An image of hands with coins.

Stagflation Simplified

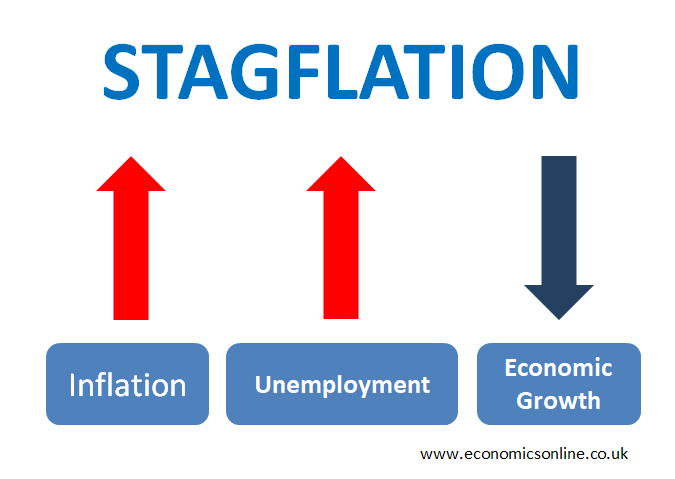

What is stagflation?

Stagflation refers to a situation in the economy when a high rate of inflation coexists with high unemployment and slow economic growth.

In simple words, during stagflation, there are:

- High rate of inflation

- Stagnant economic growth

- High unemployment

Origin

The term “stagflation” was first coined by the British politician Iain Macleod during a speech he delivered in the House of Commons in 1965. This was a period of economic strain in the United Kingdom, and Macleod used the term to describe the simultaneous occurrence of inflation and economic stagnation (little to no GDP growth).

The term "stagflation" became popular and gained widespread recognition and usage in the 1970s to describe the economic conditions characterized by a stagnant economy and high inflation rates.

Understanding Stagflation

Stagflation is a term coined from the fusion of two words: "stagnation" and "inflation." It refers to an economic situation characterised by a high rate of inflation, accompanied by high unemployment and stagnant economic growth.

Let us define some basic terms first.

Inflation

A persistent increase in the general price level of goods and services in an economy over a period of time is called inflation.

Unemployment

This refers to a situation in the economy when people in the working age group who are willing and able to work are jobless.

Economic Growth

This means an increase in the real GDP of a country over a period of time.

The three macroeconomic objectives of governments are to achieve low price inflation, low unemployment, and a high rate of economic growth. These objectives, when achieved, create an internal balance in the economy, but all three of these objectives are compromised during the period of stagflation.

This is illustrated by the following diagram:

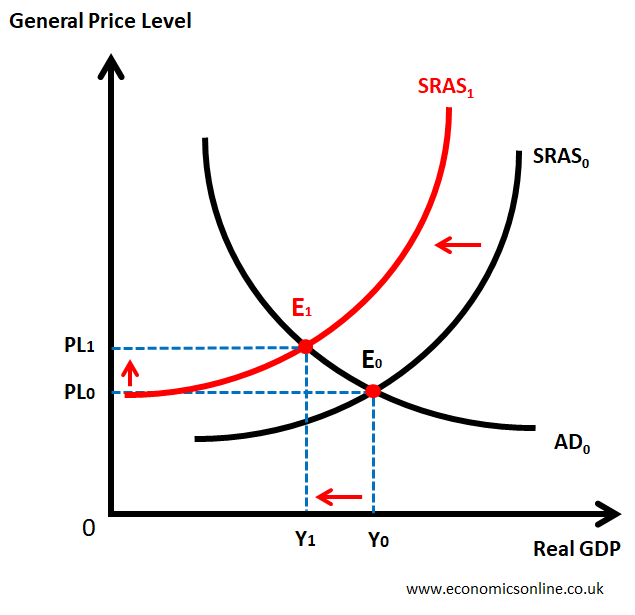

In the above diagram, the initial macroeconomic equilibrium is at E0. The general price level is at PL0, and the real GDP is at Y0. Due to the fall in the short-run aggregate supply curve from SRAS0 to SRAS1, the new equilibrium is now at E1. There is an increase in the general price level from PL0 to P1 (inflation). There is also a fall in the real GDP from Y0 to Y1, leading to unemployment and negative economic growth. This situation is stagflation.

Economic growth, a low rate of inflation, and low unemployment are the three major macroeconomic objectives. Stagflation puts an economy in a situation where all of these objectives are not being met, leading to an economic imbalance.

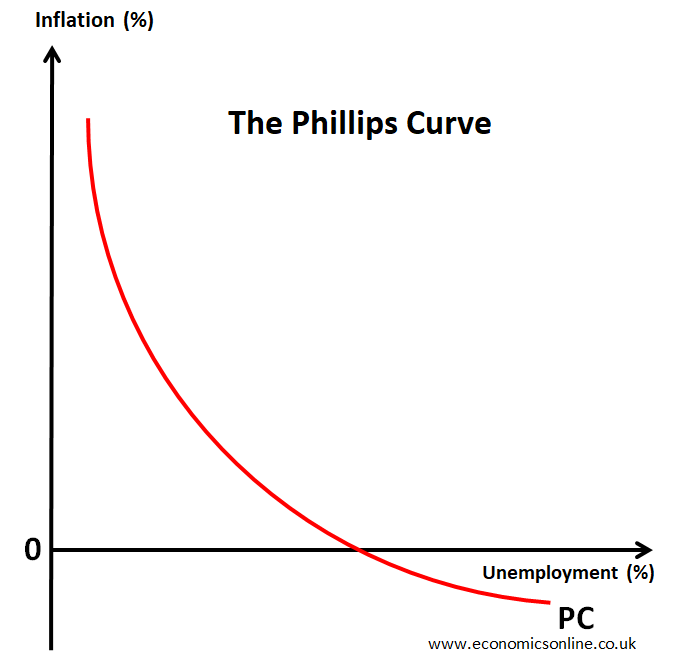

Stagflation is a bad economic situation and goes against the conventional economic theory of the Phillips curve, which assumes a trade-off between inflation and unemployment.

In 1958, a New Zealand economist, Professor William Phillips, proposed the Phillips Curve, which shows a trade-off between the unemployment rate and the inflation rate over a period of time.

The Phillips Curve shows that

- With a fall in the unemployment rate, there is a rise in the inflation rate. It is because a low unemployment rate means high income and hence an increase in aggregate demand, which leads to rising prices and a high inflation rate.

- With a rise in the unemployment rate, there is fall in inflation rate. It is because a high unemployment rate means low income and hence a decrease in aggregate demand which leads to fall in the price level and a low inflation rate.

Before 1970s, it was believed that the governments cannot simultaneously achieve lower inflation and lower unemployment. Yet, in 1970s, this classical notion of the trade-off between inflation and unemployment was put aside by the phenomenon of stagflation where high inflation and high unemployment were there simultaneously. This was a surprise for the economists.

Examples of Stagflation

United States

The United States experienced stagflation during the 1970s. This stagflation of the 1970s was marked by soaring oil prices due to oil embargo put by OPEC resulting from geopolitical tensions and supply disruptions. Inflation rates went to double digits while the economy experienced a slow growth and rising unemployment.

Japan

The 1990s and early 2000s witnessed Japan facing a long period of stagflation. A burst housing bubble and excessive government intervention led to stagflation.

Causes of Stagflation

Supply-Side Shocks

Stagflation is often caused by the supply shocks leading to the fall in aggregate supply. Such shocks can include sudden increase in oil prices, natural disasters, or geopolitical events that disrupt trade flows. For example, the oil crisis of the 1970s resulted in a sudden rise in oil prices, leading to a period of stagflation in many economies.

Structural Imbalances

Persistent structural imbalances, such as excessive government regulation, rigid labor markets, or a lack of investment in productive sectors, can contribute to stagflation. These imbalances hinder economic growth while amplifying inflationary pressures.

Consequences of Stagflation

Stagflation is very bad and can have severe consequences for the economy.

High Unemployment

Stagflation leads to higher unemployment because firms face higher costs of production and lower demand of their products. This high unemployment means higher burden for government to support the unemployed, poverty and a higher rate of crimes in the society.

Reduced Purchasing Power

Higher inflation rate depletes the purchasing power of consumers leading to lower demand of goods and services in the economy. Due to the fall in real income, people demand higher wages which puts further pressure on the costs of production.

How to Deal with Stagflation?

Addressing stagflation requires a comprehensive approach that considers both demand and supply-side factors:

Supply-Side Reforms

One way to deal with stagflation is by increasing aggregate supply. Government can use education and training of workers to increase their productivity. This can be time taking yet, output of the firms will increase leading to the increase in real GDP of the country along with fall in the general price level. Other ways of improving the supply-side of the economy can be the investment in research and development, promoting entrepreneurship, and subsidising the dying firms.

Structural Reforms

Governments should prioritize structural reforms aimed at reducing excessive regulations, increasing labor market flexibility, and encouraging investment in productive sectors. These reforms can help restore competitiveness and drive economic growth.

Demand-side Reforms

Governments can carefully manage the demand-side tools of the fiscal and monetary policies to mitigate inflationary pressures without unduly stifling economic activity. This includes carefully managing the interest rates and the money supply by the central bank, reducing unnecessary government spending, promoting investment in infrastructure and innovation, and providing targeted support to industries facing supply-side challenges. Well-designed demand-side reforms can boost economic activity without increasing inflationary pressures.

Conclusion

Stagflation refers to a complex and rare economic phenomenon that defies conventional economics poses significant challenges to policymakers. It combines the troubles of stagnant economic growth, high unemployment and soaring inflation. By understanding the causes, consequences, and historical examples of stagflation, policymakers can implement appropriate measures to address this challenging economic condition.