Investing In Bitcoin Is a Lucrative Opportunity… Or Is It? Here Is What Experts Have to Say

With a market cap of over $380 billion and increasing adoption worldwide, there is no doubt that Bitcoin is a lucrative investment. Many believe it is the best asset of our century.

As Cameron Winklevoss said, “Bitcoin is both disruptive from a technology perspective, but there’s a tremendous power of social good behind it. So you can both build a cool business or have a great investment return, and there’s the promise of potentially improving the remittance industry or banking the unbanked.”

But is it really such a great asset to add to your portfolio? Let’s find out!

What Is Bitcoin?

Before we see if investing in BTC is worth it, let’s explore its fundamentals.

Bitcoin is a virtual currency created by the mysterious figure(s) known as Satoshi Nakamoto. It was launched in 2009 to facilitate cross-border payments and resolve problems traditional banking systems have failed to tackle.

Besides, data on the Bitcoin blockchain, the technology that supports Bitcoin, is secured and transparent, and transactions are relatively fast and affordable. No wonder BTC has managed to remain the most traded and popular cryptocurrency.

Bitcoin | A Lucrative Investment

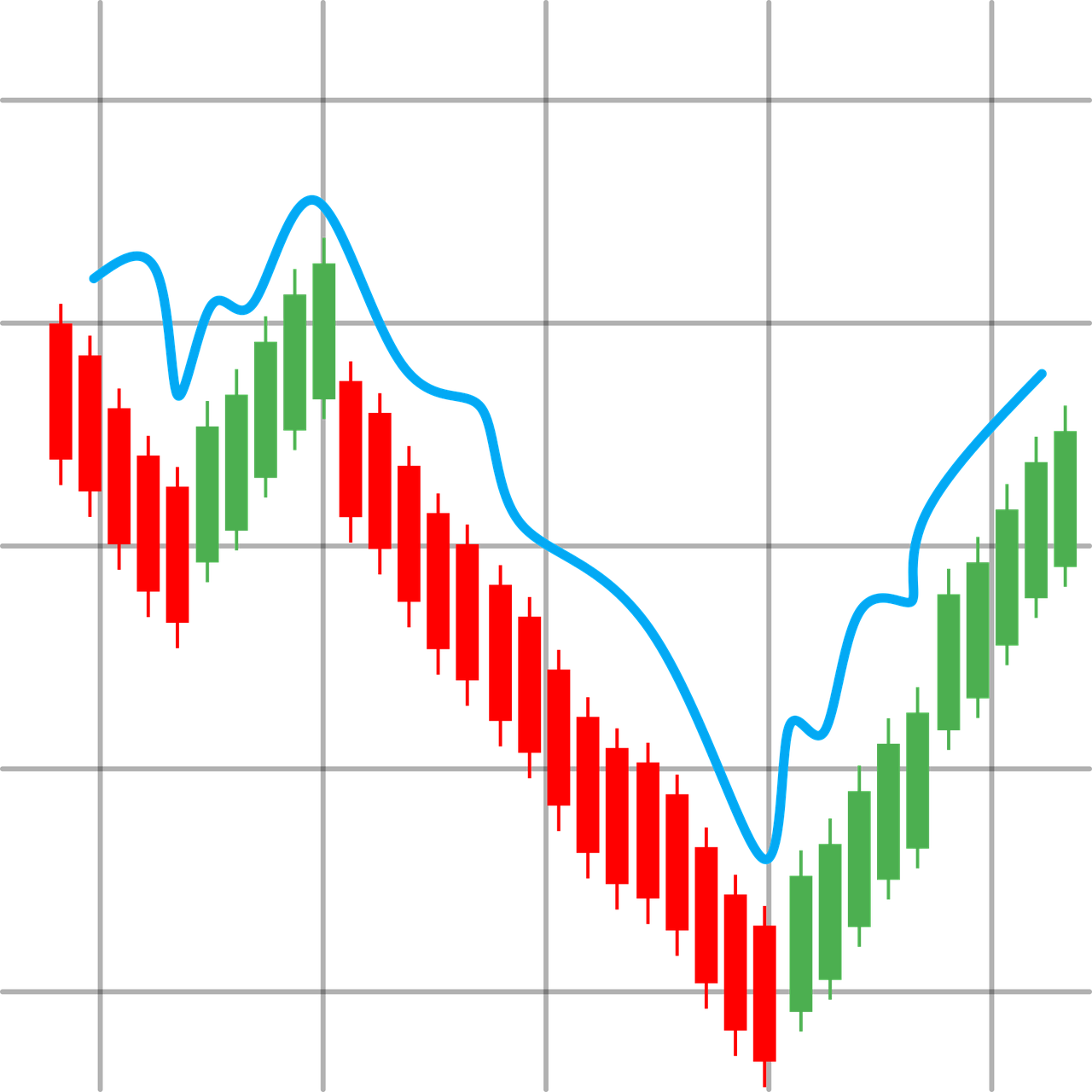

Without digging into the technicalities behind Bitcoin, we have to admit that Bitcoin is a lucrative investment. In 2021, BTC reached an all-time high of over $68,000. Many who had invested early and got the timing right managed to make a fortune.

The number of Bitcoin ATMs and businesses accepting crypto is also rising. Even big financial institutions and governments are turning to digital assets after having seen the potential the market has to offer.

That said, some experts believe that Bitcoin is not worth it, and other projects may outrank it. So let’s find out why BTC might not be suitable for you.

Trading Bitcoin Is Risky

Investing is a risky venture, with cryptocurrency trading being even more complex. Buying and selling Bitcoin, in particular, may not be suitable for beginners. Given the volatility of the market, trading BTC can lead to substantial financial and emotional losses. You risk losing your entire capital.

Moreover, there are regulatory concerns surrounding crypto trading, which one should be aware of. China is one of the well-known countries that have banned Bitcoin. Even if you choose a secure and well-known platform like Bitcoin Profit app or Gemini, you should always familiarise yourself with any relevant crypto directives and laws in your area.

Last but not least, the number of crypto scams is increasing, and one should always proceed with caution when it comes to data sharing and ways to store funds.

Bitcoin Has Its Cons

While it’s true that Bitcoin led to the creation of thousands of altcoins and DeFi projects, we can’t ignore the fact that it has its cons. Despite being highly volatile and unbacked, Bitcoin has limited use, some claim. BTC can be used mainly for payments for goods and services.

Compared to other digital assets, transactions are slow and fees expensive. For example, it takes up to 10 minutes to validate transactions.

Furthermore, some traders are not comfortable with its past, as many illicit transactions have been processed on the infamous Silk Road using Bitcoin. Note that Silk Road was shut down by the FBI in 2013.

Bitcoin May Be Outperformed by Other Technology

Given the latest tech innovations in the field, for many, Bitcoin is becoming the old king that will always be an example for the next generations, but that should be dethroned.

Unlike Ethereum, second after Bitcoin in terms of market cap and trading volume, Bitcoin does not support smart contracts and dApps. On top of that, there are more and more Web3 projects, DEXs, NFTs, and blockchain use cases beyond the financial sector, and many enthusiasts claim that BTC is not the most efficient coin.

Just look at Tether, a popular stablecoin; Binance Coin, a great utility coin; Monero, an utterly secure privacy coin; Dogecoin, a meme coin that is supported by one of the biggest celebs Elon Musk; Cardano, a third-generation cryptocurrency, and more.

Crypto Is Not for All Investors

Crypto is simply not for all investors. Here we should note that some investors do not understand the technicalities behind crypto and blockchain technologies and prefer traditional investments. Others do not agree with proof-of-work (PoS) mechanisms and dislike how energy-consuming Bitcoin mining is.

Well, while crypto trading is not rocket science, we have to admit that Bitcoin trading is not suitable for all investors. Some traditional investors simply prefer stocks, forex, commodity options, or other assets that are not so volatile. Interestingly, experts recommend investing only 5-10% of your portfolio in digital assets.

Of course, let’s not forget that there are also passive ways to increase your wealth, including dividend stocks, rental income, royalty income, and more.

Conclusion

“The governments of the world have spent hundreds and hundreds of trillions of dollars bailing out a decaying, Dickensian, outmoded system called banking when the solution to the future of finance is peer-to-peer. It’s going to be alternative currencies like bitcoin, and it’s not actually going to be a banking system as we had before 2008.” — Patrick Young

There is no doubt that Bitcoin has revolutionised the world of finance and led to the creation of numerous cryptocurrency projects. The king of cryptos is here to stay, for sure, experts claim. And while its volatility can be scary, it is precisely its unpredictable nature that many savvy investors consider a lucrative opportunity.

At the same time, investors have to explore different projects, technologies and ways to generate income. From passive income to forex trading, portfolio diversification is crucial.

In the end, though, any investment, whether you decide to buy BTC, stocks or oil, remains risky. Past performance cannot guarantee future results. You should do your own research and/or consult a licensed financial advisor before you get started.