Blockchain Payment Gateways and Transaction Costs

Blockchain payment gateways Blockchain payment gateways enable online businesses to accept payment for goods or services with Bitcoin and other cryptocurrencies while not changing how they price their goods and what information goes on their accounts. Prices will still be displayed in the local currency, and the gateway will simply calculate the equivalent amount of crypto at the current exchange rate. Additionally, instead of using a single, static wallet for all payment transactions, each order receives a unique payment address or QR code that is generated by the gateway and then monitored every time the order is paid. The gateway will wait for a transaction to receive a sufficient number of confirmations on the blockchain to report back that the order can proceed. In most cases, the gateway will also convert the payment into exclusively stablecoins or the local currency.

Economically speaking, payment gateways are an interesting example, broadly defined, because they have the potential to change transaction costs, the functions of financial intermediaries, and access to international markets. Payment gateways are an application of how financial innovations can result in different market structures without changing the core good or service being exchanged.

How Crypto Gateways Reduce Transaction Costs

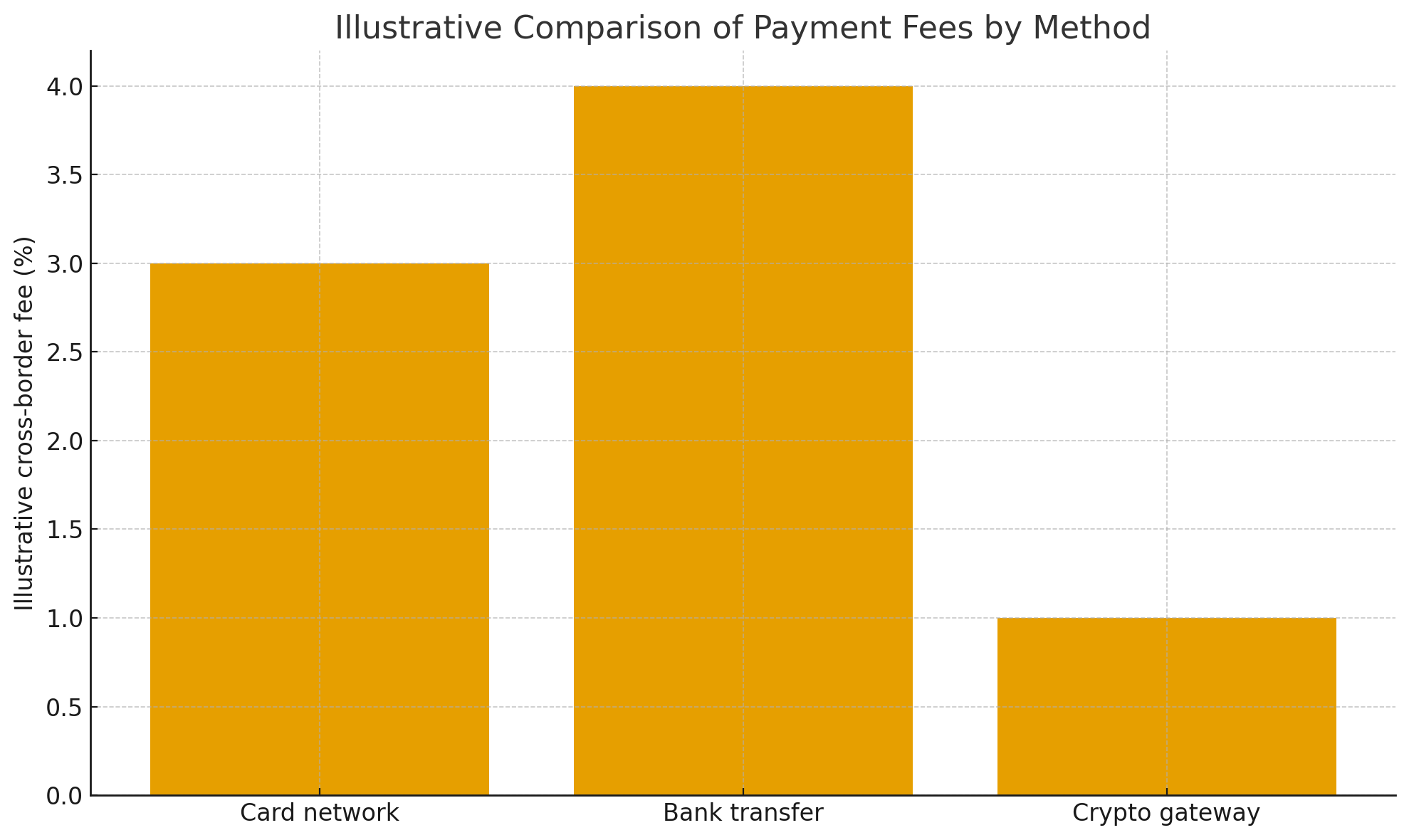

Conventional cross-border payments incorporate card networks, correspondent banks, and an array of intermediaries, which add fees with each layer. Just think about a singular online purchase: the consumer's bank, the card network, the acquiring / merchant bank, a local processor, and a conversion service into the local currency (which, by the way, many banks offer as an additional service). This all can involve several layers and can add either a fee or delay, or both. Economists use the term frictions to describe transaction costs: the additional time, money, or effort it takes to overcome obstacles and make an exchange happen.

A blockchain payment gateway is able to charge for several of the functions above as one service:

- Pricing in the local currency, while the gateway handles the conversion into crypto and back.

- Settlement can be quicker, rather than waiting three more days before cross-border payment settlement.

- Chargeback risk is substantially lower (all blockchain transactions are irreversible once confirmed).

When we talk about these elements in economic terms, block-chain payment gateways are also able to reduce several layers of transaction costs:

Search and information costs - merchants no longer have to research the best exchange or place a wallet or watch the blockchain.

Administrative costs - the gateways will generate, automatically, the reconciliation, reporting, and accounting.

Enforcement costs can also be reduced if chargebacks are an ongoing issue, as there are fewer disputes (and disputes use resources).

In the end, the effective transaction costs can be lower than card and/or bank payments especially in relation to cross-border and small payment transactions, as the fixed charge can be very high compared to the purchase amount.---

Disintermediation and Two-Sided Markets

Gateways may partially bypass traditional financial intermediaries similarly by routing payments over public blockchains. For merchants in places with weak banking infrastructure or restrictive card rules, this can finally provide access to buyers abroad willing to pay with crypto. The firm no longer needs to develop a relationship (with the associated regulatory cost) with an international banking partner. It merely has to establish a relationship with a single gateway provider.

This has implications for value in broad use cases of financial inclusion and market access. While the firms would typically be unable to get approval for card merchant accounts and incur high fees, they can now accept a form of online payment if they are able to integrate the gateway and pass certain compliance rules.

Certain groups such as freelancers, small software firms, digital content creators, or platforms hosting these services should all benefit from the lower barriers to entry.

The gateway now creates a new intermediary, or what economists would call a two-sided market, as it must attract both merchants and customers. If there are not enough merchants accepting a particular gateway platform, then there is little reason for customers to hold balances in supported coins. If there are not enough customers willing to pay in crypto, then merchants will have little incentive to integrate the gateways. Network effects create potential monopolistic behavior, where a few large providers become dominant in the market, similarly to card networks today.---

Exchange Rate Risk and Contracting

Cryptocurrency payment gateways also shift who takes on the exchange-rate risk. When a price is denominated in fiat currency (e.g., dollars or euros), and the customer pays in Bitcoin, someone must take the risk that the value of BTC changes in the time it takes to settle the payment. Many payment gateways will provide a quoted (fixed) rate to the customer for a brief time window, let's say fifteen minutes, and then hedge or instantly convert the crypto they receive into a stablecoin or fiat. In this case, the merchant has virtually no currency risk, because it is now absorbed by the payment processor or the crypto market.

These payments represent a form of risk-sharing through contracting. The payment gateways have specialised in assuming price volatility, and charge for their services. Essentially, it can be said that merchants are paying an insurance cost against any large changes in exchange rates so they can treat revenues in crypto like any regular card or bank payment.---

Risks, Regulation and Externalities

Lower transaction costs do not come free. Cryptocurrency payment processors introduce new risks to consider when weighing the concerns of policymakers and economists.

There is still a risk of some type of exchange-rate exposure lurking somewhere in the system. If a payment processor mistakenly forgets the structure of its hedging strategy, there is a chance that the transaction processor could get hurt and fail to pay merchants.

There is also regulatory risk, including anti-money laundering (AML) risk, as some crypto transactions are anonymous or at least difficult to trace. Payment processors have to conduct KYC checks and provide governance structure to monitor suspicious flows of transactions, which then presents some cost of compliance.

Operational risks include bugs in smart contracts, security flaws from hacks and other integration risks. Any issues in any of these areas could pose a risk and potentially hinder transaction payments for thousands of merchants (in unison).

These risks can be thought of as potential negative externalities. A large failure or scandal may undermine trust in crypto payments more generally. This could be the case even in those instances when payment processors have complied with their regulatory obligations and acted with higher standards. Thus, a lawmaker may have to make a trade-off as strict rules can protect consumers and the financial systems, but slow innovation and increase some costs, offsetting some of the positive benefits of efficiency that are claimed by payment processors.---

Distributional Effects and Global Competition

The benefits from reduced transaction costs are not distributed equally. Large multinational companies already enjoy discounts on card fees and banking relationships, and aren’t likely to see much additional relative advantage from crypto gateways. The biggest beneficiaries will likely be:

small exporters and digital businesses in low-income countries

merchants that service customers in low card-covered geographies

high-risk or niche industries that traditional banks do not serve

For those businesses, crypto gateways would increase contestability of international markets. Newer businesses have reduced frictions for payment from abroad, meaning they are now better positioned to compete with more established businesses. Competition could increase in some digital and service industries, putting downward pressure on prices and margins for a period of time.

Nonetheless, there also exists a possibility of concentration among gateways to settle the payments due to network effects and economies of scale in technology and compliance. The question of industry structure in the long run, therefore, remains to be seen for economic and regulatory reasons.---

Conclusion

Blockchain payment gateways are a notable example of financial innovation that influences transaction costs, intermediation and international trade in services. They reduce frictions and expand market access for many firms, especially smaller firms operating internationally or in areas considered high risk. They also move risk and regulatory challenges to new parts of the financial system and raise questions related to overall market structure, competition, and consumer protection.

For students of economics, crypto payment gateways showcase a timeless theme: when technology alters the costs of making and enforcing transactions, it does not simply lower the cost of engaging in existing markets. It can change who enters the market, which intermediaries have power, and how the gains from trade in the world economy are distributed.