Photo by Michael Moloney / Unsplash

Paradox of Thrift

Definition

Thrift means savings, which is the portion of household income that is not spent and is kept aside for future use. The paradox of thrift is an economic theory that states that when all individuals in an economy save more, then total savings in the economy will either remain the same or decrease. It is also called the paradox of savings, and apparently, it seems like a paradox because if all individuals in the economy are saving more, the aggregate level of savings should increase, but in reality, it happens otherwise. In this article, we will explain this paradox in detail.

Historical Background

The concept of paradox of thrift was popularised by the famous British economist, John Maynard Keynes. He wrote a book in 1936 named “The General Theory of Employment, Interest, and Money.” In this book, he declares that investment and spending are the two major keys to increasing a country’s gross domestic product (GDP), employment, and economic growth. When people save more, the marginal propensity to save (MPS) increases, and the total revenue for businesses will fall, which retards economic growth and causes a prolonged downfall. This statement is based on the idea that all economic recessions are demand-based.

Keynes also believed that the level of employment and output were not dependent on the capacity of production but instead dependent on the decisions taken by individuals in society on how to invest or spend their money. In addition, the central bank should lower interest rates to stimulate investments and spending.

Keynes also said that when people save more money, it reduces the amount of money that individuals spend. Due to this, businesses face less production and sales, which automatically causes unemployment, leading to lower economic growth. John Maynard Keynes called it “Paradox of Thrift.” Keynes also suggested the use of government borrowing and budget deficits to fuel economic growth during the period of recession.

Understanding the Paradox of Thrift

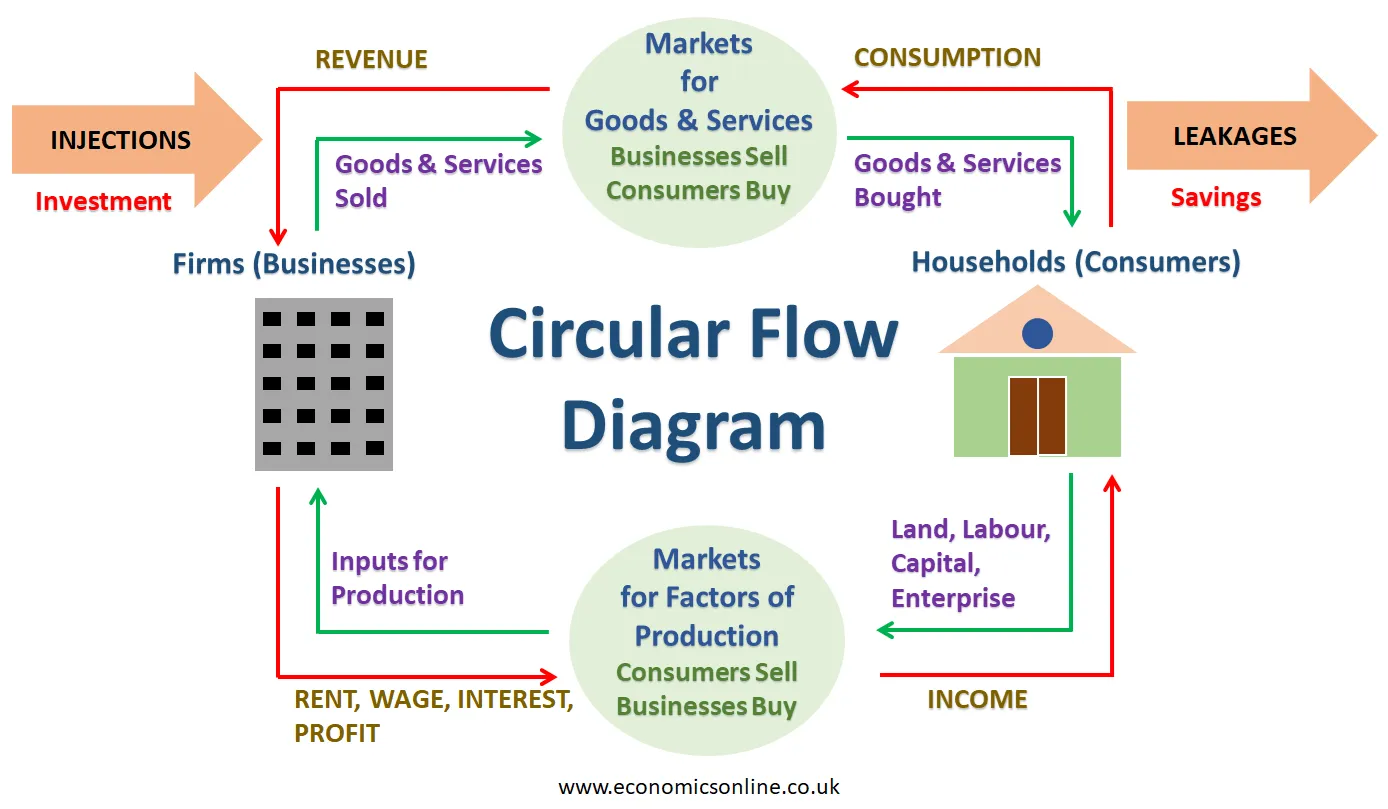

Let’s understand this paradox with the help of a circular flow diagram and a graph.

Circular Flow of National Income

Let’s consider the following circular flow model diagram for a two-sector economy.

According to this model, a person's income is divided into two parts: spending and savings. Savings is the leakage from the circular flow of income. All of the leakages or withdrawals from the circular flow reduce national income, as money is taken out of the circular flow. When everyone in the economy saves more, this increases the money taken out of circular flow in the form of leakage and have an impact on the incomes of others. It also means people are spending less. This reduced spending decreases the level of income and employment in the economy. When national income decreases, the aggregate level of savings, which is part of national income, also decreases or stays the same. This explains the paradox of savings.

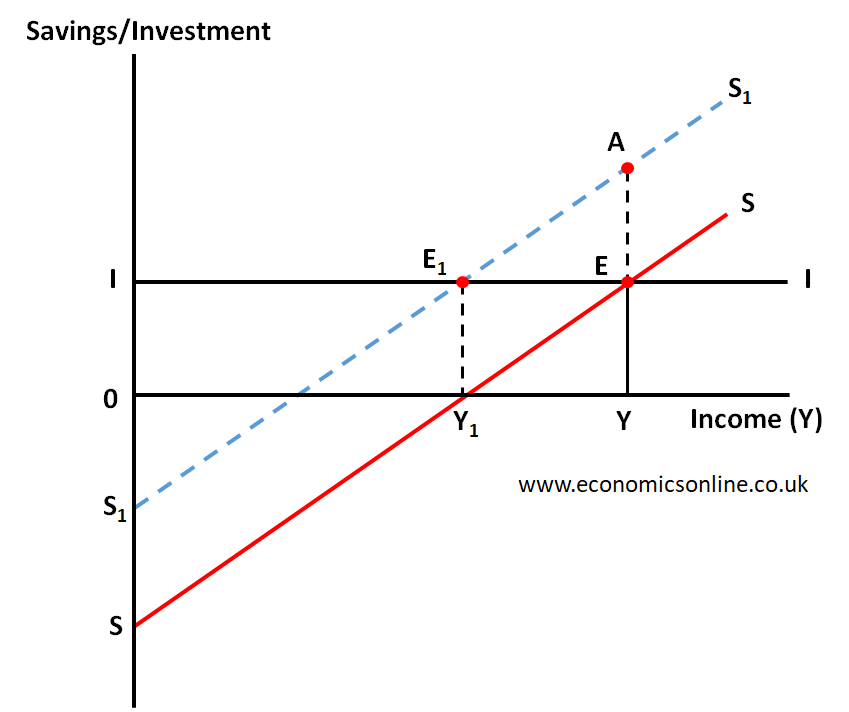

Graph

Now, let’s illustrate paradox of thrift with the following graph of national income equilibrium by using withdrawals-injections approach (W-J Approach).

In this graph, we have income (Y) on the horizontal axis (x-axis) and savings or investment on the vertical axis (y-axis). The curve SS represents initial savings and the straight line II shows autonomous investment. The initial equilibrium is at point E where investment and savings are equal (S=I). The equilibrium level of national income is Y. When all the individuals and private families in the economy save more, the savings curve shift upwards from SS to S1S1. At Y, savings become more than the amount of current investment, as shown by point A. Since savings is a withdrawal from the circular flow of national income, national income starts decreasing. The aggregate level of savings, as a portion of national income, also decreases from point A to E1. The equilibrium point also shifts from E to E1. There is also a reduction in national income from Y to Y1. At Y1, the total level of savings is again equal to the amount of investment I. This shows that the aggregate or total savings has come back to the same level. Hence, when all individuals save more, the total level of savings in the economy stays the same in the long term. This explains the paradox of thrift. This graph also illustrates that the national income has decreased, which is why increased savings and reduced spending are bad for the economy.

Paradox of Thrift: Example

A recent example of paradox of thrift was observed during COVID-19 pandemic, when people started saving more due to the uncertainties related to the pandemic. People reduced consumption and increased their savings, leading a fall in the global GDP and employment levels. A similar phenomena happened during the Great Recession and the Great Depression.

Criticisms of Paradox of Thrift

The paradox of thrift is practical in its reasoning but still faced many criticisms from neo-classical economists. The following are some of the major criticisms of the paradox of thrift by neoclassical economists:

Lending Capacity

When people save more money, then banks can be able to lend more money to the borrowers, so that borrowing increases. Due to this, there is a decrease in the significant influence of reduced consumption. Critics highlight consumers’ liquidity preferences: if an individual saves money in the form of cash, then it harms economic growth, but if an individual deposits money in a bank or demands government bonds, the impact of harm will be cancelled.

Capital Investment

Businesses need a large amount of savings and private investment in order to regulate the production process. People believe that savings can stimulate production. But in the real world, the production process is dependent on factors like the level of technological advancements and competition between firms. In order to upgrade or boost the technology, businesses need a huge amount of capital investment. This process can be much easier with savings.

Closed Economy

In the post-globalisation world, it is believed that savings cannot cause great harm to economic growth. When a country experiences that the demand for goods or services decreases, they export those products or services to foreign countries. But critics argued that the global economy is a closed system, and many countries cannot export their products globally due to the prudent economy. This inability to export could be due to a lack of transport channels, low product quality, or having no ability to cope with international market pricing.

Conclusion

In conclusion, the paradox of thrift is an economic theory that was proposed by John Maynard Keynes and states that personal saving will destroy the overall economic growth of the whole nation. The theory suggested that in order to cover the decline during a recession, the government must lower interest rates to encourage consumer spending. But the phenomenon of the paradox of thrift does not explain the potential for inflation and deflation in prices.