product manufacturing and associated timing adjustments.

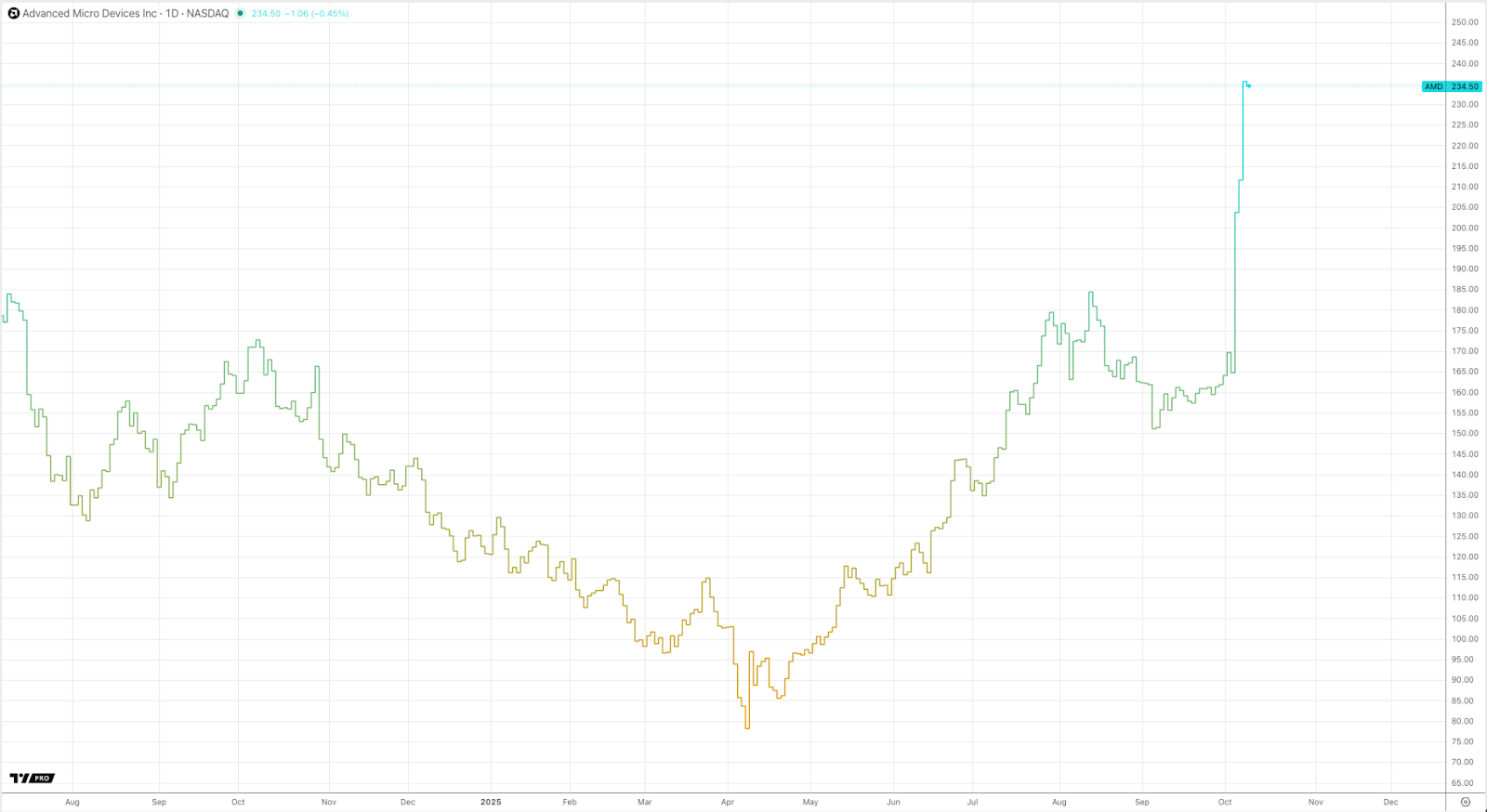

AMD has reportedly entered into an agreement with OpenAI, which offers it the right to acquire up to 10% of AMD's shares, as well as the supply of Instinct GPUs with a combined capability of 6 GW. The first tranche is set to be offered in the second half of 2026, at a power rating of 1 GW, and more will follow as the OpenAI infrastructure grows. AMD shares have already risen in price, as expected, by 40% and the company is now a $380 billion market cap company. Analysts predict that revenue will grow by another $100 billion by 2030. Note Nvidia's CEO Jensen Huang even commented that he thinks the deal OpenAI made with AMD was impressive, but did not put Nvidia's ongoing investments at risk, which continue to be active in OpenAI and other AI startups, like Elon Musk’s xAI and CoreWeave the data center operator.

Now, Nvidia said it is planning to invest up to $100 billion in OpenAI and now announced plans to project with Oracle and Meta, building large data centers totaling hundreds of billions of dollars. Nvidia products represent approximately 70% of the cost of new AI data centers, Huang said. It is clear that since market capitalization grew to a valuation of $4.5 trillion, and the company has taken a leading position in AI, as you can see on the heatmap, it will be difficult for any competitor to catch up.

In the competition for advanced technology, AMD is betting on TSMC's 2nm chips for EPYC Venice server processors as well as Instinct MI450 accelerators. In comparison, Nvidia Rubin solutions are based on 3nm technologies, but they use N3P process technology for their higher-end versions. Switching to 2nm process technology from TSMC will provide AMD with the potential to increase performance by up to 15% or reduce power consumption by 25-30%, all while keeping performance equivalent and increasing competition.

While all of this is developing, analysts, major players, and even small investors think that the AI race will continue to build, driving new partnerships and growth in capitalization while also changing the overall global indexes. AMD, Nvidia, as well as Microsoft, are all in a global race for computing power at the same time, attracting investors and new technologies which will make for an important next few years for the entire sector.